Priority Banking in UAE have become an increasingly sought-after service for high-net-worth individuals and top-level executives, particularly in the UAE.

As a priority banking customer, you can expect a higher level of personalized service and exclusive perks that cater to your unique financial needs.

In this blog post, we’ll explore the various benefits of banking and how it can provide tailored finance guidance, dedicated relationship managers, preferential rates on loans and credit cards, as well as wealth managing services from leading universal institutions.

We’ll discuss expert financial guidance tailored to individual needs, dedicated relationship managers providing personalized service, and preferential rates on loans and credit cards.

Moreover, we’ll look into major financial organizations that supply asset-managing solutions such as JPMorgan Chase & Co., UBS Wealth Management, and Credit Suisse Private Banking.

In addition to exploring these aspects of priority banking service, we will also guide you through choosing the right priority bank by evaluating personal finance planning goals and considering both digital capabilities as well as traditional customer service aspects.

Stay tuned to learn more about how Priority Bank can elevate your financial experience.

Priority Banking In UAE Services and Benefits

Priority banking terms are designed for high-net-worth individuals, offering exclusive benefits such as expert financial guidance, dedicated relationship managers, priority access to banking solutions, lifestyle perks, preferential rates for loans and credit cards, priority queuing at banks, and access to investment products unavailable to the average retail investor.

In this section, we will discuss these benefits in detail.

Expert Financial Advice Tailored to Individual Needs

To achieve consistent growth on your investment portfolio through structured notes like Quadra Wealth, personalized finance guidance based on your unique goals and risk tolerance is crucial.

Banking customers benefit from the expertise of seasoned advisors who can assist them in making well-thought-out investment decisions.

Pros of having Expert Financial Advice Tailored to Individual Needs:

- Customized guidance

- Expertise and knowledge

- Holistic approach

- Market Insights

Cons of not having Expert Financial Advice Tailored to Individual Needs:

- Limited knowledge and expertise

- Increased risk

- Lack of personalized strategies

- Time-consuming and complex

Dedicated Relationship Managers Providing Personalized Service

A key advantage of priority banking is having a dedicated relationship manager who understands your specific needs and preferences.

This ensures that you receive prompt attention whenever you require solutions to any aspect of your finances or need information about new opportunities available exclusively for priority customers.

Preferential Rates on Loans and Credit Cards

- Mortgage Rates: As a priority customer, you may be eligible for lower interest rates when applying for home loans or refinancing existing mortgages.

- Credit Card Offers: You could also enjoy better rewards programs or reduced annual fee terms on premium credit cards offered by leading global institutions like JPMorgan Chase & Co., Credit Suisse Private Banking, or UBS Wealth Management.

- Personal Loan Rates: Banking clients may also receive preferential rates on personal loans, making it more affordable to borrow cash for various purposes.

It’s important to evaluate your personal finance goals and understand the benefits of Banking to determine whether the costs associated with these services are worth it.

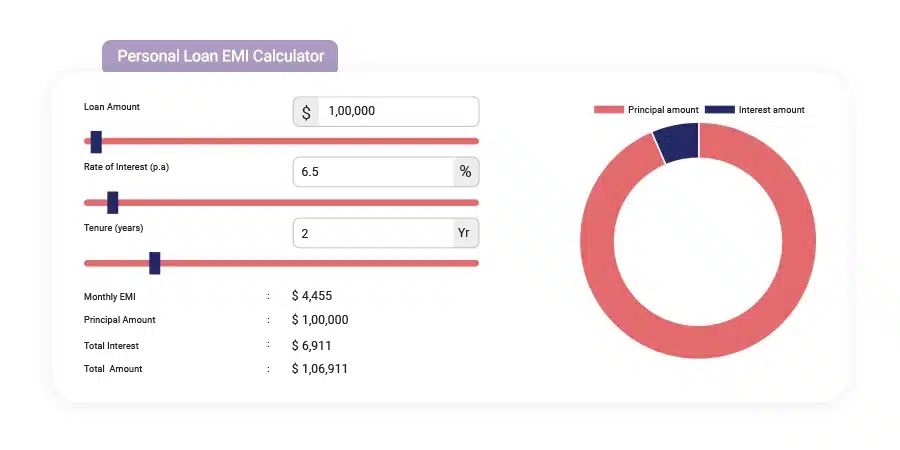

Use personal debt EMI calculators to examine the whole EMI amount payable to lenders and consider if you wish to pay extra fees for these higher-level service provisions.

Lifestyle Perks and Priority Queuing at Banks

Priority banking clients can also enjoy lifestyle perks such as exclusive access to airport lounges, hotel discounts, and other luxury experiences.

For these customers, long wait periods for service are a thing of the back; they can simply go to the front of the queue.

Access to Investment Products Unavailable to the Average Retail Investor

Priority banking clients have access to a full range of investment products that are not available to the average retail investor.

These products may include hedge funds, private equity, and other alternative investments that can help diversify your portfolio and potentially generate higher returns.

Conclusion

Overall, priority banking offers a range of exclusive benefits that can help high-net-worth individuals achieve their financial goals.

By working with experienced advisors, enjoying personalized service, and accessing preferential rates and investment products, their clients can potentially grow their cash over the year and enjoy a more luxurious lifestyle.

Key takeaways

Priority banking offers exclusive benefits to high-net-worth individuals, including expert financial guidance tailored to individual needs, dedicated relationship managers providing personalized service, preferential rates on loans and credit cards, lifestyle perks such as access to airport lounges and hotel discounts, priority queuing at banks, and access to investment products unavailable to the average retail investor. These solutions can potentially help clients achieve their personal finance goals and enjoy a more luxurious lifestyle.

Leading Global Institutions Offering Wealth Management Services

For successful asset management, it is essential to partner with a reliable financial institution.

Here are some of the leading universal institutions that offer asset management services, ensuring you receive expert guidance and access to exclusive investment opportunities:

JPMorgan Chase & Co.: A top-tier global bank with a strong presence in asset management

JPMorgan Chase & Co. is one of the largest banks in the world, offering comprehensive asset-managing solutions for high-net-worth individuals.

Their experienced team provides personalized strategies tailored to your unique and personal finance goals, while also granting access to an extensive range of investment products and solutions.

UBS Wealth Management: Swiss-based institution renowned for its expertise in managing assets

UBS Asset Management, based in Switzerland, has long been regarded as one of the premier providers of asset-managing services globally.

They offer customized guidance and dedicated support across various aspects such as investing, portfolio construction, risk managing, tax planning, and more – all aimed at helping clients achieve their desired level of financial independence.

Credit Suisse Private Banking: Another Swiss giant known for its private banking solutions

Credit Suisse Private Banking offers bespoke asset-managing solutions designed specifically for affluent individuals seeking professional guidance on growing their assets.

With dedicated relationship managers providing personalized service along with access to exclusive investing opportunities unavailable elsewhere – this Swiss powerhouse caters perfectly to those looking for exceptional assets managing support.

For those considering offshore options, BNP Paribas Bank in France and DBS Private Wealth in Singapore are also highly regarded institutions offering comprehensive assets managing solutions for high-net-worth individuals.

Making the right choice of financial organization is critical to accomplishing your long-term fiscal aspirations.

Partnering with a world-renowned bank can guarantee your assets are managed proficiently, so you can relish the rewards of all your hard work.

Key takeaways

Partnering with a reputable financial institution is crucial for managing your assets. Leading universal institutions such as JPMorgan Chase & Co., UBS Asset Managing, and Credit Suisse Private Banking offer bespoke asset-managing solutions designed specifically for high-net-worth individuals seeking professional guidance on growing their assets. By selecting the right financial institution, you can ensure that your assets are managed effectively and efficiently, allowing you to focus on enjoying the benefit of your hard-earned success.

Choosing the Right Priority Banks

When selecting a priority bank, it’s important to look for one that offers both digital and traditional personal banking solutions while evaluating your personal finance goals before committing.

A diverse network of offshore priority banks gives any high-net-worth individual access to different markets and investing opportunities unavailable elsewhere.

Evaluating personal financial goals before choosing a bank

Before selecting a priority bank, take the space to consider your long-term financial goals such as retirement planning, asset preservation, tax optimization strategies, and philanthropic endeavors.

Consider factors such as retirement planning, asset preservation, tax optimization strategies, and philanthropic endeavors.

By understanding what you want to achieve financially in the future, you can better align yourself with a priority banking institution that has expertise in these areas.

Pros of evaluating personal financial goals before choosing a bank:

- Alignment with objectives

- Tailored solutions

- Cost-effectiveness

- Long-term relationship

Cons of not evaluating personal financial goals before choosing a bank:

- Mismatched services

- Limited customization

- Higher costs

- Missed benefits

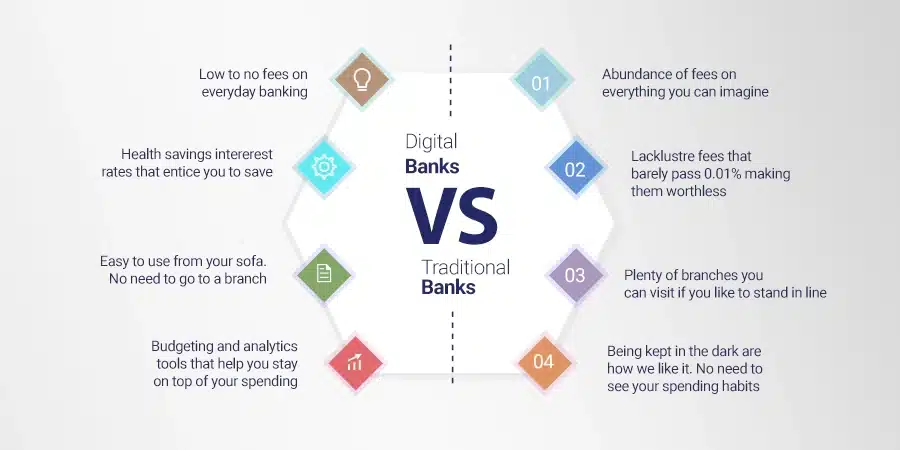

Considering both digital capabilities and traditional customer service aspects

In today’s tech-driven world, banks must provide both modern digital platforms and personal customer service to remain competitive.

When comparing various institutions’ offerings, make sure to take note of their online tools like mobile apps or web-based portals. This will help ensure seamless transactions regardless of location or time zone constraints.

- Digital Banking: Look for features such as user-friendly interfaces on mobile apps/web-based platforms allowing easy access anytime anywhere; real-time accounts monitoring options; secure fund transfers within minutes; paperless statements/transaction tracking systems, etcetera – all aimed at making life easier.

- Lifestyle Benefits: Many priority banks also provide exclusive lifestyle benefits tailored specifically towards affluent clients – think airport lounge access worldwide through partnerships with leading airlines/hotel chains.

- Expert Advice: A dedicated relationship manager who understands your financial goals and can provide personalized guidance on investment and insurance solutions, tax planning strategies, etcetera.

Conclusion

In conclusion, when choosing a priority bank that best suits your needs as an expatriate or resident in the UAE at the CXO level, it’s essential to evaluate both digital capabilities and traditional customer service aspects.

By doing so, you’ll be able to find the priority banking partner that not only offers convenience but also aligns with your long-term financial objectives. So, choose wisely.

Key takeaways

When choosing a priority bank, evaluate both digital capabilities and traditional customer service aspects. Assess your long-term financial objectives before committing to a bank that offers exclusive lifestyle benefits tailored towards affluent clients and expert guidance from dedicated relationship managers who understand your goals. Choose wisely.

The Emergence of Priority Banking in India

Priority banking is a new concept in India, but it’s gaining popularity among high-net-worth individuals.

This service offers specialized competitive rates and services based on the bank account balance maintenance or years spent maintaining relationships with specific banks.

While it provides exclusive benefits, it’s essential to evaluate whether it aligns with your financial goals and is worth any associated costs.

Specialized Rates and Services Based on Account Balance Maintenance

Indian banks offer priority banking services based on the amount maintained in an individual’s current account or the duration of their relationship with a particular bank.

For instance, ICICI Bank offers its assets Managing services to customers who maintain a minimum average balance of INR 10 lakhs (approximately $13,000) or have completed five years as an ICICI customer.

This approach allows banks to offer exclusive benefits such as preferential interest rates on loans and deposits, personalized financial guidance from dedicated relationship managers, and access to premium investing products that may not be available to regular customers.

Evaluating the Value of Banking in India

To determine if priority banking is worth pursuing in India, consider several factors:

- Financial Goals: Assess your short-term and long-term financial objectives before opting for any additional services. Ensure that the perks offered align well with your goals.

- Fees vs Benefits: Compare rates associated with priority banking against potential gains like lower debt interest rates or better returns on financing. Use tools like personal debt EMI calculators to help you make informed decisions.

- Quality of Service: Evaluate the quality of service provided by the bank, including responsiveness and expertise of relationship managers. Research customer reviews to gauge satisfaction levels.

In conclusion, while banking in India offers numerous benefits for high-net-worth individuals, it’s crucial to evaluate whether these services align with your financial goals and are worth any associated costs.

By considering factors such as fees versus benefits and quality of service, you can make an informed decision about joining a higher-tiered system within Indian banks.

Key takeaways

Priority banking is a new concept in India that offers specialized rates and services based on account balance maintenance or years spent maintaining relationships with specific banks. To determine if it is worth pursuing, consider factors such as financial goals, fee versus benefits, and quality of service provided by the bank.

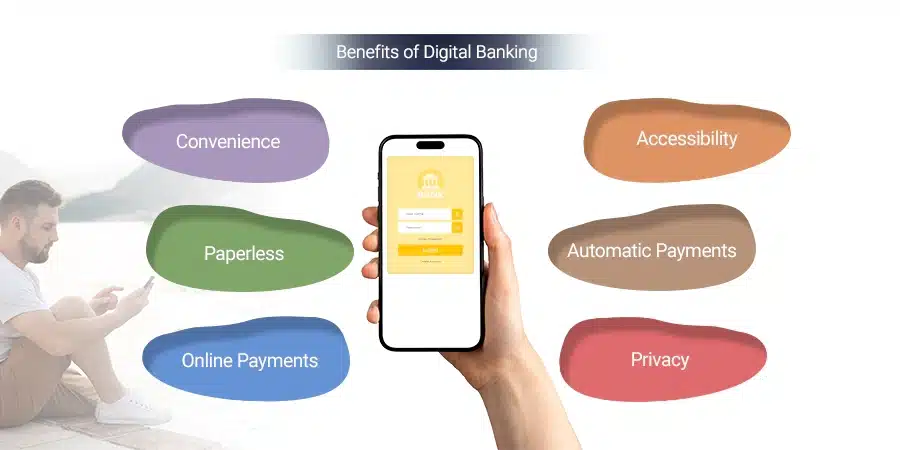

Digitalization and its Impact on Banking Services

Technology is changing the way we bank, and priority banking services are no exception. With digital platforms becoming more prevalent, customers can now manage their finances from anywhere in the world.

Less Reliance on Traditional Banking Tools

The rise of mobile and web-based platforms means fewer visits to bank branches and less need for traditional banking tools like cheque book and demand drafts.

These transfers may make some high-net-worth individuals question the value of paying fees for priority banking services.

Pros of less reliance on traditional banking tools:

- Convenience and accessibility

- Duration and cost savings

- Enhanced security measures

- Access to innovative features and tools

Cons of less reliance on traditional banking tools:

- Technological barriers

- Potential security risks

- Limited human interaction

- Potential service limitations

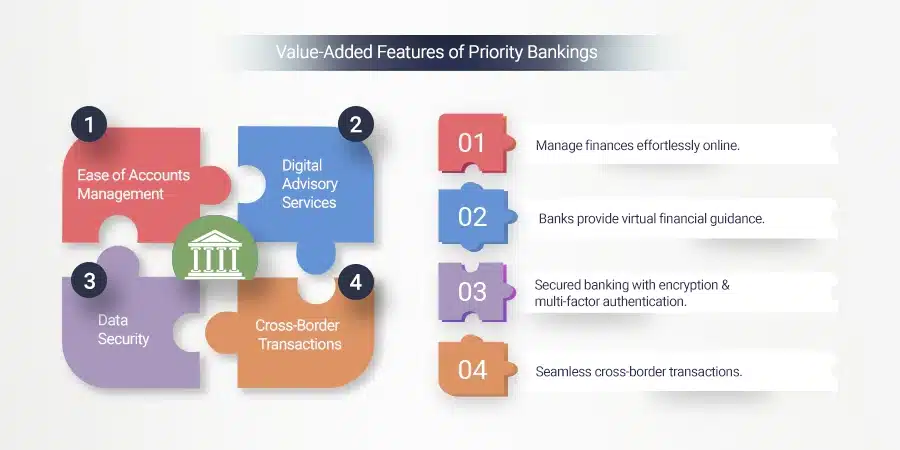

Assessing the Value-Added Features of Priority Bankings

Before opting for banking, it’s crucial to evaluate the added benefits offered by these institutions. Consider factors such as:

- Ease of Accounts Management: A user-friendly online banking platform can make managing your finances more convenient than ever before with a few clicks.

- Digital Advisory Services: Many banks offer personalized financial guidance through virtual channels like video calls or chatbots.

- Data Security: With sensitive information being shared digitally, it’s crucial that your chosen bank prioritizes data protection measures like encryption technologies and multi-factor authentication processes.

- Cross-Border Transactions: As an expatriate in the UAE, you may need to transfer funds between different countries. A priority bank with robust digital capabilities can facilitate seamless cross-border transactions.

Ultimately, the decision to pay extra money for priority banking services depends on your individual needs and preferences.

By carefully evaluating the added benefits of digitalization offered by various banks, you can make an informed decision about which institution aligns best with your financial goals and lifestyle requirements.

Key takeaways

“Upgrade your banking experience with priority banking. Evaluate added benefits like digital advisory services and cross-border transactions for seamless financial management.

Pros of assessing the value-added features of banking:

- Enhanced customer service

- Exclusive banking privileges

- Comprehensive financial solutions

- Networking and exclusive events

Cons of assessing the value-added features of banking:

- High eligibility requirements

- Higher fees and account maintenance requirements

- Limited availability of physical branches

- Potential for biased advice

Personal Loan EMI Calculators and Priority Banking Fees

When considering priority banking services, it’s crucial to evaluate the costs associated with this higher level of service provision.

One important aspect to consider is the impact of priority banking charges on your personal loan EMIs (Equated Monthly Installments).

To make an informed decision, use a personal loan EMI calculator to determine the total amount payable to lenders.

A personal debt EMI calculator helps you understand how much you need to pay each month toward your loan repayment.

By inputting details such as the principal amount, interest rate, and tenure, you can calculate your monthly installments easily.

This will give you a clear picture of whether or not paying extra money for priority banking services makes financial sense for you.

Evaluate Total Costs

- Compare Costs: Compare the overall costs associated with both regular and priority banking services by factoring in additional fees like annual maintenance rates and preferential rates on loans and credit cards.

Analyze Benefits

- Assess Benefits: Assess if the exclusive benefits offered by priority banks outweigh their additional costs – these may include expert financial advice, dedicated relationship managers, access to investing products unavailable elsewhere, lifestyle perks like travel discounts or airport lounge access, insurance solutions, etc.

Weigh Pros & Cons

- Consider Short & Long-Term: Consider both short-term gains (like lower interest rates) against long-term implications (such as increased debt burden due to higher EMIs).

In addition to using a personal loan EMI calculator for evaluating potential savings from reduced interest rates under priority banking services, it’s also important to review other factors that could influence your decision.

When deciding whether to take advantage of priority banking services, one should also assess the bank’s standing, customer service quality, and digital features.

While priority banking services can provide a range of exclusive benefits for high-net-worth individuals, it’s essential to carefully assess whether these advantages justify the additional costs.

By using a personal loan EMI calculator and considering various factors such as rates, benefits, and overall financial goals – you’ll be better equipped to make an informed decision about whether or not priority banking is right for you.

Key takeaways

When considering priority banking services, it’s important to evaluate the costs associated with this higher level of service provision. Use a personal loan EMI calculator to determine the impact of priority banking fees on your Equated Monthly Installments and compare overall costs between regular and priority banking services. Assess if exclusive benefits offered by priority banks outweigh their additional costs, weigh pros and cons, and consider short- and long-term implications before making an informed decision about whether or not priority banking is right for you.

FAQs in Relation to Priority Banking

Priority banking is a specialized service offered by financial institutions to high-net-worth individuals, providing them with exclusive benefits and personalized attention.

What are the Benefits of Priority Banking?

- Dedicated relationship managers for personalized service.

- Expert financial advice customized to individual goals.

- Preferential interest rates on loans and credit cards.

- The faster processing period for transactions.

- Access to exclusive investing opportunities.

The value of priority banking depends on an individual’s financial situation and requirements.

If you have significant assets or require specialized services like asset managing or international transactions, then priority banking can be worth the additional charges.

However, it may not be necessary for those with simpler financial needs.

How Much Do You Need to Qualify for Priority Banking?

The minimum balance required for priority banking varies between banks but typically ranges from $50,000 – $200,000 in deposits or investments.

Some banks also offer tiered levels of service based on account balances maintained over the period.

It’s essential to review each bank’s specific criteria before deciding if their offering aligns with your needs.