Struggling to decipher the complexities of Phoenix Structured Notes? You’re not alone – these debt securities, issued by investment banks, often baffle both new and experienced investors.

This guide aims to simplify structured notes for you, providing a comprehensive understanding of their mechanisms, risks, and potential rewards. Ready to demystify your investments? Let’s dive in!

Key takeaways

● Phoenix Structured Notes are debt tools. They can spread risk and possibly make money from stock market gains.

● These notes have risks such as credit risk, lack of liquidity, and wrong pricing.

● They feature memory and put options which can bring unique benefits to investors.

● There are diverse types of these notes including Autocall Twin-Win or One Star Feature catering to different needs.

● Key terms related to the notes include the role of caps, barriers on a structured note, and the absence of dividends; understanding these is critical.

● Before buying Phoenix Structured Notes be sure you understand them well as they may not fit your needs.

Understanding Structured Notes

In this section, we delve into the definition of structured notes, providing insight into their advantages such as offering diversified investment exposure and potential for positive return, as well as discussing the drawbacks including substantial credit risk and limited liquidity.

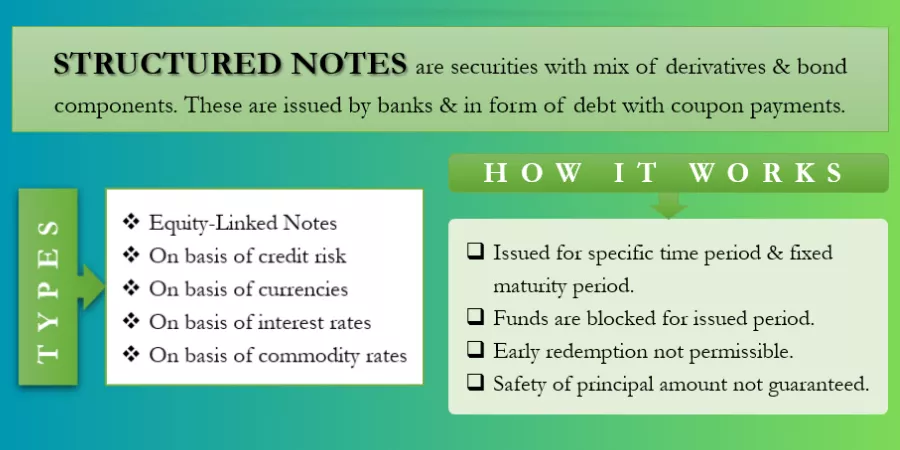

Definition of Structured Note

A structured note is a kind of debt that banks set up. They link this debt to something else like an asset or group of underlying assets. This other thing can be many things, and it changes how the debt works.

People buy these notes because big firms suggest some good points about them. They say you can spread danger across different places with these notes, make gains from stock market wins, and guard against losses too! But there’s a hang-up: a huge risk if the bank doesn’t hold their end up.

Characteristics:

Represents a debt obligation of the issuing bank

Provides exposure to various asset classes via derivatives or options, like:

Equities

Commodities

Indices

Funds

ETFs

Can provide a full or partial capital guarantee

Tradable on the secondary market

Advantages of Structured Notes

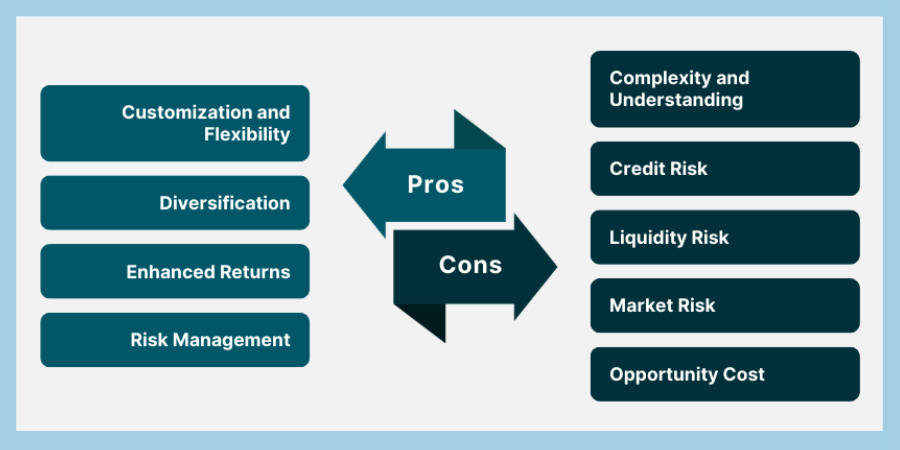

Buying structured notes can be good for you. Let’s talk about why:

Diversify your assets: Structured notes let you spread out your money to lower risk.

Join in on stock market gains: With structured notes, you can win as the stock market wins.

Protect from losses: Structured notes protect some or all of your money even when the stock market goes down.

Be patient for big results: Because structured notes take a long time to mature, they work best with the equity/interest rates link over time.

Disadvantages of Structured Notes

Structured notes may seem good but have some downsides. Here are some key drawbacks:

Credit Risk: Investors face a big risk if the bank that issues the note fails to meet its duty.

Lack of Liquidity: Most times, you can’t sell these notes quickly due to low trading activity on the market.

Call Risk: The issuer may take back the note before it matures, regardless of its price.

Fees and Costs: The average fee is high, often going up to 2.9%.

Inaccurate Pricing: The price is not always right because it’s set using matrix pricing and not net asset value.

Securities Law and Taxes: Investors might have to pay federal taxes on these notes even before they mature.

Unpacking Phoenix Structured Notes

This section delves into the specifics of Phoenix Structured Notes, exploring their unique payoff structure alongside a comprehensive risk analysis, and highlighting noteworthy features such as Memory and Put.

Description of Phoenix Structured Notes

Phoenix Structured Notes are a type of debt tool. These are offered by investment banks. The value of these notes comes from other things, like an asset or groups of assets. This is called the derivative part.

They can help make money when the stock market does well. They also add different types of items to your wealth pile for safety reasons. But, they come with risk too. If the bank has trouble and cannot pay what it owes on time, you could lose money on Phoenix Structured Notes as well.

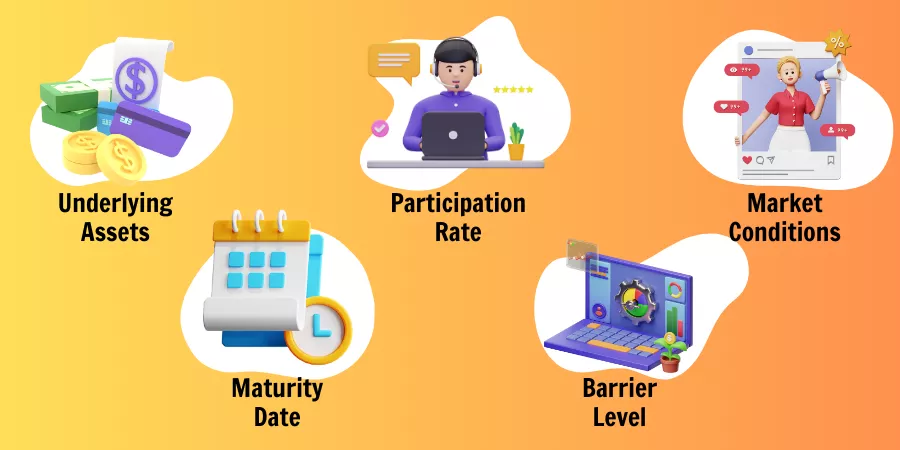

Payoff Structure

The payoff structure of Phoenix structured notes is not hard to grasp. It moves with how well the asset under it does. That means if the asset works well, you as an investor benefit a lot.

An option called a memory feature can also be in these note structures; this choice depends on your needs as an investor. If you choose and use this feature, it checks what earnings were like at the first observation time using what we call a coupon barrier level.

Later earnings rely on both old earnings and how that base asset is doing now. But there’s something to keep in mind here – high earnings might need you to let go of some protection for your money’s core value or capital.

Risk Analysis

Phoenix structured notes carry some risks. First, there’s credit risk. If the bank fails to keep its promise, you might lose your money. Second, these notes may not be easy to sell since they often lack a secondary market after being issued.

This means owning them could lack flexibility or result in a loss if sold early. Third is price risk; because of how they are valued through a matrix system instead of net asset worth, the listed prices can sometimes seem off-point.

Lastly relates to call risk where banks redeem notes before their due date without regard for their value at that time causing losses for investors who expected full maturity payouts.

Special Features: Memory and Put Feature

Phoenix Structured Notes has two cool features: the memory feature and the put feature. The first one, the memory feature, works in special notes with what we call ‘incremental coupons’.

Here’s how it goes: let’s say you did not get a coupon because your Note’s value dipped under that important level we call a ‘coupon barrier’. With this memory perk, if later on, your Note has beaten that same barrier again- you’ll still receive those missed coupons! Isn’t that neat? Now for the put option – it acts like insurance.

This happens when investors decide to sell their option within the note itself. It gives better coupon rates but keep in mind there is a risk of losing money if values take a dip.

Understanding Key Elements of Phoenix Structured Notes

This section delves into the core components of Phoenix Structured Notes, addressing essential elements such as autocalling obstacles, worst-of mechanisms in multi-asset models, and variant considerations including Autocall Twin-Win and One Star Feature notes.

Smoothing the Autocall Barrier

Smoothing the autocall barrier helps manage risks in Phoenix structured notes. It makes sure that sudden ups and downs do not hurt the investor’s money too much. This process becomes key when dealing with products that have a long time to mature.

It is also used to control unstable factors linked to the payoff of these notes. For example, if there are breaks in payoff, it may lead to explosive Greeks which can harm your invested cash.

In simple terms, smoothing this particular aspect enhances the security of your initial investment from extreme market changes.

Multi-Asset: Worst-Of Approach

The worst-of approach in multi-asset notes chooses the weakest asset. This is part of Phoenix’s structured notes. You own many assets in this note, not just one. The best-performing asset helps you win money.

But, if an asset does bad, it will protect your money from loss. A lower coupon barrier level exists for this kind of note with the worst-of approach compared to others with autocall barriers.

So even during rough times, smoothing the autocall barrier aids a stable payoff structure.

Other Variants: Autocall Twin-Win and Autocall with One Star Feature

Autocall Twin-Win is a type of Phoenix Structured Note. It can give more money back and may even end early if some things happen. Another kind is the Autocall with One Star Feature.

This one gives better coupon payments and may also finish early but with set rules. These two types are for investors who want structured products that line up with what they need or aim for in their investment plan.

They offer more ways to adjust than regular structured notes do.

The Risks Associated with Phoenix Structured Notes

Unveiling the risks behind Phoenix Structured Notes, this section dives into credit risk, lack of liquidity, and inaccurate pricing while highlighting additional factors that need to be considered, ensuring investors have a comprehensive understanding of potential pitfalls.

Credit Risk

Credit risk is a big deal with Phoenix Structured Notes. This happens if the bank that made the note can’t pay its debts. Take for example the case of Lehman Brothers. The bank shut down and could not pay back the money it owed on its notes.

“Principal-protected notes,” known as PPNs, show us how credit risk works. These are special because they promise to give back what you first paid (principal amount), plus more. However, this only happens if all is well with the bank that issued it! If something goes wrong with the bank, like with Lehman Brothers, then you might lose your invested money after all due to credit risk.

Registered Representatives

Registered Representatives are a kind of money helper. They must obey the rules to sell stocks or bonds in your area. Often, their pay comes from how much they care for or manage. Most times, this financial advisor cost is about one percent of what you give them to oversee.

However, with Robo-advisors, these costs are greatly cut down by half! Registered Representatives also make plans at an average fee of $2,000 or charge each hour around $250.

Lack of Liquidity

Phoenix Structured Notes are often hard to sell. They do not trade a lot on the second-hand market after they get sold for the first time. This lack of quick sales can be bad for investors.

It may mean that they cannot use their money when they need it most. Investors should think about this before buying Phoenix Structured Notes.

Inaccurate Pricing

Wrong price tags can be a problem with Phoenix Structured Notes. These notes often use complex pricing methods. The real estimated value and price given by sellers don’t always match up well.

Also, the higher impact of time on prices in such structures makes it even more tricky. So, there is a chance that you may pay too much for these notes without knowing it. This issue could lead to losses when you sell your note or get paid at its end-time.

Additional Risks to Consider

Be mindful of other dangers when dealing with Phoenix Structured Notes.

The credit risk is big if the bank that gave you the note fails to do its job.

These notes often don’t move much in the resale market after they’re given out.

It’s hard to know their true cost because they use a lot of numbers to get their price.

There’s a danger that the people who made the notes will take them back before you’re ready, no matter the cost.

Taxes are charged on these notes even if they haven’t fully grown yet or even if no cash has come your way.

They can be costly. On average, hidden fees can jump up to 2.9%.

An Example of a Principal-Protected Note (PPN)

A Principal-Protected Note (PPN) helps protect your money. You get back what you put in plus any gains. This safety net makes people happy when they invest.

But, PPNs also come with risks and limits. For example, if the bank that issued it goes bust, you could lose your investment. This is known as credit risk. Also, PPNs often stop your earnings from going too high by using caps.

These are some key points to watch for when handling a PPN.

Understanding the Terms of Phoenix Structured Notes

This section elucidates the crucial terms related to Phoenix Structured Notes including aspects like the role of caps, barriers on a structured note, and the implications of the absence of dividends.

The Role of Caps

Caps limit how much money you can make. In Phoenix Structured Notes, they set the top pay you can get back. If the stock goes up a lot, you might not see all those gains. Even if your note links to a thing that grows fast, a cap keeps it from paying more than its set high point.

Caps make risks lower but also keep rewards low too.

Barrier on a Structured Note

A barrier on a structured note is like a line in the sand. If the assets tied to the note go above or below this line, it changes things. The change could be good or bad for you. For instance, if prices drop too low beyond the barrier, you may get no money back at all.

So, an important thing to know about your note is where that barrier is set.

The Absence of Dividends

Structured notes have no dividends. This means you won’t get money from the company’s profits during the year. The only way to earn is if the note goes up in value.

Not getting dividends changes how much money you make. Without them, your total return could be a lot less. Be careful before buying structured notes and know that there will not be any payouts yearly like other investments.

The Costs Associated with Phoenix Structured Notes

Explore the potential costs related to Phoenix Structured Notes such as fees, loads, and tax implications, revealing why understanding these charges is crucial for investors. Dive in further to learn more about these financial aspects.

The Average Fee for a Structured Note

The fee for a Phoenix Structured Note can be steep. On average, it may reach up to 2.9%. The cost depends on the note’s setup and how much you want to change it. More complex or custom notes will have higher fees than simpler ones.

Why Phoenix Structured Notes Might Not Be Right for You

Phoenix Structured Notes are not for everyone. If you don’t like taking risks with money, stay away from them. These notes have a high credit risk. This means that if the bank can’t give you your money back, you lose it all.

You might find it tough to sell these notes too as they lack liquidity and don’t trade often after issuance. Their pricing can also confuse people because it doesn’t show the real value of the note but uses a matrix approach instead.

You may need to pay federal taxes on your Phoenix Structured Notes even before they mature or any cash has come in from them. One more thing is that these notes often have quite steep fees which average about 2.9% per year! Make sure to think well and converse with a financial professional about where Phoenix Structured Notes stand given your needs and how much risk you’re fine dealing with before making an investment decision

Conclusion

Phoenix Structured Notes are not for all. They come with risks like credit risk and lack of liquidity. If you can manage these risks, they might be good for you. So, think hard before saying yes to Phoenix Structured Notes.

FAQs

Phoenix structured notes are debt obligations with an embedded derivative component linking to a benchmark like the S&P 500 Index.

People invest for asset diversification and downside protection against poor stock market performance. Yet, this depends on creditworthiness and risk/reward ratios.

Yes, Phoenix Structured Notes come under the U.S. Securities and Exchange Commission (SEC). They check their legal work.

Unlike mutual funds or ETFs, these aren’t simple derivatives of equity indices like the S&P Emerging Markets Core Index but have inherent leverage and offer buffer features.

Financial advisory firms like Morningstar or RBC Capital Markets provide services and advice considering your financial objectives and tolerance for risk.

Phoenix Structured Note investors often give up potential dividend payments compared to directly held ETNs based on Financial Review Board lessons.