Are you confused by the concept of stagflation and its impact on the economy? Stagflation is a challenging economic cycle characterized by slow growth, high unemployment, and rising prices.

This blog post will provide an easy-to-digest explanation about what stagflation means, its possible causes, and consequences, and how to navigate through it. Ready to get enlightened? Let’s dive in!

Key takeaways

● Stagflation is a hard time in the economy. It means slow growth, lots of people without jobs, and prices going up.

● This started happening often in the 1970s due to an oil crisis. Bad economic rules can make it worse.

● Living through stagflation is tough because jobs are few and things cost more money supply.

● You can prepare for stagflation by saving money, spending less, and paying off debts. Investing wisely might also help protect your money during these times.

Understanding Stagflation

In this section, we delve into the concept of stagflation, providing a clear definition and breaking down its components – slow economic growth, high unemployment rates, and inflation.

Definition of Stagflation

Stagflation is a tough time for an economy. Stagflation is a period of stagnant economic growth accompanied by persistently high inflation and a sharp rise in the unemployment rate. It means slow growth and rising consumer prices all at once. British man Iain Macleod first used the term in 1965. This mix of problems happened a lot after the oil crisis in the 1970s. According to the National Bureau of Economic Research, the economy fluctuates between growing and contracting as part of the typical economic cycle.

Stagflation makes life hard for people because they can’t find work and things cost more money every day.

The Economic Cycle of Slow Growth, High Unemployment, and Inflation

Stagflation is a hard time in our economy. It means growth is slow and items cost more. At the same time, many people do not have work. This started happening in the 1970s during an oil crisis.

Policymakers find it tough to fix stagflation because fixing one problem can make another one worse. The cause of stagflation is still not fully understood by experts who study money matters.

To fix this issue steps such as increasing productivity and tightening monetary policy are needed which are key steps suggested by these experts. But what stagflation does show us, is that old ideas about how economies work might need to change for better insights and solutions.

The Historical Context of Stagflation

Stagflation is not new. It first came up in the 1970s. This was after a big oil crisis. The cost of oil went up fast and hard. British man Iain Macleod gave this issue its name in 1965.

This time was bad for many people and places. Prices were high, money didn’t stretch far, jobs were hard to find and things did not get made as much as before. This happened all over the world where there were rich nations like the U.S., UK, and Germany.

Causes of Stagflation

In this section, we dive into the roots of stagflation, pinpointing major triggers such as the oil prices shock, ineffective economic policies, and implications from the abandonment of the gold standard.

Oil Price Shocks

Oil price shocks can start stagflation. This is what happened in the 1970s oil crisis. The oil crisis of the 1970s is the prime example. In October 1973, the Organization of Petroleum Exporting Countries (OPEC) issued an embargo against Western countries. This caused the global price of oil to rise dramatically, therefore increasing the costs of goods and contributing to a rise in unemployment. The cost of oil went up fast and hard. When this happens, it cuts into how well an economy can work.

At the same time, jobs are lost and prices shoot up. Stagflation then sets in with high inflation, slow growth, and more people out of work. This puts a lot of heat on those who make decisions about the economy.

They have to do two things at once: fix and reduce inflation and get more jobs for people.

Poor Economic Policies

Bad rules can make stagflation worse. Often, these rules come from the people who lead our country. They might set prices that are too high or low. Or they may put limits on what people can buy and sell.

These choices can hurt how much work gets done in a country.

This has a big effect on an economy’s power to make goods and services. It also changes how well the economy does as a whole. For example, if leaders set prices too high, fewer things get sold.

This slows down economic growth and could even lead to stagflation. So good rules are very important for keeping our economy healthy.

Loss of the Gold Standard

The gold standard was a key part of money years ago. Each piece of paper money could be traded for gold. But in 1971, the U.S. said no more trading paper for gold. This caused many things to change all over the world.

Money became worth less and prices went up fast. Some people think this helped create stagflation later on.

The Impact and Consequences of Stagflation

Stagflation brings tough times. People can’t find jobs. Prices go up. The cost to buy things gets high while paychecks stay the same or get smaller. This mix makes life hard for everyone, from families to big companies.

They all feel stressed and may cut back on buying things. Fewer goods being bought means less work and even more people without jobs! It’s a harmful cycle that can be tough to break out of.

Stagflation really shakes things up in a bad way, not just at home but around the world too.

How to Navigate Through Stagflation

In this section, we will discuss the potential strategies that an individual or business can implement to mitigate the impacts of stagflation, including preparation for a recession and effective investment approaches.

Preparing for a Recession or Stagflation

Making a plan for stagflation or a recession is smart. Here are some steps you can take:

Assess Your Financial Priorities

Facing a recession can be challenging, with uncertainty looming over the future. To navigate these uncertain times, it’s crucial to have a clear understanding of your financial standing. Consider the following key questions as you evaluate your financial situation:

- Emergency Cash Reserves: How much liquid cash do you currently have on hand?

- Quick Access Funds: What resources can you easily access if you require additional cash?

- Debt Overview: What are your current outstanding debts, such as credit cards, student loans, and other financial obligations?

- Monthly Living Expenses: What are your essential monthly expenses, encompassing housing, food, healthcare, transportation, and childcare?

- Upcoming Life Events: Are there significant upcoming events with substantial financial commitments, such as weddings, childbirth, or retirement?

Now is the time to scrutinize your current expenses and anticipate financial needs for the next six months. Adequate preparation for a recession or unexpected financial setbacks involves having an emergency fund that can cover three to six months of living expenses, ideally with a retirement nest egg in place.

If you don’t currently have three to six months of basic expenses saved, consider this as a financial goal. Begin by gaining a comprehensive understanding of your spending patterns and establishing a budget.

To create a budget, calculate your total household income, including your earnings, your spouse/partner’s income, and any supplementary income sources such as side jobs or investments. Don’t forget to account for child support or other revenue streams.

Next, outline your monthly expenses, which should encompass rent or mortgage payments, utilities, groceries, medical expenses, childcare costs, home and vehicle maintenance, debt repayments, insurance premiums, and any other regular outlays, even those paid annually.

Sum up these expenses to see if you are spending more, less, or roughly the same as your monthly take-home pay.

Prioritize essential expenses and determine the minimum amount you need to get by each month. This is crucial in case you or your spouse/partner faces a job loss.

It’s normal for your budget to adapt in preparation for a recession. Aim to reduce non-essential spending, such as entertainment, cable, or clothing. While eliminating all discretionary spending might be unrealistic, it’s essential to differentiate between needs and wants.

Identify areas where you may have overspent and understand why. In the short term, you might not have extra funds for retirement or a down payment, which is acceptable.

Once you develop a habit of reviewing your finances and addressing potential issues, you’re on the right track to financial stability.

Prioritize Debt Repayment

If you’re concerned about settling outstanding debts like credit card balances, utility bills, or student loans in the months ahead, it’s crucial to understand which bills should take precedence. Income loss might force you to delay or partially pay some of these bills, affecting your credit scores.

Under normal circumstances, preserving your credit scores is essential, but during a recession, this may not always be feasible. Thus, it’s essential to prioritize your bill payments based on your available funds.

Ensure you pay your rent or mortgage on time and in full to avoid foreclosure or eviction. Make your car payment, especially if it’s vital for commuting to work. If facing an income reduction, contact your student loan provider to inquire about hardship applications that could provide temporary payment relief.

Try to meet at least the minimum payment on your credit card. If this isn’t possible, reach out to your credit card company to negotiate a payment plan, although this might lead to account freezes, preventing additional purchases.

Maintain payments on medical debts, but prioritize them after other debts. If you have employer-provided health insurance, your coverage will continue, even if medical bills accumulate. If you purchase your health insurance, ensure you pay the premiums promptly to avoid policy cancellation.

If you’re falling behind, contact your creditors and discuss hardship concessions, which could involve interest-only payments or putting payments on forbearance. Explore options at local banks, credit unions, online lenders, or even your employer’s short-term loan programs in times of need.

For those consistently making on-time payments, inquire with your credit card company or lender about lowering interest rates. Many utility providers offer programs that allow for delayed bill payments or provide hardship assistance. Don’t hesitate to explore potential agreements with your creditors; you might be surprised at the solutions available.

Evaluate Career Opportunities

Recessions typically bring higher unemployment rates, making it crucial to assess how economic challenges may impact your career. Having a backup plan in case of a layoff is wise.

Begin by reestablishing connections within your professional network, including not only colleagues but also individuals beyond your current workplace. Building relationships in various organizations can provide a significant advantage in the job market. You might consider reaching out to your network through social media or scheduling in-person meetings for networking.

Updating your resume and other job-seeking tools in advance can be beneficial. Look for any gaps in your work history and explore opportunities for further education or training. Expanding your skill set is valuable even if you manage to retain your job during a recession.

For those concerned about potential layoffs, consider taking on a side gig, such as freelancing or working for rideshare services. Extra income not only provides a safety net in case of job loss but also helps you build your emergency savings while still employed.

Boost Your Emergency Fund

Even if layoffs or job cuts are looming, strive to bolster your emergency fund by saving as much cash as possible. Sacrifice non-essential expenses like takeout and delivery to do so.

Dipping into your emergency fund should be a last resort, but losing your job or experiencing reduced income certainly qualifies as a legitimate reason to use these savings. However, it’s crucial to rebuild your emergency fund once your financial situation stabilizes.

Otherwise, you might find yourself making difficult decisions, such as tapping into your retirement savings or seeking a home equity line of credit when the next emergency arises.

Maintain Financial Vigilance

A recession brings uncertainty, but taking proactive steps now is your best course of action. To help you navigate your finances during these challenging times, rely on Equifax for reliable information on essential topics.

Financial education is now more critical than ever, ensuring you can manage your finances confidently, no matter the challenges you face ahead.

Investing During Stagflation

Putting your money to work during stagflation is tricky. It’s an economic cycle that can hurt your investments a lot. But, you can still make smart choices to keep your money safe and maybe even grow it.

- Keep a close eye on inflation trends. High inflation makes things cost more.

- Understand the market well. Know about companies’ growth rates and income.

- Plan for the worst-case scenario. This can help you keep some of your money safe even if there are bad times ahead.

- Consider buying bonds. They earn interest over time and do not lose value as fast as other types of investments during stagflation.

- Think about investing in physical assets like gold or real estate. These often hold value better than money during periods of high inflation.

- Let a financial advisor guide you through these tough times.

- Be patient and don’t make any quick investment decisions without thinking them through.

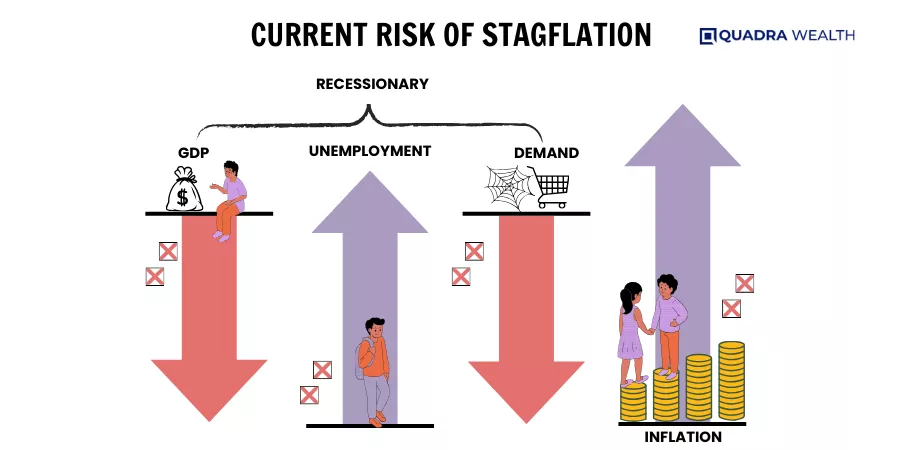

Current Risk of Stagflation

Today, our world faces a risk of stagflation. This is due to slow growth, high prices, and many people out of work. Some top economists warn us that stagflation could slow down the recovery from the Covid-19 pandemic.

The World Bank also gives warnings about stagflation. They say it could make struggles last for years. Other problems like supply chain issues are still there. Attacks on Ukraine by Russia and new waves of COVID-19 cases may make things worse for all global economies.

Stagflation is a big threat because it means no growth in the economy, many jobless people, and higher costs of goods or services.

- Lower Interest Rates

- Focus on Reforms

- Innovation Incentive

- Economic Stagnation

- Higher Living Costs

- Financial Stress

- Business Struggles

- Challenging Investments

- Uncertainty

- Policy Dilemma

Conclusion

In conclusion, stagflation is an intricate economic phenomenon characterized by sluggish growth, high unemployment, and soaring prices. Its historical roots in the 1970s oil crisis and its resurgence as current global stagflation risks highlight its enduring relevance.

Navigating stagflation necessitates a multifaceted approach, from assessing financial priorities and prioritizing debt repayment to staying vigilant and exploring investment strategies. With the right measures in place, individuals and businesses can navigate these challenging times and emerge resilient.

Stagflation underscores the need for adaptability, sound economic policies, and continuous financial education to thrive amidst economic complexities.

Stagflation is a tricky puzzle for the economy. It mixes slow growth, high job loss, and rising costs. To handle it right, we need sharp minds and smart action plans.

Let’s keep learning about it to sail through smoothly if it hits us again.

FAQs

Stagflation is a term that comes from the words “economic stagnation” and “inflation.” Stagflation happens when the economy grows slowly, unemployment is high, and prices rise fast.

In times of stagflation, things often cost more money. At the same time, fewer people have jobs and it’s harder to find work.

Yes, economic policymakers can use tools like interest rates and currency values to manage economic growth, jobs, and costs in the economy.

Prices can go up because of a supply shock or due to demand-pull inflation.

Economic indicators help us study trends in financial markets but predicting exact conditions such as a major recession or stagflation is hard.

Having an emergency expense plan would be smart for you! Refinancing your adjustable-rate debt like mortgages or credit cards could also help save some money.