The money market rate is a critical factor to consider when seeking to optimize your financial portfolio. The bank money market rate directly influences the returns on money market accounts (MMA) and money market funds (MMF), making them an essential element in your wealth management strategy.

In this comprehensive guide, we delve into the intricacies of MMA, comparing its benefits with traditional savings accounts.

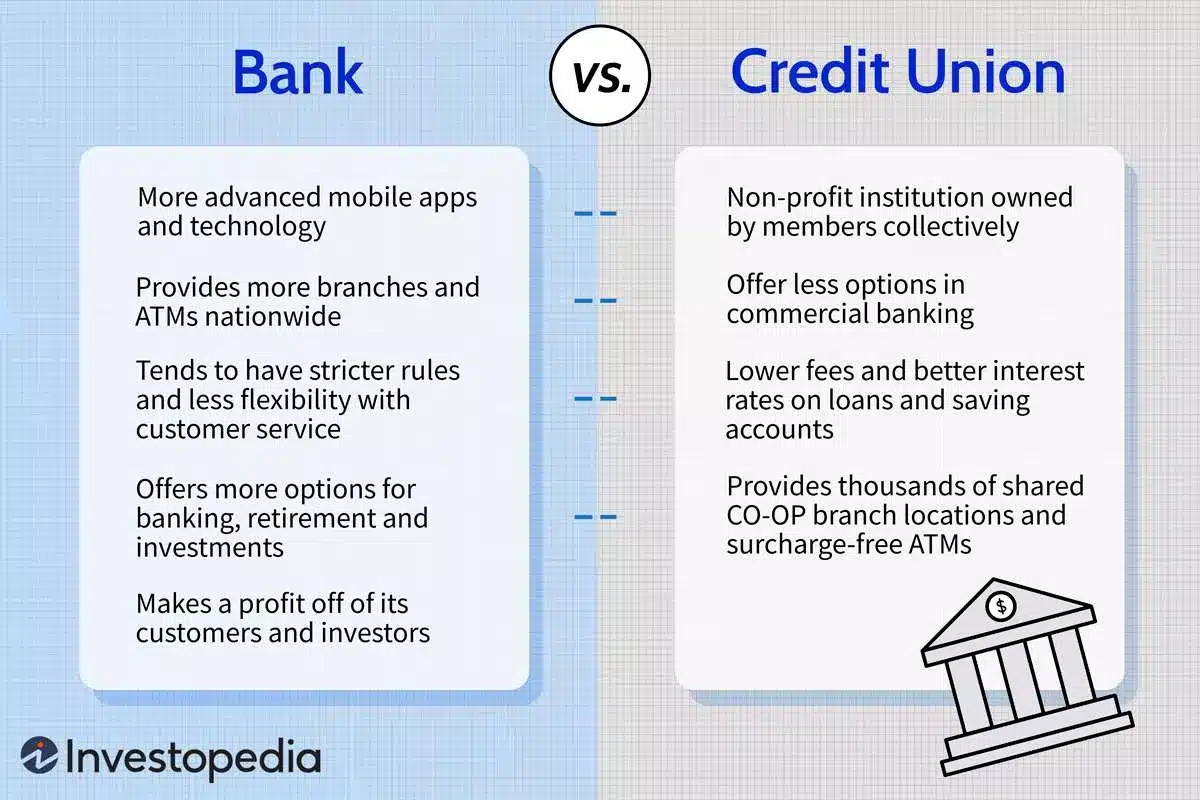

We also evaluate various banks’ offerings, including banks and credit unions that often pay higher interest rates. We explore online banking platforms that provide competitive MMA offerings and examine liquidity advantages associated with MMFs.

Lastly, in this section, we address risk management strategies for investing in these markets given their susceptibility to fluctuating bank money market account rates.

Money Market Accounts: The Perfect Blend of Savings and Checking

Want to grow your wealth in the UAE? Look no further than money market accounts (MMA). A money market account is an interest-bearing bank account that gives you the advantage of a high-yield savings account earning potential and the checking account’s versatility.

What are Money Market Accounts?

MMA is a hybrid between savings and checking accounts. A money market account is a deposit account offered by your bank or credit union that is liquid and federally insured. They allow you to earn interest on your balance while also providing check-writing privileges or debit card access to transfer money.

This dual functionality makes them highly appealing. Money market accounts work like other deposit accounts, such as savings accounts. As customers deposit funds in a money market account, they earn interest on those funds.

Typically, interest on money market accounts is compounded daily and paid monthly. Money kept in money market accounts is accessible when you need it, without incurring a withdrawal penalty, as you might with a certificate of deposit.

Why Choose Money Market Accounts?

- Better Interest Rates: Generally money market accounts offer higher interest rates than regular savings accounts, which means more money in your pocket.

- Liquidity: Unlike the fixed deposit account, money market deposit accounts allow easy access to the money fund when needed without any additional charges.

- Safety: Bank or credit union insure MMA balances up to $250,000 through the Federal Deposit Insurance Corporation (FDIC) or National Credit Union Administration (NCUA), offering protection against bank failures.

MMA is an excellent choice for UAE residents who want their money working harder for them. However, before opening an MMA or any financial product, always ensure that you fully understand its terms and conditions as well as the risks involved.

Maximize your savings potential and enjoy flexibility with high-yield Money Market Accounts in the UAE. Get better interest rates, liquidity, and safety.

Pros of Choosing MMA:

- Higher Rates

- Liquidity

- Safety

- Dual Functionality

Cons of Not Choosing MMA:

- Lower Rates

- Limited Flexibility

- Lower Safety Net

- Missed Growth Potential

Leading Banks Offering Competitive APYs on Money Market Accounts

If you want to grow your wealth in the UAE, consider many money market accounts (MMA) offered by leading banks and credit unions.

These financial institutions provide competitive Annual Percentage Yield (APY), allowing you to earn more from your savings.

Overview of Leading Banks Offering Money Market Accounts

Banks such as First Internet Bank, Vio Bank, and TIAA Bank are renowned for their attractive MMA offerings. For instance, First Internet’s Money Market Savings offers a 3.56% Yearly Percentage Yield, which is significantly higher than many high-yield savings accounts available today.

In addition to these banks, other notable mentions include Sallie Mae Bank and Discover Bank which also provide lucrative rates on their MMA. It’s always beneficial to compare different bank offerings before making an investment decision.

Comparing Different Banks’ Money Market Accounts Offerings

- Synchrony Bank: Known for its user-friendly online banking platform and excellent customer service.

- Ally Bank: Offers a robust 4.15% Annual Percentage Yield on all balance tiers – one of the highest in the industry.

- Sallie Mae: An excellent choice if you’re seeking versatility with options like High-Yield Savings Accounts or Certificates of Deposit alongside its MMA offering.

- Vio Bank: A relatively new entrant but has quickly made a name due to its highly competitive interest rates.

We’re constantly looking for not only the best jumbo money market rate and top Money Market Accounts (MMA) features but also the money market providers that will live up to our golden rule expectation to “do right” by their loyal customers, new and existing.

So the key is not just choosing any bank or credit union but selecting one that aligns best with your financial goals while providing optimal returns over time through a substantial Annual Percentage Yield

Maximize your savings in the Middle East with leading banks offering competitive Annual Percentage Yield on MMA. Compare and find the best money market accounts from different financial institutions to find the best rates and fees and choose wisely for optimal returns.

Credit Unions vs. traditional Banks in Terms of Market Rates

Selecting the appropriate financial establishment can have a considerable impact on building your riches. When it comes to high-yield market rates, credit unions often outperform traditional banks. or credit union.

Advantages of Credit Unions

Credit unions are not-for-profit organizations that exist to serve their members. This means they often offer higher interest rates on a high-yield savings account, including MMAs, compared to traditional banks and credit unions.

Lower minimums and fewer charges can make them an appealing selection for those seeking to expand their riches.

Case Study: Navy Federal & Connexus

Let’s take a look at two examples: Navy Federal Credit Union, the largest credit union in the world by membership; and Connexus Credit Union, known for its high-yield checking accounts.

- Navy Federal offers various types of MMAs, including Jumbo Money Market Savings, which currently pays an Annual Percentage Yield of up to 0.50% depending on the balance maintained. This outperforms most national brick-and-mortar banks in the same category.

- Their regular MMA requires only a $2500 minimum ongoing balance and provides access to debit cards and ATMs, ensuring liquidity and convenience combined with attractive yields. This makes them an ideal choice for anyone looking to grow their wealth through smart investing strategies without taking undue risks associated with other forms of investments like money market mutual funds or stocks.

So, if you’re looking to maximize your bank Money Market Account rates, consider credit unions like Navy Federal and Connexus. Your wallet will thank you.

“Boost your wealth with higher MMA rates. Choose credit unions like Navy Federal & Connexus for attractive yields, lower fees & convenient access.

Liquidity Advantage of Money Market Funds

When it comes to investing, liquidity is crucial. A Money market fund (MMF) offers high liquidity compared to other investments like certificates or bonds.

The Liquidity Factor Explained

Liquidity speaks to the capacity of a venture to be rapidly exchanged for money without influencing its market cost. Money funds offer easy access to cash when needed most, unlike fixed-term investments like CDs or bonds that incur penalties for early withdrawal.

A Money market fund has no lock-in period, making it an attractive option for short-term parking spaces for surplus cash while still earning a higher interest rate than traditional savings accounts.

Investing in a Money market fund offers the advantage of paying higher interest rates compared to regular checking accounts balance, providing an opportunity to grow wealth over time with relatively lower risk levels involved due to the inherent nature of underlying assets held by these mutual funds.

A Money market fund primarily consists of low-risk securities such as U.S Treasury bills and commercial paper, making them a safe haven type asset class.

Remember to consult professional advice to ensure you are fully aware of all risks involved before venturing into any form of investment activity to achieve optimal outcomes while minimizing exposure to unnecessary risks along the way.

“Investing in money market funds offers high liquidity & potential for growth with lower risk levels. Consult professional advice before investing.

Online Banking Platforms Outpacing National Brick-and-Mortar Banks

Digital banking platforms are revolutionizing the way we manage our finances, often surpassing traditional brick-and-mortar banks in terms of Annual Percentage Yield.

These virtual banks often outpace national brick-and-mortar banks when it comes to offering substantial Annual Percentage Yields (APYs). This is primarily due to their reduced overhead costs which allow them to pass those benefits onto consumers via enhanced interest rates.

The rise and advantages of online banking platforms

Advances in tech have made online banking more accessible than ever. It offers convenience, 24/7 access, and most importantly for investors – higher returns on savings accounts such as MMAs.

For instance, Axos Bank’s High Yield Money Market Account, an online bank based in San Diego provides up to 0.60% Annual Percentage Yield depending upon your balance tier.

Besides Axos Bank, there are other notable players like Ally Bank and Marcus by Goldman Sachs that offer competitive Annual Percentage Yield on money market accounts with no minimum deposit requirements or monthly maintenance fee – a feature not commonly found among traditional brick-and-mortar institutions.

Maximizing potential earnings over time

Apart from providing high yields on MMAs, these digital-first financial institutions also provide several tools and resources aimed at helping you grow your wealth consistently over time.

Features like automatic savings plans can help you set aside funds regularly while budgeting tools can aid in managing expenses effectively ensuring optimal utilization of available resources thereby maximizing potential earnings from deposited funds over time.

To sum it up; if you’re looking for better returns without compromising accessibility or flexibility then considering investing through an online platform might be worth exploring given their ability to offer superior APYs compared to conventional physical banks and credit unions largely owing to operational efficiencies achieved through digitization process adopted within this space today leading towards overall improved customer experience alongside increased profitability margins realized therein.

Pros of Maximizing Potential Earnings over Time:

- Increased Wealth

- Retirement Planning

- Financial Security

- Achieving Goals

Cons of Not Maximizing Potential Earnings over Time:

- Missed Growth Opportunities

- Limited Options

- Retirement Challenges

- Reduced Security

Key takeaways

Online banking platforms are offering higher Annual Percentage Yields (APYs) on savings accounts like MMAs due to their reduced overhead costs, providing investors with better returns. Players like Axos Bank, Ally Bank, and Marcus by Goldman Sachs offer competitive APYs on the best money market account without a minimum deposit requirement or monthly maintenance fees while also providing tools for consistent wealth growth over time. Overall, investing through online platforms can be a worthwhile option for those seeking better returns without compromising accessibility or flexibility.

Risk Management in Investing with MMFs

Investing in the Money Market Fund (MMF) is often considered low-risk, but it’s important to remember that there are still inherent risks involved. These funds invest in short-term debt securities traded within volatile financial markets where prices fluctuate based on prevailing economic conditions. This volatility can impact the overall performance of your fund.

Understanding the Inherent Risks in Investing with MMFs

The primary risk associated with MMFs lies in their exposure to market fluctuations and interest rate changes. For instance, if interest rates rise significantly, the value of certain money market instruments may decline, which could negatively affect your investment returns.

In addition, while these funds typically maintain a stable net asset value (NAV), they aren’t immune from losses. If an issuer fails to pay or becomes financially unstable, this could result in losses for investors.

Pros of Understanding Risks in MMFs:

- Informed decisions

- Risk mitigation

- Capital preservation

- Portfolio optimization

Cons of Not Understanding Risks in MMFs:

- Potential losses

- Lack of preparedness

- Missed opportunities

- Inadequate risk management

Importance and Strategies for Effective Risk Management

To mitigate these potential pitfalls when investing with MMFs, it’s crucial to have a robust risk management framework in place. Vanguard Fixed Income Group veteran Nafis Smith emphasizes this point, stating that such measures help avoid losing the capital invested therein.

- Diversification: Spreading investments across various sectors and industries helps reduce concentration risk.

- Fundamental Analysis: Understanding the fundamentals of companies whose securities you’re buying into provides insights into their ability to meet financial obligations.

- Maintaining Liquidity: Having enough liquid assets ensures you can meet redemption requests without having to sell assets at unfavorable prices.

Beyond individual efforts towards managing risks effectively, recent regulatory changes have been implemented to protect MMA holders against potential losses incurred during adverse situations such as Fed repurchase agreements common within this space. These regulations mandate certain practices, including maintaining sufficient liquidity levels and imposing fees or gates under specific circumstances – all aimed at safeguarding investor interests.

Key takeaways

First learn the pros and cons of money market funds because investing in (MMFs) involves inherent risks due to market fluctuations and interest rate changes, which can impact the overall performance of your fund. To mitigate these potential pitfalls, effective risk management strategies such as diversification, fundamental analysis, and maintaining liquidity are crucial. Recent regulatory changes have also been implemented to protect MMA holders against potential losses incurred during adverse situations.

Conclusion

Maximizing your savings means understanding bank money market account rates and accounts, and choosing the right bank or credit union can make all the difference.

While online banking platforms offer convenience and higher APYs, it’s important to remember that investing in MMFs comes with inherent risks that can be mitigated with effective risk management strategies.

Stay informed on current MMA offerings and implement smart investment strategies to make the most out of your bank money market account rates.

Learn How To Increase Your Passive Income By 20%, 30%, or more….and Secure A Reliable, Predictable Income Stream In Less Than 5 Years!

FAQs

What is the current money market interest rate?

The average rate on a money market is currently around 0.10% Annual Percentage Yield, but this can vary depending on the financial institutions and amount invested. Check out Bankrate for up-to-date information.

Where can I find 5% interest on my money?

Finding a consistent 5% return is challenging in today’s low-interest environment, but some credit unions or banks offer higher rates. Check out the Deposit account for options.

Where can I find 10% interest on my money?

Achieving a steady 10% return typically involves taking on more risk through investments like stocks or mutual funds rather than traditional savings accounts. For guidance, visit Vanguard Investor Home.

Is the money market rate fixed?

No, rates are variable and can change over time. The money market accounts featured on this page are among those with the consistently highest rates

Are the rates going up or down?

The direction of the money market rate largely depends on economic factors such as inflation and Federal Reserve policy decisions. Stay updated by following the latest news at the Federal Reserve Monetary Policy Reports.

Note: We do not provide specific investment advice or promote specific banks or any financial institutions.