You may be interested in investing, but as a Muslim, you want to ensure your investments align with Islamic principles.

Did you know that halal investing can offer benefits to both Muslims and non-Muslims alike? In this comprehensive guide, we’ll explore Shariah’s investment rule helping you navigate through the world of ethical and socially responsible investing while adhering to your faith.

Let’s dive in!

Key takeaways

●The Shariah-compliant fund follows rules set by Islamic law and focuses on ethical and socially responsible investments.

●Halal investing involves abstaining from interest, avoiding prohibited industries, making regular charity contributions, and refraining from excessive risk sharing and speculation.

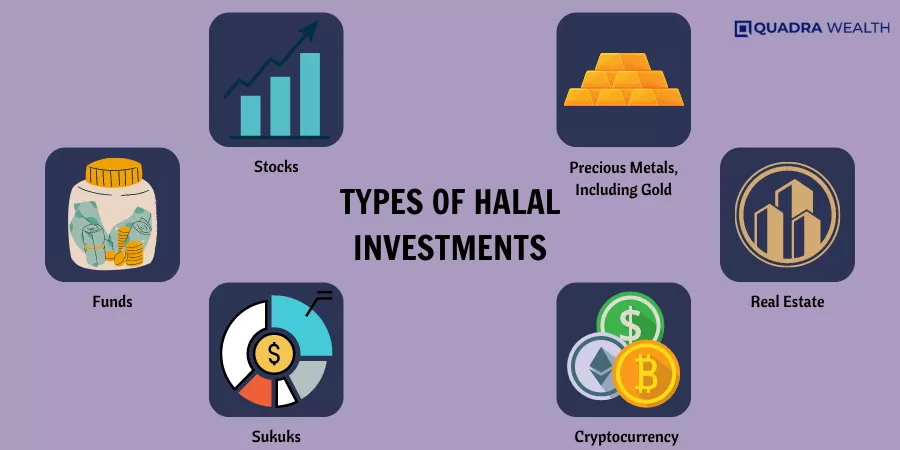

●Types of halal investments include stocks, funds, Sukuk (Islamic bonds), precious metals like gold, real estate, and cryptocurrency.

●The halal investment screening process is important to ensure investments align with Islamic principles and guidelines. It helps avoid prohibited activities and upholds values of social justice and non-exploitation.

Understanding Shariah-Compliant Investing

Shariah-compliant investing follows rules set by Islamic law. It is a type of ethical and socially responsible investing. Muslim investor use these rules to pick where to put their money.

Some types of business are not okay for Sharia compliant investing. These include interest-paying investments and businesses linked to alcohol, tobacco, or gambling.

This way of investing puts focus on long-term gains, not short-term wins. It is very careful about risk and avoids short-term bets on the stock market, known as speculation.

This helps save money on trading costs and taxes that can eat into your profits over time. Halal standards play a big part in this kind of investment too.

They stop Muslims from putting money into things seen as haram activities under Islamic law like pork-related products or non-Islamic financial sectors.

Basic Tenets of Halal Investing

Halal investing involves abstaining from interest, avoiding prohibited industries, making regular charity contributions, and refraining from excessive risk and speculation.

Abstaining from Interest

In Halal investing, interest is a big no-no. This rule comes from Islamic principles. They say that earning money from interest is not right or “Halal”.

So, all the cash reserves in Halal investing avoid places where they might earn interest.

That means money market funds and bank accounts are out.

This step away from interest may look tough but it upholds Shariah guidelines. These laws shape our choices in Halal investing. Plus, steering clear of interest makes us careful with our investments.

We learn to follow rules and make smart finance moves for our future without relying on easy earnings like those from interest payments.

Avoidance of Prohibited Industries

In Halal investing, some industries are off-limits. They must not make money from things that go against Islamic rules and regulations. These include the alcohol industry, gambling, and tobacco. We also avoid firms dealing in pork or non-halal food production.

Weapons and pornography sectors are out too. So if a business gets most of its money from these banned areas, it can’t be part of Halal investments.

Regular Charity Contributions

Regular charity contributions are an essential aspect of Halal investing and adhering to Islamic principles. These contributions demonstrate a commitment to giving back and upholding Islamic values.

Muslims are encouraged to donate a percentage of their wealth through Zakat, which is a form of charitable giving.

By regularly contributing to charities, Islamic investors can ensure that their investments align with their religious beliefs and support causes that promote social justice and non-exploitation.

Giving back not only helps individuals purify their wealth but also contributes to the overall betterment of society.

Refraining from Excessive Risk and Speculation

Halal investing promotes a cautious approach by avoiding excessive risk and speculation. Islamic principles encourage investors to prioritize stable, long-term investments over short-term gains.

This helps protect the investment from unnecessary volatility and potential losses. By focusing on companies with strong fundamentals and sustainable growth prospects, halal investors aim to build a resilient portfolio that aligns with their values.

Additionally, by refraining from speculative investments, halal investors can avoid potential pitfalls associated with high-risk ventures. This strategy promotes financial stability and prudent decision-making in line with global Islamic financial principles.

Types of Halal Investments

Halal investments can include stocks, funds, Sukuk (Islamic bonds), precious metals like gold, real estate, and even cryptocurrency.

Stocks

Halal investing in stocks involves carefully selecting companies that adhere to Sharia principles. This means avoiding businesses involved in prohibited activities, such as alcohol, gambling, pornography, tobacco, and weapons.

It also means ensuring the company’s financials are structured in iance

compliance with Sharia law. Muslim investors who choose halal stocks can benefit from long-term growth potential and dividends while aligning their investments with their values.

However, limiting investment choices to halal stocks may result in fewer opportunities and potentially higher risks compared to conventional finance ((non-Islamic banking, finance and insurance, etc.)

Funds

Funds are a type of investment that allows individuals to pool their money together with other investors. In the context of halal investing, there are specific types of funds that adhere to principles of Islamic.

These halal funds invest in companies and industries that align with Shariah standards, avoiding prohibited activities such as interest-based transactions, alcohol, gambling, and non-halal food production.

Halal funds can include mutual funds or exchange-traded funds (ETFs) that offer diversification and professional investment management while ensuring investments remain in line with Islamic values.

Sukuks

Sukuks play a significant role in understanding Shariah investment rules. They are halal alternatives to bonds and offer an appealing option for risk-averse investors. Unlike traditional bonds, sukuks generate profits from the underlying assets rather than interest and principal payments.

This makes them compliant with Islamic finance principles. Sukuks are part of a Shariah-compliant fund, which aims to achieve financial returns while adhering to Islamic rules and regulations.

By providing a halal alternative to conventional bonds, sukuks contribute to the diverse range of halal investments available to Muslim investors who want their investments aligned with their religious beliefs.

Precious Metals, Including Gold

Muslim investors who adhere to Shariah rules often consider precious metals, including gold, as a halal investment option. Gold is valued for its stability and has been considered a safe haven asset for centuries.

It is seen as a tangible store of value that can protect against inflation and currency fluctuations. By investing in gold, Muslim investors can diversify their asset allocation while remaining compliant with Islamic financial principles.

The demand for Shariah-compliant investment funds in gold has increased in recent years, leading to the development of innovative products such as gold-based mutual funds and exchange-traded funds (ETFs) that cater specifically to Muslim investors.

Real Estate

Real estate is considered a halal investment in Islamic finances. This means that buying and owning properties, such as residential homes or commercial buildings, is allowed under Shariah law.

Many Muslim investors find real estate to be an attractive option because it provides stability and potential for long-term growth. The demand for halal real estate investments is particularly high in emerging markets like Africa and the Middle East, where wealthy individuals are looking for opportunities to grow their wealth while adhering to Islamic principles.

As the Islamic finance industry continues to expand, more investment products and Islamic financial services focused on real estate are being developed to meet the needs of Muslim investors.

Cryptocurrency

Cryptocurrency is a type of halal investment that follows Islamic financial principles. It is a digital or virtual form of currency that uses cryptography to secure transactions and control the creation of new units.

With cryptocurrency, there is no involvement of interest or usury, which aligns with the prohibition on interest-paying investments in Islamic money management. Cryptocurrency also allows for transparency as all transactions are recorded on a public ledger called the blockchain.

However, it’s important to note that not all cryptocurrencies may be considered halal because some may involve speculation or investment in prohibited industries. Therefore, Muslim investors should do their research and consult with Shariah advisors to ensure they choose halal-compliant cryptocurrencies for their investments.

The Significance of Halal Investment Screening

Halal investment screening is a crucial aspect of understanding Shariah rules in Islamic investment. It plays an important role in ensuring that investments align with Islamic principles and guidelines.

Halal investing follows a disciplined investment process, which involves thorough research and analysis of securities to determine their compliance with the Shariah law. This approach appeals to risk-averse investors who prioritize financial stability and ethical considerations.

By implementing halal investment screens, investors can avoid engaging in prohibited activities such as interest-based transactions (riba), gambling (maisir), and investing in industries like alcohol, tobacco, pornography, or weapons.

These screens help uphold the values of social justice and non-exploitation promoted by Islamic principles.

However, it’s worth noting that adhering to halal standards may limit the available investment choices and potentially introduce additional risks.

The stricter criteria for halal investments mean that certain sectors might be excluded from consideration, reducing diversification opportunities within a portfolio.

Nonetheless, halal investment screening provides Muslim investors with peace of mind knowing that their investments are aligned with their religious beliefs. Additionally, non-Muslims interested in socially responsible investing can also benefit from considering halal principles when making financial decisions.

Overall, understanding the significance of halal investment screening is essential for anyone looking to invest according to Islamic principles or seeking morally conscious financial opportunities.

By following these guidelines, investors can embrace ethical investing practices while pursuing their financial goals and investment objectives.

Exploring Halal Mutual Funds and Sukuk Investments

Halal Mutual Funds:

– Halal mutual funds are investment vehicles that comply with Islamic principles.

– These funds are managed by financial institutions that specialize in Sharia compliance investments.

– Halal mutual funds provide Muslim investors with access to a diversified portfolio of stocks and other permissible assets.

– They are designed to meet the needs of those who want their investments to align with their religious beliefs.

Sukuk Investments:

– Sukuk, also known as Islamic bonds, are another type of halal investment.

– Unlike conventional interest-bearing bonds, sukuk follows Islamic financial principles.

– Sukuk represents ownership interests in tangible assets rather than debt obligations.

– Investors receive periodic payments based on the income generated by the underlying assets instead of fixed interest payments.

Benefits of Halal Mutual Funds and Sukuk Investments:

– Investing in halal mutual funds and sukuk allows Muslims to grow their wealth while adhering to Shariah-compliant guidelines.

– These investments offer diversification across multiple asset classes, reducing risk for investors.

– By investing in companies that abide by ethical standards, individuals can support businesses aligned with their values.

Overall, exploring halal mutual funds and sukuks provides Muslim investors with opportunities for growth while staying true to their religious beliefs.

The Role of Halal Certifications in Shariah-Compliant Investing

Halal certifications play a significant role in Shariah-compliant funds. These certifications ensure that investment products and financial services comply with Islamic principles.

They provide Muslim investors with the confidence that their investments are halal, or permissible according to Islamic rules and regulations.

Halal certifications involve an independent review of investment offerings by Islamic scholars who specialize in Islamic investments. These Islamic scholars evaluate whether the investments meet the criteria set forth by Shariah law, such as avoiding interest-based transactions and prohibited industries like alcohol, gambling, and pornography.

By obtaining halal certifications, financial institutions demonstrate their commitment to providing ethical and socially responsible investment options for Muslim investors.

These certifications are crucial for promoting transparency and trust in the financial industry. They help investors identify investment opportunities that align with their religious beliefs while also considering factors such as risk management and financial performance.

Additionally, halal certifications contribute to standardizing Shariah-compliant funds practices across different markets, making it easier for investors to navigate the global landscape of Islamic finance.

In conclusion, halal certifications serve as a guide for Muslim investors seeking Shariah-compliant investments. They provide assurance that their investment choices adhere to Islamic principles while also meeting rigorous standards of ethics and social responsibility.

Sure, here are the pros and cons of investing in Shariah-compliant investments summarized in 3 to 4 words each:

- Ethical Alignment

- Long-Term Focus

- Avoid Prohibited Industries

- Risk Diversification

- Transparency & Trust

- Positive Social Impact

- Limited Investment Choices

- Lower Yield Potential

- Complex Screening

- Sector Volatility

- Reliance on Advisors

- Potential Higher Costs

Conclusion

In conclusion, understanding Shariah’s investment rules is essential for those looking to engage in halal investing. By following Shariah compliant investment principles and adhering to halal standards, investors can make ethical and socially responsible investment choices that align with their beliefs.

While there may be limitations and risks associated with halal investing, it offers a disciplined approach and the potential for long-term financial growth.

With the help of certified advisors and comprehensive research, individuals can navigate the world of Sharia-compliant investments and pave their way toward prosperity.

FAQs

Shariah’s investment rules are a set of principles based on Islamic teachings that guide Muslims in making ethical and permissible financial investments.

Yes, anyone can choose to invest according to Shariah’s investment rules if they want to align their investments with ethical and socially responsible practices.

Shariah investment rule determines the permissibility of investments based on criteria such as avoiding interest-based transactions (riba), prohibited industries (such as alcohol or gambling), and ensuring fairness in business dealings.

Yes, there are specific financial products known as Islamic or Shariah-compliant funds that adhere to the principles outlined by Shariah investing guidelines, allowing investors to participate in ethical and halal investments while following their religious beliefs.