Struggling to find sustainable investment opportunities that blend both profit and purpose? Consider the rising star of green finance, Green Structured Notes.

Our deep dive into these eco-conscious financial instruments will illuminate how they can add diversity and sustainability to your portfolio while also revealing potential risks.

Ready to explore this new frontier in sustainable investing? Let’s dive in!

Key takeaways

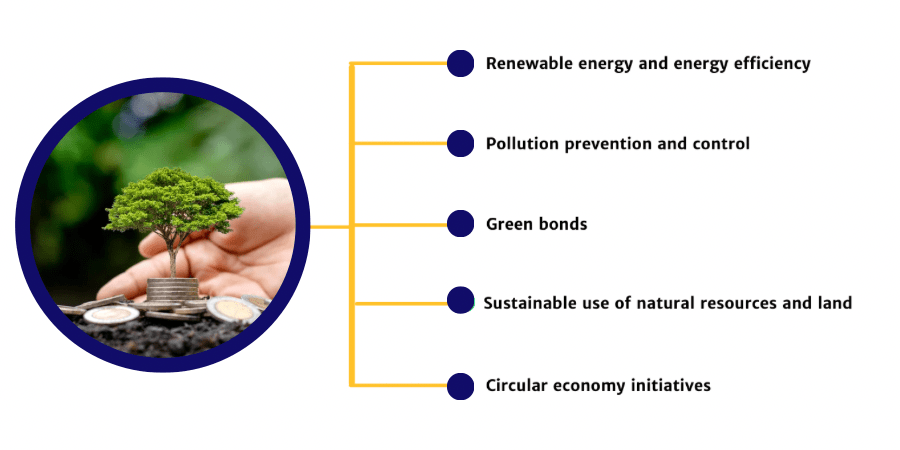

● Green Structured Notes are used by Barclays for green finance. They let people invest in eco-friendly things.

●These notes can make your money grow while also helping the earth. The payment comes from how well companies do on a green index.

●Investing in these notes has benefits and dangers. You could lose money if there are sudden changes in the market or if projects fail.

●Barclays started a program to sell these green notes to help renewable energy, efficient power use, and clean transport loans as part of their Net Zero aim.

Understanding Green Structured Notes in Sustainable Finance

Green Structured Notes are a part of green finance. Barclays uses them in its Green Structured Notes Programme. Barclays has launched a green structured notes program to offer institutional and retail investors a ‘differentiated green investment opportunity’.

They give people and groups a way to invest in green activities. The money made from these notes goes to help renewable energy, better use of power, and ways for travel to be kinder on Earth.

The payoff of the structured notes issued under the program will be based on a green index. The proceeds of the notes will be allocated to the financing or re-financing of eligible green activities such as renewable energy, energy efficiency, and sustainable transportation loans and contribute to the bank’s net-zero goals as well as providing £100bn of green financing by 2030.

C.S. Venkatakrishnan (pictured), head of global markets at Barclays, said the green structured notes program will provide clients with a new opportunity to access the green market while enabling the bank to offer ‘more compelling and sustainable structured products offerings.

Both the investment and the use of proceeds will be in line with the Sustainable Finance Framework and Green Issuance Framework, and the index will be selected in line with the Green Index Selection Principles.

The program will be an ‘important part of delivering that commitment in order to help accelerate the global transition to a low carbon economy. The payment we get from these notes depends on what the green index says. Here’s how it works: You buy or put money into one note today.

In time, you may get more back based on how well the linked item is doing in that index. That linked item can be something like solar power plants or wind farms running well which helps our environment stay clean.

The Popularity and Role of Green Structured Notes in Asset Allocation

Green structured notes have gained a lot of attention. Many people are using them for asset allocation. These green notes offer a fresh chance to invest in the future.

They get their money from eco-friendly works like solar power plants. The role of these notes is unique and useful. Your assets are not just placed anywhere, they go into something earth helping like energy-saving ventures or clean transport loans.

Plus, your returns are tied to an index that only tracks companies that do good for the planet. In short, when you pick green structured notes, you make your portfolio better with each passing day while playing an active part in saving our world.

Benefits of Investing in Green Structured Notes

Delve into the attractive world of Green Structured Notes, honing in on its dual benefits of fostering a more sustainable portfolio while offering an enticing diversification opportunity.

Stay tuned to discover more about this unique green investment strategy.

More Sustainable Portfolio

Green structured notes help you make a real change in the world. Barclays’ Green Structured Notes Programme makes your money work for good things. It gives money to green works like wind farms and bus lines that don’t hurt the earth.

The same bank, Barclays Bank PLC, picks these good works. A group checks to see if what they say is true about being green.

This whole plan goes with Barclay’s big goal of getting £100bn out by 2030 for all kinds of green work.

Opportunity for Diversification

Green structured notes give you a chance to spread your money out. This means it will not all go into one type of investment. With the green index, you can put some funds into eco-friendly items.

Barclays provides different ways for your cash to grow using things like renewable energy and sustainable transportation loans.

Risks and Points of Vigilance in Green Structured Notes Investment

Understanding the risks associated with Green Structured Notes – including market volatility and potential losses – is paramount to making informed investment decisions. Discover more on how these challenges can be navigated in sustainable investing.

Market Volatility

Market changes can shake up green-structured product. This is called market volatility. Big swings in stock prices can impact the value of these notes.

For example, if a green index falls, the return on your investment might be low.

Sometimes, these drastic shifts come fast and without warning. The price of a green structured note could fall lower than what you paid for it.

It’s important to know that while investing in sustainable markets is good for our planet, it also comes with risks.

Potential for Loss

Investing in green structured notes also comes with risks. One of these is the chance to lose money. The value of the notes can go up and down like a roller coaster ride because they are tied to a green index.

If the green projects funded do not work out, the investor might not get their full investment back.

So, while these notes support great causes like clean energy and public transport, there’s no promise that they will make money all the time.

Case Study: Barclays Green Structured Notes Programme

Barclays started a Green Structured Notes Programme. It helps investors do good for the earth and make money. Barclays uses the money from selling these notes to help renewable energy, energy efficiency, and sustainable transportation loans.

This way, they aim to boost green financing.

This program is part of Barclays’ Net Zero goal. They plan to offer £100bn of green funds by 2030.

The payoff from this note comes from a green index. Both big-time and small-time investors can take part in this chance.

So, it’s clear that with projects like the Green Structured Notes Programme, Barclays banks on both profit and planet health.

Conclusion

Investing in Green Structured Notes can be a smart move. It helps build a sustainable portfolio and supports green activities.

But, like all investments, it has risks too. Always aim to understand these risks before investing your money.

FAQs

A green structured note is a type of debt security from a financial institution for financing or re-financing eligible green activities.

Green Bonds like Barclays’ Green Bond Program can offer investment opportunities in projects that meet environmental, social, and governance (ESG) criteria such as climate change, affordable housing, and biodiversity projects.

Investing in green structured notes has market risk and credit risk similar to other securities.

Yes, errors may happen like in Barclays’ case where there was an overissuance of securities due to human error which resulted in them having to buy back and cancel them at their own cost.

Yes! The third-party verification agent checks underlying assets against sustainability issues like ESG rating ensuring its alignment with standards like the Green Bond Principles.

Yes! Take Barclays, they have set an ambition known as Net Zero Ambition aiming at £100bn of green financing by 2030 aligning with the Paris Agreement’s goal for a net zero bank by 2050.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way