Do you wonder how to make smart investments and grow your wealth? Corporate bonds are debt obligations often overlooked by many investors. This beginner-friendly guide will educate you about the basics of corporate bonds, from what they are to their potential risks and rewards.

Let’s kick-start your journey into the exciting world of bond investing!

Key takeaways

●Corporate bonds are issued by companies to raise money, and they pay interest to investors who lend them money.

●There are different types of corporate bonds, including a fixed interest rate, floating rate, zero coupon bond, convertible, and high-yield bonds.

●Bond credit ratings provide information about the issuer's financial condition and can help investors assess the risk associated with a particular bond.

●Liquidity concerns exist because corporate bonds may not be easily bought or sold in the market due to factors like lower trading volumes and credit risk.

Understanding Corporate Bonds

A corporate bond is a deal you make with a company. They borrow your money to pay for things they need. In return, the company agrees to give you back your money after some time.

When it comes to earning the highest yields, most corporate bonds often come out ahead of Treasury bonds issued by the federal government bonds and municipal bonds issued by state and local governments.

The best part? While you wait, the company pays you interest! This is how investors earn from corporate bonds.

But it also comes with its own set of risks like not getting paid back on time or at all, which we will discuss later.

How do Corporate Bonds Work?

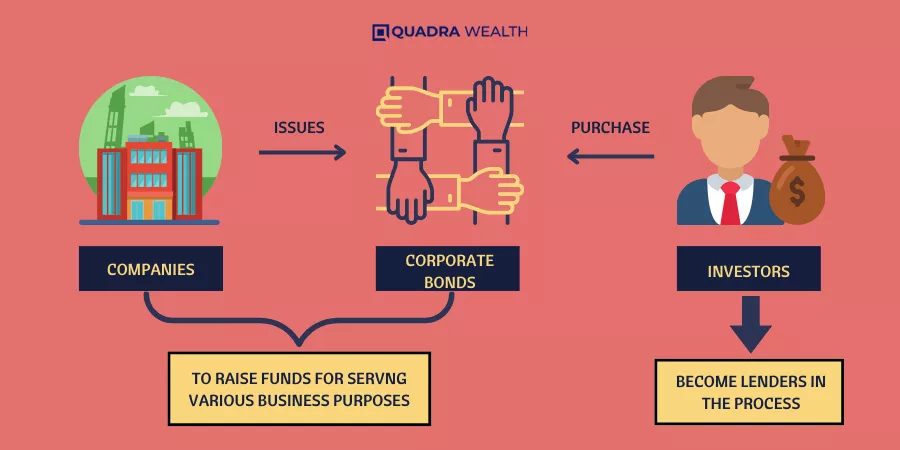

Corporate bonds work in a clear process.

- First, a corporation issues these bonds to gather money.

- Buyers of these bonds are called investors.

- These investors give money to the corporation by buying their bonds.

- In return, the corporation promises to return this money.

- They also promise to pay extra money as interest for borrowing.

- The extra money is paid from time to time until the bond ends.

- At the end of the bond’s term, the corporation pays back all the borrowed money.

Types of Corporate Bonds

Bonds, as well as the companies that issue them, are classified based on their credit quality. Credit rating agencies assign credit ratings based on their assessment of the likelihood of a company defaulting on its bonds.

Credit rating agencies review their bond ratings on a regular basis and may revise them if conditions or expectations change.

based on credit rating, bonds are classified as investment grade bond or non-investment grades based on their credit ratings. Investment-grade bonds are thought to be more likely to be paid on time than non-investment-grade bonds.

Non-investment grade bonds, also known as high-yield or speculative bonds, typically pay higher interest rates to compensate investors for higher risk.

There are many different kinds of corporate bonds. They all come with their own set of rules and benefits. Here’s a list:

- Fixed-rate bonds: These are the most common type. The rate of bond interest stays the same for the whole term.

- Floating-rate bonds: The interest rate on these bonds change over time. It moves up and down with market rates.

- Zero coupon bonds: This type does not offer regular interest payments. Instead, you buy them at a price lower than their face value. When Zero coupon bonds mature, you get the full amount back.

- Convertible bonds: These can be changed into shares of the issuing company’s stock if you want to.

- High-yield bonds: Also known as junk bonds, these offer high returns but also come with high risk.

The Role of Yield in Corporate Bonds

Corporate bonds offer higher yields than government bonds or certificates of deposit. Yield is the return that investors receive on their investment, and it reflects the higher risk associated with corporate bonds.

The yield is influenced by factors such as the credit rating of the issuing corporation and market conditions. Higher-rated bonds generally have lower yields because they are considered less risky investments, while lower-rated bonds have higher yields to compensate for the increased risk.

It’s important for investors to carefully consider the yield when investing in corporate bonds, as it can impact their overall return on investment.

Understanding Credit Ratings for Corporate Bonds

Credit ratings are important for investors who want to understand the creditworthiness of corporate bonds. Credit ratings are determined by agencies like Moody’s and S&P, which assess the financial condition and credit history of companies issuing bonds.

Moody’s considers a rating of Baa3 or above investment grades for corporate bonds. while S&P considers BBB- or above as investment grade. These ratings indicate that the issuer is more likely to make timely payments on both principal and interest.

Investors should pay attention to these ratings because they can help determine the level of risk associated with a particular bond. Higher-rated bonds generally have lower interest rate risk, while lower-rated bonds carry higher risks.

It’s important to note that credit ratings are not guaranteed and do not predict future performance. However, they provide useful insights into an issuer’s ability to meet its financial obligations.

In summary, understanding credit ratings for corporate bonds is essential for investors looking to make informed decisions about their investments.

By considering these ratings alongside other factors such as yield and liquidity concerns, investors can build a diversified bond portfolio aligned with their financial goals.

The Importance of Disclosures in Corporate Bonds

Issuers of corporate bonds have to provide important information about their bond offerings and financial condition. This information is disclosed in a prospectus that they file with the Securities and Exchange Commission (SEC).

It’s crucial for investors to have access to this information so they can make informed investment decisions. The disclosures help investors understand the risks associated with investing in a particular bond, such as changes in interest rates or economic factors that could affect the issuer’s ability to make timely payments on the bond.

Without these disclosures, investors would be left in the dark about important details that could impact their investment. So, having clear and transparent disclosures is key when it comes to corporate bonds.

Liquidity Concerns with Corporate Bonds

Liquidity concerns with corporate bonds refer to the risk that these bonds may not be easily bought or sold in the market. This can happen if there is a lack of buyers or sellers for a particular bond.

When investors are unable to find willing buyers, they may have trouble selling their bonds quickly and at fair prices.

One reason for liquidity concerns is that corporate bonds are typically traded in the secondary over-the-counter (OTC) market, which is smaller and less regulated than major exchanges like the stock market.

As a result, there may be fewer participants in this market, leading to lower trading volumes and potentially wider bid-ask spreads.

Another factor contributing to liquidity concerns is risk. Corporate bonds with lower credit ratings or those issued by financially unstable companies may face higher liquidity risks because investors perceive them as riskier investments.

In times of economic uncertainty or financial stress, buyers may become more hesitant to purchase these bonds due to concerns about potential defaults.

Investors should be aware of these liquidity concerns when investing in corporate bonds. It’s important to carefully evaluate the creditworthiness of the issuing company and consider diversifying holdings across different sectors and maturities to mitigate risks.

Additionally, consulting with a financial advisor or brokerage service like Vanguard Brokerage Services can provide valuable insights on navigating the bond market effectively while managing liquidity risks.

Tax Implications of Corporate Bonds

The tax implications of corporate bonds can impact your overall investment returns. When you invest in corporate bonds, the interest income you earn is subject to federal, state, and local taxes.

This means that a portion of your earnings will go towards paying taxes. It’s important to be aware of these tax obligations as they can affect the amount of money you actually receive from your bond investment.

If you hold corporate bonds in taxable accounts, such as a regular brokerage account, there may be additional tax implications to consider. The interest income on these bonds is typically taxed at your ordinary income tax rate.

This means that if you’re in a higher tax bracket, you may end up paying more in taxes on your bond earnings.

To minimize the impact of taxes on your investment returns, some investors choose to hold their corporate bonds in tax-advantaged accounts like an Individual Retirement Account (IRA) or a Roth IRA.

By doing so, they can potentially defer or even avoid paying taxes on their bond earnings until they withdraw the funds from these accounts.

It’s always a good idea to consult with a qualified tax advisor before investing in bonds or making any decisions about how best to manage your investments from a taxation perspective.

They can help provide guidance based on your specific financial situation and goals.

Understanding the Fees Associated with Corporate Bonds

Investing in corporate bonds comes with fees that investors need to be aware of. These fees can include a concession fee, which is the difference between the buying and selling price of the bond.

There may also be a commission fee charged by brokers for facilitating the purchase or sale of the bond in the secondary market. It’s important to understand these fees as they can eat into your investment returns over time.

By carefully considering and comparing different investment options, you can choose bonds with lower fees, helping you maximize your potential earnings from corporate bonds.

The Risks Involved in Corporate Bonds

Investing in corporate bonds comes with certain risks. Here are some key risks to consider:

- Credit Risk: There is a risk that the issuing corporation may not be able to make interest payments or repay the principal amount. This depends on the financial condition and credit history of the issuing corporation.

- Market Risk: Bond prices can fluctuate based on changes in interest rates. If interest rates rise, bond prices typically fall, and vice versa.

- Liquidity Risk: Corporate bonds may have lower liquidity compared to government bonds or stocks. This means it may be harder to sell them quickly at a fair price if you need to access your money urgently.

- Event Risk: Economic, political, legal, or regulatory changes can impact the creditworthiness of a corporation and its ability to make timely payments on its bonds. Natural disasters are also considered event risks.

- Default Risk: There is a risk that the issuing corporation defaults on its payments. Investors may lose their investment if this happens.

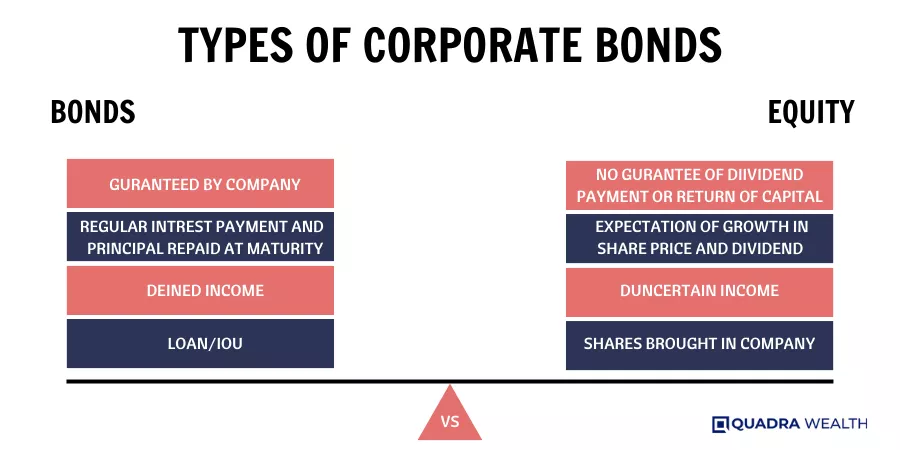

Corporate Bonds vs. Stocks: A Comparison

Investors often weigh the pros and cons of corporate bonds versus stocks when deciding where to invest their money. Here is a comparative table that breaks down the key differences and similarities between the two.

Corporate Bonds | Stocks | |

Ownership | No ownership rights in the corporation | Investors become partial owners in the corporation |

Return | Potential dividends and capital gains | |

Risk | Generally lower risk than stocks | Risk of losing the entire investment |

Market Volatility | Less impacted by market volatility | Highly affected by market volatility |

Credit Ratings | Many are rated by agencies like Moody’s and Standard & Poor’s | Stocks are not rated for creditworthiness |

Denominations | Typically issued in denominations of $1,000 or $5,000 | No specific denomination, can be purchased in any quantity |

Note that while corporate bonds generally offer higher yields compared to options like government bonds, the potential for returns with stocks can be significantly higher.

However, the risk associated with stocks is also notably higher. Each investor should carefully consider these factors and their individual risk tolerance when deciding between these two investment options.

The Advantages and Disadvantages of Corporate Bonds

Corporate bonds offer the potential for higher returns but come with increased risk. Understanding both sides of the equation is crucial for investors looking to diversify their portfolios.

Pro: Potential for Higher Returns

Corporate bonds have the potential to offer higher returns compared to government bonds or certificates of deposit. This is because corporate bonds typically carry higher yields as they involve more risk.

Investors who are willing to take on this increased risk may be rewarded with higher interest payments and the potential for capital appreciation. It’s important to note that the potential for higher returns also comes with a greater level of risk, so it’s essential for investors to carefully assess their own interest rate risk tolerance before investing in corporate bonds.

Con: Increased Risk

Corporate bonds come with increased risk compared to government bonds or certificates of deposit. This is because they offer higher yields, which reflect the greater risk involved.

One major concern is more credit risk, where there’s a chance that the issuing corporation may not be able to make timely payments of interest and principal or even default altogether.

Additionally, preferred securities are also at high risk due to their vulnerability to rising Treasury yields, which can cause prices to drop.

It’s important for investors to be aware of these risks when considering investing in corporate bonds or preferred fixed-income securities.

How to Choose the Right Corporate Bonds for Your Portfolio

- Consider your financial goals and risk tolerance before investing in corporate bonds.

- Research the credit ratings of potential issuers to determine their creditworthiness.

- Evaluate the interest rates offered by different corporate bonds to maximize potential returns.

- Assess the maturity dates of bonds to align with your investment timeline.

- Diversify your bond portfolio by investing in a mix of different types of corporate bonds.

- Pay attention to fees associated with buying and selling corporate bonds to minimize costs.

- Monitor market conditions, including interest rate changes, to make informed investment decisions.

- Seek advice from a financial advisor or brokerage firm for guidance on selecting suitable corporate bonds.

Making Money from Corporate Bonds

- Investors can make money from corporate bonds by lending money to the company.

- In return for lending their money, investors receive periodic payments of interest from the issuer.

- These interest payments serve as a source of income for investors.

- The frequency of interest payments varies depending on the terms of the bond, but they are typically paid semiannually or annually.

- The amount of interest paid is determined by the bond’s coupon rate, which is set at the time of issuance.

- Investors can also make money from corporate bonds through capital appreciation.

- If the bond’s price increases in the secondary market, investors can sell their bonds at a higher price than they originally paid, resulting in a profit.

- On the other hand, if the bond’s price decreases in value, investors may experience a capital loss if they decide to sell their bonds before maturity.

- It’s important to note that bond prices can be influenced by various factors such as changes in interest rates and market conditions.

- Therefore, it’s crucial for investors to carefully monitor these factors when considering buying or selling corporate bonds.

- Additionally, investors should consider diversifying their bond portfolio to spread out risk and potentially increase returns.

- By investing in a mix of different corporate bonds with varying credit ratings, industries, and maturities, investors can mitigate some of the risks associated with individual bonds while still having the potential for returns.

- It’s also worth noting that there is a bond fund available that offers exposure to a diversified portfolio of corporate bonds, making it easier for investors to gain access to this asset class.

- However, investors should be aware that these funds may charge fees and expenses that can impact overall investment returns.

Is Investing in Corporate Bonds Right for You?

Investing in corporate bonds can be a good option for you if you are looking for fixed-income investments and are willing to take on some risk. Corporate bonds offer higher yields compared to government bonds or certificates of deposit, which means you have the potential for higher returns.

However, it’s important to note that with higher yields comes increased risk.

Before investing in corporate bonds, it’s essential to consider your financial goals and risk tolerance. You should also evaluate the creditworthiness of the issuing corporation by looking at their credit ratings from agencies like Moody’s Investors Service and Standard & Poor’s Corporation.

These ratings reflect the company’s timely payments of principal and interest and give you an idea of its financial condition.

Additionally, make sure to review the disclosures provided by the company in its prospectus, which can be accessed through the Securities and Exchange Commission (SEC)’s EDGAR database.

This will help you understand any potential risks associated with investing in their bonds.

Remember, while investing in corporate bonds can provide income stability, there is always a possibility of losing your principal investment if things go wrong with the issuing company or if there are economic changes that affect bond prices.

It’s crucial to carefully assess your own financial situation and consult with a financial advisor before making any investment decisions regarding corporate bonds.

Changes in Interest Rates and Their Effects on Corporate Bonds

Changes in interest rates can have a significant impact on corporate bonds. When interest rates rise, the yield of existing corporate bonds may decrease.

This means that if you already own corporate bonds and interest rates go up, the value of your bonds may go down.

On the other hand, when interest rates fall, the price of existing corporate bonds tends to increase. This means that if you hold corporate bonds and interest rates drop, the value of your bonds could go up.

It’s important to note that changes in interest rates affect different types of corporate bonds differently. Bonds with longer maturities are generally more sensitive to changes in interest rates than those with shorter maturities.

Additionally, corporate bonds with higher credit ratings tend to be less affected by changes in interest rates compared to lower-rated or riskier ones. Overall, investors need to pay close attention to changes in interest rates as they can directly impact their investments in corporate bonds.

By understanding how changing interest rate environments can affect bond prices and yields, investors can make informed decisions about buying or selling these types of government securities for their portfolios.

Understanding the Gross Expense Ratio in Corporate Bonds

The gross expense ratio is an important factor to consider when investing in corporate bonds. It represents the percentage of a fund’s average net assets that are used to cover operating expenses.

These expenses can include management fees, administrative costs, and other operational charges. A lower gross expense ratio means that less of your investment is being deducted for these expenses, allowing you to keep more of your returns.

Investors should be aware that the gross expense ratio does not include transaction costs or sales charges associated with buying or selling bonds. It is also important to note that actively managed bond funds typically have higher expense ratios compared to passively managed index funds.

When choosing corporate bond investments, it’s essential to carefully review the prospectus or offering document provided by the bond issuer or fund manager. This document will provide detailed information about the gross expense ratio and other fees associated with the investment.

By understanding and comparing different funds’ gross expense ratios, investors can make informed decisions about which corporate bond investments best align with their financial goals while minimizing unnecessary costs.

2023 Mid-Year Outlook: Corporate Bonds

Looking ahead to the second half of 2023, the outlook for corporate bonds remains positive. Despite some potential challenges, such as rising interest rates and economic uncertainty, corporate bonds continue to be a valuable investment option.

One key factor influencing the mid-year outlook is the Federal Reserve’s stance on interest rates. If rates continue to rise, it could put downward pressure on bond prices.

However, high-quality investments like investment-grade-rated corporate bonds can still provide stability in uncertain market conditions.

Another aspect to consider is the performance of preferreds issued by U.S. banks. These securities offer attractive yields and may present opportunities for investors seeking income.

In summary, while there may be some volatility in the bond market during the second half of 2023, investing in well-diversified portfolios that include investment-grade corporate bonds and preferred securities from reputable issuers can help mitigate financial risks while capitalizing on potential returns.

High-Yield Corporate Bonds: A Word of Caution

Investors need to be cautious when considering high-yield corporate bonds. These bonds come with more risk compared to investment-grade bonds.

The prices of high-yield corporate bonds can be affected by changes in interest rates, especially for long-term bonds.

There is also a risk of default or delayed payments from the issuing corporation. It’s important to note that some high-yield corporate bonds have the option to be redeemed before their bond matures, which can impact investors’ returns.

Additionally, certain events like economic or regulatory changes can affect an issuer’s ability to make timely payments to bondholders. It is crucial for investors to carefully evaluate the creditworthiness and financial condition of the issuing corporation before investing in high-yield corporate bonds.

The Attractiveness of Investment-Grade Corporate Bonds

Investment-grade corporate bonds are appealing to conservative investors who want to earn income. These bonds offer higher yields compared to government bonds and certificates of deposit because they come with greater risk.

Moody’s and S&P rate investment-grade bonds as Baa3 or above and BBB– or above, respectively. Preferred stocks issued by large, highly rated U.S. banks may be more stable than high-yield bonds during a slow economy.

Currently, yields for investment-grade corporate bonds are at their highest levels since 2009, making them an attractive option for those seeking income from their investments.

Conclusion

In conclusion, understanding the basics of corporate bonds is essential for investors. This debt obligation allows corporations to raise capital while providing investors with periodic interest payments and repayment of principal.

By considering factors such as credit quality ratings, disclosures, inflation risk, liquidity concerns, and tax implications, investors can make informed decisions about investing in corporate bonds.

It’s important to remember that while corporate bonds offer potentially higher returns, they also come with increased risk compared to certificates of deposit or a government bond.

Ultimately, whether or not investing in corporate bonds is right for you depends on your financial goals and risk tolerance.

FAQs

A corporate bond is a type of investment where a company borrows money from investors and promises to pay it back with interest over a specified period.

You can buy corporate bonds through your brokerage account or financial advisor, who will help you find suitable options based on your investment goals and risk tolerance.

While corporate bonds carry some level of risk, they are generally considered safer than stocks because they have fixed interest payments and the issuer’s creditworthiness is evaluated by rating agencies.

The return on your investment in corporate bonds is determined by the coupon rate (interest rate) set at issuance, the length of time until maturity, and any changes in market interest rates during that time.