For HNWIs in the UAE, grasping the difference between private banking and wealth management is essential for financial administration.

In this blog post, we will delve into these two distinct yet often confused financial services, shedding light on their key differences and how they cater to unique financial needs.

Private banking offers exclusive personalized service tailored specifically for HNWIs, while wealth management takes a more holistic approach toward long-term financial security.

We’ll look at both of these services more closely, weighing up their features and contrasting them.

Before selecting between private banking services and wealth management, it is crucial to consider one’s financial objectives and priorities.

Because both are overlapping concepts associated with the financial institution.

This post will provide guidance on choosing between private banking and wealth management as well as leveraging the expertise of both types of professionals when necessary.

Trusted advisors or wealth managers plays pivotal role in ensuring financial success; hence we’ll also discuss the importance of regularly reviewing strategies with financial advisors and adapting to changing circumstances for long-term success.

Stay tuned as we unravel what sets apart private banking from wealth management in this comprehensive guide.

Private Banking Services

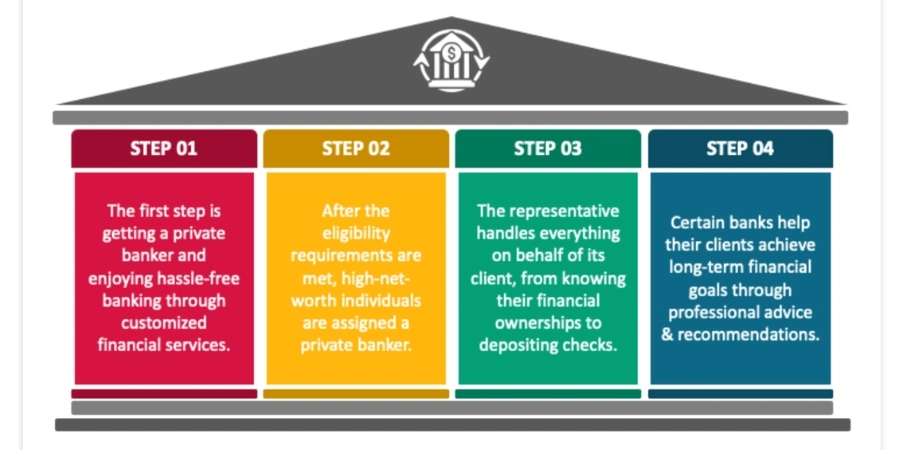

Private banking is like a VIP club for the wealthy. HNWIs can access exclusive financial services tailored to their specific requirements, such as customized investment plans, superior interest rates on deposits and loans, plus top-notch customer service from knowledgeable bankers familiar with the intricacies of managing large amounts of wealth.

This includes tailored investment strategies, preferential interest rates on deposits and loans, and priority customer support from experienced bankers who understand the complexities of managing significant wealth.

Exclusive Financial Services Tailored for High Net Worth Individuals

Private banking clients get personalized service from dedicated relationship managers who work closely with each client to develop customized solutions that align with individual goals and preferences.

They also get bespoke lending options for complex transactions like structured finance deals or large-scale real estate investments.

And let’s not forget about the premium credit cards with enhanced rewards programs or travel benefits exclusively reserved for HNWI clientele.

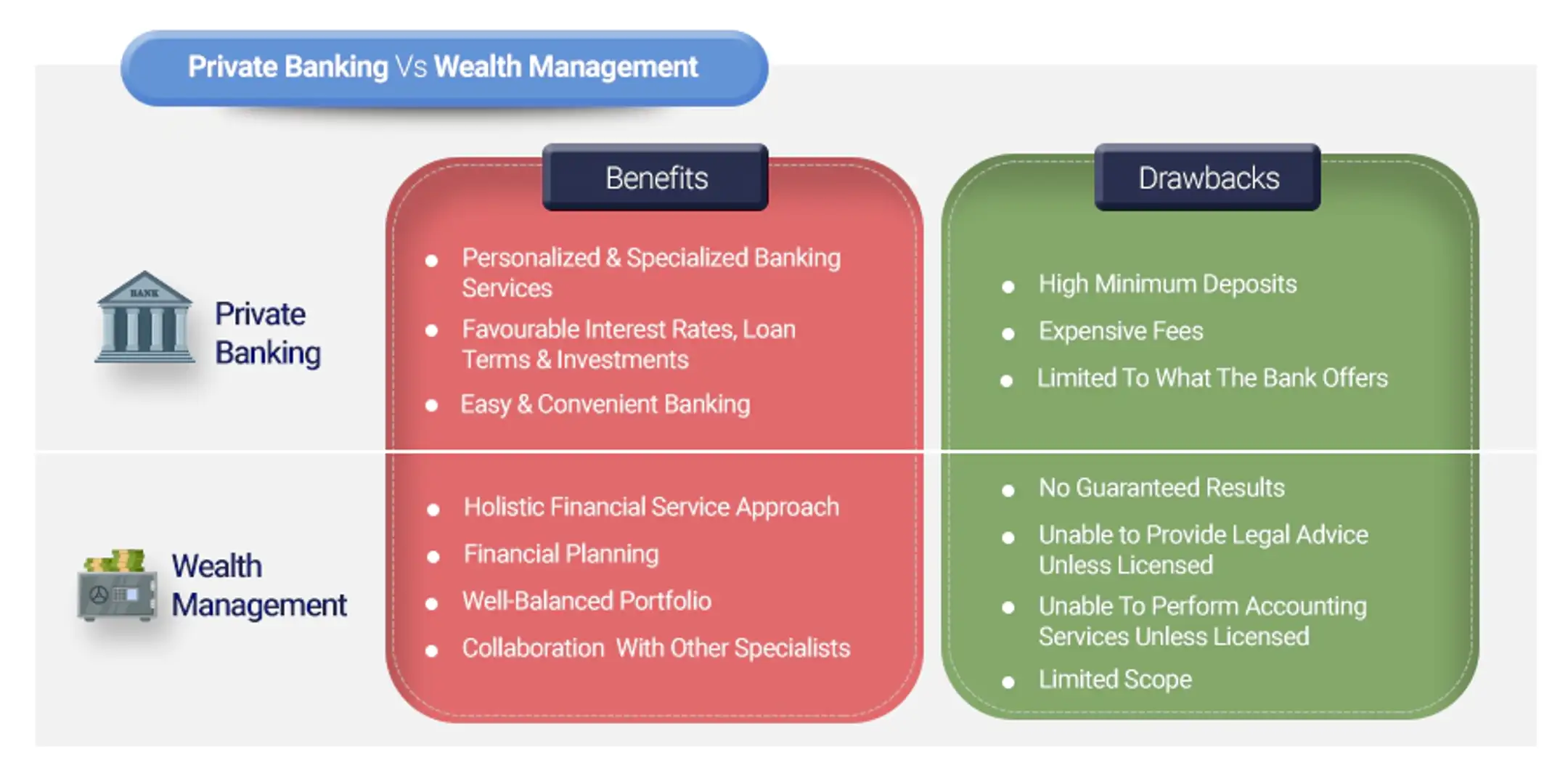

pros

- Tailored solutions

- Specialized expertise

- Exclusive Opportunities

cons

- Limited accessibility

- Potential high costs

- Dependence on one provider

Preferential Treatment Regarding Loan Terms and Interest Rates

A key advantage private banking clients receive when it comes to loan terms and interest rates.

The Private bank recognize that HNWIs often have a lower risk profile than other borrowers, which allows them to offer more favorable lending conditions.

This can include lower interest rates, higher borrowing limits, or even tailored repayment schedules designed specifically for each client’s unique financial situation.

Private banking services also provide specialized investment advice aimed at growing assets while protecting investments through various strategies like portfolio diversification across stocks, bonds, mutual funds, and ETFs.

They also offer tax planning, Medicare and estate planning, risk insurance, and long-term goal optimization such as overall net worth maximization.

Key takeaways

Private banking offers exclusive financial services tailored for high-net-worth individuals, including personalized attention and preferential treatment on loan terms and interest rates.

pros

- Favorable loan terms

- Increased borrowing capacity

- Enhancing financial flexibility

cons

- Limited eligibility

- Potential for dependency

Wealth Management Services

The difference between wealth management services is like a personal financial concierge for the rich and famous.

It’s a fancy way of saying that someone is there to help you manage your money, so you don’t have to.

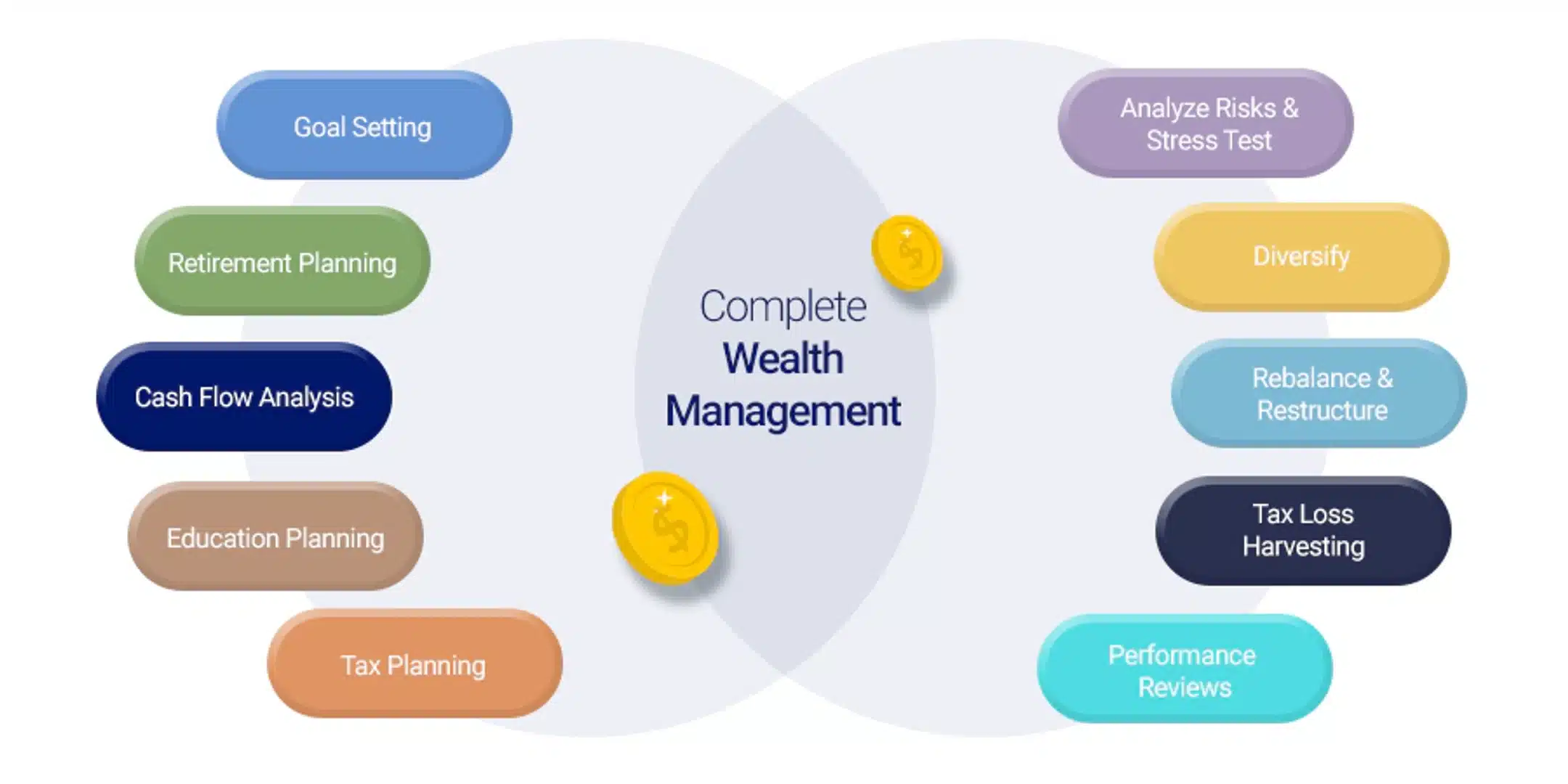

Holistic Approach to Long-Term Financial Security

Think of wealth management as a one-stop shop for all your financial needs.

A tailored strategy will be crafted with your wealth manager, comprising investment counsel, tax strategies, legacy preparation, hazard insurance, and long-term goal optimization.

It’s like having a personal financial coach who’s always looking out for your best interests.

pros

- Comprehensive planning

- Better risk management

- Enhanced well-being

cons

- Fragmented planning

- Increased risk exposure

- Suboptimal decisions

Independent Advisors or Larger Institutions Offering Personalized Solutions

When it comes to choosing a wealth manager, you have two options: independent advisors or larger institutions.

Independent financial advisor offers a more personal touch, while larger institutions have more resources. It’s your call to make which one suits you best.

pros

- Customized approach

- Objective advice

- Access to a wide range of options

cons

- Limited customization

- Potential conflicts of interest

- Restricted product selection

Comparing Wealth Management with Private Banking

Private banking is like having a personal banker who caters to your every financial need.

Wealth management, on the other hand, takes a more comprehensive approach by addressing all aspects of your financial life.

For a more holistic approach to your finances, wealth management is the ideal solution.

For more information on wealth management, check out this Investopedia article.

Key takeaways

Take control of your finances with personalized solutions from wealth management. Say goodbye to financial stress and hello to long-term security.

Comparing the Scope of Services

The primary difference between private banking and private wealth management lies in the scope of services provided.

While both types of professionals aim at addressing the complex needs of high-net-worth individuals (HNWIs) by improving their experience with exclusive features available to them, the private banker focuses on enhancing daily transactions whereas wealth managers concentrate on holistic approaches towards optimizing finances over time.

Daily Transaction Enhancements vs Long-term Finance Optimization

- Private Banking: Private banks offer personalized private banking services such as checking accounts, savings accounts, investment accounts, retirement accounts, loans, and mortgages.And private banking focuses on a client’s investable assets.

They also provide dedicated service teams for their elite customers to ensure a seamless private banking experience.

This includes preferential treatment regarding loan terms and interest rates that cater specifically to HNWIs’ unique financial requirements.

- Wealth Management: The advisors take a more comprehensive approach by offering tailored solutions for each client’s specific circumstances.These include investment advice aimed at growing assets while protecting investments through various strategies like portfolio diversification across stocks, bonds, and mutual funds; tax planning;

Medicare and estate planning; risk insurance; long-term goals optimization such as overall net worth maximization.

Overlapping Areas Depending on Individual Preferences

In some cases, there might be an overlap between private banking services and assets management services depending on individual preferences or financial institutions’ offerings. For instance,

- A bank’s financial advisor may also act as a dedicated banker providing traditional banking services alongside specialized guidance in areas like investment management, retirement planning, and estate planning.

- Some wealth managers offer private banking services as part of their overall financial planning for affluent clients. This can include providing checking accounts or assisting with loan applications to ensure seamless integration of all aspects of the client’s financial life.

It is crucial to note that not all private banks or wealth management firms offer the same services and capabilities.

Some institutions may have more extensive offerings in one area over another, while others might provide a balanced mix between both types of services.

To make an informed decision about which service best suits your needs, it’s crucial to research various options available from different financial institutions, such as Goldman Sachs or other reputable companies operating within the UAE region.

Key takeaways

Private banking and wealth management both cater to the needs of high-net-worth individuals but differ in their scope of services.

Private banking focus on enhancing daily transactions while wealth managers concentrate on holistic approaches towards optimizing finances over time through tailored solutions such as investment advice, tax planning, Medicare and estate planning, risk insurance, and overall net worth maximization. There may be an overlap between these two areas depending on high net worth individual preferences or financial institutions’ offerings.

Choosing Between Private Banking & Wealth Management

Deciding between private banks and private wealth management firm depends on your financial goals and priorities.

If you want to improve daily transactions with a better financing term, private banking may be the way to go.

A wealth manager may be the answer if you need a thorough strategy for sustained safety, encompassing investments, retirement planning, and tax organizing.

Assessing Your Financial Goals and Priorities

To make the right choice, start by assessing your financial goals and priorities. Consider factors like:

- Your net worth

- Short-term vs long-term objectives

- Your risk tolerance

- Tax services implications of investments

- Estate planning needs

Creating a personal financial statement is a great way to evaluate these factors.

Leveraging the Expertise of Private Bankers and Wealth Managers

In some cases, it may be beneficial to use both private bankers and wealth managers. For example:

- A client with substantial assets may need personalized attention from a private banker for day-to-day transactions while also requiring comprehensive advice on managing their overall portfolio through a wealth manager.

- Private banking clients looking to diversify their portfolios by investing in alternative asset classes like real estate or hedge funds could seek guidance from specialized financial advisors within each field.

- Expatriates in UAE, particularly at a CXO level, can benefit from working with both private banking and wealth management experts to maximize financial growth while minimizing risks associated with international investments.

When choosing between these services, consider factors like fees, provider reputation, and access to exclusive investment options. For example:

- Fee-only advisors charge a flat fee for their services instead of earning commissions on products they sell.

- Larger institutions may offer more resources and access to global markets but could lack personalized attention compared to smaller firms.

- Institutions like Quadra Wealth specialize in helping expatriates and residents in the Middle East become financially independent by providing consistent growth through structured notes.

Deciding between private banking and wealth management to accomplish your fiscal ambitions requires a thorough analysis of your requirements and inclinations.

Key takeaways

Choosing between private banking and assets management depends on your financial goals and priorities. Assessing factors like net worth, short-term vs long-term objectives, risk tolerance, tax implications of investments, and estate planning needs can help you make the right choice. In some cases, it may be beneficial to use both private bankers and wealth managers for personalized attention and comprehensive advice on managing portfolios while minimizing risks associated with international investments.

The Importance of a Trusted Advisor

Having a reliable advisor is essential for HNWIs to maximize their financial health and ensure lasting prosperity.

Regardless of whether they choose private banking or assets management services, having an expert by their side can make all the difference in making informed decisions that cater to their unique needs and circumstances.

Regularly reviewing strategies with Wealth Manager

A key aspect of maintaining successful financial planning is regularly reviewing and updating strategies based on changes in personal circumstances, market conditions, and economic trends.

This process involves evaluating one’s financial goals, assessing current investments, identifying new opportunities, and adjusting risk tolerance levels as needed.

A trusted advisor can provide valuable insights during these reviews while also ensuring that clients stay on track toward achieving their objectives.

Analyze performance: Advisors help clients assess the performance of existing investments against benchmarks such as indices or industry standards.

Identify gaps: They identify areas where adjustments may be necessary to align portfolios more closely with desired outcomes.

Navigate changing markets: As market conditions evolve over time, advisors guide HNWIs through potential challenges while seizing opportunities for growth when appropriate.

pros

- Adaptability and responsiveness

- Accountability and monitoring

- Access to expert insights

cons

- Missed opportunities

- Lack of course correction

- Limited perspective and expertise

Adapting to changing circumstances for long-term success

In addition to monitoring market developments, it’s crucial for high-net-worth individuals to adapt their financial plans according to shifts in personal situations like career transitions or family dynamics. For instance:

- If an individual receives a significant inheritance or sells off assets at considerable profit margins, they may need assistance reallocating funds into diversified investment vehicles that minimize risks while maximizing returns.

- When doing financial planning for retirement, a trusted advisor can help clients explore various income streams and ensure they have adequate savings to maintain their desired lifestyle without depleting resources too quickly.

- In this event of major life changes such as marriage or divorce, an expert can provide guidance on updating estate plans and adjusting financial strategies accordingly.

A reliable advisor will also keep HNWIs informed about relevant tax laws and regulations that may impact their finances.

By staying abreast of these developments, high-net-worth individuals can avoid potential pitfalls while capitalizing on opportunities to minimize liabilities and enhance overall wealth preservation efforts.

The wealth management advisors will also be able to provide advice on how to take advantage of available tax breaks and make the most tax-efficient decisions.

They can also provide advice on the best way to structure investments and assets to minimize taxes.

Partnering with a trusted advisor is paramount for high-net individuals seeking to secure lasting financial independence.

These experts offer invaluable expertise that helps navigate complex financial landscapes with confidence.

Ultimately, by leveraging this reinforcement system throughout their journey toward achieving long-term success, residents in the Middle East are better equipped to secure lasting financial independence for themselves and future generations alike.

pros

- Resilience and flexibility

- Seizing new opportunities

- Alignment with evolving goals

cons

- Increased risk exposure

- Missed opportunities for optimization

- Potential for stagnation or obsolescence

Key takeaways

Working closely with a trusted advisor is crucial for HNWIs seeking financial success. Advisors can help clients regularly review and adjust their strategies, analyze performance, identify gaps, navigate changing markets, and adapt to personal circumstances for long-term wealth preservation efforts. By partnering with a reliable expert, residents in the Middle East can secure lasting financial independence and confidently navigate complex financial landscapes.

Conclusion

Private banking vs. wealth management: What’s the difference?

Private banking is a tailored financial service for high-net-worth individuals, while wealth management takes a holistic approach to long-term financial security.

But both offer personalized solutions, but private banking is typically offered by the larger financial institution, while wealth management can be offered by independent advisors.

Choosing between the two depends on assessing personal financial goals and priorities, and it’s important to regularly review strategies with trusted advisors to adapt to changing circumstances for long-term success.

Frequently Asked Questions

Private Banking vs. Wealth Management: What’s the Difference?

Private banking offers exclusive financial services for high-net-worth individuals, while wealth management professionals provide customized banking solutions for long-term financial security.

Private banking services include preferential loan terms and interest rates, while wealth management advisors cover areas like investment management, retirement planning, and estate planning.

Investopedia offers more information on private banking and wealth management.

Private Banker vs. Financial Advisor: What’s the Difference?

A private banker focuses on personalized private banking services for HNWIs, while a wealth manager is a type of financial advisor who helps clients create comprehensive strategies for long-term finance optimization.

Private bankers enhance daily transactions, such as loan terms, while a financial advisor covers investment management, retirement planning, and estate planning.

The Balance Careers provides more information on financial advisors and private bankers.

Investment Banking vs. Private Banking: What’s the Difference?

Investment banking raises capital for companies, while private banking caters to wealthy net-worth individuals’ unique needs with specialized products beyond the traditional banking services offerings.

Investment banking involves underwriting securities issuance or facilitating mergers & acquisitions, while private banking offers exclusive financial services for HNWIs.

Discover more about these differences here.

Financial Management vs. Wealth Management: What’s the Difference?

Financial management plans organizes, and controls financial resources for high-net-worth individuals or organizations, while wealth management specifically caters to HNWIs by offering personalized solutions for long-term wealth growth and preservation.

Wealth management is a subset of financial management that covers areas like investment management, retirement planning, and estate planning.

Find out more about these distinctions here.