Planning for retirement and wondering what a reasonable rate of return might be? Investing wisely is crucial to ensuring that your golden years are as gold-filled as possible.

This blog post will guide you through important concepts, such as the role of the realistic rate of return in retirement planning, the factors influencing it, and how to maximize your earnings.

Ready to secure your future? Let’s dive in!

Key takeaways

●The rate of return is the money you make from an investment, and it shows if your investment is doing well. A higher rate of return means more profit.

●A good rate of return is important for retirement planning because it determines how much your retirement savings and investments grow over time. Higher rates can help your money grow faster.

●Factors like risk, inflation, and the type of investments you choose affect the rate of return. It's important to understand these factors to make smart retirement planning decisions.

●To determine a reasonable rate of return for retirement, consider your risk tolerance, look at average returns by asset class, and account for the impact of inflation on your retirement savings.

What Is A Reasonable Rate Of Return For Retirement Planning?

The rate of return is the money you make from an investment. If you put money into a business, real estate, or stocks, the rate of return shows if you win or lose. It is like a score in a game.

The higher your score (rate of return), the more money you make.

The rate of return gets talked about as a percent. For example, if someone says the rate of return on stocks is 7%, it means for every $100 invested in the stock market, they expect to get back $107 at year-end.

They have made a $7 profit. This way, investors can tell which investments are good and which ones are bad by comparing their rates of return.

The Importance of Rate of Return in Retirement Planning

A good rate of return is key in retirement planning. It tells you how much your retirement savings and investments grow over time. If the rate is high, your money grows fast.

You rely on this growth to live well when you stop working. The right rate of return can make a big difference. That’s why it’s so vital in planning for a reasonable retirement.

Each person will have different goals for their retirement funds. Some people may want to travel often. Others might just want a cozy home life without work stress. Your target rate of return needs to match these plans.

Also, as you grow older, your targets may change too! So always keep an eye on them.

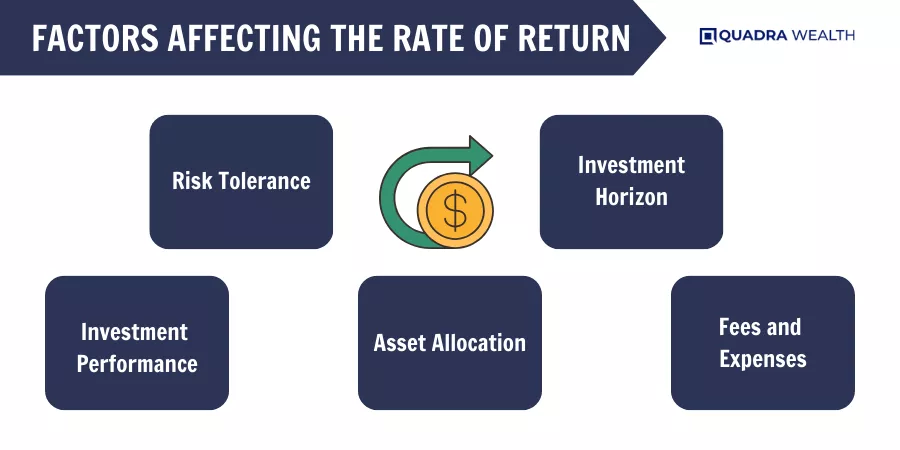

Factors Affecting the Rate of Return

Factors affecting the rate of return include risk profile, inflation rate, and investment type. Understanding these factors is crucial for effective retirement planning. Read on to learn more.

Risk Profile

Your risk profile plays a big part in your retirement plan. It tells how okay you are with taking risks in your investments. Young people can take more risks for better returns because they have time to recover from losses.

But as we get older, it’s smarter to play safe with our money. We should shift to steady choices like bonds that keep our retirement income stable. A good balance of these choices can earn us about 9% every year.

Inflation Rate

The inflation rate plays a big role in your rate of return. This is how much prices for things go up each year. If prices rise, the money you have saved buys less.

So, if your money grows slower than prices rise, you lose buying power.

Stocks can often grow faster than inflation. Bonds can help lessen its effect too. For example, a 6% gain when prices only go up 2% is better than a 10% gain when prices jump by 8%.

Some tools like TIPS get more valuable as costs increase on goods and services we buy every day!

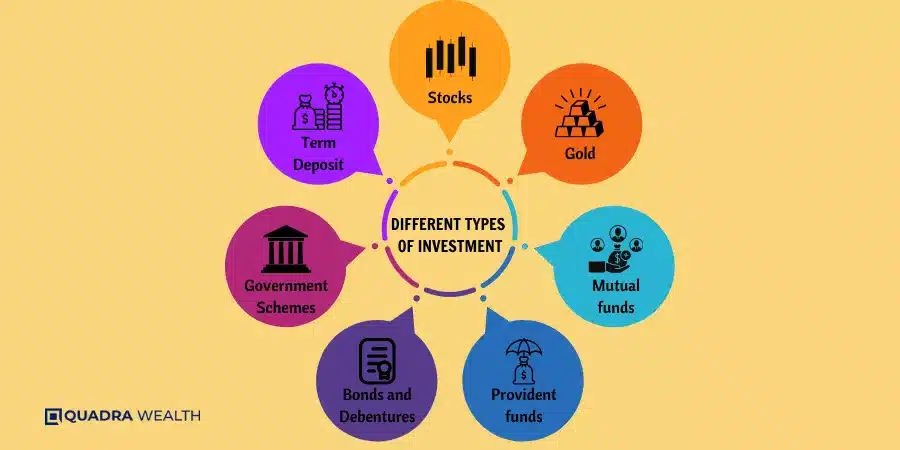

Investment Type

Different investment types have varying rates of return. Stocks, for example, generally have a higher average rate of return than bonds. This means that they have the potential to provide greater income and a compound annual growth rate over time.

On the other hand, bonds are more stable and produce a relatively smaller income compared to stocks.

When doing financial planning for retirement, it is important to carefully consider your risk tolerance and portfolio configuration to determine which investment types are suitable for your financial goals.

Average Rates of Return for Different Types of Investments

Stocks generally offer higher average rates of return compared to bonds and cash equivalents. However, they also come with higher volatility and risk.

Bonds tend to provide more stable investment returns but at a lower rate, while cash equivalents like retirement accounts or money market funds have the lowest potential for growth but offer greater safety.

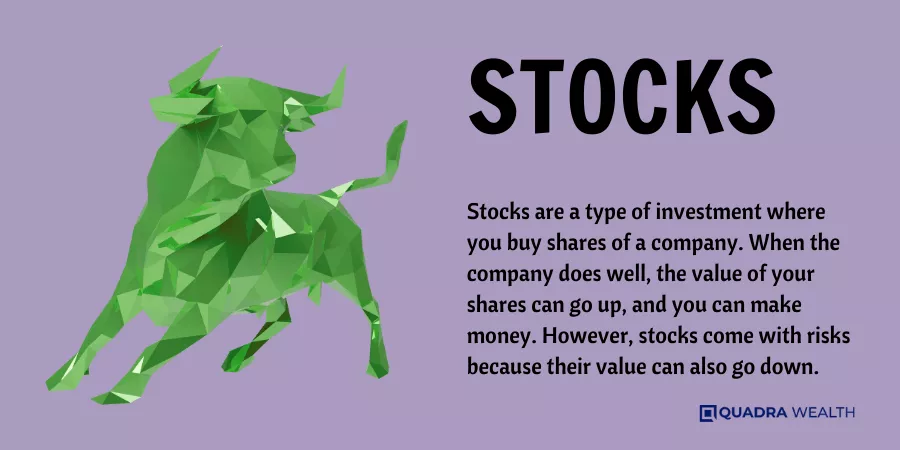

Stocks

Stocks are a type of investment where you buy shares of a company. When the company does well, the value of your shares can go up, and you can make money.

However, stocks come with risks because their value can also go down. Right now, it seems like the stock market is doing well as the S&P Futures, Dow Futures, Nasdaq Futures, and Russell 2000 Futures are all experiencing gains.

This means that many companies are doing well and could potentially give you a good return on your investment. But remember, investing in stocks carries a level of risk and it’s important to understand this before making any decisions.

Bonds

Bonds are a type of investment that has historically been considered low risk with low returns. Treasury bonds, in particular, are known for their stability but tend to provide a small income.

When planning for retirement, it is important to consider the role of bonds in your portfolio as they can help balance out higher-risk investments and provide a steady source of retirement income.

However, it’s worth noting that the returns on bonds may not keep up with inflation over time. Additionally, market conditions and interest rates can impact bond yields and share prices.

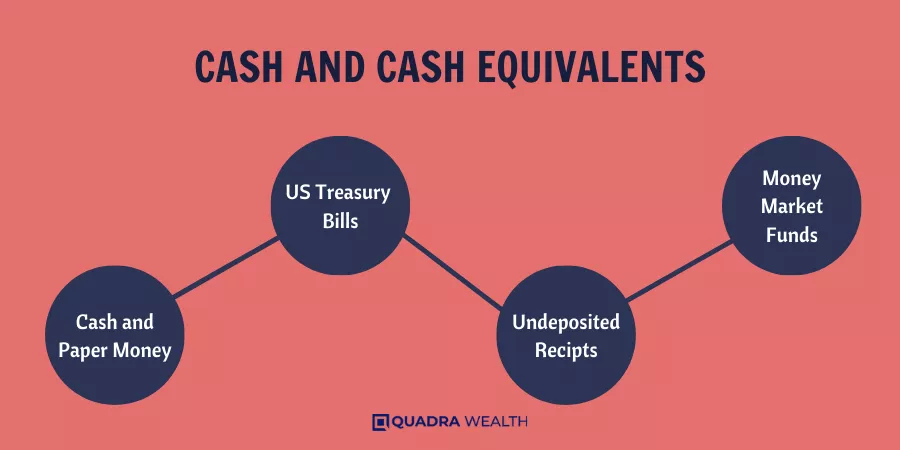

Cash and Cash Equivalents

Cash and cash equivalents play a crucial role in retirement planning. These include money you have readily available in your bank accounts, as well as short-term investments that can easily be converted into cash.

While cash and cash equivalents may not offer high returns compared to other investment types, they provide stability and liquidity.

It’s important to have some portion of your retirement portfolio allocated to cash and cash equivalents to cover immediate expenses or unexpected emergencies.

By maintaining a portion of your savings in this asset allocation, you can ensure financial security during market downturns or when other investments are experiencing fluctuations.

Regularly evaluating and adjusting the allocation between cash and other investment types will help maintain a balanced retirement plan that aligns with your financial goals.

How to Determine a Reasonable Rate of Return for Retirement

Determine a reasonable rate of return for retirement by considering your risk tolerance, familiarizing yourself with average returns by asset class, and understanding the impact of inflation.

Consider your risk tolerance

Assessing your risk tolerance is an important factor to consider when determining a reasonable rate of return for retirement planning. Your risk tolerance refers to how comfortable you are with taking risks in your investments.

By understanding your risk tolerance, you can determine the right asset allocation for your investment portfolio.

If you have a higher risk tolerance, you may be more open to investing in stocks, which can potentially offer higher returns but also come with greater volatility.

On the other hand, if you have a lower risk tolerance, you may prefer safer investments like bonds or cash equivalents that offer lower returns but also lower risks.

It’s crucial to find a balance between potential returns and potential losses based on your risk tolerance to ensure a suitable rate of return for your retirement planning goals.

Familiarize yourself with average returns by asset class

Different types of investments have different average rates of return. By familiarizing yourself with these averages, you can get an idea of what to expect from each asset class.

For example, historically, the S&P 500 has delivered an average annualized return of around 10%, while long-term US government bonds have returned between 5% and 6%.

Generally, stocks tend to have a higher average rate of return than bonds. Knowing these averages can help you make more informed decisions when planning for retirement and choosing where to invest your money.

Understand the impact of inflation

Inflation can have a significant impact on your retirement savings. When prices rise, the value of your money decreases over time. This means that if you don’t account for inflation when planning for retirement, you may not be able to afford the same things in the future as you can today.

Understanding how inflation affects your investments is crucial for ensuring that your rate of return keeps up with rising costs.

By investing in assets like stocks and Treasury Inflation-Protected Securities (TIPS), which tend to perform well during inflationary periods, you can help safeguard your retirement income against the erosion caused by inflation over time.

How to Maximize Your Rate of Return

Diversify your investment portfolio and regularly review and adjust your investment strategy to maximize your rate of return. Read on to learn more about these strategies for financial success in retirement planning.

Diversifying your portfolio

Diversifying your portfolio means spreading out your investments across different types of assets, such as stocks, bonds, and cash.

It can help protect you from losses if one investment does poorly because different assets tend to perform differently over time.

By diversifying, you reduce the risk of losing all your money in case one investment goes bad. This strategy can help balance out volatility and potentially increase returns over the long term.

Regularly reviewing and adjusting your investment strategy

Regularly reviewing and adjusting your investment strategy is essential for maximizing your rate of return and planning for retirement.

It’s important to remember that past performance doesn’t guarantee future results, so you need to continuously monitor and make changes to your strategy.

By regularly reviewing and adjusting your investments, you can ensure that they align with your financial goals and adapt to changing market dynamics.

This proactive approach helps you stay on track towards achieving the returns you need for a comfortable retirement.

Conclusion

In conclusion, determining a reasonable rate of return for retirement planning is crucial for ensuring financial security in your golden years.

Factors such as risk tolerance, inflation, and investment type play a significant role in this process.

By diversifying your portfolio, regularly reviewing and adjusting your investment strategy, and seeking guidance and investment advice from a financial advisor or utilizing platforms like the New Retirement Planner, you can maximize your rate of return and work towards achieving a comfortable retirement income.

FAQs

A reasonable rate of return differs for each person. It’s based on factors like your retirement timeline, investment fund choices, and asset classes.

The real rate of return matters because it shows true financial growth after accounting for taxes and administration fees such as investment management fees.

By having a diversified portfolio with different asset classes – like mutual funds, exchange-traded funds, Real Estate Investment Trusts (REITs), and precious metals – you can manage fluctuating returns better.

Indeed! A financial advisor or a certified financial planner helps with portfolio management to ensure annualized compounding returns are maximized while considering taxation effects, thus aiding sequence-of-returns risk control.

Yes! Apart from stocks and bonds, investing in tools like life insurance policies or annuities is also an efficient way to provide cash reserves safeguarding against high inflation environments.

Market fluctuations directly touch upon how much your investments will be worth at the time you wish to leverage them, affecting their final value either positively or negatively.