Imagine a world where money isn’t a constant worry, where unexpected expenses don’t make you bite your nails. Your finances don’t stop you from chasing your dreams, you fulfill your desires without compromising your life’s basics.

Most important, your retirement is secured. Got Utopian vibes? These all are indicators of ‘sound financial health’.

Good physical health empowers you, and so does ‘sound financial health’ Your financial health includes the overall state of your finances.

It’s not just about having a fat bank account (although that would be nice!). It’s the overall stability and security of your finances. It’s about how much grip you hold on your income and expenses, with being prepared for the unexpected.

Your past, present, and future all together impact your financial health and financial security. It’s a measure of how well you’re managing your money and how prepared you are for the future.

Just like physical health, your financial health can fluctuate over time and is influenced by a variety of factors, such as your income, living expenses, debts, savings, investments, and certain life events.

Why is financial health important?

Think of it like physical health. You eat right, exercise regularly, and take care of your body because you want to feel good, avoid illness, and live a long life.

It’s the same with your finances. Building good financial habits helps you stress less, sleep better, and make confident decisions about your life.

Let us talk about some financial situations, A Car broke down? No problem, you’ve got your emergency fund.

Bali trip? Do it! Your budget can handle it. Retirement? Relax, you’ve been saving for it.

Here are key pointers as to why financial health is important:

Reduces stress

Money worries can be a major source of stress. When you’re in good financial health, you’re less likely to worry about making ends meet, which can improve your overall mental and physical well-being.

Gives you peace of mind

Having your finances secured gives you a natural sense of security and thus peace of mind. Knowing that you have a financial safety net allows you to focus on other aspects of your life.

This aids in your overall well-being.

Provides opportunities

Good financial health opens up doors to opportunities that might otherwise be out of reach, such as buying a home, starting a business, or traveling the world.

Let’s say a lucrative investment opportunity comes up. If your finances are secured you can grab it which otherwise couldn’t be thought of.

Helps you achieve your goals

Whether your goal is to retire early, clear your debt, or send your kids to college, good financial health is essential for making your dreams a reality.

Also Read: Financial planning for your growing family

How can you improve your financial health?

There are many things you can do to improve your financial health. Just like physical health, it’s not one one-time activity.

Your financial health is measured by your net worth, debt, earnings, and spending habits.

Not only that, achieving and improving financial health requires mindfulness, thorough discipline, consistency, and knowledge.

Here are a few habits to inculcate in your daily lives to get there.

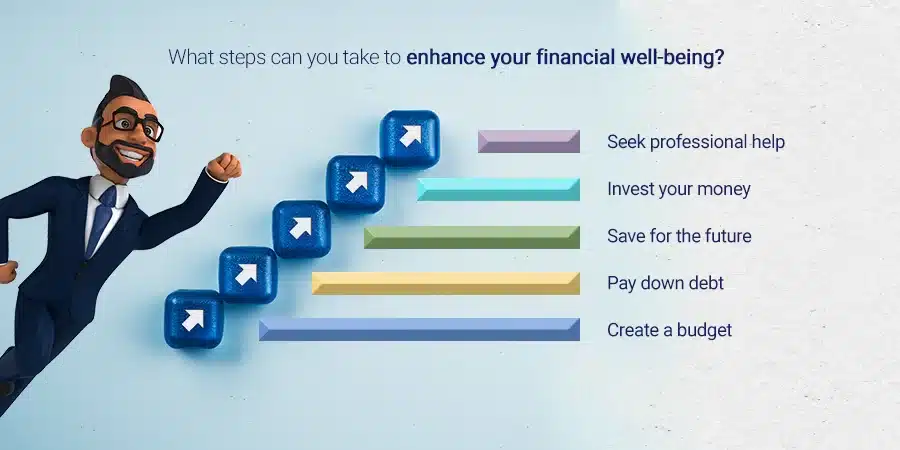

Create a budget

Your financial health maintenance starts with budgeting. It lets you track your income and expenses so you can see where your money is going.

Once you know where your money is going, you can start to make changes to improve your spending habits. Use the 50/30/20 rule here.

As per this rule, allocate 50% of after-tax income towards your needs, 30% towards fun and entertainment, and a balance of 20% towards savings account and debt reduction.

Pay down debt

Debt can be a major drain on your finances. If you have debt, make it a priority to pay it off as quickly as possible. Especially the higher ones like those of credit cards and other unsecured ones.

Remember, never pay off one debt with another.

Save for the future

It’s important to save for the future, even if it’s just a small amount each month. Implement the 50/30/20 rule here. As the wise say, don’t spend and save but rather save first and then spend.

Start by setting up an emergency fund to cover unexpected expenses. Then, start saving for your long-term goals, such as retirement.

Invest your money

Investing your money is a great way to grow your wealth over time. Let your money work for you. There are many different investment options available, so do your research and choose investments that are right for you.

Seek professional help

If you’re struggling to manage your finances on your own, don’t be afraid to seek professional help. A financial advisor can help you in creating a financial plan to reach your financial goals. Use apps and tools that help you budget.

Financial health is a journey, not a destination. It takes time and effort to build good financial health, but it’s worth it in the long run.

By improving your financial health, you can reduce stress, gain peace of mind, and create a brighter future for yourself.

A few more tips for improving your financial health

Automate your finances

Set up automatic transfers to your savings and investment accounts. This will help you save money without having to think about it.

Educate yourself about personal finance

There are many resources available to help you learn more about personal finance. Read books, articles, and blog posts. Take online courses or attend workshops.

Make financial planning a regular part of your life

Review your budget and personal financial goals regularly. Make adjustments as needed.

In addition to the tips mentioned above, here are a few other things you can do to improve your financial health:

Cook more meals at home

Eating out can be expensive. You can save a lot of money by cooking more meals at home. Also home home-cooked meals facilitate wellbeing which further prevents medical expenses.

The bonus tip here is, that cooking is also a stress buster and it improves your mindfulness.

Find cheaper ways to have fun

There are many fun things to do that don’t cost a lot of money. Get creative and find activities that you enjoy without breaking the bank. This also means getting along with the right and like-minded people.

Get friends who have similar approach towards money. You all will rub down on each other and just get better at it.

Shop around for better deals

Don’t just pay the first price you see. Take some time to compare prices before you make a purchase. Or rather, think before you buy.

They say to wait till 7 days to make that final purchase. What is just fancy or impulse buying will fade away after 7 days. This will prevent you from overindulging and hefty credit card bills.

Cancel unused subscriptions

Do you have any subscriptions that you’re not using? Well, it’s the job of the marketers to entice us to subscribe to something we don’t need at all. Cancel them to save money.

Negotiate your bills

Don’t be afraid to negotiate with your service providers. You might be able to get a better deal. As the wise say, what is the harm in asking for it?

By following these tips, you can start to improve your financial health today.

Also Read: Best Gold Coins for Investment

Parting Thoughts

Financial literacy is essential for maintaining a balanced and secure lifestyle. One surely can live and make prudent decisions without having to worry about money. Let us not forget that, getting healthy financially involves responsible financial management, consistent efforts, discipline, mind fullness, and adaptability.

Last but not least, financial health is a journey, not a destination.

Ready for a bespoke financial planning conversation? Schedule your personalized investment advisory meeting today