Navigating the financial world can often feel complex and overwhelming, particularly when trying to understand the differences between wealth management and investment banking. While both offer valuable services, they serve distinct purposes in the finance industry.

This article aims to demystify these two areas of finance by examining their roles, responsibilities, and distinguishing features. Let’s find out where your money works best for you!

Key takeaways

● Wealth management helps rich people manage their money. They help with making investments, tax planning, and retirement.

● Investment banking serves big firms and groups like governments. It helps to raise lots of money through selling stocks or debts.

● Both wealth managers and investment bankers handle different kinds of clients and investments.

● Working in wealth management can give you stable jobs and work-life balance while investment banking involves longer hours but offers high pay..

Understanding Wealth Management

Wealth management is a branch of finance that focuses on offering comprehensive financial advisory services to high-net-worth investors. Professionals in this financial sector, known as wealth managers or certified financial advisors, work closely with clients to help them achieve their long-term goals by providing tailored advice on investment management, estate planning, retirement strategies, and tax planning.

They utilize their deep knowledge of the market and various asset classes such as stocks, mutual funds and shares, property investments, and foreign currency investments to create strategic plans for wealth building.

Wealth management services can extend beyond traditional money management into other areas like philanthropic planning, education planning, or even business advising. While some wealth managers operate independently (freelance), many work within organizations (wealth management agencies) ensuring a more holistic approach towards personal finance.

Role of Wealth Managers

Wealth managers have many jobs. They work to understand your financial goals. Then they come up with a plan to help you reach those goals. This often involves choosing the right investments for you.

But it’s not all about investing money. A wealth manager can also help you with things like saving for retirement, planning your estate, or figuring out how to pay less in taxes. It’s their job to watch over your finances and make sure everything is going as planned.

Services Offered: Investment Management, Retirement Planning, Estate Planning, Tax Planning

Wealth management offers many services. The main ones are:

- Investment Management: Wealth managers help you with your investments. They make sure your money grows.

- Retirement Planning: They plan for your future when you stop working. Your money needs to last for a long time after retirement.

- Estate Planning: Wealth managers also look after your estate, which is the stuff you own, like houses and cars. They make plans for these things after you pass away.

- Tax Planning: Taxes can take a big part of your money. Wealth managers help reduce the amount of tax you have to pay.

- Steady Income

- Client relationships

- Work-life balance

- Diverse services

- Client dependence

- Market volatility

- Regulatory requirements

- Income variability

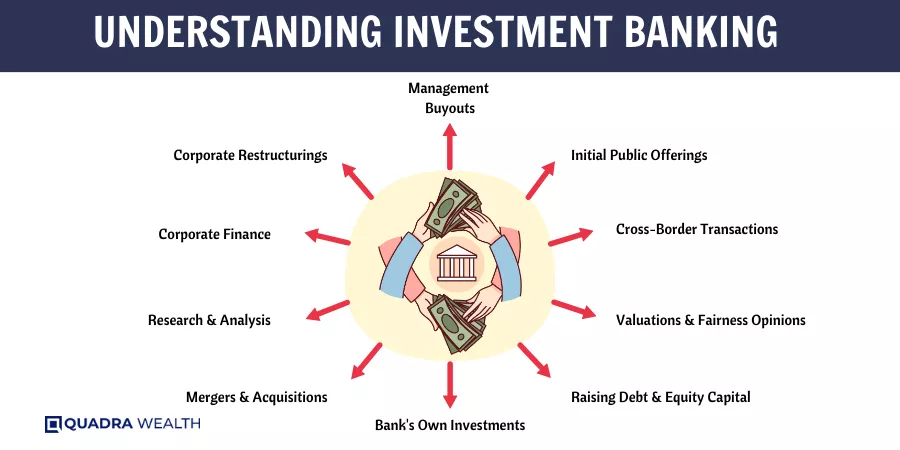

Understanding Investment Banking

Investment banking focuses on revolves around large-scale, corporate financial transactions. An investment banker’s role is multi-faceted; they assist corporations, governments, and other institutional clients in raising capital.

Underwriting forms the crux of their service offerings – it involves the sale of equity or debt securities to investors. Investment bankers also play a pivotal part in Initial Public Offerings (IPOs) and equity financing activities.

The realm of investment banking extends to advising on mergers & acquisitions (M&A), facilitating sales and trading operations, and conducting thorough equity research. They have a comprehensive market understanding that aids them in helping investment banking clients make informed decisions related to major financial transitions.

Role of Investment Bankers

Investment bankers play a big role in the finance world. They help companies and governments get money. They do this by selling stocks or bonds for them or helping them with big deals like buying other companies.

Investment bankers also give advice on what investments are good to make. But they do not work with people who want to invest their own money, only large groups like companies or governments.

Investment Banking Services Offered: Underwriting, Mergers & Acquisitions, Sales and Trading, Equity Research

Investment banks give many services. One service is “Underwriting”. This is when banks put up money for a part of a company or its bonds. Another service is “Mergers and Acquisitions”. Here, banks control talks between companies that want to join or buy each other. They also look at how good these deals might be.

- High earnings potential

- Prestige

- Challenging work

- Networking opportunities

- Long hours

- High stress

- Job instability

- Lack of work-life balance

- Market dependency

Key Differences Between Wealth Management and Investment Banking

Wealth managers cater to high-net-worth individual investors, helping them plan and achieve long-term financial goals through personalized strategies. In contrast, investment bankers work with governments, corporations, and institutional clients on significant finance-related transactions like underwriting debt and equity securities or facilitating mergers and acquisitions.

While wealth management focuses on managing assets to build wealth over the long term through various services like retirement planning, tax planning, estate planning, etc., investment banking primarily involves raising capital for firms by issuing new stocks or bonds in the market.

Compensation structures also vary between these two fields; wealth managers typically earn fees based on a percentage of Assets Under Management (AUM), while investment bankers often receive a fixed salary with performance-based bonuses.

Moreover, career stability can differ significantly; a career in wealth management tends to offer more relationship continuity with clients which can lead to greater job security whereas careers in investment banking are generally associated with higher risk due to their dependency on market conditions.

Clients Served

Two groups get help from wealth management and the investment bank. High net-worth people and families are the main clients for wealth management. They have a lot of money and need help to keep it safe and growing.

Sometimes, trusts, business entities, or rich individuals also use these services.

On the other hand, Investment bankers work more with governments, businesses that are not public yet (private corporations), and those who invest a lot of money at once (institutional investors).

That means they deal with big money matters like helping companies buy other companies or become publicly traded.

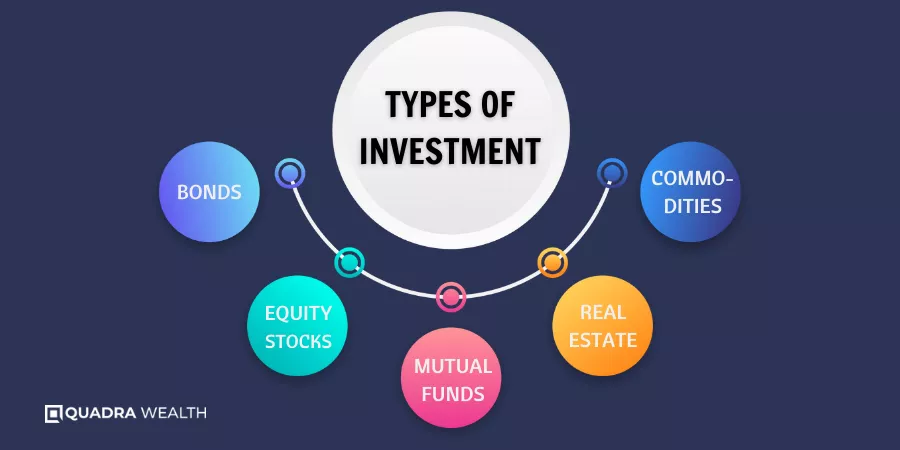

Types of Investment

Different investments are used in wealth management and investment banking. Stock, bonds, and real estate are common types that a wealth manager might suggest for an individual or family.

These types of investments can help grow money over time. They also can provide income during retirement years.

On the other hand, investment bankers handle more complex deals. They work with things like initial public offerings (IPOs) or mergers & acquisitions (M&A). An IPO is when a company sells shares to the public for the first time.

M&A is when one company buys another one or joins with it to form a new company.

Both sets of professionals must understand market trends and risks well. This helps them to pick the best options for their clients’ needs.

Compensation Structure

Money rule is different in wealth management and investment banking. In investment banking, your pay links with how well your group or bank does. People doing well get a bonus. The bonus makes up a large part of the total pay.

In wealth management, it’s different. Here pay hangs on how you do as an individual and how much money your clients have with the firm. After some years, people start to earn more from their share of client fees than their base pays.

Career Stability

Wealth management jobs are steady. They give a good work-life balance. In this field, you have the same clients for many years. You help them grow their wealth over time. But in investment banking, the work is project-based.

Once a deal is done, you move on to the next one.

Investment banking hours can be long and hard to predict. This makes it tough to plan your free time. The pay is high but stress levels can also be high. On the other hand, wealth managers have more control over their schedules.

This helps them balance work and life better.

The points above show that both careers are different in terms of job stability.

Choosing Between Wealth Management and Investment Banking: Factors to Consider

The choice between wealth management and investment banking involves the consideration of various factors such as one’s interest, work-life balance needs, risk tolerance level and risk management, earnings potential, and career goals.

Continue reading to delve deeper into these deciding variables that every financial aspirant should carefully reflect on.

Interest and Passion

Loving your job matters a lot. If you love numbers, solving puzzles, and feel excited by big deals, investment banking might be for you. You may like to talk with clients and make plans for their money.

Then wealth management could be a good fit. Think about what excites you more: working on huge business deals or helping families plan their futures. Your answer can guide your choice.

Work-Life Balance

Work-life balance means different things in wealth management and investment banking. Wealth managers get to plan their hours better. They have more time for family or hobbies. On the other hand, investment bankers often work long hours, including on weekends.

Their jobs are high-stress and demand a lot of their time. Yet, many find the work exciting as well as rewarding.

Risk Tolerance

Risk tolerance means how much loss you can bear. In wealth management, it helps make plans for your money. If you don’t like taking big risks, they might put your money in safe places.

If you are okay with risk, they might aim for bigger wins with smarter bets.

Investment banking also thinks about risk tolerance. This is when advising big clients on where to put their money. They look at the client’s comfort level with risk and then suggest moves that line up with this level of comfort.

So, both career paths use an understanding of risk tolerance to do their job right.

Earnings Potential

In both jobs, you can make good money. But how you earn it is different. If you work in investment banking, your pay links to how well the group or bank does overall. In wealth management, what you get paid relates more to how well you do and the assets of your clients.

Over time, sales become a big part of an investment banker’s job. This starts when they reach the managing director level.

Career Goals

Think about what you want to do in the future. Maybe you like to build deep bonds with people over time. Then a career in wealth management is right for you. You can help families enjoy their riches for a long time.

On the other hand, if you love making big deals and moving fast, investment banking could be your path. This world gives more chances to move into new roles or big firms like private equity or hedge funds.

Conclusion

Wealth management and investment banking are both key parts of the finance world. Both help people, but in different ways. Investment bankers work with big companies to raise money and do big deals.

Wealth managers help families manage their money and reach their financial goals. Your choice between the two will depend on what you like doing best – working with numbers or building relationships!

FAQs

Wealth management is an investment advisory service for High Net Worth individuals (HNIs) with a focus on protecting and growing their capital and wealth. Wealth managers help wealth management clients with financial planning, asset preservation, and portfolio management. Investment bankers offer services like IPO handling, selling derivative products, and dealing in mutual fund investing activities.

Wealth managers act as relationship managers who provide strategic advice on things like budgeting, debt management, insurance services or charitable works for family finance or organizational finance. On the other hand, investment professionals work more with tangible assets creating pitch books or doing analytical works such as DCF models.

Yes! In wealth management agencies there might be service fees including fee-based services like Assets Under Management (AUM) fees or retainer fees whilst investment bankers may charge commissions from deals they manage.

For business purchasing you can seek guidance from both; a freelance wealth manager could give legacy planning insights while an investment banker’s industry-specific knowledge could influence your choice of buying into name brands like Goldman Sachs or Morgan Stanley.

Both use data analysis techniques to forecast trends but an investment banker would particularly focus on managing market presence through corporate reorganizations meanwhile a wealth manager might customize individual portfolios based on financial flexibility needs considering long-term investment strategies.

Jobs vary greatly! As a college student eyeing high finance careers within Corporate America, you might want to choose between being a vice president at an established bank handling sovereign wealth funds against privatization matters versus being a hedge fund analyst running a smile-and-dial sales role at emerging firms in green ventures vying for prestige.