Navigating the investment world can be daunting, especially when you’re aiming for stable returns with minimal risk.

Did you know there are numerous low-risk investments that could meet these exact needs? This article will explore the 10 best low-risk investments for 2024 to help keep your hard-earned wealth growing steadily.

Ready for a smoother financial journey? Let’s dive in!

Key takeaways

●Low-risk investments are a safe choice for steady returns and minimal risk.

●Examples of low-risk investments include high-yield savings accounts, treasury bills, and dividend-paying stocks.

●Considerations for low-risk investors include understanding your tolerance for risk and knowing your time horizon.

●The top 10 low-risk investments featured in this article offer stable returns, including high-yield savings accounts, certificates of deposit (CDs), treasury bills, money market accounts, corporate bonds, dividend-paying stocks, preferred stocks, fixed annuities, cash management accounts, and index funds.

Understanding Low-Risk Investments

Low-risk investments are a safe choice for those who want growth, but not too much risk. These types of investments do not change much in market value. They aim to protect your money while giving back small gains over time.

It’s all about stability and keeping what you have safe.

Examples of low-risk investments include high-yield savings accounts, certificates of deposit (CDs), and treasury bills. Other kinds could be corporate bonds or dividend-paying stocks.

You may also consider preferred stocks or fixed annuities. All these options can help keep your money steady as you grow it bit by bit.

Considerations for Low-Risk Investors

Considerations for Low-Risk Investors include understanding your risk tolerance and knowing your time horizon.

Understanding Your Risk Tolerance

Your risk tolerance is how you feel about risk and the level of anxiety you feel when risk is present. It’s about what amount of money you are willing to lose if things go bad. For some, a small loss may cause worry.

Others may sleep easily even if they lose a large sum. If fear takes over when your money drops in value, low-risk investments might be right for you.

Different kinds of risks come with different types of investments. High-risk investment options can bring high rewards or big losses. Low-risk choices bring smaller rewards but also less chance to lose much money.

Knowing your own comfort zone with losing money helps guide your investing path.

Knowing Your Time Horizon

Your time horizon is key to your investment plan. This term means how long you will invest before you need the money back.

For some, it could be a few years for a car or home buy. For others, it may be decades before retirement.

Long time frames are one of the best low-risk investments like savings bonds, mutual funds, or treasury notes.

These can grow slowly over many years and they are safe from market ups and downs too! Talk with an expert if you’re not sure about your time horizon.

Top 10 Low Risk Investments for Stable Returns

In this section, we will explore the top 10 low-risk investments that offer stable returns.

High-Yield Savings Accounts

High-yield savings accounts are the best low-risk investment option for stable returns. These accounts offer higher interest rates compared to the traditional savings account, allowing your money to grow more quickly over time.

With high-yield savings accounts, your capital is protected and there’s virtually no risk of losing your principal investment. With next to no risk of losing money plus the possibility of modest returns (depending on prevailing rates), parking your emergency fund or cash you need for near-term purchases in a high-yield savings account makes a lot of sense.

The interest rates offered by high-yield savings accounts can vary widely depending on market conditions. But you’ll never lose money on your principal and earned interest.

They are typically offered by online banks and provide easy access to your funds when needed. A high-yield savings account offers an unbeatable combination of a modest return on your money, unlimited liquidity—you can withdraw money whenever you wish—plus the backing of the Federal Deposit Insurance Corporation which insures deposits up to a set limit.

It’s important to note that high-yield savings accounts are not subject to the ups and downs of the stock market, making them a safe choice for conservative investors looking for steady returns.

Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are a popular choice for conservative investors looking for low-risk investment options. With CDs, you deposit a fixed amount of money with banks or financial institutions for a specific period of time, known as the term.

In return, the bank pays you interest on your deposit at a predetermined rate.

CDs offer stability and peace of mind because they provide a guaranteed rate of return. This means that regardless of any fluctuations in the market, your principal investment is protected.

The interest rates offered by CDs may be higher than those from traditional savings accounts, making them an attractive option for individuals who prioritize capital preservation.

By diversifying their portfolio to include less risky assets like CDs, investors can mitigate risk and navigate through volatility more easily.

It’s important to consider factors such as the term length and interest rate when choosing a CD that aligns with your financial goals and risk tolerance.

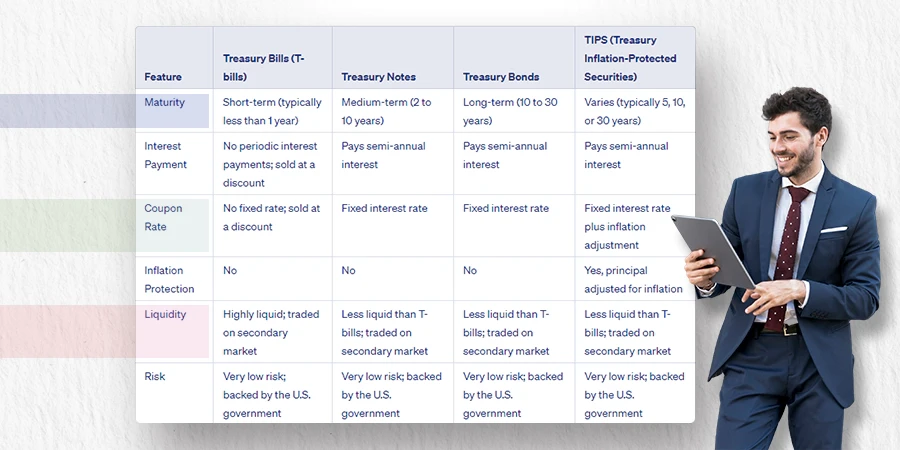

Treasury Bills, Notes, Bonds, and TIPS

Treasury bills, notes, bonds, and TIPS are part of the top 10 low-risk investments for stable returns. Treasury bills are short-term government debt securities with different maturity dates.

Treasury notes have maturities of two and ten years, while Treasury bonds have longer maturities. These investments are backed by the U.S. government’s full faith and credit, which means they are considered very safe.

Another option is Treasury Inflation-Protected Securities (TIPS), which provide protection against inflation. It’s important to note that these investments can be a good choice for investors looking for stability and capital preservation in their portfolios.

Money Market Funds

Money market account funds are a type of low-risk investment that invests in high-quality, short-term corporate or government debt other low-risk investments are grouped together to diversify risk and are typically sold by brokerage firms and mutual fund companies.

They are considered a safe option for conservative investors because they can help mitigate risk and ride out volatility in the market. One of the advantages of a money market fund is that it offers stable returns, which makes it suitable for those looking for a steady income.

Compared to traditional savings accounts, money market accounts funds may also offer higher interest rates. Overall, a money market account provides a secure and reliable investment option with the potential for modest growth.

Corporate Bonds

Corporate bonds are a type of investment that can provide stable returns with relatively best low-risk investments. These bonds are issued by companies to raise money, and they offer higher interest rates than government bonds.

By investing in corporate bonds, you become a bondholder and receive regular interest payments from the issuing company. This can be a reliable source of passive income.

Compared to stocks, corporate bonds are generally considered lower risk because if the company goes bankrupt, bondholders have a higher priority in receiving their money back.

So, if you’re looking for an investment option with steady returns and less volatility, corporate bonds could be worth considering.

Dividend-Paying Stocks

Dividend-paying stocks are a top choice for low-risk investors who want stable returns. These stocks are seen as safer than high-growth stocks because they can help limit volatility in your investment portfolio.

When you invest in dividend-paying companies, you have the potential to receive both regular cash dividends and see an increase in the stock price over time.

This can be really beneficial if you’re looking for a steady income stream from your investments. Dividend-paying stocks are considered a safer option for conservative investors who want to protect their money while still benefiting from modest growth.

Preferred Stocks

Preferred stocks are a type of investment that is considered low-risk and can provide stable returns. They are called preferred because holders of these stocks are paid out before common stockholders, giving them a level of safety.

While the value of preferred stocks may fluctuate based on market conditions and changes in interest rates, they generally offer dependable income payments and have the potential for appreciation over time.

When considering investing in preferred stocks, it’s important to take into account individual financial situations and risk tolerance.

Fixed Annuities

Fixed annuities are a popular type of annuity contract that are frequently used for retirement planning, but can also be useful for medium-term financial goals. Sold by insurance companies and financial services companies.

Fixed annuities are low-risk investments that guarantee a fixed rate of return over a specific period of time. They provide a predictable and stable source of income. These annuities are long-term contracts with insurance providers, backed by their financial strength and stability.

Fixed annuities are considered safe because they offer protection against volatility and do not expose investors to stock market risks. With a fixed annuity, individuals can have peace of mind knowing that their investment will grow at a steady pace without the worry of losing money.

Cash Management Accounts

Cash management accounts are a convenient option for investors who want a combination of checking and savings features. These investment accounts offer competitive rates compared to other short-term investment options, making them an attractive choice for those looking for stable returns on their investments.

With cash management accounts, you can enjoy higher interest rates while having the flexibility to invest and manage your funds in one place. They are particularly beneficial during periods of high macroeconomic and geopolitical uncertainty when low-risk investments are more desirable.

Index Funds

Index funds are an excellent low-risk investment option. These funds are designed to track a specific market index, such as the S&P 500 or the Dow Jones Industrial Average. One of the main advantages of index funds is their low cost, which means you don’t have to pay high fees to invest in them.

Another benefit is that index funds provide diversification because they include a wide range of stocks within the chosen index. This diversification helps spread out your risk and potentially increases your chances of stable returns over time.

Plus, since these funds aim to replicate the performance of an entire market segment, they tend to offer higher returns compared to actively managed mutual funds or individual preferred stock.

And here’s a bonus low-risk investment option for you to get stable returns

Series I Savings Bonds

I bonds are a special type of U.S. savings bond with a variable interest rate designed to keep up with inflation, as measured by the consumer price index (CPI).

They offer returns based on two interest rates: A fixed rate that remains the same for the 30-year term of the bond, plus a variable interest rate that is updated every six months to match the prevailing rate of inflation.

In addition, I bonds benefit from semiannual compounding: Earned interest is added to the value of the bond twice a year, gradually increasing the principal on which you earn interest.

You must hold the bond for at least one year before cashing out, and there is a small penalty if you cash out before five years have passed.

If you live in a place with high taxes, I bonds are a good option since their interest payments are exempt from both state and local taxes.

Detailed Overview of Selected Investments

In this section, we will provide a detailed overview of three selected low-risk investments: TIPS, Investment-Grade Corporate Bonds, and Dividend Aristocrats.

Treasury Inflation-Protected Securities (TIPS)

TIPS are low-risk investments issued by the U.S. Treasury. These securities have maturities of five, 10, or 30 years and are backed by the government.

They provide a fixed period of interest rate paid semi-annually and have a principal value that adjusts with inflation. This means that as prices rise, the value of TIPS increases, protecting investors against inflation.

For conservative investors seeking stable returns and safeguarding against rising prices, TIPS can be a suitable choice.

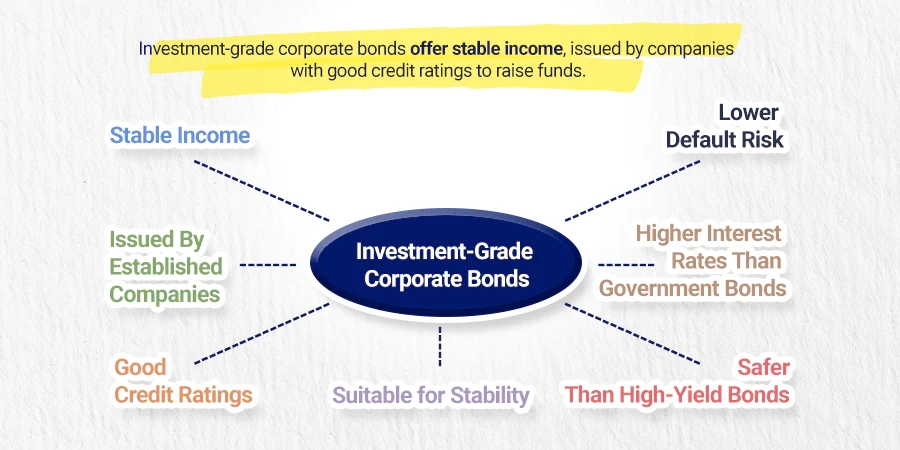

Investment-Grade Corporate Bonds

Investment-grade corporate bonds are a type of investment that can provide stable income. These bonds are issued by companies to raise money, and they have good credit ratings.

This means that they are less likely to default on their debt payments. Compared to government bonds, investment-grade bonds offer higher interest rates.

They are considered safer than high-yield or junk bonds because there is a lower risk of companies failing to repay their debts. Investing in investment-grade bonds can be a good option for those looking for stable returns.

Dividend Aristocrats

Dividend Aristocrats are companies that have a strong track record of increasing their dividends for at least 25 years in a row. These companies are considered to be financially stable and reliable options for low-risk investments.

By investing in Dividend Aristocrats, you can benefit from regular income through their dividend payments. These companies are often large, well-established businesses with a proven history of financial success.

Some examples of Dividend Aristocrats include Procter & Gamble, Coca-Cola, and Johnson & Johnson. Investing in Dividend Aristocrats can be a smart choice for those looking for steady returns and the potential for long-term growth.

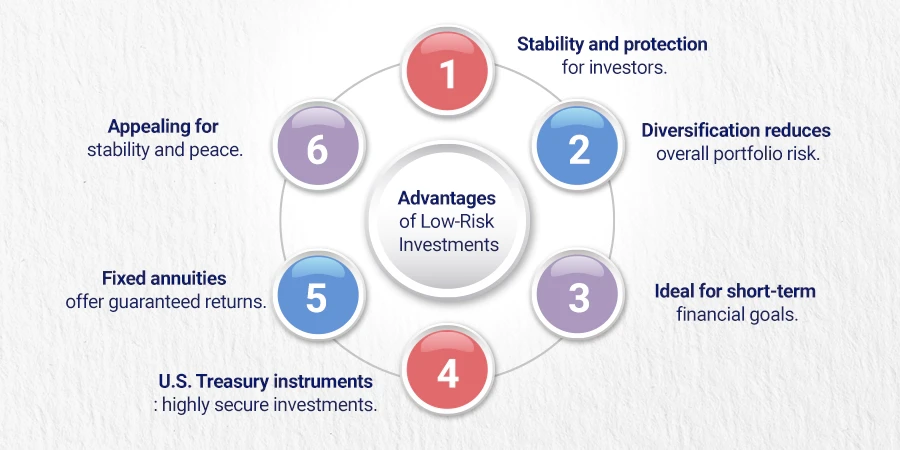

Advantages of Low-Risk Investments

Low-risk investments have several advantages that make them attractive to investors. First and foremost, they provide stability and protection against potential losses. This is especially important for conservative investors who prioritize capital preservation over high returns.

Low-risk assets also offer additional diversification to a portfolio, which can help reduce overall risk and volatility. Furthermore, these types of investments are suitable for individuals saving for near-term financial goals, as they provide consistent and stable returns without the need to worry about market fluctuations.

U.S. Treasury instruments, such as Treasury bills, notes, treasury bonds, and TIPS, are highly regarded as very low-risk investments backed by the government.

They are seen as safe havens during times of economic uncertainty or volatility. A fixed annuity is another example of a low-risk investment that guarantees a fixed rate of return regardless of market conditions.

These advantages make low-risk investments an appealing option for those seeking stability and peace of mind in their investment strategy.

How to Start Investing in Low-Risk Investments

If you want to start investing in low-risk investments, here are some steps you can follow:

- Assess your financial goals and risk tolerance: Determine what you hope to achieve with your investments and how much risk you are comfortable taking on.

- Educate yourself about low-risk investment options: Research different types of low-risk investments and understand how they work their potential returns, and any associated risks.

- Set a budget for investing: Decide how much money you are willing to commit to low-risk investments and create a plan for allocating funds accordingly.

- Open an account: Choose reputable financial institutions or online platforms that offer the low-risk investment options you are interested in. Follow their instructions to open an account.

- Consult with a financial planner: If needed, seek guidance from a qualified professional who can provide personalized advice based on your specific financial situation and goals.

- Build a diversified portfolio: Allocate your investment funds across different types of low-risk assets to reduce the impact of any individual investment’s performance on your overall portfolio.

- Monitor and adjust your investments as needed: Regularly review the performance of your low-risk investments and make adjustments if necessary to align with changing market conditions or meet your financial goals.

What you what to know about Low-Risk Investments

What is low-risk investing? Why should one own low-risk investments? When should one buy low-risk investments? What is risk management?

What is low-risk investing?

Low-risk investing refers to a strategy where individuals choose investments that have a lower chance of losing money. It is suitable for people who are not comfortable with taking on a lot of risks and prefer stability in their investment returns.

Low-risk investments typically offer lower potential returns compared to higher-risk options like the stock market, but they also come with less volatility and the possibility of preserving capital.

Examples of low-risk investments include government-backed securities like Treasury bills, certificates of deposit (CDs), and fixed annuities.

These types of investments are generally considered safe because they are backed by a reputable financial institution or have guaranteed rates of return.

Why should one own low-risk investments?

Owning low-risk investments is important because they help individuals make smarter financial decisions and protect their money. During times of volatility in the financial markets or economic uncertainty, low-risk investments can provide stable returns and minimize potential losses.

They are a good option for those who want to ride out any ups and downs in the market without risking too much. By diversifying their portfolio with low-risk assets, individuals can ensure that they have a reliable source of income even during a recession or economic downturn.

It’s always a good idea to discuss low-risk investments with a qualified professional who can guide you toward options that align with your investment goals.

When should one buy low-risk investments?

Low-risk investments are a good choice when you want to play it safe and protect your money. They are especially suitable for investors who don’t like taking risks or have short-term financial goals.

If there is a lot of uncertainty in the economy or world events, low-risk investments can provide stability and peace of mind. It’s important to remember that low-risk investments are not designed for high returns but rather for capital preservation.

So, if you have a short investment horizon or prefer less risk, considering low-risk investments may be the right move for you.

What is risk management?

Risk management is the process of identifying, assessing, and prioritizing risks in order to protect investments and achieve stable returns.

It involves taking measures to mitigate or reduce the impact of risks that may arise from factors such as market volatility, economic conditions, interest rates, and inflation.

Risk management is especially important during times of uncertainty in the economy or geopolitical events. By effectively managing risks, investors can make informed decisions to preserve their capital and minimize potential losses.

- Capital Preservation

- Stable Returns

- Reduced Volatility

- Diversification

- Short-Term Goals

- Peace of Mind

- Lower Returns

- Inflation Risk

- Opportunity Cost

- Limited Growth

- Interest Rate Risk

- Market Fluctuations

Conclusion

In conclusion, understanding low-risk investments and considering your risk tolerance and time horizon are crucial for stable returns.

The top 10 low-risk investments featured, such as high-yield savings accounts, treasury bills, dividend-paying stocks, and fixed annuities, offer capital protection and the potential for steady growth.

By diversifying your portfolio with these low-risk options, you can navigate market volatility while working towards your financial goals effectively. Start investing in low-risk options today to secure a more stable future.

FAQs

Some examples of low-risk investments include savings accounts, certificates of deposit (CDs), government bonds, and index funds.

You can ensure stable returns with low-risk investments by diversifying your portfolio, investing in long-term options, and carefully researching investment opportunities before making investment decisions.

Yes, low-risk investments are suitable for everyone who wants to preserve their capital and achieve steady returns without taking on significant financial risks.

Low-risk investments typically offer lower returns compared to riskier investment options. They prioritize stability over high profits but still provide a safe way to grow your money over time.