Why is financial planning important for everyone has become more than

just important these days. It is, in fact, the most crucial thing in one’s present as well as future.

Yet, according to a survey in 2012, do you know that 70% of the people residing in the UAE are financially illiterate. This implies that they have no prudent or rational knowledge about their financial goals or future budgetary plans.

This ultimately leads to individuals being highly indebted to financial institutions or banks. Are you investing your wealth aggressively and ignorantly? Are you not getting fruitful outcomes to form your financial decisions?

Do you want to double your money in the UAE? Well, we will guide you through the process and stand by you. This blog is ideal for you.

Quick Summary

In short, you will learn the aspects and importance of financial planning, and its benefits, which help you to achieve your goals smoothly, keep you motivated, increase your long-term savings, and maintain your mental stability.

Not only that you can gain knowledge about the aspect of financial planning, its process, types, and potential goals like wealth creation, retirement planning, and funding for children’s education.

Plus it also highlights the importance of financial planning in providing financial security, control over your finances, and the ability to shape your future.

What Is Financial Planning?

Financial planning meaning is quite simple. It is a steady process for predicting the number of assets necessary and selecting how to obtain them.

Simply said, it aids in the management of your money by keeping note of your revenue, expenditures, and holdings. Therefore, you should assess your current financial situation and your foreseeable financial goals when establishing an overall financial plan.

Furthermore, one need not concentrate on a single area of their resources to grasp the meaning of financial planning. Instead, it is a comprehensive concept that incorporates a plethora of options.

Financial planning is more like having the right amount of money at the right time. For instance, you want around USD 36,000 for your daughter after she is 18 for her education.

Hence, you plan your current income and expenses so that it mold into providing you with enough to survive when your daughter is 18. Therefore, if you are thinking, “Is financial planning important?” Well, then the answer is quite simple.

Generally, people opt for a financial advisor to plan their financial future for a better life. A financial planner studies your current status economically.

Then he draws an optimized plan for you. Many a time, people take responsibility for their financial goals themselves.

However, due to their lack of knowledge in the respective field, they drown themselves in debt most of the population of UAE lacks this financial literacy.

You should carefully select a financial advisor who can comprehend your requirements and design a strategy that will guide you through your working career and into retirement. However, you do not have to worry.

We at Quadra Wealth are here to assist you with it. We analyze your overall financial status and guide you toward a better future for you and your family. Hence, feel free to contact us at

app.quadrawealth.com/free-training. We can help you out. Now you must know that financial planning can provide you with a lot of benefits if done prudently.

So let us take a quick peek into it.

What are the benefits of Financial Planning?

There is a slew of benefits to creating a monetary strategy that you can access right away. In addition, financial plans have a cumulative beneficial influence on all elements of your lifestyle, from economic and medical gains to socioeconomic perks.

While there are abundant pros of financial planning, some have a more noteworthy impact than others. The following are some of the essential benefits of making a financial plan.

1. Achieve your goals smoothly.

An appropriate financial plan can help you achieve the particular goals in your life. You want a stable life with a healthy standard of living. An efficient financial plan will ensure this for you.

In the event that your goals are realistic, contingent on your revenue and expenses, a financial plan can help you go a long way in the future without worrying about the major cost.

Sometimes, a particular unforeseeable expense might land upon you. An efficient financial strategy will help you go through these sudden expenses.

For example, your financial plan may include getting health insurance for you and your family. Hence, in any case in the future, if you find yourself with a sudden health hazard.

You will be fully equipped with the finance you need.

pros

- Peace of mind

- Better financial management

- Improved standard of living

- Reduced stress

- Increased savings

- Better financial decision-making

- Greater financial security

cons

- Financial instability

- Stress and anxiety

- Missed opportunities

- Dependence on others

2. Keeps you motivated

When it comes to motivation, it can be fickle. However, with a financial plan, you know what your benchmark is.

You will have to reach it, or else it might disrupt your future. Hence, you might feel motivated to work hard to get closer to a safe and secure future.

Everyone needs the motivation to work. A financial plan sets an explicit goal for you. This way, you will find yourself driven to work because you have a target to accomplish.

pros

- Provides a clear benchmark to work towards.

- Helps establish explicit goals.

- Increases accountability for reaching financial milestones.

- Encourages a sense of purpose and direction.

- Reduces stress and anxiety around financial uncertainty.

- Increases confidence in financial decision-making.

- Offers a sense of control over one’s financial future.

- Provides a framework for prioritizing financial goals.

- Encourages discipline and consistency in financial habits.

- Offers a tangible reward for hard work and dedication.

cons

- This can lead to confusion and a lack of direction.

- Overspending be demotivating as it can feel like you are working hard but not making any progress toward your financial goals.

- Uncertainty about your financial future can be demotivating and create anxiety and stress about what lies ahead.

- Missed opportunities to invest or save money can be demotivating, as it can feel like you are not taking advantage of opportunities to improve your financial situation.

- Not being in control of your finances can be demotivating as it can make you feel powerless and unable to make progress toward your financial goals.

3. Increases your savings in the long run

A financial plan consists of all the details of your current as well as prospective revenues and costs. With comprehensive information on your resources, you will know how much you can save today and tomorrow.

You will find yourself cutting expenses to accumulate wealth. For instance, you know with your weekly income and cost that you can save up to USD 1,000.

However, you have to start saving more for a stable retirement. Hence, you will begin cutting your expenses from today to plan a better retirement for you.

pros

- Debt-free when facing unexpected expenses, emergencies, or job losses.

- Saving more money helps you achieve your financial goals such as buying a house, starting a business, or taking a dream vacation.

- Your retirement can be more secure if you plan well.

- Profit from different investment opportunities.

- Financial worries aren’t a problem.

- Make smart decisions and avoid making impulsive decisions.

cons

- Unexpected expenses or emergencies may not be covered. It can leave you feeling stressed and insecure.

- Limited retirement funds.

- Limited opportunities.

- Limited financial freedom.

- Limited legacy.

4. It keeps you mentally stable

What if we tell you that your future is completely secure? The very fact that you do not have to worry about the monetary aspect of your forthcoming feels relieving.

You can handle your regular expenditures, prepare for your potential objectives, and spend a bit personally without fear if you have enough money.

Financial planning allows you to regulate your finances efficiently while also providing you with a sense of safety. If you have not obtained this point yet, do not panic.

If you follow the path of financial planning, you will arrive at financial tranquility in no time. Quadra Wealth is here to provide you with all such benefits.

We can plan the best strategy for you. We are just one call away. Book a call now at app.quadrawealth.com/free-training.

Now, you must ask yourself whether it is even worth it to go through financial planning. Next, we will discuss the importance of financial planning.

pros

- Provides a sense of security and relief from financial stress.

- Helps to regulate finances efficiently and effectively.

- Enables you to handle regular expenditures and plan for future objectives.

- Allows you to spend a bit personally without fear.

- Provides a sense of safety and reassurance about your financial future.

- Helps to reduce anxiety and worry about money matters.

- Enables you to make informed decisions about your financial situation.

- Helps to build confidence and a sense of control over your finances.

- Enables you to achieve financial tranquility and peace of mind.

- Improves overall mental health and well-being by reducing financial stress.

cons

- Difficulty achieving goals.

- Lack of direction.

- Lack of a financial plan leads to constant stress regarding bills, savings, and unexpected expenses.

- Impulsive decisions – can cause long-term regrets and frustration.

Importance Of Financial Planning:

When we say financial planning, it does not mean somehow organizing your wealth. On the contrary, financial planning needs to be optimized to be perfect. You need to save money to invest in your financial goals. Therefore, it becomes crucial to know if financial planning is important or not. What is the essence of financial planning?

Financial planning will give you the right amount of wealth you need today to secure your tomorrow. Therefore, you have to work on your present, accordingly.

- A financial strategy will allocate your wealth in an appropriate way to meet the final destination. Hence, you get a full-fledged plan of how you should invest. It can be in long-term bonds, mutual funds, equity shares, structured notes, etc.

- Financial planning implies that you have more control over your finances. Unfortunately, many a time, people get tricked by their finances. For example, you might expect a certain income, but your revenues might not be up to your expectations. However, proper financial planning will measure the expense and the risk tolerance, your income, and the probability of the revenue to draw the perfect plan for you.

- One of the answers to “Why is financial planning important”, is because of safety. An effective strategy can protect you from many unseen shocks to your financial stability.

- The most crucial reason for opting to plan your finances is that you can decide your future. You have the opportunity to choose how you want your future to look in terms of wealth.

These are a few reasons why we think one should go for financial planning. Your wealth portfolio will only improve with a good plan. Therefore, you must understand the importance of planning your finances.

Now, you can plan for anything. For example, you might want to start planning for your business or your retirement. You might even want to plan your resources for your children.

In addition to that financial planning helps investors achieve their financial goals e.g. home purchase, children’s higher education, children’s marriage, retirement planning, estate planning, etc., and long-term financial security.

Let us discuss what potential long-term goals a financial strategy can open the doors to.

What Can Be Potential Goals Of Financial Planning?

Financial planning and importance play a significant role in framing life goals for individuals. Unfortunately, most people in the UAE lack an authentic and competent financial planner.

Most of the time people ask their wealth manager to plan their finances. However, there is a difference between the financial planner and the wealth manager.

But we at Quadra Wealth are all trained and experienced financial planners. Therefore, by the age when they cannot work any longer, they have little to no reserve for themselves.

Consequently, it becomes essential that you start saving from your youth. The goals that you can plan your finances for can be:

1. Creating money

Because the cost of common products is rising, you will need to build an adequate financial foundation if you wish to continue or improve your existing way of life in the coming years.

In the future, you could want to buy a decent automobile or a permanent home. You might want to save to start your own business as well. Financial planning business plan is important for the success of the company.

All of this necessitates adequate funds, emphasizing the need for wealth generation. By employing your money in the ideal routes, you can accomplish these objectives.

2. Financial planning for retirement

Your retirement planning could be a long way now. However, this does not imply that you start preparing for it at the very time you retire.

On the contrary, you must begin establishing your welfare and wealth support if you want to live a happy and secure retirement life. Early budgeting can help you safeguard your retirement savings in the face of financial uncertainty.

Also, if you plan, you can benefit from the force of cumulation or compounding. This can help you develop a substantial endowment over a 25–30-year period.

3. Planning your child’s education

Not only in UAE but around the globe, learning has become prohibitively unaffordable. And this expense will continue to climb in the coming years.

This is why it is critical to begin preparing as soon as your baby arrives. First, evaluate how much you might need for your children’s education.

Then, if you’re unsure how to continue, you can seek guidance from us. We will guide you through the possible expenses you might want to cover for your child. Ultimately Quadra Wealth will assist you in the best financial plan for you.

Therefore, if you are looking for someone to aid you or guide you feel free to contact us. You can take a look at our children’s education packages here:https://quadrawealth.com/childrens-education-plan/.

We have until now all the possible reasons why financial planning important. You by now know why financial planning is the best way to deal with unforeseeable circumstances.

You know that financial planning can help you save, invest, expend, and earn money. It looks into every aspect of your wealth.

So, you might wonder what the ultimate objective of financial planning is. The next section of the blog aims to provide a conclusive answer to you for it.

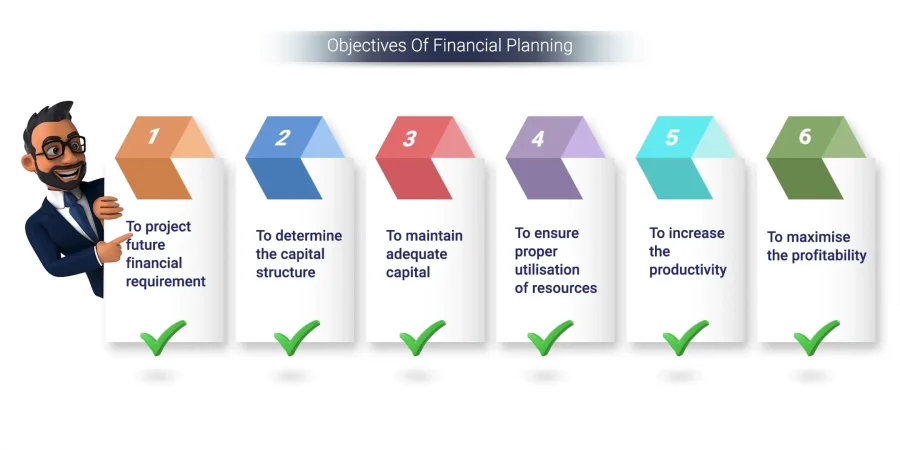

What Is The Objective Of Financial Planning?

The ultimate objective of financial planning is money. Financial planning aims at getting you the funds that you need at the right time. For instance, you need funds in 5 years to invest in a specific short-term asset.

Financial planning will help you precisely with the amount of funds you are looking for. For many businesses, financial planning is solely responsible for their success. In each business operation, time is a twisting aspect.

It is essential to provide cash at the correct period and to the right place. It’s just as important as wealth creation. While the passage of time is critical, the origins of these finances are also essential.

It is essential to provide cash at the correct period and to the right place. It’s just as important as wealth creation. While the passage of time is critical, the origins of these finances are also essential.

As a result, an efficient budget plan allows you to conservatively predict the period and origin of a particular fund that you will require as an individual or an organization. It is an integral organizational goal to ensure that the business does not generate excessive resources.

Due to a lack of finances, the company is unable to meet its financial obligations. When a company has an excess of money, it does not make profits but instead increases costs.

You have learned so much about why financial planning is essential for your and your family’s future ahead until now. Financial planning provides so many exceptional perks to you.

It might seem obvious that the process of financial planning would be so precise and complex. However, when Quadra Wealth is concerned, we make the process simple and understandable to you.

We make it devoid of intellectual and financial concepts and present it to you in terms you would be comfortable understanding. The following section discusses how Quadra Wealth makes the financial planning process easy for you.

We have discussed the method in accordance with the experience of one of our investors.

Know more about us here: https://quadrawealth.com/overview/

What is the process Of Financial Planning?

An individual looking for a proper financial portfolio contacted us for assistance. We helped him formulate the best plan for his finances. To do so, Quadra Wealth followed the steps below:

Step 1: Analyzing his financial status

The very first thing we did was study where he stood financially. We studied his sources of revenue and regular expenses. We also examined how much and where he invested until then.

After that, we judged his financial stability.

Step 2: Listening to his goals

We then asked him what he wanted his future financial stability to look like. We guided him to what to look for in his future for himself and his family. These goals were set after judging his financial status

Step 3: Telling him his options

We, after knowing his goals and finances, gave him different alternatives. This would help him achieve his realistic financial goals. For instance, the individual wanted a stable pension.

But, in order to do so, he had to earn a little more than what he did now. So, we advised him to apply for a raise, promotion, or look for better opportunities.

Step 4: Monitoring his plan

If you ask us “What is the most important part of a financial plan?” this is it—monitoring your progress. We do not believe in leaving you on your own.

If you decide to take our advice, we will look into the fact that you are following the plan. Just investing in assets, we say, is not enough.

One needs to monitor whether the expected return on the investments was as projected. Suppose they are not, then one needs to look for alternatives to compensate them. Therefore, we did that for our client.

Margaret Thatcher said, “Plan your work for today and every day and then work your plan”. Therefore, it is essential that you abide by or work on the plan so created.

You may have a variety of financial objectives in mind, but in order to attain them at the appropriate time in your life, you must establish a financial plan as early as possible.

Now one has a lot of types of financial planning. We aim to be as transparent as possible. So we discuss the types of financial planning one could opt for.

What Are The Types Of Financial Planning?

Here are the types of financial planning you should know about:

1. Cashflow management

It is when you plan your economic condition on the basis of your cashflows. We keep a record of whatever cash is incoming and whatever is outgoing.

This way, one can check whether their cash flow is according to the financial plan. If it is not, you can make changes accordingly.

pros

- Helps in avoiding cash shortages

- Enables better decision-making

- Helps in managing debt

- Improves financial planning

- Analyzing cash flow patterns helps businesses enhance financial performance, increasing profitability & reducing costs.

cons

- Overspending

- Late payments

- Inability to save

- Lack of financial control

- Difficulty in making financial decisions

2. Investment management

This can be another type of financial planning. Investments are supposed to help you raise money for your long-term financial goals. This comprises investments in a variety of areas such as bonds, mutual funds, structured notes, and crypto, among others. Therefore, investment management can assist you in improving your financial situation.

pros

- Diversifying investments can mitigate risk and enhance portfolio performance.

- Active management can help maximize returns and minimize losses.

- Higher returns and market outperformance.

- Time-saving.

cons

- Lack of Diversification

- Limited Knowledge

- Emotional Investing

- No clear plans for investments

3. Insurance planning

Insurance is when you cover your assets from any uncertainty. You can ensure your life as well, in fact, one of the most important forms of insurance.

Insurance aims at helping you out during unanticipated events and having an emergency fund is an important aspect o financial planning. If you fail to do so, you might not be well-equipped during the time of financial need.

pros

- Provides financial security for unforeseen events.

- Gives you peace of mind knowing that you are protected against financial losses.

- Protect your assets such as your home, car, and business from any damage or loss.

- Offer tax benefits, such as deductions on premiums paid or tax-free payouts.

- Health insurance ensures affordable access to quality healthcare.

- Protects business from financial losses in emergencies.

cons

- Significant financial burdens.

- Exposed to risks, including property and life loss.

- limited access to quality care.

- Limited finances may lead to borrowing.

- Increased stress and anxiety

4. Tax planning

Tax is something that every individual has to pay. It is a compulsion. One should be ready to face any tax shocks as well. Planning your tax payment is equally essential in the UAE.

pros

- Reduces tax liability

- Increases cash flow

- Helps in financial planning

- Avoids penalties

- Helps in compliance

cons

- You may end up paying more taxes than necessary, leading to an inefficient use of resources.

- Increased risk of tax audits, resulting in penalties, fines, and other legal actions.

- Poor financial planning can lead to stress and uncertainty.

5. Real estate planning

Property creation has shown to be a crucial choice with minimal uncertainty and high profits on investment. Therefore, it becomes important to consider such planning as well.

pros

- High returns on investment

- Diversification

- Inflation hedge

- Passive income

- Legacy planning

- Real estate investments offer tax benefits such as depreciation, mortgage interest deductions, and property tax deductions.

cons

- uncertainty about who will inherit the property, leading to disputes and legal battles among family members.

- Inefficient tax planning

- Lack of protection for assets

- The delayed or complicated probate process

- Inability to make informed decisions

Conclusion

A very famous business rule is “Do not put all your eggs in one basket“. This is the basic rule of financial planning. Diversify your money to reduce risk.

You will eventually find yourself with more cash in your hand. Financial planning has so many advantages attached to it. We have looked into every benefit financial planning can provide you.

There is no reason why you should not opt for it and innumerable reasons why you should opt for it. We at Quadra Wealth aim to make this whole process easy for you. We design customized and flexible plans that suit your needs and purpose. Therefore, do not hesitate and book a call today

itself:app.quadrawealth.com/free-training.

FAQ

Why is financial planning important?

Financial planning is important because it helps you make informed decisions about your money, reduce financial stress, and achieve your short and long-term financial goals. It also helps you prepare for unexpected events such as job loss or illness.

How can financial planning benefit me?

Financial planning can benefit you by helping you create a budget, save for retirement, pay off debt, invest your money, and plan for major life events.

What are the types of financial planning?

There are several types of financial planning, including retirement planning, investment planning, tax planning, estate planning, and risk management planning.

How can Quadra Wealth assist me with financial planning?

Quadra Wealth can assist you with financial planning by providing personalized advice and guidance based on your individual financial situation and goals. They can help you create a comprehensive financial plan that takes into account all aspects of your financial life.

Is financial planning only for wealthy individuals?

Financial planning is not just for wealthy individuals. Anyone can benefit from creating a financial plan, regardless of their income or net worth.

Can financial planning help me save for my child’s education?

Yes, financial planning can help you save for your child’s education by creating a plan to save for college expenses and exploring options such as 529 plans and other education savings accounts.

How often should I review my financial plan?

It is recommended that you review your financial plan at least once a year or whenever there is a major life event that could impact your finances, such as a job change, marriage, or the birth of a child.