Navigating the world of investing can be daunting, especially when it comes to understanding the different types of bonds.

As one of three core asset classes, bonds are an essential part of a well-diversified investment portfolio.

This comprehensive guide will break down everything you need to know about bonds in simple terms – what they are, their attributes, and how they work, as well as explore various types including U.S. government and agency securities among others.

Stick with us; your financial literacy journey is just starting!

Key takeaways

●Bonds are like loans, where investors lend money to bond issuers in return for regular interest payments and the return on their initial investment at maturity.

●Different kinds of bonds include U.S. bonds and securities, municipal bonds, international and emerging markets bonds, corporate bonds, bond ETFs, and green bonds..

●Factors to consider when investing in bonds include maturity & duration, risk, volatility, quality, inflation impact on returns, and liquidity.

Understanding Bonds

Bonds are fixed-income securities that represent a loan made by an investor to a bond issuer, who is typically a government or corporation.

What are bonds?

Bonds are like loans. They are a type of debt. When you buy bonds, you give your money to someone else for some time.

The person who gets the money is the issuer of the bond. It could be a company or a government body. Mostly companies and governments issue bonds and investors buy those bonds as a savings and security option.

In return, they promise to pay back that money on an agreed date which we call the maturity date. Until then, they will also pay you interest at regular times for your loaned amount.

This steady income from interest makes bonds a good choice for many people who want consistent earnings over time.

Bond attributes

Bonds have unique features or ‘attributes’. The face value of a bond is the money amount the bond will be worth at its maturity, and is also the amount that is used to compute interest payments.

The coupon rate is the rate of interest that the bond issuer will pay on the face or par value.

The term of a bond refers to how long until it reaches maturity date when you get your initial investment back from the issuer. There are also special types of bonds: callable bonds can allow an issuer to pay off their debt early if they choose, and redeemable bonds give investors a chance to sell them back before they mature.

How bonds work

Bonds work like a loan. The person buying the bond is lending money to the issuer of the bond. This money helps funds for projects and operations. In return, the bond issuer pays interest to the buyer at set times until maturity.

Once a bond reaches its maturity date, full payment occurs. The issuer gives back all the money to the lender at face value.

Through this process, bonds can be a steady source of income for many investors.

Different Types of Bonds

– U.S. government bonds and securities, municipal bonds or “munis,” international and emerging markets bonds, corporate bonds, bond ETFs, and green bonds are the different bond types investors can consider for their portfolios.

U.S. government bonds and securities

U.S. government bonds and securities are considered very safe investments because they are backed by the U.S. government guarantee.

They include Treasury bills, notes, and bonds, each with different characteristics and maturity dates.

For low-risk options, there are also U.S. savings bonds like I-bonds and Series EE Savings Bonds available to investors.

Another type of bond is agency securities issued by GNMA (Government National Mortgage Association), Fannie Mae, and Freddie Mac which have virtually no risk associated with them.

Investing in U.S. bonds can provide a steady source of income through regular interest payments.

- Safety

- Steady Income

- Diverse Options

- Lower Returns,

- Interest Rate Risk

Municipal bonds, or munis

Municipal bonds, also known as munis, are a type of bond issued by local governments to raise money for public projects like schools, roads, and hospitals.

When you buy a municipal bond, you are essentially lending money to the government in exchange for regular interest payments.

One key advantage of municipal bonds is that they are often exempt from federal taxes. This means that the interest income you earn from these bonds may not be subject to federal income tax.

Municipal bonds can be a good option if you want to support your local community while potentially earning tax-advantaged income. Additionally, municipal bonds are generally considered less risky than corporate bonds because they have a lower default rate.

Municipal Bonds:

- Tax Advantages

- Local Impact

- Lower Default Rate

- Lower Yields

- Market Complexity

- State and Local Risks

International and emerging markets bonds

International and emerging markets bonds are a type of investment that offers varying interest rates, maturity dates, and credit quality. These bonds are issued by governments and corporations in countries outside of the United States.

It’s important to note that information on these bonds may be harder to come by due to the lack of an international bond regulator. While U.S. government and agency bonds are considered safe investments, international and emerging markets bonds carry more risk.

Therefore, investing in these bonds requires careful research and analysis to assess the potential risks and rewards involved.

International and Emerging Markets Bonds:

- Diversification

- Higher Yields

- Growth Potential

- Higher Risk

- Lack of Regulation

- Volatility

Corporate bonds

Corporate bonds are a type of bond issued by companies to raise funds for various purposes. These bonds carry more risk compared to the government’s bonds because they depend on the financial stability and performance of the issuing company.

However, they also offer higher interest payments, which can be attractive to investors seeking higher returns. Corporate bonds are issued by different types of companies, ranging from large corporations to smaller businesses.

It’s important for investors to carefully evaluate the creditworthiness and financial health of the issuer before investing in corporate bonds.

Corporate Bonds

- Higher Yields

- Diverse Options

- Income Generation

- Credit Risk

- Interest Rate Sensitivity

- Market Volatility

Bond ETFs

Bond ETFs, or exchange-traded funds, are investment vehicles that allow investors to own a diversified portfolio of bonds.

These funds include different types of bonds, such as U.S. government bonds, municipal bonds, international and emerging markets bonds, and corporate bonds.

By investing in bond ETFs, individuals can gain exposure to a variety of bond holdings without the need to buy individual bonds themselves. They provide income for investors through interest payments made by the underlying bonds and offer liquidity as shares can be easily bought and sold on the secondary market.

Bond ETFs are a convenient way to diversify bond investments and potentially generate income.

Bond ETFs:

- Diversification

- Liquidity

- Income Generation

- Fees

- Market Risk

- Price Tracking

Green bonds

Green bonds are a special type of bond that helps governments and companies raise money for projects that benefit the environment. These bonds are different from regular bonds because the funds raised can only be used for environmentally-friendly initiatives.

For example, the money might go towards building renewable energy projects or improving water and air quality. By investing in green bonds, individuals can support efforts to create a more sustainable economy.

In recent years, the market for green bonds has grown significantly, with more and more issuers choosing to raise bond funds through these environmentally-focused investments.

In fact, record levels of green bond issuance have been seen as society places greater emphasis on addressing climate change and promoting sustainability.

- Environmental Impact

- Investor Demand

- Diverse Projects

- Limited Regulation

- Lack of Transparency

- Niche Market

Factors to Consider When Investing in Bonds

Maturity, risk, volatility, quality, inflation, and liquidity are all important factors to consider when investing in bonds. Make sure you understand these factors before making any investment decisions.

Keep reading to learn more!

Maturity & duration

Maturity and duration are important factors to consider when investing in bonds. Maturity refers to the length of time until the bond reaches its full repayment. Bonds with longer maturities often offer higher interest rates. but they also come with higher risks.

On the other hand, shorter-maturity bonds have lower interest rates but are considered less risky. Duration measures how sensitive a bond’s price is to changes in interest rates. Bonds with longer durations are more sensitive to interest rate changes.

It’s essential for investors to carefully consider their investment objectives and risk tolerance when choosing bonds with different maturities and durations.

Risk

Investing in bonds comes with certain risks that you need to be aware of. One important risk is the possibility of losing money. Yes, there is a chance that you may not get back the amount you invested, including your principal.

Different types of bonds carry different levels of risk. For example, government bonds are generally considered safer because they are backed by the government’s guarantee.

On the other hand, corporate bonds involve lending money to companies and their risk depends on how creditworthy those companies are.

It’s important to understand these risks and consider them when deciding where to invest your money.

Volatility

Volatility is an important factor to consider when investing in bonds. It refers to how much the price of a bond fluctuates over time.

Bonds with high volatility can experience large price swings, while bonds with low volatility have more stable prices.

Understanding the volatility of a bond can help investors assess the potential risk and return of their investment. Higher volatility may mean higher potential returns, but it also means higher risk.

On the other hand, lower volatility provides more stability but may offer lower returns. Factors that can affect bond volatility include changes in interest rates, inflation expectations, and market conditions.

When interest rates rise, bond prices usually decrease and become more volatile. Inflation expectations can also impact bond prices and increase volatility.

Quality

The quality of a bond refers to its creditworthiness. It indicates the likelihood that the issuer will be able to make interest payments and repay the principal amount at maturity.

Higher-quality bonds are considered safer investments because they have a lower risk of default. U.S. government bonds, for example, are considered high-quality due to the guarantee of the U.S. government.

On the other hand, lower-quality or “junk” bonds come with a higher risk of default but offer higher yields in return for investors willing to take on more risk. Credit rating agencies like Moody’s Investors Service and Standard & Poor’s (S&P) provide ratings that reflect the creditworthiness of different bonds, making it easier for investors to assess their quality before investing.

Inflation

Inflation can have an impact on bonds. It can reduce the purchasing power of the returns you get from owning a bond. Bonds with longer maturities are more affected by inflation than those with shorter maturities.

To protect against inflation, there are special types of bonds called Treasury Inflation-Protected Securities (TIPS). These bonds adjust their value based on changes in inflation rates.

When investing in bonds, it’s important to consider expectations for future inflation.

Liquidity

Bonds offer liquidity to investors, which means they can be easily bought and sold in the secondary market. Liquidity refers to how quickly you can turn your bond into cash without it losing value.

In general, U.S. government and agency bonds are highly liquid, meaning there’s a strong demand for them and you can sell them easily. However, different types of bonds may have different levels of liquidity depending on who issued them and how much people want to buy or sell them.

It’s important to consider liquidity risk when investing in bonds because it means there might not be enough buyers if you need to sell your bond, so you may not get a fair price for it.

Benefits and Risks of Bonds

Investors can enjoy consistent income through regular interest payments and the potential for capital appreciation, while also facing risks such as fluctuating interest rates and credit risk.

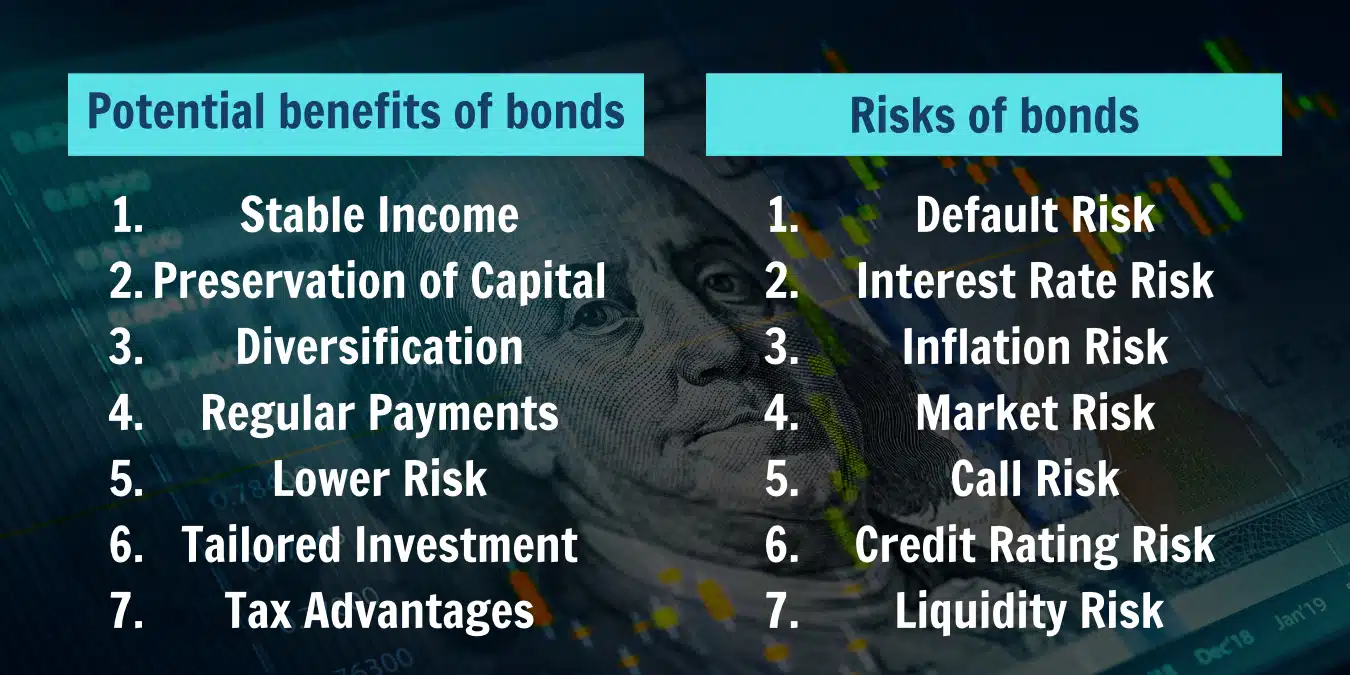

Potential benefits of bonds

Bonds offer several potential benefits for investors:

- Stable Income: Bonds provide regular interest payments, which can serve as a steady source of income.

- Preservation of Capital: High-quality bonds are generally less volatile than stocks, making them a safer option for preserving capital.

- Diversification: Investing in bonds can help diversify an investment portfolio and reduce overall risk.

- Regular Payments: Bondholders receive fixed interest payments at regular intervals, providing predictable cash flow.

- Lower Risk: U.S. government and agency bonds are considered low-risk investments due to the guarantee provided by the U.S. government.

- Tailored Investment Goals: Bonds come with various maturities and durations, allowing investors to align their investments with specific financial goals.

- Potential for Capital Appreciation: If interest rates decline, existing bond prices may increase, potentially resulting in capital appreciation for bondholders.

- Tax Advantages: Some types of bonds offer tax advantages such as exemption from federal income tax or state taxes on interest income.

Risks of bonds

Investing in bonds comes with certain risks that you should be aware of. These risks include:

- Default Risk: There is a possibility that the issuer of the bond may not be able to make interest payments or repay the principal amount when it is due. This can happen if the issuer experiences financial difficulties.

- Interest Rate Risk: Bond prices are sensitive to changes in interest rates. When interest rates rise, the value of existing bonds decreases, which means you could experience a loss if you need to sell your bonds before they mature.

- Inflation Risk: Bonds provide fixed interest payments, which means their purchasing power can erode over time due to inflation. If inflation rises higher than expected, the real return on your bond investment may decrease.

- Market Risk: The price of bonds can fluctuate based on supply and demand factors in the market. Economic conditions, investor sentiment, and global events can all impact bond prices.

- Call Risk: Some bonds have a call feature that allows the issuer to redeem them before maturity. If this happens, you may have to reinvest at a lower interest rate or in less favorable market conditions.

- Credit Rating Downgrade Risk: If the creditworthiness of the bond issuer is downgraded by rating agencies, it can negatively affect the value of the bond and increase its risk.

- Liquidity Risk: Some bonds may not trade frequently in secondary markets, making it difficult for you to sell them quickly without impacting their price.

How Do Credit Ratings Affect Bonds?

Credit ratings play a crucial role in determining the attractiveness and risk associated with investing in bonds. These ratings are determined by independent agencies that assess the creditworthiness of bond issuers.

Bonds with higher credit ratings are considered less risky, which means they have a lower chance of defaulting on payments. As a result, these bonds typically offer lower interest rates compared to bonds with lower credit ratings.

Investors use credit ratings as an important tool to evaluate the risk and potential return of investing in a particular bond. Higher-rated bonds provide investors with more confidence and security in receiving their interest payments and principal amount at maturity.

On the other hand, lower-rated or “junk” bonds carry higher risks but may offer higher yields to compensate for this increased risk.

For issuers, credit ratings can impact their borrowing costs. A higher credit rating allows them to borrow money at lower interest rates because lenders perceive them as being less likely to default on their debt obligations.

Conversely, a lower credit rating can result in increased borrowing costs for issuers as lenders demand higher compensation for taking on more risk.

It’s important to note that credit ratings can change over time based on the financial health and performance of the issuer. Upgrades or downgrades in credit ratings can significantly affect bond prices. and investor sentiment toward those bonds.

In summary, credit ratings provide valuable information about the level of risk associated with investing in specific bonds. They help investors make informed decisions based on their risk tolerance and desired returns while also influencing borrowing costs for bond issuers.

Conclusion

In conclusion, understanding the different types of bonds is crucial for investors looking to diversify their portfolios and generate income. From U.S. government bonds to corporate bonds and green bonds, there are various options available with different levels of risk and potential returns.

By considering factors like maturity, risk tolerance, and credit ratings, individuals can make informed decisions when investing in bonds.

It’s essential to consult a financial advisor or do thorough research before making any investment choices.

FAQs

The different types of bonds include government bonds, corporate bonds, municipal bonds, and savings bonds.

Government bonds are issued by governments to borrow money from investors. They pay regular interest payments and return the principal amount at maturity.

Corporate bonds are debt securities also known as fixed-income securities issued by corporations to raise capital from investors. They offer regular interest payments and return the principal amount at maturity.

A municipal bond is a type of bond issued by local governments or municipalities to finance infrastructure projects such as schools or highways. Investors receive regular interest payments and the return on their principal investment at maturity.

(Note: The British English version provided in this response may not fully adhere to all conventions of British English.)

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way