Are you looking to diversify your investment portfolio in 2024 but wary of the rising inflation rates? I Bonds, issued by the U.S. government, could be your answer. Our blog will guide you through everything you need to know about these bonds – from understanding how they work and their benefits to acknowledging the potential risks involved.

Ready? Let’s unveil the mystery behind I Bonds together!

Key takeaways

●I Bonds are savings bonds issued by the U.S. government that protect against high inflation and provide a fixed bond interest rate combined with an inflation-adjusted rate.

●They are a safe investment option for low-risk investors who want to preserve their purchasing power over time and earn more than traditional savings accounts or CDs.

●The current bond interest rates are made up of a fixed base rate and an inflation rate, which can change every six months.

●Bonds that earn interest are subject to federal income taxes but exempt from state and local income taxes, making them tax-efficient for investors.

●Risks associated with investing in I Bonds include purchase limitations and potential penalties for early withdrawals, but the bonds will never be worth less than their initial investment.

●Alternatives to consider include certificates of deposit (CDs), bond ETFs, fixed annuities, high-yield savings accounts, or Series EE Bonds. Each alternative has its own advantages and disadvantages.

●You can get I Bonds online through TreasuryDirect.gov or with your IRS Federal tax refund as a paper bond. Cashing out depends on whether you have digital or paper bonds and when you choose to cash them out.

Understanding I Bonds

I Bonds are a type of savings bond issued by the U.S. Treasury Department that offers protection against inflation and provides a fixed interest rate combined with an inflation-adjusted rate.

How do they work?

Savings Bonds get sold by the U.S. government. They help to save you from inflation’s effects. The Urban Consumer Price Index (CPI-U) sets its interest rates twice a year. You can buy them on TreasuryDirect.gov or with your IRS Federal tax refund as a paper bond.

An I Bond interest rate comes from both a fixed base interest rate and the inflation rate. These bonds earn interest for 30 years, then they stop earning any more money.

When do they mature?

I Bonds keep earning interest for 30 years. After this time, they stop getting more value from interest. Your Digital I Bonds will send the money to your bank account at once when its bond matures.

If you have paper I Bonds, you need to give them in by hand to get your cash after 30 years.

How is the value calculated?

The value of I Bonds goes up every six months. This happens when the earned interest gets added to the account value. fixed interest rates plus an inflation-based variable rate make up this whole interest amount.

An exact formula is used to work out this overall interest rate. Two parts are in it: a fixed base interest rate and another adjusted for inflation, known as the Inflation rate.

The U.S. Treasury division sets the fixed base interest rate, while changes in the Urban Consumer Price Index (CPI-U) decide the inflation-adjusted portion.

No matter what happens with I bond rate or inflation, I Bonds will never be worth less than what you first pay for them!

Benefits of Investing in I Bonds

I Bonds are a good investment option for low-risk investors and retirees due to their current interest rate and tax benefits on earnings.

Which investors are I Bonds good for

I Bonds are a great investment option for low-risk investors who want to protect their money from the effects of inflation. They are particularly suitable for individuals who want their savings to grow while keeping up with the rising cost of living.

I Bonds can also be beneficial for those who are looking to earn more than what traditional savings accounts, CDs, or EE bonds offer.

Additionally, I Bonds provide income tax benefits, as the interest earned is exempt from state and local income taxes.

Overall, I Bonds are a smart choice for conservative investors who value stability and want to preserve their purchasing power over time.

Current interest rate

The current interest rate on I Bonds is made up of two components: a fixed base interest rate and an inflation rate. I bond’s fixed rate remains the same throughout the life of the bond, while the inflation rate is adjusted every six months.

These rates are combined to determine the composite rate, which determines how much interest your I Bond will earn. It’s important to know that this composite rate can change every six months, so it’s a good idea to check for updates regularly.

Currently, there is no data available for the specific current interest rate on I Bond.

Tax implications for earnings

Bonds earns Interest is subject to the federal income tax return, but there’s good news! It is exempt from state and local income tax. If you use the earnings for qualified higher education expenses, they may even be exempt from federal income tax returns too.

When it comes time to cash out your I Bond, you will receive Form 1099-INT as a tax form. If you want to report your interest annually, you can use the total from TreasuryDirect if you have the electronic I bonds or calculate the interest yourself for a paper bond.

Just keep in mind that if you cash out your I Bond within the first five years of owning them, you will lose the last three months of interest.

Risks of Investing in I Bonds

There are risks associated with investing in series I Bonds, such as purchase limitations and the potential for loss. There is no guaranteed return with I bonds. Find out more about these risks and why it’s important to consider them before investing.

Is there a cap on purchases?

There is a limit on how much you can purchase on I Bond each year. If you choose to buy digital bonds, the maximum amount is $10,000. For a paper bond, the limit is $5,000.

Remember that these limits are per person and per Social Security Number or Employer Identification Number (EIN).

You cannot exceed these caps when you choose to buy an I Bond or other securities.

Can investors lose money on I Bonds?

Investors can potentially lose money on I Bonds if they decide to cash them out before five years. There is a penalty of three months of interest for early withdrawals.

However, it’s important to note that even if the value of the I Bond decreases due to deflation, the bonds will never be worth less than their initial investment.

So while there is a risk of losing some interest earnings, investors are still guaranteed to get back at least what they put in.

- Inflation Protection

- Low Risk

- Tax Efficiency

- Flexible Purchase

- Long-Term Growth

- Diversification

- Inflation Erosion

- Lower Returns

- Limited Tax Benefits

- Reduced Diversification

- Missed Fixed Income

- Lost Stability

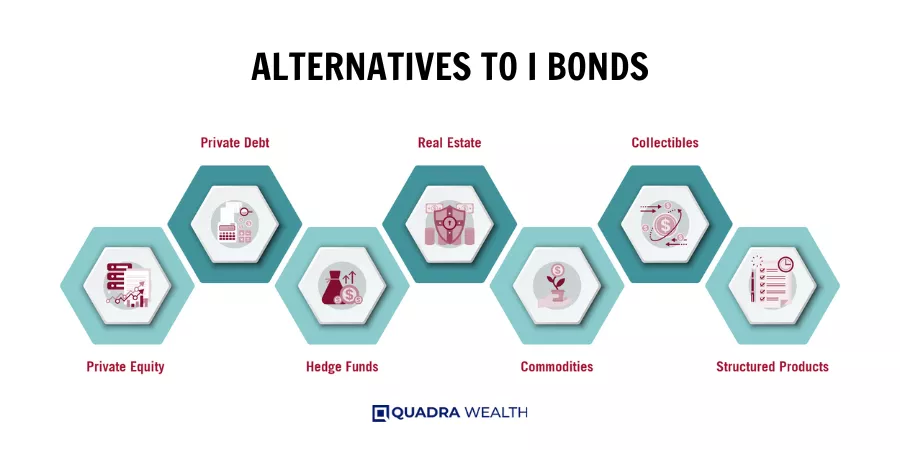

Alternatives to I Bonds

- Certificates of deposit (CDs) are a safe and low-risk alternative to the savings bond.

- Bond ETFs are another option that provides diversification and the potential for higher returns.

- Fixed annuities can also be considered as an alternative, offering guaranteed income over a specific period.

- High-yield savings accounts are a convenient choice if you want easy access to your funds while earning competitive interest rates.

- Series EE Bonds are similar to I Bonds, but they have a different interest rate structure and may be worth considering as an alternative investment option.

Remember, each alternative has its own advantages and disadvantages, so it’s important to assess your personal finances and resources before making a decision.

How to Invest in I Bonds

To invest in I Bond, you can purchase them online through TreasuryDirect.gov or buy them through your employer if they offer payroll savings plans.

Where to buy

I Bonds can be conveniently purchased online through TreasuryDirect.gov, making it easy to start your investment journey. You can also buy paper I Bond using your IRS Federal tax refund.

For digital bonds, there is a maximum annual purchase limit of $10,000, while for a paper bond the limit is $5,000.

If you choose to go digital, you can track the value of your I Bonds by creating an account on TreasuryDirect.gov or using their “Savings Bond Calculator” tool if you have a paper bond.

Purchasing I Bonds has never been easier with these accessible options provided by the U.S. Treasury Department.

How to cash them

To cash your I Bonds, you have a few options. Here’s what you can do:

- Digital I Bonds: If you purchased your I Bonds digitally through TreasuryDirect.gov, they will automatically cash out into your linked bank account after 30 years.

- Paper I Bonds: If you have paper I Bonds, you need to physically submit them to be cashed out. You can do this at most financial institutions or by mailing them to the U.S. Department of the Treasury.

- Cashing Before Five Years: If you want to cash out your I Bonds before they reach five years, there is a penalty of three months of interest.

Frequently Asked Questions

Should I choose EE or I Savings Bonds? Can I purchase I Bonds for my children?

Should I buy EE or I Savings Bonds?

If you’re considering whether to buy EE or Series I Savings Bonds, it’s important to understand the key differences between the two.

EE Bonds offer fixed interest rates that don’t change over time, while I Bonds have an interest rate that is based on inflation.

So, if you’re looking for a safe and predictable investment option, EE Bonds or Series I Savings Bonds might be better for you. However, if you want your money to keep up with inflation and potentially earn higher returns, I Bond could be a good choice.

It ultimately depends on your financial goals and risk tolerance.

Can I buy I Bonds for my kids?

Yes, you can buy I Bonds for your kids. It’s a great way to start saving for their future. You can purchase I Bonds in their name as the primary owner, and they can also be co-owned with you or someone else.

I bonds are taxed Like other investments, the interest you earn from I bonds is subject to taxes. These taxes include federal income tax (but not state or local income tax) and any federal estate, gift, and excise taxes plus any state estate or inheritance taxes.

The minimum purchase amount is $25, and the maximum amount per year is $10,000 for digital bonds and $5,000 for paper bonds.

Just keep in mind that there are some eligibility requirements, such as having a Social Security Number or an Employer Identification Number (EIN) for your child.

Conclusion

In conclusion, investing in I Bonds can provide several benefits, such as protection against inflation and higher returns compared to traditional savings accounts. However, it’s important to be aware of the risks involved, including potential penalties for early withdrawal and the possibility of losing money if interest rates drop.

Before investing in I Bonds, it’s advisable to consult with a financial advisor who can provide personalized guidance based on your individual investment goals and risk tolerance.

FAQs

Investing in I Bonds can provide a safe and low-risk way to save money, as they are backed by the government and offer protection against inflation.

While I Bonds have low risk, their interest rates are variable and may not keep up with inflation over time. Additionally, if you redeem the bonds before 5 years, you may lose some interest.

You can invest in I Bonds through the TreasuryDirect website or by setting up an account with a financial institution that offers them.

Yes, anyone who is a U.S. citizen or resident alien, including minors, can invest in I Bonds as long as they have a Social Security number and meet certain criteria outlined by the Department of Treasury.