Have you ever wondered if you can manage your financial future all by yourself? With proper guidance and resources, it is indeed possible to do your own financial planning. This blog post outlines the steps necessary for independent wealth building, including budgeting, investing, insuring assets, and more.

Ready to take the reins of your finances? Let’s dive in!

Key takeaways

● It is possible to create a financial plan of your own with guidance and resources.

● Steps to independent wealth-building include budgeting, investing, insuring assets, and more.

● Seek professional help when needed or choose to do your own financial planning based on individual preferences.

● Regularly review and adjust your financial plans to adapt to changing circumstances.

Understanding Financial Planning

Financial planning is the process of setting and achieving financial goals through proper management of resources and allocation of funds.

Definition and Importance

Financial planning is a set of steps. It helps you reach your money goals. It lets you control your cash flow, reduce high-interest debt, and grow wealth. A good plan shows the way to financial freedom and financial independence.

This gives peace of mind as you know where every dollar goes. You can enjoy life today and save for tomorrow. Also, it makes sure that there’s help ready in case bad things happen – like job loss or health problems.

So, having a plan is very important for everyone’s financial life and future.

Types of Financial Planning Help

Financial planning help comes in many forms.

- Vetted Financial Advisors: They give personalized financial and investment advice and make a plan for your money.

- Robo-Advisors: These are online tools that can choose investments for you.

- Accountants: They help you with tax savings investment options and bookkeeping.

- Lawyers: They can set up legal papers for your estate plan.

- Insurance Agents: They find the right insurance to protect your money and assets.

- Mortgage Brokers: These experts help you find the best home loan deals.

- Certified Financial Planners: They take care of all parts of your comprehensive financial plan. They can work with all the other helpers on this list.

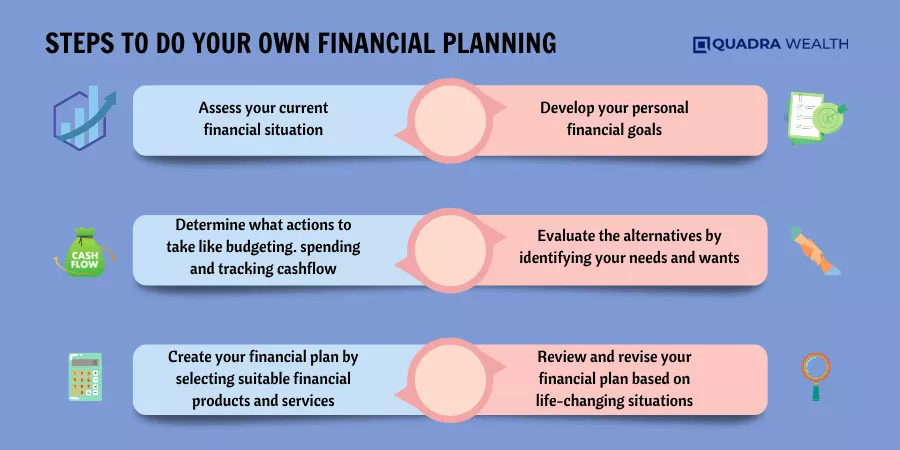

Steps to Do Your Own Financial Planning

Evaluate your current financial state, set and review your financial goals, track your spending and maximize your disposable income, establish an emergency fund, pay down debt, plan for retirement, optimize your personal finance with tax planning, organize your investments, address estate planning needs, insure your assets, plan for taxes and regularly review all of these steps to ensure ongoing success.

Evaluate Your Current Financial State

First, know where you stand. Look at your money. How much do you have? Where is it? This means checking all accounts, bills, and loans. Write down the amount in each account. List all your debts too.

It will show how much cash flow you have coming in and out each month.

Set and Review Your Financial Goals

Start by listing your financial goals. They can be short or long-term targets. These may include saving for a house down payment, retirement savings, or an emergency fund. Make sure the goals are SMART: Specific, Measurable, Achievable, Realistic, and Timely.

Then, watch over these goals. Life changes often lead to goal changes too.

Track Your Spending and Maximize Your Disposable Income

To take control of your financial situation and make the most of your money, it’s important to track your spending and find ways to maximize your disposable income. By keeping a close eye on where your money is going, you can identify areas where you can cut back and save more.

This will help you prioritize your financial goals and make informed decisions about how to allocate your resources effectively. Tracking your spending also allows you to identify unnecessary expenses that you can eliminate or reduce, freeing up more money for saving or investing.

With a clear picture of your essential living expenses, you can make adjustments to maximize your disposable income and increase financial stability.

Emergency Fund Basics

An emergency fund is an important part of financial planning. It helps you handle unexpected expenses without going into debt. The purpose of an emergency fund is to provide a safety net for situations like job loss, medical emergencies, or major repairs.

Ideally, your emergency fund should have enough money to cover 3-6 months’ worth of living expenses. Having this fund in place can help prevent financial stress and give you peace of mind knowing that you’re prepared for the unexpected.

Pay Down Debt

To pay down debt, start by creating a budget to see how much money you can allocate towards debt repayment each month. Look for areas where you can cut back on expenses and save more.

Consider using the snowball or avalanche method to prioritize which debts to pay off first. The snowball method focuses on paying off smaller debts first, while the avalanche method prioritizes higher interest rates.

Make consistent payments towards your debts and avoid taking on new debt whenever possible. It’s important to stay motivated and committed to paying down your debt, as it can help improve your financial situation in the long run.

Plan for Retirement

To plan for retirement, there are a few important things to consider. First, think about how much money you will need when you retire. This will help you set savings goals and determine how much you should be putting away each month.

Next, explore different retirement accounts like an IRA, 401(k), or employer-sponsored retirement plan and start contributing to them regularly. It’s also a good idea to diversify your investments by putting money into the stock market, bonds, and other assets that have the potential for growth over time.

Lastly, review your retirement plans periodically to make sure they align with your goals and adjust as needed. By following these steps, you can take charge of planning for your future financial security.

Optimize Your Finances with Tax Planning

Tax planning is an important part of financial planning, and it is something that individuals can do on their own. By understanding your tax situation and taking advantage of available deductions and credits, you can optimize your finances and potentially save money.

It involves reviewing your income, expenses, and investments to ensure that you are maximizing your tax benefits. You can also file your own taxes or use online tools to help with the process.

While hiring a Certified Financial Planner™ practitioner or a CPA can provide expert guidance in this area, doing your own tax planning is possible for those who prefer to oversee their finances independently.

Organize Your Investments

To organize your investments, start by creating a clear plan that aligns with your financial goals. Determine the level of risk you are comfortable with (risk tolerance) and diversify your own portfolio accordingly.

Keep track of all your investment accounts and regularly review their performance. Consider using online tools or platforms to help manage and monitor your investments. Stay informed about market trends and make adjustments as needed.

Remember to stay focused on long-term objectives rather than getting caught up in short-term fluctuations. By staying organized, you can effectively grow and manage your investment portfolio for a more secure financial future.

Estate Planning

Estate planning involves making arrangements for the management and distribution of your assets after you pass away. It ensures that your wishes are carried out regarding who receives your property and how it is divided.

Estate planning also includes naming guardians for minor children, appointing an executor to handle your affairs, and establishing trusts or other legal structures to protect assets.

By creating a comprehensive estate plan, you can minimize stress and conflicts among family members and ensure that your loved ones are taken care of according to your wishes.

Insure Your Assets

Insuring your assets is an important part of managing your own finances. It helps protect you from potential financial losses if something happens to your belongings. You can do this by purchasing insurance policies for things like your home, car, or valuable possessions.

Having the right coverage gives you peace of mind and safeguards your hard-earned money against unexpected events. While some people prefer to work with professionals, such as insurance agents, others choose to research and compare different policies on their own.

Whichever path you take, it’s crucial to review your insurance needs regularly and ensure that you have adequate coverage for all of your assets.

Plan for Taxes

As part of your own financial planning, it’s important to plan for taxes. This means understanding how much you may owe in taxes each year and taking steps to minimize your tax burden legally.

One important step is keeping track of expenses that can be used as deductions on your tax return, such as business expenses if you’re self-employed or charitable donations. It’s also a good idea to stay informed about any changes in tax laws that may affect you.

By planning ahead and making smart decisions, you can ensure that you are prepared for tax season and make the most of any potential tax savings available to you.

Review Your Plans Regularly

Regularly reviewing your financial plans is crucial to ensure they are still in line with your goals and current financial situation. By taking the time to review your plans, you can make sure they are effective and relevant.

This will help you identify any adjustments or changes that need to be made to stay on track toward achieving your financial goals. Additionally, regular reviews enable you to stay informed about any changes in your financial situation or future goals.

So make it a habit to regularly review and update your plans for a stronger financial future.

Tips for Successful Financial Planning

Establish a routine for reviewing and updating your financial plan regularly, seek expert opinions to gain valuable insights, and be flexible in adjusting your plan as your circumstances change.

Establish a Routine

To successfully do your own financial planning, it is important to establish a routine. This means setting aside dedicated time on a regular basis to review and manage your finances.

By making it a habit, you can stay on top of your financial goals and track your progress effectively. Whether it’s weekly or monthly, find a schedule that works for you and stick to it.

During this time, you can update your budget, review your investments, pay bills, and assess any changes in your financial situation. By establishing a routine, you’ll ensure that financial planning becomes an integral part of your life and help set yourself up for long-term success in managing your money.

Adjust as Circumstances Change

As you continue on your financial planning journey, it’s important to remember that life is constantly changing. This means that your financial circumstances will also change over time.

It’s crucial to regularly review and adjust your financial plans to align with these changes. For instance, if you experience a significant increase or decrease in income, you may need to reassess your budget and savings goals.

If you have a major life event such as getting married or having children, updating your estate plan and insurance coverage becomes essential. By staying proactive and adaptable, you can ensure that your financial plans remain relevant and effective in helping you achieve long-term success.

- Cost savings

- Personalized control

- Educational opportunity

- Flexibility

- Privacy

- Ownership

- Limited expertise

- Risk of mistakes

- Lack of objectivity

- Time-consuming

- Overwhelm

- Risk management

- Accountability

Conclusion

In conclusion, taking charge of your financial future is not only possible but also empowering. With the right guidance and resources, anyone can navigate the path to being financially independent.

This comprehensive step-by-step guide has outlined the key steps involved in DIY financial planning, from budgeting and debt management to an individual retirement arrangement and estate considerations.

Whether you choose to seek professional assistance or go it alone, the principles remain the same: assess, set goals, track progress, and adapt to changing circumstances.

By doing so, you can secure your financial well-being, gain peace of mind, and confidently steer your financial ship toward a brighter, more prosperous future.

FAQs

Yes, you can do your own financial planning! It includes creating a monthly budget, debt repayments, and setting up an emergency account.

DIY (Do It Yourself) financial planning means making your own financial decisions about debt management, savings plans, and income sources. You also track all bills and their due dates yourself.

Using a budget planner or investment ROI calculator helps guide money goals like retirement income or short-term savings goals.

Life changes like marriage may need adjustments in the existing plan. Joint accounts instead of separate accounts can help manage family finances better.

For full risk coverage, apart from health insurance; home insurance, disability insurance, and life insurance should be part of estate plans too.

A tax accountant might help with tax deductions; while an estate attorney ensures the right legal steps for personal affairs.