Caveats Before the Dive – Doubling Investments

Alright, let’s kick this off by saying, the best ways to double your money isn’t like jumping headfirst into those enticing but risky speculative adventures.

Trust me, taking that route is like playing a game of chance with your hard-earned bucks, and the chances of multiplying?

Slim to none! Now, think of doubling your investment over time as this quirky way of saying, “Hey, let’s steadily grow this stash and watch it balloon.”

It’s not about becoming a Wall Street wizard; it’s more about being practical and putting some thought into it, no need for fancy technical jargon.

And hey, getting some advice from trustworthy financial wizards can really light up the path to stash your cash.

So, depending on your timeframe and how much risk you can stomach, it’s like crafting this well-thought-out game plan for your money journey.

Easy peasy, right?

Before thinking about doubling investments

Know Thyself:

Seriously, be real with yourself, and if you’ve got an investment advisor, spill the beans to them too.

Discovering you can’t handle the rollercoaster ride when the market takes a 20% nosedive is like finding out you’re allergic to peanuts after chowing down on a PB&J—ouch! Not great for your financial well-being, trust me.

Emotions at the Wheel:

Greed and fear – the dynamic duo driving most investors. Don’t let them hijack your investment strategy and decisions.

It’s like keeping your cool when you’re stuck in traffic – not always easy, but oh-so-necessary.

Side-Eye on 'Get-Rich-Quick':

Now, when it comes to those “get-rich-quick” schemes promising the moon with zero risk? Yeah, not a thing.

There are more investment scams out there than sure bets. So, if someone’s dangling a guarantee that sounds too good to be true – your broker, your brother-in-law, or even a late-night infomercial – give it the skeptical side-eye.

Take a beat to make sure they’re not using you to double their own money. Trust your instincts, they’re usually onto something.

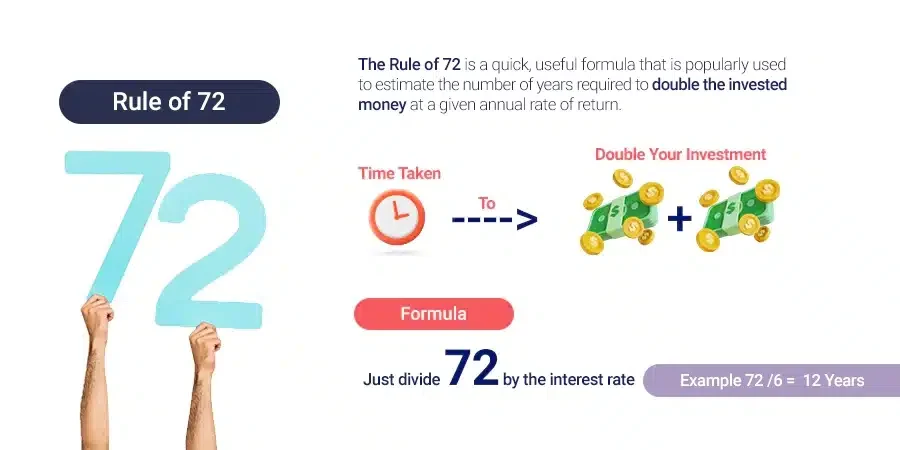

Ever heard of the Rule of 72?

It’s like a financial crystal ball, revealing the magic of compound interest. Here’s the lowdown: take 72 and divide it by your annual investment return percentage.

Voilà! That’s the estimated time it’ll take for your hard-earned money to double. For example, with a sweet 8% return, your cash could potentially double in around 9 years (72 divided by 8).

It’s not rocket science, just a nifty trick to gauge the power of compounding and plan your investment journey. So, next time someone throws around the Rule of 72, nod knowingly – you’re in on the secret!

Also Read: Financial planning for your growing family

5 Ways to Double Your money

1) The Classic Way – Diversified Portfolios

Bonds and Bluechips

Now, when it comes to doubling your money in the most traditional way, Picture this: a solid, balanced portfolio playing the field with blue-chip stocks and investment-grade bonds.

Check this out – the S&P 500 Index fund, the big player in blue-chip stocks, showed off a cool 9.8% annual rate of return (including dividends) from 1928 to 2020.

Meanwhile, those reliable investment-grade corporate bonds brought in a steady 7.0% annually over 93 years.

Crunch the numbers, and a classic 60/40 portfolio (60% stocks, 40% bonds) would’ve handed you around 8.7% annually during that stretch.

According to the Rule of 72, that could double their money in roughly 8.3 years and quadruple in about 16.5 years.

Now, here’s the lowdown: this ride can get a bit bumpy, like the 35% nosedive in the S&P 500 in early 2020 when the whole pandemic chaos hit.

Though, eventually the S&P 500 roared back from that 2020 plunge in record time, scoring a jaw-dropping 100% total return from 2019 to 2021.

But, and it’s a big but, future returns might not be as dazzling.

So, if you’re eyeing the classic route, buckle up, stay steady, and be ready for the occasional financial rollercoaster.

Real Estate

Let’s take a trip back to a real estate boom, and it’s a whole different story. Imagine doubling your money, an irresistible daydream during a real estate frenzy.

With that mortgage magic, a 20% down payment on a $500,000 property, including $100,000 from your pocket and a $400,000 mortgage, can turn into a doubled investment if the property appreciates by 20% – suddenly, it’s worth $600,000, and your initial $100,000 has doubled with $200,000 in equity.

However, Real estate, the OG wealth builder, isn’t feeling as glamorous these days.

2) The Contrarian Way

So, even the most play-it-safe investor knows there’s a moment when you gotta throw caution to the wind and go against the flow.

Same deal in the stock world – when others are hitting the panic button, that’s your cue.

We’re not saying go grab stocks from the discount bin; it’s more about sniffing out those diamonds in the rough when good companies hit a slump.

Now, here’s the secret sauce – valuation metrics.

We’re talking price-to-earnings ratio, book value – the stock market’s version of batting averages.

When good companies dip below their historical averages for legit or kinda silly reasons, smart investors see a chance to double their cash.

It’s not for the faint of heart – you need a bit of risk tolerance and a hefty dose of homework.

3) The Safe Way

So, imagine the investing journey is a bit like choosing between the fast lane and the slow lane on the highway.

Both will get you to the same destination, but if you’re the type who prefers a chill, less hair-raising adventure, bonds are your go-to travel buddy.

Zero-coupon bonds

Basically, bonds that keep it simple. Instead of getting regular interest payments, you buy these bonds at a discount, and your big payday comes when the bond matures.

No reinvestment challenges or risks – it’s a one-time deal.

But, here’s the catch – these bonds can get a bit touchy with changes in the rate of interest, and they might lose value if rates decide to do the cha-cha.

Now, if you’re eyeing the ultra-safe zone, check out Series EE Savings Bonds from the U.S.

Treasury. Sure, the interest rates might sound like a snooze fest – a measly 0.10% for bonds issued from November 2021 to April 2022.

But, here’s the kicker – they come with a guarantee. Hold onto these bonds for 20 years, and bam, they double in value.

Term Deposits

Term deposits are like the unsung heroes of investing. Park your money, sit back, and watch it grow with peace of mind.

Guaranteed returns, minimal risk of losing all of your money and no market jitters. It’s like a financial spa day – low stress, high gains, and your money getting a little R&R.

4) The Speculative Way –

So, while the slow and steady approach might have its fans, some folks are looking for the financial rollercoaster, ready to risk it all.

If you’ve got nerves of steel and some cash to spare, here’s where things get spicy – aggressive strategies like options, margin trading, penny stocks, and the new kid on the block, cryptocurrencies, step into the ring.

But beware, It’s like putting your money on steroids.

Also Read: Exploring The Potential Of Diamonds As Investments

Options and Margins

Each Option is like holding a potential jackpot of 100 shares, and a small jump in a company’s price can be a grand slam.

Just a heads-up – this isn’t a lazy Sunday strategy.

Now, if diving into the Option deep end isn’t your style, there’s the margin trading and short-selling game.

It’s like borrowing money from the brokerage house to play with more shares than you actually own. But hold your horses – this is not for the faint-hearted.

A margin call can feel like getting back into a corner, and short-selling. Well, it’s a game with infinite losses.

Penny Stocks

And then there’s the penny stock adventure – the extreme bargain hunt.

Throw some cash at what looks like the next big thing; penny stocks can do the money dance and double up in a single trading day.

Just a heads-up, though – the low prices tell a tale of what most investors are feeling.

Cryptos

Now, welcome to the crypto craze! Bitcoin might have had its moment with a 60% surge in 2021, but let’s talk about Ethereum, Cardano, Shiba Inu, Dogecoin, Solana, and Terra – the cool kids of the crypto block.

They went above and beyond, with gains reaching the stars (Solana and Terra went intergalactic in 2021, but 2022 saw them coming back to Earth).

But, here’s the reality check – scams are as common as confetti at a party, so if you’re diving into the crypto pool, keep those eyes wide open.

5) The Best Way

Sometimes, the best path is the less glamorous one. Employer-sponsored retirement plans, like a 401(k), shine here.

The automatic match from your employer feels like free money. It’s not flashy, but it’s solid.

For most of us, that means every dollar invested costs only around 65 to 75 cents – a sweet discount on your financial future.

If the 401(k) party isn’t your scene, no worries – you can still join the savings shindig with an individual retirement account (IRA), traditional or Roth.

Sure, you miss the company match, but the tax benefits are no joke.

The traditional IRA gives an instant tax break, and the Roth IRA, though taxed when you invest, offers tax-free withdrawals on principal and profits come retirement, as long as you stick to the age and time invested rules.

Both IRAs are a solid deal for savvy taxpayers. If you’re on the younger side, give that Roth IRA a nod – zero taxes on capital gains for a higher effective return.

And if your income is playing hide and seek, the government practically throws in extra cash by effectively matching a chunk of your retirement savings through the Retirement Savings Contributions Credit, a silver lining to your tax bill.

Consider the Roth IRA for tax-free gains and government incentives.

Parting Thoughts

Doubling your investments isn’t a mythical feat; it’s a realistic goal with the right approach.

Whether you opt for the classic, contrarian, safe, speculative, or best way, tailor your strategy to match your risk tolerance and time horizon.

Remember, in the world of investments, patience and a well-thought-out plan are your best allies.