Understanding the Internal Rate of Return formula is crucial for residents in UAE, especially expatriates at the CXO level who are keen on making informed investment decisions. The IRR is an essential factor to consider when assessing the success and potential growth of a venture.

In this guide, we explore the concept of the IRR method and its importance in investment analysis, as well as the manual calculation process with associated challenges. We also highlight the role accounting software plays in computing IRR with ease and accuracy.

Further on, we address some limitations within the unadjusted internal rate of return calculations and explore ways to rectify issues related to reinvesting rates. You’ll learn about the Modified Internal Rate of Return (MIRR), its benefits over traditional methods, and how it adjusts reinvestment-rate distortion.

We will illustrate these concepts through real-world applications using case studies like ABC Widget Company’s use of ROI metrics. Lastly, we compare different ROI calculation methods’ strengths and weaknesses to help you make an educated choice suitable for your unique financial situation.

Understanding the IRR Formula

The Internal Rate of Return (IRR) is a crucial financial metric used in corporate finance for evaluating profit centers and making decisions about capital projects.

It allows venture capital investors to analyze the profitability of investments, while companies can use it to assess the viability of their capital outlays.

What is IRR?

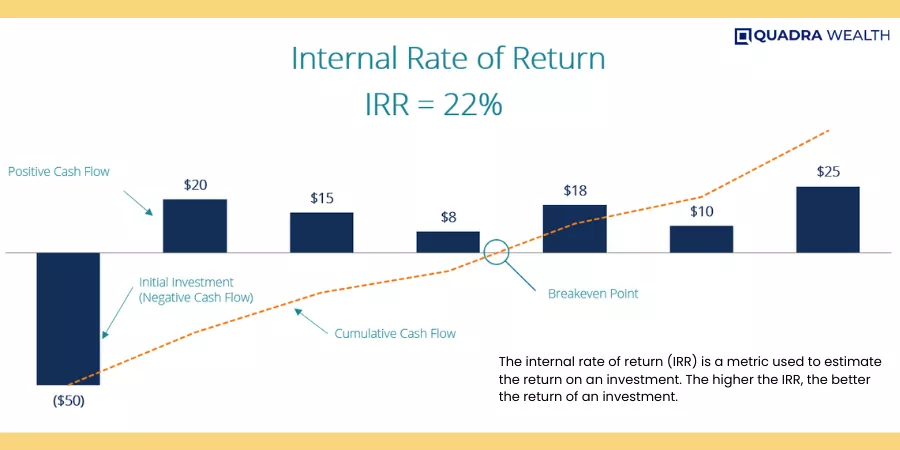

The Internal Rate of Return (IRR) is a discount rate that makes the net present value (NPV) of all cash flows from a particular project equal to zero. In simpler terms, it’s an estimate of your investment’s annual growth rate if nothing changes over time.

How does IRR work?

In essence, the Internal Rate of Return provides businesses with an annual growth percentage they can expect on their investment under current conditions. The formula takes into account both incoming and outgoing cash flow throughout the lifespan of a potential investment project.

When calculating this figure manually, you’ll need to find a discount rate that brings the NPV equal to zero or reaches the break-even point.

[The break-even point is the point or activity level at which the volume of sales or revenue exactly equals total expenses. In other words, it is a point at which neither a profit nor a loss is made and the total cost and total revenue of the business are equal] – not exactly easy without some mathematical prowess

Importance of IRR in Investment Analysis

- By using this method, investors can determine whether potential investments are likely to yield good returns or not.

- Making Decisions: Companies often use these calculations when deciding which projects deserve funding based on projected return rates.

- Risk Assessment: This measure also helps identify risks associated with different ventures by showing what kind of return one could expect.

- Accurate profitability assessment

- Informed decision making

- Risk identification

- Comparability

- Performance evaluation

- Financial independence

- Inaccurate profitability assessment

- Limited decision-making

- Increased risk

- Lack of comparability

- Performance evaluation challenges

- Reduced financial planning

To sum up: understanding how this formula works will help you make informed decisions about where to best invest your money to maximize profits.

So next time you’re faced with multiple options, don’t forget to consider the internal rate of return as part of your decision-making process.

Key takeaways

Maximize your investment profits with the Internal Rate of Return (IRR) formula. Evaluate profitability, make informed decisions, and assess risks for financial independence.

Calculating the IRR

Want to know if your initial investment amount is worth it? Look no further than the internal rate of return (IRR). But beware, manually calculating the IRR can be a real headache.

Manually calculating the IRR can be a laborious and error-prone process.

The IRR Calculation Struggle Is Real

Calculating IRR manually involves solving for the discount rates in a net present value equation set at zero. Figuring it out ain’t no stroll in the park.

You’ll need to guess and check until you reach an acceptable level of accuracy. And if there are multiple changes in cash flow direction during the investment period, you might end up with more than one IRR, which can be confusing.

Let Software Do the Heavy Lifting

Luckily, there are plenty of accounting software programs that can do the heavy lifting for you. They use advanced mathematical algorithms to automatically calculate Internal Rate, saving you time and reducing the risk of human error.

- Xero: Input your cash flow directly into Xero’s easy-to-use platform for instant IRR calculation results.

- Zoho Books: Zoho Books has a robust accounting suite with comprehensive reporting capabilities, including automatic computation of ROI metrics like NPV and IRR.

- FreshBooks: FreshBooks provides intuitive dashboards where you can track your investment’s performance over time using various financial indicators, including internal rate of return.

Not only do these software solutions save you time and effort, but they also provide accurate insights into your business’s profitability.

This helps you make informed decisions about capital planning and investment options efficiently. Plus, they offer clear visualizations that make it easier for non-financial professionals to understand complex concepts related to ROI calculations, empowering them to participate actively in decision-making processes within the organization.

In conclusion, it’s important to remember that this is a type of compound annual return rate, so returns from the investment are reinvested annually.

Understanding how to calculate and interpret key financial metrics like internal rate of return is crucial to the success of any business venture, especially in today’s volatile economic environment. Because the internal rate of return (IRR) determines the worthiness of any investment project.

In addition, the IRR determines the efficiency of a project in generating profits. Therefore, companies use the metric to plan before investing in any project.

The company’s hurdle rate or required rate of return is the minimum return expected by an organization on its investment. Any project with an internal rate of return exceeding the hurdle rate is considered profitable.

That’s why leveraging technology to streamline these tasks cannot be overstated enough. So next time you find yourself grappling with the complexities involved in manual computations, remember that there are plenty of reliable and efficient accounting software options available on the market, designed specifically to cater to the needs of a diverse range of industries and sectors worldwide.

They ensure that every business, regardless of size or scope, has access to the sophisticated analytical tools they need to thrive and succeed in the long term.

Key takeaways

The article explains how to calculate the Internal Rate of Return (IRR) and highlights the challenges involved in manually calculating it. It suggests using accounting software programs like Xero, Zoho Books, and FreshBooks that can automate IRR calculation accurately while saving time and reducing human errors. The article emphasizes leveraging technology to streamline financial computations for better decision-making processes within organizations.

Limitations of the Internal Rate of Return (IRR)

Despite its utility, the Internal Rate of Return (IRR) is not without flaws and should be assessed in light of these limitations when evaluating projects or the initial investment.

It’s important to understand its limitations and how to address them when evaluating projects or the initial investment.

Issues with Unadjusted IRR Calculations

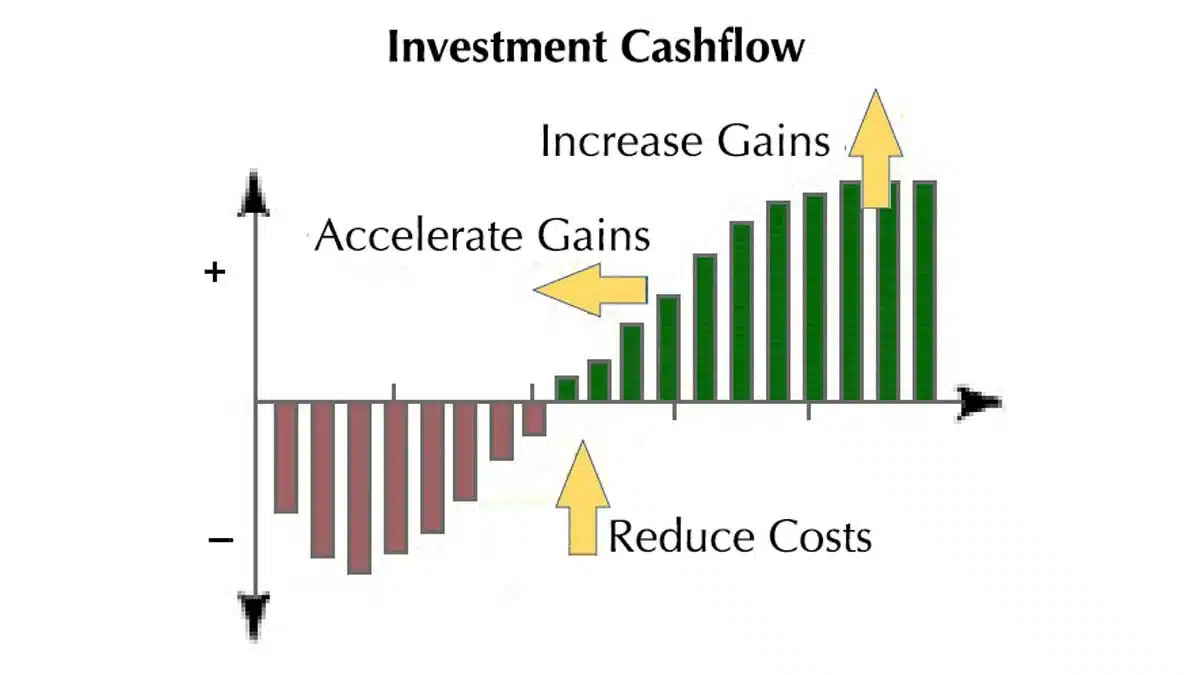

The main problem with traditional IRR calculation is that they assume all interim cash flows are reinvested at a similar rate as the initial investment. This is unrealistic and can lead to an overestimation of potential returns.

Additionally, manually calculating IRR can be complex and difficult to interpret for projects with non-conventional cash flow patterns.

Addressing Reinvesting Rate Issues with MIRR

To address these shortcomings, analysts often use the Modified Internal Rate of Return (MIRR). MIRR adjusts for reinvesting-rate distortion, providing more accurate insights into potential returns.

MIRR makes realistic assumptions, is simpler to calculate, and provides better comparability between projects.

- Realistic assumptions: MIRR assumes that interim cash flows are invested at a safe rate, rather than the project’s own rate of return.

- Simplicity: Calculating MIRR is simpler than computing regular IRR because there’s only one unique solution regardless of cash flow pattern.

- Better comparability: MIRR takes into account different risk tolerance levels between projects through adjustment for financing costs and re-investment rates, providing a better basis for comparing mutually exclusive projects.

No single method should be used exclusively when assessing investment opportunities. Instead, consider employing several metrics such as Net Present Value (NPV) alongside IRR/MIRR to ensure a comprehensive understanding of overall profitability and risks associated

Key takeaways

Maximize your initial investment potential in the Middle East with MIRR - a more accurate and simpler alternative to traditional IRR calculation.

Modified Internal Rate of Return (MIRR)

Financial analysis requires accurate calculations to determine potential returns. Traditional methods like Net Present Value (NPV), payback, and breakeven points can be useful tools, but savvy executives often turn to the MIRR to mitigate risks.

Benefits of Using MIRR over Traditional Methods

MIRR is an advanced financial metric that calculates the true annual equivalent yield by adjusting for reinvestment-rates distortion. This adjustment provides a more accurate reflection of an investment’s profitability compared to traditional methods.

- Better Accuracy: Unlike traditional IRR calculation, MIRR assumes cash flows generated are only invested at the company’s cost of capital budgeting, providing better accuracy.

- Risk Mitigation: By taking into account both financing costs and reinvesting rates, MIRR helps investors make decisions with less risk involved.

- Easier Comparison: MIRR eliminates the multiple solutions issue in IRR calculation, making a comparison between different projects easier.

How Does MIRR Adjust Reinvestment-Rate Distortion?

MIRR calculates future cash flows using the company’s finance rate and a present value for negative cash flows using the company’s reinvestment rates. These values help calculate the MIRR, which adjusts any distortions caused due to unrealistic assumptions made during traditional IRR calculations.

MIRR allows us to factor real-world variables such as changes in interest rates or market conditions into our projections, making them much more realistic and reliable.

To maximize profits from the initial investment by minimizing risks, considering the use of an MIRR could prove a beneficial strategy to navigate the complex world of corporate finance.

Therefore, it is essential to comprehend the intricacies of each technique prior to utilizing them for decision-making.

Key takeaways

Maximize your investment profits and minimize risks with MIRR. Say goodbye to traditional methods and hello to accuracy.

Real-World Application of ROI Calculation Metrics

Understanding and applying ROI calculation metrics is crucial for making informed investment decisions in the complex world of finance. One such example can be seen in the operations of a hypothetical company, ABC Widget Company.

Case Study: ABC Widget Company's Use of ROI Metrics

The ROI (Return on Investment) metric is widely used by companies like ABC Widget to assess their business performance. For instance, let’s say that this company was considering two options: creating a new widget assembly line or speeding up an existing one.

- New Assembly Line: The first option would involve significant capital expenditure but could potentially increase production capacity and profits over time. Here, they would calculate the expected return from this investment using IRR (Internal Rate of Return) formulas.

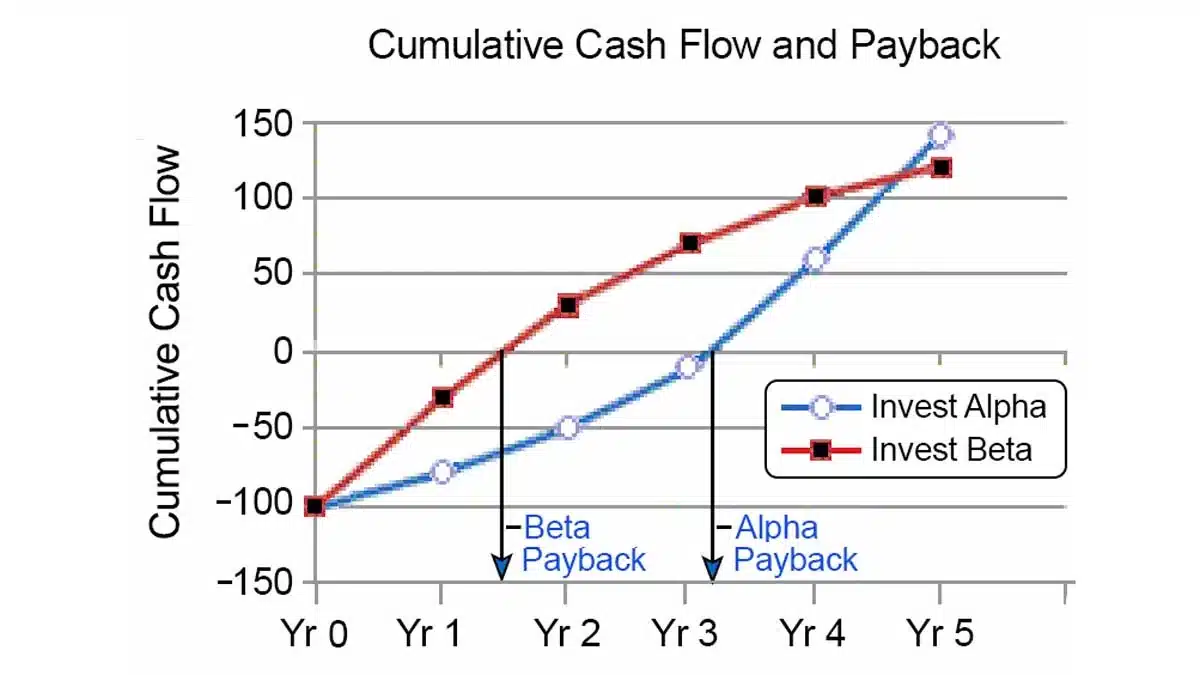

- Speeding Up Existing Line: The second option might require less upfront cost but may not have as much potential for profit growth. In this case, they might use another method such as NPV (Net Present Value) or payback period to evaluate its viability.

To make an informed decision about which path to take, ABC Widget Company needs to compare these figures accurately.

This requires them not only to know how each method works but also to be able to interpret what those numbers mean in terms of potential profitability and risk associated with each project.

This real-world application illustrates why it’s so important for businesses – especially those operating in highly competitive industries – to understand the different investment projects available when calculating ROI.

To make the most of profits and minimize risks, it is essential to choose a calculation method that best fits your unique circumstances.

And that starts with selecting the most appropriate calculation method based on the unique circumstances and requirements of your specific situation.

Key takeaways

The article explains the importance of understanding and applying ROI calculation metrics in making informed investment decisions. It uses a hypothetical case study of ABC Widget Company to illustrate how different methods like IRR and NPV, or payback period can be used to evaluate the viability and potential profitability of investment options. The key takeaway is that businesses need to analyze data effectively by selecting the most appropriate calculation method based on their unique circumstances and requirements for maximizing profits while minimizing risks.

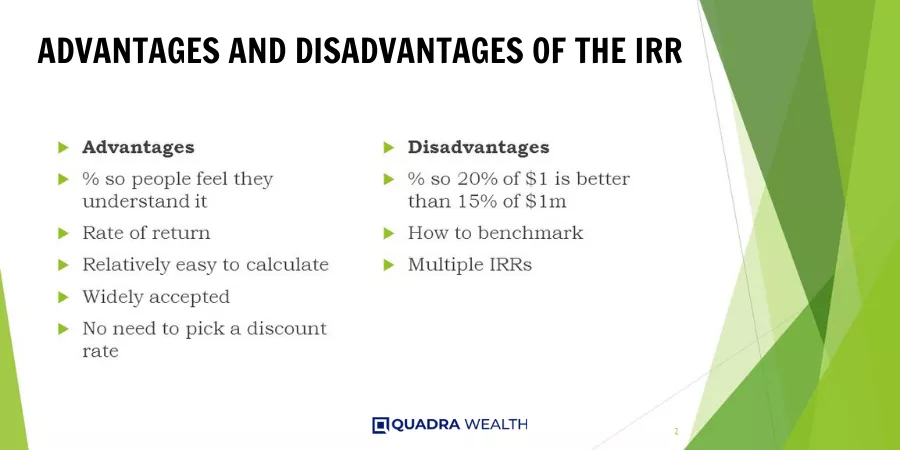

Choosing Between Different ROI Calculation Methods

To make an informed decision, it is important to compare the pros and cons of different ROI calculation methods. It’s crucial to understand these nuances to select the most appropriate method based on unique circumstances and requirements.

Comparing Strengths And Weaknesses Of Various ROI Calculation Methods

Return On Investment (ROI) is a popular performance measure used by businesses globally. However, different calculation methods may yield varying results depending on specific scenarios.

- Net Present Value (NPV): This measures the profitability of an investment by comparing present-value cash inflows with the cash outflow. While NPV provides a dollar value that makes comparisons easy, it assumes reinvestment at the project’s cost of capital which might not always be realistic.

- Payback Period: This simple approach calculates how long it will take for the initial investment to be recovered from cash inflows generated by the project. Although easy to understand, this method ignores the time value of money and could lead to inaccurate conclusions if not adjusted appropriately.

- Breakeven Point: This technique determines the point where total costs equal total revenues. It helps determine the viability of a business venture or product line. However, it does not consider profit potential beyond the breakeven point and might limit strategic decisions related to expansion and growth opportunities.

- Internal Rate of Return (IRR): An advanced metric that calculates the discount rate making the net present value of all cash flows zero, thereby offering a percentage-based result for easier comparison across projects and investments alike. Nevertheless, limitations such as the multiple IRR problem and the assumption of constant reinvestment rates need careful consideration during the application process.

To maximize profits and ensure sustainable growth, businesses must choose carefully between these different ROI calculation methods based on their unique context and requirements. By doing so, they can make informed decisions about future investments while minimizing risks associated with financial planning.

No single ROI calculation approach is applicable in all situations; the best choice for one situation may not be suitable for another.

Key takeaways

Different ROI calculation methods have their own strengths and weaknesses, so it's important to choose the most appropriate one based on unique circumstances. Some popular methods include net present value (NPV), payback period, breakeven point, and internal rate of return (IRR). Businesses must carefully consider these options to make informed decisions about future investments while minimizing risks associated with financial planning.

FAQs in relation to IRR formulas

Calculating IRR can be done through the trial and error method or with the help of financial calculator software.

However, the Internal Rate of Return has its limitations, including its assumption of reinvestment at a similar rate and difficulty in manual computation.

A 30% IRR means an investment is expected to generate a return of 30% annually over its life span, assuming all profits are reinvested at this same rate.

To manually calculate IRR, set up an equation equaling zero NPV and solve for ‘r’, which represents the discount rate.

But be warned, this usually requires trial and error due to the complex polynomial equations involved.

For more information on the Investment’s Internal Rate of Return, check out this source.

Conclusion

An Internal Rate of Return formula is a crucial tool for investment options analysis, but traditional calculations have limitations that must be addressed.

MIRR offers benefits over traditional methods by adjusting for deficiencies and providing a more accurate picture of an investment return.

Calculating IRR can be challenging, but accounting software can make it easier.

Looking for more information on IRR and MIRR? Check out these Investopedia articles.

Remember, investing involves risk, and personal opinions or anecdotes should be taken with a grain of salt.