Do you know what are small-cap value stocks and whether they are a good investment?

Well, a small-cap value stock is a stock from a public company whose total market capitalization or market value is typically ranging from $250 million to $2 billion. The accurate figures can vary.

Investors in small-cap value stocks typically look for up-and-coming startup companies that may be undervalued but have strong growth prospects. The small-cap universe has observed some of the best returns over time from small-cap stocks trading at low valuations.

Let’s explore are small cap value stocks a good investment along with tips and tricks on how you can grow your income with good investment strategies:

What are Small Cap Value Stocks?

The “cap” in small-cap refers to capitalization. The term in full form is market capitalization.

$250 million to $2 billion is the market’s current estimate of the total dollar value of a company’s outstanding shares. A company’s market capitalization can be calculated by multiplying its current share price by the number of outstanding shares.

One misconception about small-cap value stocks is that they are brand new or startup companies. In fact, numerous small-cap value stocks are from long-standing businesses with great financials and strong track records. And small-cap value stocks are smaller, but often experience significant growth potential.

Classifications such as small-cap or large cap are estimates that change over time. Moreover, the exact definition of small-cap value stocks versus large-cap value stocks may vary among brokers.

Are Small Cap Value Stocks a Good Investment?

Investing in small-cap value stocks offers high potential returns. These companies tend to grow much larger than large cap stocks/blue chip companies. So, if an investor enters at a good price, they can get a good return on investment.

Small-cap value stocks are more volatile and risky than the stocks of bigger, more established enterprises. So investors should do thorough research before making any investment decisions.

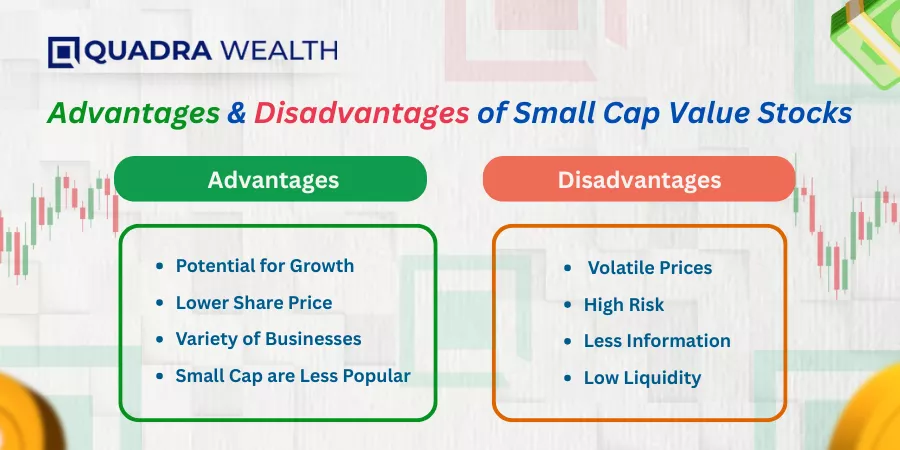

Advantages and Disadvantages of Small-Cap Value Stocks

Advantages

Here’s a summary of ‘are small-cap value stocks a good investment?’:

Potential for Growth

Because these businesses are smaller, they have room for potential growth compared to large cap companies. This means, small-cap investors have the potential for higher returns.

Lower Share Price

The lower share prices of small-cap value stocks make initial investments easier for investors. And share prices can’t be artificially raised by hedge funds or mutual funds, since there are rules in place to stop financial institutions from investing largely in them.

Variety of Businesses

Small-cap companies are not necessarily start-ups. They can be seen in various industries, and a large number of them have been in business for many years. This offers plenty of options for investing.

Small-Cap Value Stocks are Less Popular

Due to limited media and analyst coverage, small-cap stocks are often undervalued, providing opportunities for strategic investors. It means their prices are often below their value and have potential for greater returns.

Disadvantages

On the flip side, small-cap value stocks also carry some notable risks including:

Volatile Prices

Small companies respond more to volatility in the market because they have less financial reserves than their bigger competitors. It leads small-cap value stocks to observe sudden and large price fluctuations.

High Risk

While small-cap companies tend to have a large potential for growth, they have an equal tendency to fail. Small-cap value stocks are considered a riskier investment than their larger counterparts due to smaller market cap.

These companies are more sensitive to market changes as they have less access to investment capital. So small-cap arena is regarded as a riskier investment.

Less Available Information

Small-cap stocks may receive less coverage by analysts and financial institutions than mid cap and larger companies. As a result, investors must have a solid understanding of company valuation and enough time for research in order to elevate their investment portfolio.

Low Liquidity

The lower popularity and smaller size of small-cap companies often make their stocks less liquid. When a company isn’t that popular, it can be challenging to find a seller when investors want to buy shares. And it can also be difficult to sell shares when you want to leave the market.

How to Invest in Small-Cap Value Stocks?

If you have time for research and gathering valuable information about individual small-cap value stocks, you can put money into individual companies. Their stocks can be bought through a brokerage account. You should investigate the following factors before allocating funds to a company:

- Earnings and revenue growth: Even if a company is not gaining much profits, you need to notice whether it is thriving and making progress in its revenue.

- Price-to-earning ratio: The P/E ratio contrasts the current share price to the earnings per share to assess the value of the company’s shares.

- Price-to-sale ratio: For companies with limited earnings, the price to sales ratio (P/S) can be a useful metric.

If exposure to small-cap stocks seems to be risky or too time-consuming, you can also buy small-cap mutual funds and ETFs (exchange-traded funds). These could trail broad small cap indexes, specific industries within the small-cap market, or investment goals like growth and value.

Small-Cap Stock Indexes

Many brokerages provide small-cap value stock index funds, either as ETF, or mutual funds, to follow the U.S. small cap market. Relying on the brokerage you use, you could, for instance, finance in the Fidelity Small Cap Index Fund (FSSNX), or the Vanguard Small-Cap Index Fund (VSMX).

However, the following two small-cap indexes are used as yardsticks for the small-cap equities market.

S&P 600 Index

The S&P Small Cap 600 Index was founded by Standard & Poor’s (the founder of the S&P 500). It is a capitalization-weighted index that tracks the performance of small-cap stocks on the U.S. equities market. It consists of 600 companies and demonstrates around 3% of the U.S. market.

Unlike various other small-cap benchmarks, the S&P 600 offers earnings requirements, which is used to make sure the quality of the stocks involved and hedge against volatility. To be included, a company must have a market capitalization between $1 billion and 6.7 billion.

Also, it should:

- Be located in the U.S.

- Preserve at least 10% of its shares outstanding

- Manage positive earnings for both its most recent quarter and the sum of its trailing four consecutive quarters.

The Russell 2000 Index

The Russell 2000 is a small-cap stock market index that includes the 2000 smallest companies in the Russell 3000. The Index frequently serves as a yardstick to assess the performance of small-cap mutual funds. And London’s FTSE Russell Group manages all its ventures.

Because it follows such a grand share of the small=cap market, the Russell 2000 is employed by many ETFs and mutual funds. It is extensively influenced by healthcare, industrials, and financials.

The Bottom Line

Small-cap companies outperform large-cap stocks because they have greater potential for growth with the likelihood of becoming large-cap stocks companies. So, small-cap value stocks offer more opportunities for potential growth.

Investors should carefully do research to find smaller companies to evaluate if there is room for growth before taking any financial decision, hoping to achieve future financial goals.

Moreover, the shifting market dynamics can additionally reinforce small-cap value equities, significantly boosting relative returns and narrowing or closing their discount to other sectors of the equity market.

Seeking advice from a qualified investment advisor can help investors make well-informed decisions about investing in small-caps.

It was all about “are small cap value stocks a good investment?” How was it? Share your comments below.

FAQs

Q1. Are Small-Cap Value Stocks a Good Investment?

A: Small-cap value stocks can be a good investment. Generally, they tend to grow much larger than blue chip companies or large-cap stocks. So if an investor puts in money at a good price, they can hope to find a good return on investment. However, small-cap stocks are more volatile and risky than large-cap stocks.

Q2. Which is Better, Small-Cap or Mid-Cap?

A: Any company with a competitive edge, smart leadership, a strong business strategy, and good fundamentals can be a good investment whether that is a small-cap or mid-cap company. Small-cap value stocks often offer higher growth potential than their counterpart, large-cap companies.

Q3. What are the Risks Associated with Investing in Small-Cap Markets?

A: Small-cap stocks carry more risk than large cap stocks due to higher volatility, lower liquidity, and greater sensitivity to economic conditions.