As people start to think about managing their finances seriously, they take all the measures to expand their wealth and financial opportunities.

People, be they ordinary men or individuals of high net worth, always want to do the right things to aid in their future. And when it comes to their finances, they become even more cautious.

However people make many financial mistakes, and solving them requires sufficient information on where they are making mistakes.

We have heard several times that when we make mistakes, we get an opportunity to learn. Well, it is all the more important not to repeat the same mistakes, especially in today’s world, where financial security is paramount.

To add to it, when money is involved in the process. To combat the most common financial planning mistake: we must gather sufficient information.

There is no scope for growth and learning when one does not know where they lag or make errors. Therefore, this article will help you understand where people are making mistakes while planning their finances.

And then, once they become clear on their faults, they can rectify them with reasonable steps.

Quick Summary

→ In short, this article discusses financial planning, 10 common financial planning mistakes that people make, and provides advice on how to avoid them.

→It tells you the benefits of effective financial planning and shares the story of a client who rectified her financial mistakes and made positive changes.

→ It also provides tips to avoid financial risks, such as protecting assets with proper insurance, keeping emergency funds, and avoiding unnecessary debts and loans.

What Is Financial Planning?

The concept of conducting a detailed assessment of your financial condition and developing a precise financial strategy to accomplish your objectives is known as financial planning.

As a result, financial planning frequently covers a wide range of economic topics, including investment, banking, budgeting, pensions, real estate, and coverage.

Financial planning is the process of setting forth a strategy for your tomorrow, focusing on how you will handle your resources and anticipate all prospective costs and challenges.

The procedure entails assessing your existing financial condition, determining your objectives, and generating and executing appropriate advice.

A financial planner, as you might assume, provides financial planning expertise, while financial advisors frequently serve as planners as well.

In addition, you may be able to get assistance from a financial planner.

Tax planning, tax deductions, tax saving investments, real estate investments, retirement reimbursements, prudent budgeting, children’s education plans, and health care and assurances are just a few examples.

We at Quadra Wealth will provide you with rational advice to plan your financial resources to secure your future. We will create a path in accordance with your financial situation and future goals and provide you with all the best options available to you.

Book your call today by clicking on this link: app.quadrawealth.com/free-training

Let us look into the common mistakes to avoid if you choose Quadra Wealth.

Common Financial Planning Mistakes:

We’ll take a look at some of the most common financial mistakes that often lead people to financial stress. You might already face some of the discussed financial problems.

However, it is suggestive that you avoid such mistakes from now on.

1. Being too optimistic about your decisions

The first and foremost mistake in financial planning is too optimistic. No doubt, it is good to have a positive outlook, but excess of anything does no good to people.

People tend to make some farfetched and aggressive assumptions, painting an overly optimistic picture of the long term that no one knows.

For instance, you assume that you will get huge bonuses in the future. But in reality, you have never got it or at least did not get high rewards in the past.

Making such aggressive assumptions can make us feel very optimistic now, but this high positivity can become toxic in the future. Always being overconfident regarding one’s finances means denying the emergency fund.

You never know what catastrophe is just around the corner.

One of the first steps to avoid this mistake is to work on alternate scenarios if your plan A does not work out.

For instance, assuming you’ll earn a little less than you realistically expect. And because of unforeseen circumstances, spending a lot more than you usually do.

Pros of being too optimistic about your decisions

- help maintain a positive mindset during setbacks and challenges.

Cons of being too optimistic about your decisions

- lead to overlooking potential risks and not preparing for setbacks.

- result in overestimating potential returns on investments or financial decisions.

- lead to impulsive decision-making without proper research or analysis.

- result in ignoring important feedback or advice from others.

2. Being resistant to change

The next mistake depends on the individual’s adaptability. And when it comes to not repeating mistakes while planning your finances, you must be flexible.

Change is the only constant. Unfortunately, the less time people take to acknowledge this; the less is the frequency to take a step forward to rectify this mistake.

When people make decisions that lead them to act in a specific and fixed way for quite a time, it shows their lack of awareness of the inevitable change.

For instance, you think of buying a new and expensive car. But unfortunately, this might mean having very little available in your budget to use on other things that you want now or in the future.

These things could include traveling, taking up an expensive course you are interested in, or achieving other goals.

A good plan will account for every factor, including the change. So, it is essential to make decisions, not for the present self but keeping in mind your life over the decades to come.

Pros of being resistant to change

- Lead to missing out on potential opportunities for growth and improvement.

- Result in stagnation or becoming outdated in financial strategies.

- Result in being too rigid and inflexible in adapting to changing financial circumstances.

Cons of being resistant to change

- prevent impulsive decision-making or chasing short-term trends.

3. Thinking that Google can answer all your questions correctly

The last one is an exciting subject. Sure, go ahead. Google it. It is good to assume that you have a solution to every problem.

In today’s world, it is the Internet. Doing it yourself building your own financial plan requires a lot of researching and learning.

Well, this does not necessarily work every time. With a vast wealth of knowledge comes much noise. You get a plethora of answers, some factually correct, some misleading, and the rest does not even fit-in in your situation.

There is no doubt that you can research, and gather viewpoints. But in this age of technological transformation, you might be missing some crucial points.

One of the suggestions is not to consume knowledge. Use wisdom. Wisdom combined with knowledge can do wonders. Obviously, relatively.

And the best way to do this is to approach a financial planner or a wealth manager if you are wealthy and looking for long-term financial goals. We are always here to help you out in the same.

Pros of using google while making financial goals

- provide quick and easy access to information.

- help broaden knowledge and understanding of financial concepts and strategies.

- lead to discovering new financial resources and opportunities.

- inspire independent thinking and decision-making.

Cons of using google while making financial goals

- Information may not always be accurate or relevant to individual financial situations.

- Result in overlooking important nuances or complexities in financial decisions.

- lead to an overreliance on Internet sources without seeking professional advice.

- result in information overload and confusion.

4. Ignoring inflation

Many of us tend to ignore the time value of money or how money loses its value over time when doing financial planning.

However, while balancing the increase in income with time, we need to consider increasing living expenses. The expense may be much more due to the drop in the value of money.

This drop in the value of money causes the overall increase in everyday goods and services prices.

By being too dependent on “safe” investments like saving accounts, bank FDs, and government bonds, you will direct your portfolio towards yielding returns at a rate lower than the inflation rate.

By ignoring inflation, you might witness your savings slowly decreasing over time. Thereby, your financial plan loses its essence.

Pros of ignoring inflation

- Ease of managing and monitoring investment with low risk.

Cons of ignoring inflation

- lead to underestimating future expenses and not properly planning for financial stability.

- result in losing purchasing power over time.

- lead to being unprepared for unexpected inflation spikes.

- result in not properly adjusting financial strategies to account for inflation.

5. Ignoring long-term expenses while planning for retirement plans

The next common financial planning mistake people make is undervaluing their long-term expenses for the sake of retirement goals.

When investing and saving for your retirement, it is vital to consider the long-term expenses and save for the same.

This considering the long-term expenses includes correct valuation and estimation of healthcare, children’s education plans, and other necessary expenditures.

It becomes even more important to consider them since they are the essential by-product of aging. For effective retirement planning, you must incorporate expenses like health care, education loan, wealth expansion, and other long-term costs which increase with age.

By not doing so, you would endanger your savings and finances during the years of zero income.

Pros of ignoring long term expenses while planning for retirement:

- This can lead to focusing on immediate financial goals and needs.

- This may allow for more flexibility in budgeting and spending in the present.

- Can reduce stress and anxiety about future expenses.

- Can allow for more enjoyment and experiences in the present.

Cons of ignoring long term expenses while planning for retirement:

- This can lead to underestimating future expenses and not properly planning for financial stability in retirement.

- This may result in not having enough savings to cover unexpected expenses in the future.

- Can lead to financial instability and hardship in the future.

- This can result in having to work longer than desired or not being able to retire at all.

6. Being reckless in youth

Not saving enough or investing when you are young can cause many financial issues in the later stages of life.

Savings should be a significant part of your initial investing life.

It would be best if you kept the savings rate during that time higher than the rate of returns. Once you are saving consistently and to your utmost capability in those initial years, you can eventually draw out an effective investment plan.

The earlier you start; the more time compounding has to double or triple your money.

Pros of being reckless in youth:

- This can lead to learning valuable financial lessons and building resilience.

- May provide opportunities for growth and development.

- Can lead to experiences and memories that are valuable and important.

- Can allow for more enjoyment and experiences in the present.

Cons of being reckless in youth:

- This can lead to accumulating debt and hindering long-term financial stability.

- This may result in missed opportunities for saving and investing.

- Can lead to financial instability and hardship in the future.

- This can result in not being able to achieve long-term financial goals.

7. Making financial planning all about investing

You would be mistaken to believe that financial planning is all about investing. Instead, investing is just a part of an ideal financial plan that you must practice to meet your long-term goals.

To create a healthy financial plan, you need to focus on day-to-day budgeting and have suitable insurance coverage (for everything of real value to you, including your health).

And then, you should align these with your primary financial goals to make effective and aptly long-term financial plans.

Pros of making financial planning all about investing:

- This can allow for more flexibility in budgeting and spending in the present.

- May provide a sense of control and confidence in financial decision-making.

- Can provide opportunities for learning and growth in investment knowledge.

Cons of making financial planning all about investing:

- This may result in not having enough savings to cover unexpected expenses in the future.

- financial instability and hardship in the future.

8. Being too aggressive or conservative while investing

It is advisable for people from the age group of 20-40 to invest aggressively. Although this idea is logically attractive for many, you need to invest using good sense and not be blind toward risk.

For example, suppose you happen to expose yourself to more risk than your goals permit. In that case, you may end up losing a lot and eventually move away entirely from investing in the future.

Being too aggressive in your approach is not recommended. Likewise, being too conservative when investing has its drawbacks as well.

You will be losing a tremendous amount of quality and quantity of money by being over-conservative. Growing cash in your savings account will decrease its value over some time.

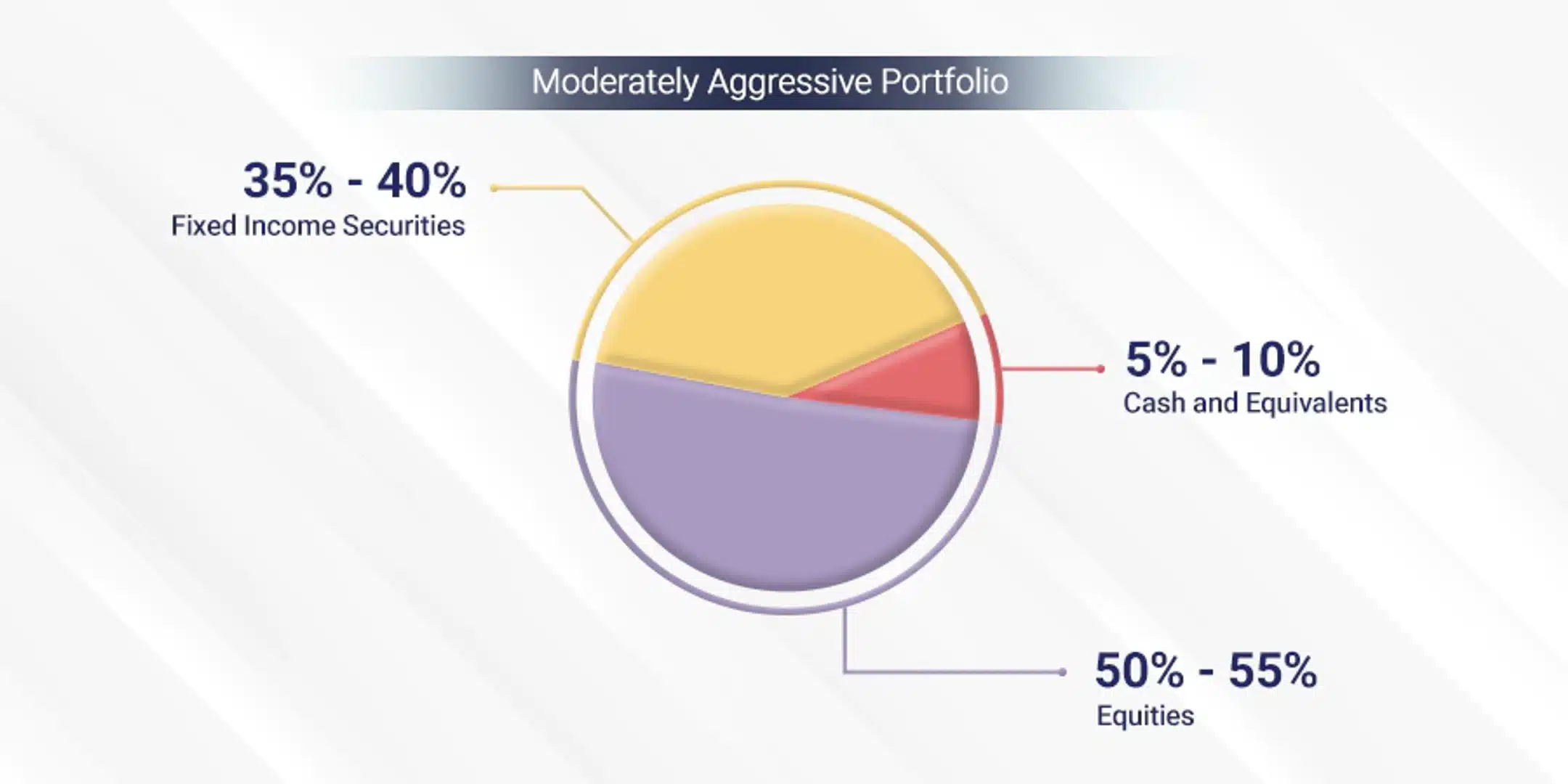

Therefore, it is advisable to invest in different investment options with varying degrees of risk to make your money grow at a uniform and increasing rate.

Consequently, it would help if you diversify your portfolio. Investing in different financial assets such as stocks, bonds, equities, and structured notes aids a lot in proper and progressive wealth management.

Diversification comes with its benefits in the short as well as in the long term.

Pros of being too aggressive or conservative while investing:

- Aggressive investing can lead to high returns.

- Allow for more flexibility in budgeting and spending in the present.

Cons of being too aggressive or conservative while investing:

- High risk and potential loss.

- Missed opportunities for growth.

- This may result in not having enough savings to cover unexpected expenses in the future.

- lead to financial instability and hardship in the future.

9. Not taking any professional assistance

As aforesaid, one should always seek help from a financial expert, be it a financial planner or a wealth manager, to get more benefits.

An expert will give a balanced and organized view of the entire financial picture. Though the costs associated with hiring a qualified financial advisor are high, the advantages of more returns on investments with optimum protection against higher risk or reduced hassles will exceed the costs.

If you want to know “What is the worst financial decision?”. This is it. Therefore, do not hesitate and come to us. We will help you plan for your future properly.

Pros of not taking any professional assistance:

- Cost and fees

Cons of not taking any professional assistance:

- You need to spend more time on researching and studying different investment strategies.

- Not aware of or struggling to choose the most advantageous investment strategy for your long-term goals

- Emotional investing

- Possibility of hasty buying and selling as the market fluctuates.

10. Not communicating with our near ones

Not communicating is an often ignored and neglected mistake many people make when comes to financial planning. People generally do not share their personal finances with their spouses, children, or any other legal heir.

This may seem very unnecessary and trifling to them. Still, they aren’t aware that this mistake can create substantial financial difficulties in the future.

These financial difficulties can sometimes lead to personal life stress as well. For example, suppose a person dies, and none of his family members knows about his financial whereabouts.

In that case, they will not be able to take benefit of his earnings and investments. Therefore, everybody must keep their spouses, children and other family members updated about their wealth.

Pros of not Communicating with Near Ones:

- Sense of privacy.

- Sense of independence and self-reliance

- Avoiding Conflict or disagreements that may arise from differing opinions or expectations regarding money.

Cons of not communicating with near ones:

- Lack of support during financial hardships or emergencies.

- When families feel helpless, they may not know what resources exist.

- Missed Legacy Opportunities: Not sharing financial information with near ones can hinder the ability to pass on a meaningful legacy.

- Without open communication, there is a higher chance of incomplete or inadequate financial planning. Important details, such as beneficiaries, investment strategies, or estate plans, may be overlooked, leading to complications and potential financial difficulties in the future.

Thus the article discusses the top 10 most common financial mistakes people make when planning their finances.

These include being overconfident and not having an emergency fund, being resistant to change, relying too much on Google for financial advice, ignoring inflation and long-term expenses, not saving enough when young, focusing too much on investing, being too aggressive or conservative in investing, not seeking professional assistance, and not communicating with family members about finances.

The article emphasizes the importance of being flexible, planning for alternate scenarios, considering long-term expenses, diversifying investments, and seeking professional help.

The benefits of effective financial planning with minor errors are that it can change someone’s life entirely. Taking the right approach and carrying it out wisely can mark a significant positive change in one’s life.

One of our clients experienced issues with her financial planning. We helped her out in various ways and designed a perfect journey for her financial future. Let us take a peek at her story.

Benefits of effective financial planning

If you are searching for, “What is the good financial planning mistakes example?” This next section is ideal for you.

One such example is the story of one of our clients. When she was in her mid-thirties and was earning decently but realized that her expenses exceeded her savings enormously, she decided to step towards healthy financial habits.

She became aware that she was spending a lot on unnecessary things such as using costly salons and other grooming stuff. She didn’t even invest wisely, and savings were not even a term in her life.

When things started turning upside down, she decided to pause and then restart with fresh and healthy financial choices. She set a goal of saving and investing a considerable amount, around $1.5 million, by 35.

In her late twenties now and very near to her financial goals, our investor is ready for her future. She owes these healthy financial choices to the mistakes she started to rectify and make positive changes.

These are explained below:

1. Changing her spending habits

When she looked back observingly at her expenditure, she didn’t even know where her money was going. When she realized this, she decided to be more strategic and organized.

Initially, she spent around $1000 on her grooming and accessories. And now this has been reduced to a total of about $150-$200.

She chooses to be natural now rather than artificial beauty. And that has given her a feeling of authenticity and satisfaction too. Need not to mention the financial benefits she must be getting with this one wise decision.

2. Increasing her income

She was working in a small firm with a skillet that could earn more. On understanding this, she began to explore and look for opportunities that would pay her well for a very demanding skill set.

And now she holds an exceedingly reputed position in an excellent company. That pays her fairly and decently. Thus, exploring and knowing your potential and the endless opportunities in this world is very important.

Especially in today’s world where being financially independent and stable is so crucial in anyone’s life.

3. She chose to diversify her portfolio

This step is something without which you cannot think of achieving your financial goals to the best of your capacity. So, when she learned about the benefits of diversification, she immediately chose to bring it into action.

Now she has investments in index funds, IRA and HRA. However, she says she has a long way to go in diversification platforms even now and further in the future.

You can only imagine how this can be so fruitful in her future and for her family.

4. In Covid-19, she lives at her parents’ house

The wise is the one who knows where a mutual decision will help both parties. Our client is one such person. On account of Covid-19, she moved in with her parents.

The shifting to her parents’ house has reduced her costs and helped her, and her parents strengthen their emotional bond.

She doesn’t have to pay rent now, which otherwise was a very high expense. Now when she is with her parents, they have good times, and thus, their physical and mental health are also healthy.

5. She does not let her high savings decrease the quality of her life

Although she saves 80% of her total income, she says, she never experienced that she had to give up her leisurely wishes.

When asked how she achieves this, she says she is highly intentional with her savings and expenses. She now doesn’t spend on unnecessary things that do not make her happy as she thought they would usually do.

She still goes out for drinks with her friends and often travels but within an ample and satisfying budget. And she says that she is extremely happy and satisfied with her life choices and her life at large.

Concisely, effective financial planning means growing your wealth gradually and uniformly. It consists of predetermining specific goals, saving regularly, investing those savings, and safeguarding your assets.

Unfortunately, however, some prevalent common financial planning mistakes can deprive you of doing any good to your money. And the goal is to reduce them and not repeat them as much as possible.

Therefore, it becomes necessarily crucial to avoid such risk appetite and mistakes. To sum up, we have provided some essential tips to prevent financial risks and plan your economic journey accordingly.

How to avoid financial risks?

Financial risks could lead to a massive leak in your resources, be it individual or your organization’s resources. Here are some tips you should consider to avoid them.

Protect your assets and properties with proper insurance as much as possible.

- Keep enough emergency funds to help you in unexpected mishaps.

- Keep a second source of income for you and your family.

- Avoid taking unnecessary debts and loans.

Nevertheless, life is an economic roller coaster. You never know when you will be at your boom and when you will be at your low. Moreover, financial stability is quite fickle these days.

So, plan accordingly. And besides, even the most brilliant risk-takers and investors occasionally find themselves wishing for a safe web.

Even after such a comprehensive discussion on financial planning mistakes and the probable solution, you might have some questions clouding your judgment. Therefore, look at the next section of the blog if it provides a compelling answer to your questions.

Is it safe to do financial planning in UAE?

According to polls, less than 44% of people with a monthly income of USD 10,889.69 or more have a financial planner.

On the other hand, Americans were the most likely of the various nationalities in the UAE to have a financial planner, with 21% indicating they presently seek financial assistance, followed by 20% of Emiratis.

This study reveals a critical requirement in the UAE to modify people’s perceptions of assistance and financial planning and the value it provides. The financial planning process is more than just making investments.

Because our affairs are so complicated, the importance of a qualified financial planner should not be overlooked. Working with a fully regulated firm and qualified financial advisor should provide you with the assurance and direction you need.

Therefore, it is not just safe but necessary to opt for financial planning in UAE through a firm like Quadra Wealth.

Where to find the best financial planner for ex-pats in UAE?

Be it expats or the locals; Quadra Wealth can be the best financial planner for your future. We provide the best services and the best opportunity suiting your economic conditions and budget constraint. Book a call today at app.quadrawealth.com/free-training.

After all this, you might wonder whether is it just you who have been making such silly mistakes with your resources. Is it normal to make financial mistakes?

Well, it is quite normal for people to make financial mistakes in UAE. Most people out there do not seek professional advice for a plethora of silly reasons. So do not be one of them and fall into the pit of bankruptcy.

Thus, it is essential to know where you are going wrong in your financial planning. These mistakes impact not only you but also your family members and the next generation of your family.

Therefore, a prudent and humble mindset must have good financial planning and learn and grow from mistakes. We can help you with that. Book a call today at: app.quadrawealth.com/free-training

In conclusion

In conclusion, effective financial planning is crucial for achieving financial stability and growth. It involves setting specific goals, saving regularly, investing wisely, and safeguarding assets.

However, common financial planning mistakes can hinder progress and lead to financial risks.

To avoid these mistakes, it is important to protect assets with proper insurance, maintain emergency funds, have a second source of income, and avoid unnecessary debts and loans.

Seeking professional financial planning advice from a qualified firm can provide direction and assurance for a successful financial future.

Remember, it is normal to make financial mistakes, but it is important to learn from them and make positive changes for the future.

FAQ

Financial planning is the process of managing your finances to achieve specific goals, such as saving for retirement, for children higher education or building wealth. It involves setting financial goals, creating a budget, saving regularly, investing wisely, and protecting your assets.

What are some common financial planning mistakes?

Common financial planning mistakes include overspending, not saving enough, not investing wisely, taking on too much debt, not having an emergency fund, and not taking professional help when needed.

How can I avoid financial risks?

To avoid financial risks, it is important to protect your assets with proper insurance, maintain emergency funds, have a second source of income, and avoid unnecessary debts and loans.

Is it safe to do financial planning in UAE?

Yes, it is safe to do financial planning in UAE. Well, especially in UAE, the standard of lifestyle varies from time to time. Try not to get swayed by that. Whether you are a regular wage worker, an investor, or a successful industrialist, you need to have an adequately chalked out financial planning for your future.

Is it normal to make financial mistakes?

Yes, it is safe to do financial planning in UAE. Well, especially in UAE, the standard of lifestyle varies from time to time. Try not to get swayed by that. Whether you are a regular wage worker, an investor, or a successful industrialist, you need to have an adequately chalked out financial planning for your future.