Debt consolidation is a debt management strategy that combines your current multiple debts into one using a new credit card or loan, most likely with a modest interest rate. With the right debt consolidation plan, you can save both time and money while managing your consumer debt.

Debt consolidation can certainly streamline your debt repayment process. Moreover, it enables you to benefit from the lower interest rate, an ideal repayment strategy and a more compact payoff timeline.

Stay tuned to explore what is debt consolidation and how you should go about it.

Debt Consolidation Definition

Debt consolidation is a debt management plan by taking out a new loan or credit card to pay off other existing loans. By merging several debts into a single, bigger loan, you can benefit from more supportive payoff terms, such as lower monthly payments, lower interest rates, or both. You may consolidate your debts by leveraging a balance- transfer credit card, home equity loan, or personal loan.

How Does Debt Consolidation Work?

The process of debt consolidation involves uniting numerous balances into one, typically with a new credit card or loan. It offers lower interest rate and loan with favorable terms. However, it is also possible to consolidate a single balance, although it is less common.

You can transform old debt into a new debt by various methods, such as securing a new personal loan, a home equity loan, or a new credit card. However, the credit card should be of high credit score. It allows you to pay off your smaller debts with the new one.

If you use a new credit card to combine other credit card debts, you can transfer the balances on your old card to the new one. Thus you can pay the loan and profit from the incentives offered by some balance transfer credit cards. For example, a 0% interest rate on your balance for a particular period.

Along with the possibility of smaller monthly payments and lower interest rates, debt consolidation also improves your financial life, with fewer bills and due dates to stress over.

When getting a consolidation loan, you usually borrow enough to tackle the debts you intend to unite. Then, once you obtain the loan funds, you employ them to clear other debts. In some instances, even the money lenders may repay your debts directly.

With a new credit card, you’ll appeal for balance transfer to the new credit card provider, who will repay your mentioned balances directly.

Types of Debt Consolidation Loans

There are various debt consolidation options. For example, credit cards or taking loans. The option that works best for consolidating your debt depends on your current financial situation and the terms and types of your current loans.

Generally, debt consolidation loans are of two broad types:

- Secured loans

- Unsecured loans

Secured loans are supported by an asset like your home, which acts as security for the loan. In contrast, unsecured loans are not reinforced by assets and may be challenging to obtain. They are also supposed to have lower qualifying amounts, and higher interest rates.

However, both types of loans generally have lower interest rates compared to credit cards. And most of the time, the rates are fixed which don’t get high over the paying off period.

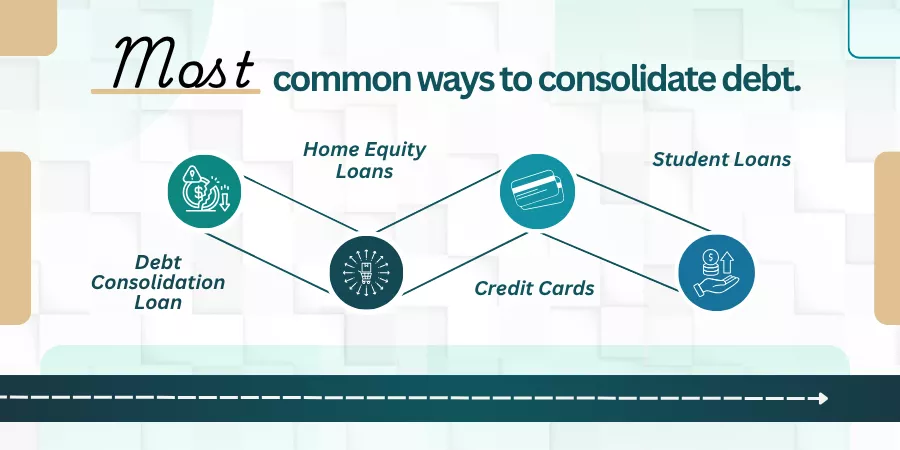

Here’s a glimpse of the most common ways to consolidate debt. Which option proves most useful depends on your specific financial circumstances.

These are as follows:

Debt Consolidation Loan

Personal loans are the most common among all types of loans simply known as debt consolidation loans. This loan is an unsecured loan you need to pay from a credit union or bank that grants a lump sum amount.

Then, you repay that loan on a monthly basis following a fixed interest rate and for a designated time frame. Personal loans usually come with better terms and lower interest rates than most credit cards. So, they seem to be a more fascinating option for debt repayment.

In this type of loan, the borrower doesn’t have to stake an asset as security to return the loan. However, the borrowers can only embrace the best interest rates and lower monthly payments with other attractive loan terms if they boast good credit scores.

Home Equity Loans

Home equity loan or home equity line of credit (HELOC) can be a beneficial method to consolidate debt for a homeowner who has built up equity over the years. This equity serves as collateral against these secured loans that charge interest rates mildly higher than average mortgage rates, which are way below credit card interest rates.

Credit Card Debt Consolidation

A new credit card can be valuable to alleviate your credit card burden if it yields a lower interest rate. Some credit cards come with an introductory period with 0% APR when you shift your current debts to them.

These favorable loan terms generally last from 6 to 21 months or so, after which the interest rates are expected to leap into double digits. Also, debt consolidation may be a challenge with lower credit scores. So, the best option is to review your credit and repay your debts as quickly as possible.

Also remember that credit cards may also apply an initial fee, typically equal to 3% to 5% of the amount you want to transfer.

Student Loans

Often, the federal government offers debt consolidation options to people as student loans, involving direct consolidation loans through the Federal Direct Loan Program. The new interest rate is set average of the prior loans.

The federal student loans offer reduced monthly installments and extensive pay off period (as prolonged as 30 years). However, that also means paying off more amounts of total interest over the extended period.

Pros and Cons of Debt Consolidation

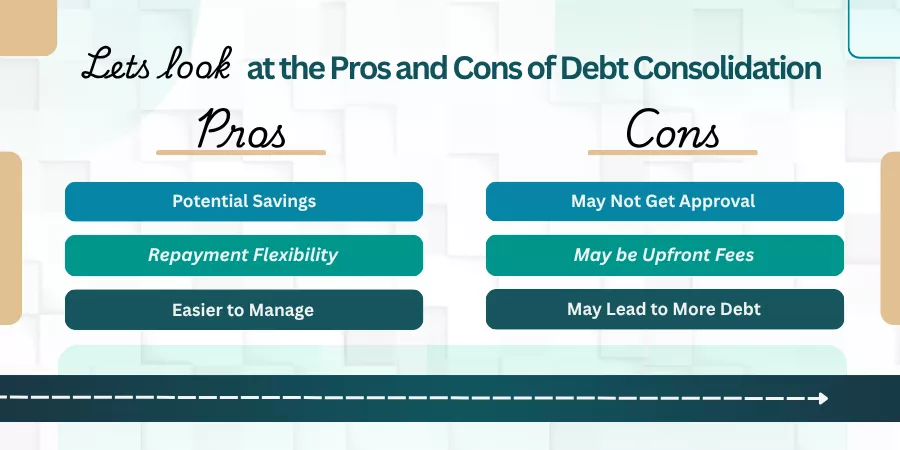

Here’s a snapshot of advantages and disadvantages of debt consolidation:

Pros

Potential Savings

Whether you get a personal loan with a lower interest rate than the one you’re paying at present or a balance transfer credit card, you can considerably save thousands of dollars on interest fees.

You can also tap into a lower monthly payment, unlocking some cash flow in your budget.

Repayment Flexibility

A balance transfer card offers you a 0% intro APR promotion from anywhere between 12 to 21 months.

But if you owe a lot of debt on your shoulders and want more adjustability with your monthly payment, you could go for a debt consolidation loan and attain more options – making it feasible for you to take on a term that aligns with your requirements.

Easier to Manage

Consolidating your multiple monthly debt payments into one compact payment makes it more convenient for you to regulate your repayment plan.

Cons

May Not Get Approval

If your credit score is not good or excellent, you may not qualify for a balance transfer card or a low interest debt consolidation loan.

Even if you have a good score, you may not acquire the intended terms if you are to pay a huge amount of debt.

May be Upfront Fees

You may have a hard time getting a balance transfer credit card that doesn’t impose a balance transfer fee on a 0% APR promotion ( Annual Percentage Rate).

While you get approval for a personal loan with no inception fee, you may not enjoy unlimited options if your credit is not almost perfect.

While these charges are not considered a deal-breaker, be sure to keep them in mind when measuring your savings.

May Lead to More Debt

While consolidating your debt can simplify your debt payment method, it won’t change circumstances that trapped you in debt in the first place.

Until you map out a plan to prevent further debt, using available credit on a credit card or another card could place you at risk of accumulating another debt!

Final Thoughts

Debt consolidation is an efficient way to pay off debt more quickly and lower your interest fees. There are several ways to consolidate debt, such as via a new credit card, a personal loan, or a home equity loan.

It is good to know your credit before you apply for loans for debt consolidation. It will enable you to know where you stand and highlight loopholes of your credit profile that need some improvements before you initiate the consolidation process.

Understanding what is debt consolidation and how to qualify for a loan can streamline your debt repayment strategies and build trust in the business world!

If you are planning to consolidate your debts, reach out to Quadrawealth to hire a debt consolidation advisor for credit counseling services.

Frequently Asked Questions

Q1. What Are the Risks of Debt Consolidation?

A: There are some downsides to consider while consolidating debt. When you get a new loan, it could hit your credit score which might impact your approval for other new loans.

Q2. Will Debt Consolidation Loan Affect Your Credit?

A: Debt consolidation loan makes the debt payment process convenient in the form of single monthly payment and a lower interest rate. However, it can also impact your credit score – for the better and for the worse.

Q3. What is Debt Settlement?

A: Debt settlement relates to an agreement between a borrower and a creditor in which the decreased payment from the borrower is considered full payment. In simple words, it is a debt reduction agreement between a creditor and a borrower.