Navigating the complex world of wealth management can be daunting, especially when trying to find a firm that aligns with your financial goals. With hundreds to choose from, each offering unique services and fee structures, making the right choice could seem overwhelming.

This article will guide you through five key steps in choosing a wealth management firm, from understanding what they do to thoroughly reviewing their credentials. Let’s embark on this journey towards securing your financial future!

Key takeaways

● A wealth management firm handles your money. They help you with things like knowing your worth, doing financial planning for retirement, or saving for a house.

● To pick the right firm, look at their ideal client type and services offered. Also, check how they charge fees and if they are easy to reach.

● You should also look at the firm's SEC records and brochures. This can tell you if they've done well in the past and what they plan to do with your money.

● Check out other things too like how long they have been in business or if their staff has good credentials. Look into their payment methods, their activity level, and range of services as well.

Understanding Wealth Management Firms

Wealth management firms help you handle your money. They offer many wealth management services to fit your financial needs, goals, and situation. You can get help with knowing your net worth or individual wealth planning for retirement.

The firm can guide you in saving for a house or children’s schooling costs. Or maybe you need help on how to pass on wealth when you die.

Each firm will specialize in different areas of finance like buying property or choosing stocks. It is also useful to know that these firms charge fees based on the amount of money they manage for you.

Services under wealth management may include investment management, financial planning, estate planning, and tax planning. This type of service is considered high-end, and most firms require a certain level of investment asset allocation or a minimum net worth.

For high-net-worth individuals, private wealth managers can make a tremendous impact on their present and future. It can be helpful to consolidate all types of personal finance advice with one firm. While a financial advisor is focused solely on financial planning or investment management, a private wealth manager takes a more comprehensive investment approach to handling a client’s finances.

Not only do you get to understand your entire financial picture through a firm, but you can also enjoy several benefits that’ll make your life easier.

Hence, it’s crucial to look at these charges and ensure what they give back is worth it.

Five Crucial Tips for Choosing a Wealth Management Firm

To pick the right wealth management firm, start by identifying their ideal client and see if it aligns with your financial situation. Compare the variety of wealth management services offered to ensure they meet your specific needs, like estate planning or retirement income planning.

Choosing a wealth management firm is not a decision you should take lightly. The hedge funds and mutual funds you put your money into can make a significant impact on your life. Thus, this is a decision you should pay strong attention detail as you search for the best certified financial planner.

Take a keen interest in their fee structure; is it commission-based or fee-only? An advisor’s availability towards clients measures how responsive they are; consider this while choosing as well. After all, you’ll be paying a tremendous amount of money for their services.

Lastly, do thorough research on a firm’s SEC records and brochures to ensure credibility and transparency in their dealings.

Identify the Firm's Ideal Client

Wealth management firms serve many types of clients. Some firms may focus on people with assets from $50,000 to $500,000. Others only work with millionaires. You need to make sure you fit the firm’s ideal client profile before choosing one.

Some wealth management firms have a special area of focus. They might be experts in real estate or skilled at picking stocks, or in mutual funds. The kind of client they want can change based on their wealth planning services and how they like to invest money.

It is key for your financial goals to match with what the firm does best to achieve financial success.

Compare the Services Offered

Checking the services offered by a wealth management firm is an important step.

- Firms offer different types of services.

- These can include help with net worth determination.

- They may give advice for estate planning.

- Some firms aid in planning for retirement income.

- Education fund planning might be another service they provide.

- Does the firm help with trust planning?

- How do they manage and lower taxes?

- You should find out if they can manage your investments.

- They might also offer insurance planning or risk management.

Review the Fee and Commission Structure

Understanding the fee and commission structure of a wealth management firm is critical in making informed investment decisions. Fee-only advisors, like Brown | Miller, are often preferred for their transparency and consistency in charging fees.

Factor | Consideration |

Fee structure | Some firms charge a flat fee, others a percentage of assets managed. Determining the structure can impact the total cost over time. |

Commission-based | Some firms receive commissions for selling specific products. This can lead to potential conflicts of interest as advisors may promote products that bring them the most commission. |

Fee-only | Firms that charge only a fee for their services can offer a more transparent pricing model. They don’t earn a commission for selling products, removing potential conflicts of interest. |

Additional costs | Beyond the fee and commission, there might be additional charges like transaction costs or custodian fees. It’s important to understand all the charges involved. |

Investigate the Firm's Client-Advisor Availability

You need to find out how often you can talk with your private wealth manager. This is called client-advisor availability. Some private wealth managers are hard to reach or too busy for regular talks. A good firm will make sure you can speak with your wealth advisor when needed.

You have the right to ask about this. It helps to know that your questions and concerns will be addressed in a timely manner.

Examine the Firm's SEC Records and Brochures

You should look at the firm’s SEC records. This can give you information about their past work with clients. It can tell you if they’ve done a good job and kept their clients happy.

You can also see if they’ve broken any rules or been in trouble.

A firm’s brochures are useful too. They show what services the firm offers and how they make a financial plan to invest your money. Look at these documents carefully and make sure that what the firm offers matches up with what you need for your financial future.

- Expertise

- Diversification

- Personalized Planning

- Time-saving

- Exclusive Opportunities

- Risk Management

- Financial Education

- Costs

- Limited Asset Access

Key Factors to Consider

In your search for a wealth management firm, prioritize the firm’s credentials and experience to ensure they have a proven track record. Check if their payment methods align with your preference – either fee-only or commission-based.

Assess the firm’s responsiveness and proactivity tactics in handling finances, as this reflects on their commitment to client satisfaction. Investigate the range of services offered by the potential firms; whether they cover all your financial needs or only focus on specific areas.

Importantly, inquire about their succession plan to guarantee continuity even when key a few individuals leave the company.

Firm's Credentials and Experience

You should check if the investment management firm has good experience. This means they have been in business for many years. Also, look at their credentials. The staff should have certificates like Certified Financial Planner (CFP).

These prove that they know what they are doing.

Look at the portfolio’s performance of the firm too. If they have made lots of money for other people, they might do well for you too! Be sure to use tools like SEC records and Finra’s BrokerCheck.

They help you find out more about a firm’s past.

Payment Structure (Fee-only or Commission-based)

Wealth management firms typically use two main types of payment structures: fee-only or commission-based.

Type | Description | Benefits | Considerations |

Fee-only | Fee-only advisors charge a flat rate for their services, which can be a set dollar amount or a percentage of the total assets under management. | The payment structure is transparent and easy to understand. Clients won’t face any hidden fees or be sold unnecessary financial products for the financial advisor to receive a commission. | The cost might be high for clients and it may not match the value received. Additionally, fee-only advisors might not have incentives to grow the client’s investment portfolio as their compensation isn’t tied to performance. |

Commission-based | Commission-based advisors earn their income from the financial products they sell or transactions they carry out on behalf of their clients. | Commission-based advisors may have a strong incentive to grow the client’s investment portfolio as this could increase their commission. An initial consultation is usually cheaper than with fee-only advisors. | Clients may be sold financial products they don’t need or aren’t in their best interest, as commission-based financial advisors earn more when they sell more. |

It’s crucial to understand the payment structure and choose a wealth management firm that aligns with your financial goals and values. “Goals” may be the most overused word in private wealth management – but it is an important one. Your goals determine risk tolerance, return objectives, income needs to support your current lifestyle, future liabilities, desire for liquidity, and several other considerations. Both types have their advantages and considerations, but a transparent fee structure is often preferred by clients who want to avoid sales pitches.

Firm's Responsiveness and Proactivity

A wealth management firm must be quick to act. The team at Brown | Miller is good at this. They help clients fast and with care. Clients stay in the know about how their money is doing.

Changes can happen in life or the economy that affect your money. When they do, Brown | Miller looks at your financial plans again. This shows they are active and care for their client’s money health.

Services Offered by the Firm

A wealth management firm provides many services. Here are some services you should look for:

- Net worth determination: This helps you understand how much money you have now.

- Estate Plan Creation: This plan guides what will happen to your assets after your death.

- Retirement Income Planning: This service helps you know how much money you will need when you retire.

- Education Fund Planning: If children’s school costs are in your future, this is an important service.

- Trust Planning: This plan is about who takes care of your assets when you can’t.

- Tax Management and Minimization: A good firm will help lower the tax you owe.

- Investment Management: This service guides how your money grows over time.

- Insurance Planning: A firm can suggest what types of insurance might be good for you.

- Risk Management: This service plans for bad things that could happen to your money or assets.

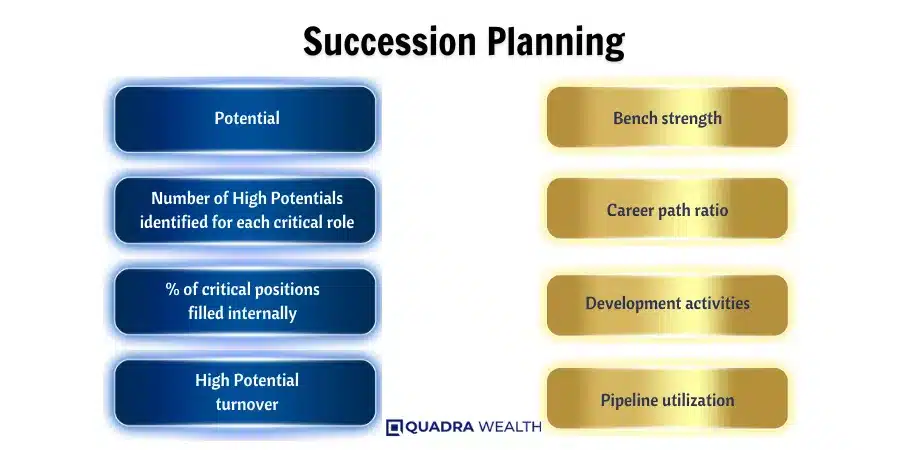

Does the Firm Have a Succession Plan in Place?

Check if the firm has a plan for when their main financial advisor leaves or retires. This is called a succession plan. A good one makes sure services don’t stop and that the same level of care continues.

If there’s no such plan, you might lose your trusted advisor and face breaks in service. Ask about this while picking a wealth management firm. The best plans have clear steps, involve key registered investment advisors, and show successful past changes.

With a solid plan in place, you can feel at ease knowing your wealth strategy won’t fall apart.

Certainly, here are the pros and cons of wealth management firms in order:

Conclusion

Choosing the right wealth management firm matters a lot. It can shape your future and that of your loved ones. Make sure you pick one wisely by using these tips we shared today. Good luck!

FAQs

A wealth management firm can help with financial decision-making and plans for the growth and preservation of your assets.

Look at their fee and commission schedule, check if they follow fiduciary duty, and consider their investment strategy, portfolio size handling experience, and client-advisor relationship style.

Yes, it can match you to financial advisors who are suited to assist with retirement planning, capital gains tax issues, or mortgage rates.

Not always! Some firms have multiple experts like property managers or robo-advisors for specific tasks like value investing or managing self-directed IRAs.

The type of service depends on the business model followed by both publicly held firms and privately held companies rather than on size alone!

Always take referrals seriously but don’t forget to perform your own checks regarding their brokerage accounts’ performance history as well as the breadth of traditional investment opportunities offered.