Are you contemplating building your wealth but unsure how to start investing in a Systematic Investment Plan (SIP)? It’s an interesting fact that SIPs not only simplify the investment process but also foster disciplined saving and reduce the impact of market volatility.

This article provides a step-by-step guide on starting your SIP investment journey, from understanding these plans to actually setting one up. Let’s dive into this guide and unfold what it means to invest smartly!

Key takeaways

● A SIP lets you put money into a mutual fund every month.

● It's good to stay in an SIP for a long time to make more money.

● To start an SIP, know how much risk you can take and what your goals are.

● You can start a SIP online by giving some papers like your PAN card and bank details. Also, finish the KYC process first.

● You can check out how other funds have done before picking one for your own SIP.

Understanding the Concept of SIP

SIPs stands for Systematic Investment Plans. Systematic investing is a way of disciplined investment in investment vehicles like ULIP or mutual fund schemes over a specific tenure. It makes saving money simple. You choose how much to save each month and that set amount gets moved from your bank into a mutual fund. This happens every month.

The SIP helps you make more money over time. This is because of something called the power of compounding. Each dollar you put in can grow bigger the longer it stays in the mutual fund.

The key to making this work is to leave your money in for a long time.

You also have control when using an SIP. You can look at how your mutual fund is doing and decide if you want to keep your money there or move it somewhere else. And, if needed, you can take out your investment anytime if there’s no lock-in period.

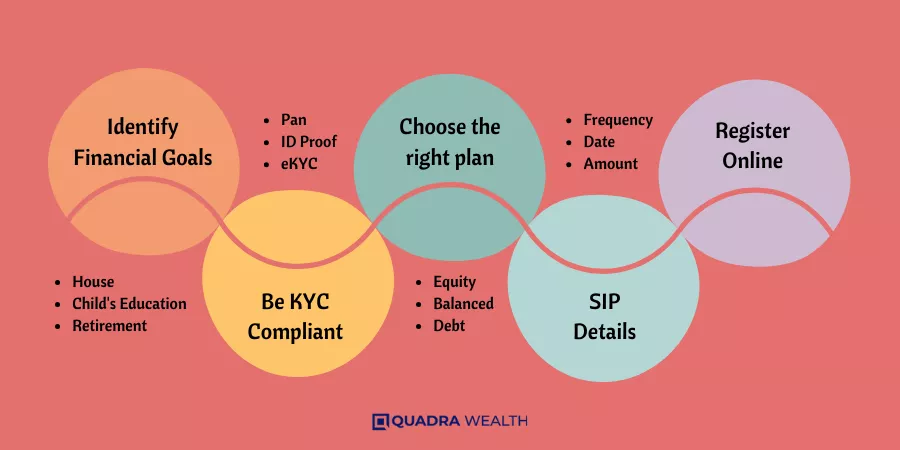

Step-by-Step Guide to Starting a SIP Investment

Determine your risk capacity and investment goals, then choose a mutual fund matching them. Decide your SIP date and duration based on your payment convenience and long-term financial planning.

Choose an online or offline investment method according to your comfort level with technology. Stay invested for the long haul to reap maximum benefits and diversify your investments for balancing risks effectively in different market scenarios.

Assessing Your Risk Appetite and Investment Objective

Knowing your risk appetite is a key step in SIP investment. The risk you can take depends on many factors. These include how old you are, how much money you have saved, and your future plans.

Some people may not mind taking risks for high returns. Others might want to play safe with their hard-earned money.

Apart from this, it’s vital to decide why you’re investing your money. This means setting an investment objective before starting the SIP journey. For instance, some people invest for retirement or to buy a house in the future.

Kids’ schooling funds or vacation plans could be other goals too! So it’s important to know what drives your decisions around investing.

Choosing the Right Mutual Fund

You need to pick the best mutual funds for your SIP. Look at the past performance and size of the fund. A big, well-doing fund can be a good choice. But don’t just look at how much money it made before.

Also, think about what you want from your money later in life. Think deeply about this step, as choosing wisely helps you reach goals faster.

Deciding the SIP Date

Picking the right day for your SIP is key. Many choose a date soon after they get paid each month. This makes sure you have money in your bank account for the investment. You set this date when you start your SIP plan.

You can pick any day of the month that works well for you. It’s good to stick with this day every month to make saving money a habit.

Setting the Duration of the SIP

Picking the length of your SIP is key. You should have a clear idea of your financial goals. Is it for five years or ten? Maybe even longer? You decide based on what you aim to achieve with your SIP investment.

If you’re saving up for something big, like buying a house, you might want to keep investing for many years. This way, you can make more money in the long term and reach your goal faster.

But remember, each person’s plans are different, so there isn’t one right answer that fits everyone!

Choosing Between Online and Offline Investment

Online or offline, both ways are good to start SIP. For online mode, use an app on your mobile phone. Some apps also offer help over the phone for sales and service-related issues.

Offline mode means going to a mutual fund company office. Fill out a paper form there.

But many people like online mode more now. It is fast and does not need any travel time. With an auto-debit facility, you can set up monthly payments easily too. In both modes, remember safety first when giving bank details.

Staying Invested and Diversifying Your SIP Investments

You have to stay in the SIP for a long time. This will help you make more money. You can also spread your money out in different places. This is called diversifying. It helps keep your money safe if one place loses value.

So, don’t just put all of your eggs in one basket!

How to Start SIP Online

Starting a SIP online is a straightforward process that involves organizing necessary documents, completing the KYC process, and initiating your investment. Learn this simple procedure in-depth to kick-start your financial journey confidently.

Arranging the Necessary Documents

You need some papers to start a SIP investment. First, get your PAN card and bank details ready. You also need an address proof like a utility bill or Aadhar Card. If you are new, fill out the KYC form online.

Always check all your data on these papers before moving to the next step.

Completing KYC (Know Your Customer) Process

Before starting SIP, you need to finish the KYC process. It is a must-do step set by the government. You will give proof of who you are and where you live for it. This helps keep your money safe.

For the KYC process, make sure your ID proof, PAN card, and address proof are ready. You will also sign up with an Indian broker or financial advisor. They can guide you and help with this paperwork.

Always check that every detail in each document is correct before handing them over.

Starting Your SIP Online

You need a few key things to open an SIP account online. First, get all the needed papers ready. Your PAN and bank details are vital. Next, fill out an E-KYC form for identity checks. The process is easier if you have Aadhar for verification.

Now log on to the mutual fund company site or mobile app. Choose “New User Registration”. Fill out all required fields with correct information.

Pick the mutual fund sips you want based on past research and planning. Key in how much money you want to invest each month and choose your start date.

Lastly, provide bank details for auto-debit facility setup of monthly payments.

Before clicking submit, do a final check of everything! Make sure there are no errors or wrong inputs. Now you’re ready to click submit and begin your journey with SIP investment!

Comparing Lump Sum Vs SIP: Which Plan Is Better?

Investing in mutual funds can be done in two ways: through lump sum investments or through Systematic Investment Plans (SIPs). Both methods have their own advantages and disadvantages. The best investment plan depends on the investor’s financial goals, risk tolerance, and investment horizon.

– Lump Sum Investment: This is a one-time investment where the investor puts a large amount of money into a mutual fund. Depending on the market conditions, investors can generate substantial returns. This strategy is suitable for investors who have a high-risk tolerance and can afford to lock in their money for a long period.

– Systematic Investment Plan (SIP): This investment plan allows investors to invest a fixed amount at regular intervals. This strategy is beneficial for beginners or those who have a low-risk appetite. SIP helps in mitigating market volatility and reduces the risk as it follows the concept of rupee cost averaging.

– Risk: Lump sum investment carries a higher risk as compared to SIP. The risk in lump sum is related to market timing as one can enter at a higher market level whereas SIP removes the risk of market timing.

– Return: While both SIP and lump sum investments can provide substantial returns, the actual return depends on the market condition, the fund’s performance, and the timing of the investment.

– Convenience: SIP scores over lump sum in terms of convenience and affordability. It allows investors to start with a small amount and also automates the investment process, making it easier for them to invest regularly.

– Financial Planning: SIP helps in financial discipline as it forces the investor to save a fixed amount every month. It can be linked to specific financial goals, making it a more effective tool for long-term financial planning.

In conclusion, both lump-sum and SIP have their own merits and demerits. The decision should be based on the individual’s financial objectives, risk appetite, and investment horizon.

Tips and Tricks for SIP Investment

Set realistic goals for your SIP, understand how it operates, and decide the best assets to invest in; these are all critical steps toward a successful SIP investment strategy.

Setting Goals for SIP

To start a SIP investing, you need to have clear goals. These goals guide your choices. They tell you how much money to set aside each month from your budget. You can plan for a new car, a dream vacation, or a safe old age with these goals.

Your targets should be attainable and practical. If they are too hard and big, you may feel discouraged and stop saving. A good way is to break down large aims into small steps over time.

This makes it easy to reach them without stress or worry!

Understanding How SIP Works

SIP is a simple way to put money into mutual funds. You choose an amount and it goes in every month. This plan lets you buy fund units with each payment. When the market is high, you get fewer units for your money.

But when it’s low, that same amount gets more units.

The magic of SIP starts when these unit prices change over time. If the price goes up, all your units are now worth more! So even if the market swings up and down, over the years you still make a profit.

That’s why people say SIP works best over a long-term period for big growth goals.

Deciding Where to Invest in SIP

You need to pick the right SIP fund. This choice should be made based on what you want to achieve with your money and how well the funds have done before. Do a lot of research about different mutual funds before you make a choice.

It is very important for your SIP investment.

Features of SIP Investment

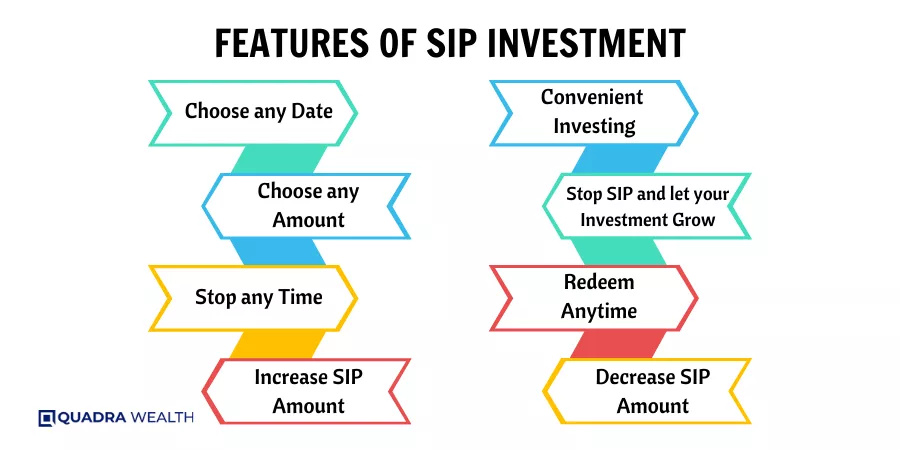

SIP Investment has many good points. It lets you save money in the long run. You start by investing a small amount each month. This is helpful for people who don’t have a lot of money to invest at once.

An interesting part about SIP is the “rupee cost averaging” feature. This means it lowers the cost of buying units when market prices are high and allows more units when prices are low.

So, if the market goes up or down, your money stays safe.

Another feature of SIP investment is its flexibility. You can stop your plan anytime you want without paying extra fees.

Lastly, SIP gives you the power of compounding. Your money grows faster over time because you earn interest on both your savings and past interests.

Finally, there’s also an “auto-debit” feature with a SIP investment that makes saving easy for investors as it directly takes a fixed amount from your bank account every month towards investments.

So, no matter how busy life gets; one wouldn’t miss out on their monthly contributions!

- Disciplined Savings

- Accessibility

- Rupee Cost Averaging

- Compounding Benefits

- Flexibility

- Diversification

- Low Minimum Investment

- Market Risk

- Limited Control

- Fees and Charges

- Lock-In Periods

- Returns Variability

- Not for Short-term Goals

- Market Timing

Conclusion: Making the Most of Your SIP Investment

In conclusion, embarking on a Systematic Investment Plan (SIP) journey offers a disciplined and accessible path to wealth creation. By understanding your risk tolerance, setting clear investment goals, and wisely choosing mutual funds, you can navigate the world of investments with confidence. Whether opting for online or offline modes, the key is to stay committed for the long haul, leveraging the power of compounding and rupee cost averaging. SIP investments provide a means to realize financial aspirations and secure a brighter future. So, begin your SIP journey today, start small, and watch your wealth grow steadily over time.

SIP Investment can make a big change for you. Start slow and learn what works best. Stay patient and enjoy the growth! Don’t let fear stop you from starting your SIP journey today!

FAQs

Starting a SIP investment requires first creating an e-KYC using Aadhaar-based identification verification, then choosing a portfolio mix depending on risk profiling and market trends.

A Unit-Linked Insurance Plan uses your money to invest in market-linked assets like equities or debts to balance your portfolio for long-term investments.

NAV or Net Asset Value shows the value of equity securities or debt securities at which they are bought or sold, making it crucial when investing through SIP.

SIP helps maintain good investment discipline by making regular deposits into mutual fund investments like ICICI Pru Large & Mid Cap Fund, and SBI Equity Hybrid Fund over time and adjusting to the market dynamics.

You can pay for your Monthly SIP payment using multiple modes that include PDCs (Post-Dated Cheques), NACH (National Automated Clearing House), and bank mandates set up with entities such as the National Payment Corporation of India.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way