Jennifers Story

The Roller Coaster World Of Investing

Years ago, when fresh out of college and brimming with ambition, Jennifer was like her impulsive friends.

They all chased hot stocks, rode the waves of volatility in the name of insider ‘tips’, investing in fancy and flashy financial instruments without understanding them.

But they all witnessed the inevitable crash leading to their portfolios’ unfathomable losses.

The financial crisis had taught a harsh lesson. Her hard-earned money gone in the whirlwind, Jennifer picked up from there.

She discussed with some of her friends and colleagues, few of them had not incurred losses to the magnitude of hers.

They could still preserve their capital invested. One aspect was starkly clear to her, excitement was for the casino, not the investments.

Now That The Minimum Variance Is A Mainstay

That’s when she discovered the power of minimum variance. It wasn’t about maximizing returns but minimizing risk.

By carefully selecting assets with low volatility and low correlation, she built a portfolio that moved less with the market’s volatility.

It wasn’t glamorous, but it was reliable.

Today, as the news reported another market dip, shivers ran down spines around her, and Jennifer barely blinked.

Her colleagues, face looking worrisome, sought her counsel. “Aren’t you worried?” they asked. Jennifer simply smiled. “Why should I be? My portfolio is built for this.”

She explained the magic of minimum variance, the power of diversification, and the beauty of playing the long game.

As she spoke, a sense of calm settled over the room.

They began to understand, the allure of chasing short-term gains fading in the light of long-term stability.

Welcome To Investing With Minimum Variance

Imagine this: you’ve got a bunch of investments, each with its own way of responding to market fluctuations.

But what if you could combine them in a way that smooths out the bumps and keeps things steady? That’s the magic of minimum variance.

Think of it like a seesaw, on one side, you have high-risk asset classes like stocks, and on the other, low-risk ones like bonds.

The goal is to find the sweet spot where the seesaw stays balanced, even when the market throws a tantrum.

Here's How Minimum Variance Works

Lower Risk, Not ‘No Risk’:

It’s not about eliminating risk but minimizing its impact on your portfolio. You still get some growth potential but without heart palpitations.

Diversification Is Key:

There’s no rocket science to it. It is simply picking assets that don’t move in lockstep. When one goes down, the other (hopefully) goes up, keeping your overall portfolio from nosediving.

Not For Everyone:

If you’re a thrill-seeker who loves the market drama, this might not be your cup of tea. But for those who prioritize peace of mind, it’s a solid option.

Indicators Of Minimum Variance

While there’s no single “indicator” that guarantees minimum variance, several financial statistics can help you assess and build a portfolio with lower volatility. Here are a few key ones:

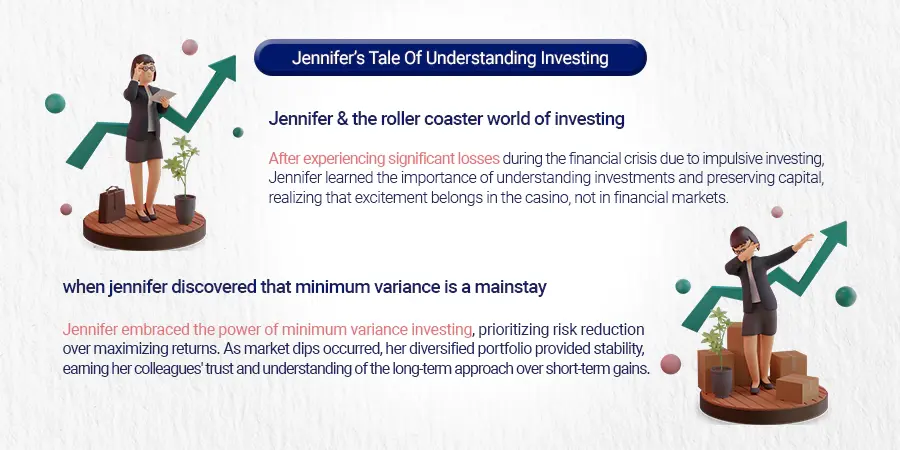

Asset-level indicators:

These indicators consider picking up individual assets in your portfolio like a stock, a structure note, or a mutual fund, and study their variances.

Standard deviation:

Standard deviation is the “spread” of your investment returns, telling you how much they deviate from the average.

A high standard deviation signifies a volatile portfolio with the potential for larger swings, while a low one suggests stability with smaller fluctuations.

Understanding your portfolio’s standard deviation helps you assess portfolio risk, compare options, and make informed investment decisions.

Beta:

Portfolio beta gauges how your entire investment basket moves compared to the market (like the S&P 500).

Imagine it as a sensitivity meter: a beta above 1 means your portfolio swings more than the market, below 1 means less, and 1 means they move in sync.

This helps you understand your portfolio’s overall risk profile and compare it to other options.

Correlation coefficient:

The correlation coefficient measures the strength and direction of the linear relationship between two variables, like stocks in your portfolio.

It ranges from -1 (perfect negative correlation) to 1 (perfect positive correlation), with 0 indicating no linear relationship.

A positive value means they tend to move in the same direction, while a negative means they move oppositely.

It’s a tool to understand how your investments might influence each other, but remember, it doesn’t capture all types of relationships.

Portfolio-Level Indicators:

These indicators work on the entire investment bunch. It combines all in one unit and weighs its potential.

Portfolio Standard Deviation:

This measures the overall volatility of your entire portfolio, considering the weights of each asset and their correlations. Lower portfolio standard deviation signifies lower overall risk.

Sharpe Ratio:

This compares the expected return of your portfolio to its risk (measured by standard deviation).

A higher Sharpe ratio indicates better risk-adjusted returns, potentially signifying a more efficient portfolio with lower variance compared to its return potential.

Maximum Drawdown:

This measures the largest peak-to-trough decline your portfolio has experienced historically.

A lower maximum drawdown suggests better resilience to market downturns, aligning with the goal of minimizing volatility.

Additional considerations

It’s important to understand that providing specific portfolio examples can be risky and misleading, as it implies a one-size-fits-all approach to investment, which is never the case.

Each investor has unique risk tolerance, goals, and circumstances.

Risk tolerance:

Remember, minimum variance doesn’t mean zero risk. Consider your risk tolerance and adjust your portfolio based on your needs.

Rebalancing:

Regularly rebalancing your portfolio to maintain your desired asset allocation and risk profile is crucial for maintaining minimum variance.

Professional Guidance:

Building a truly optimal portfolio can be complex. Consulting a financial advisor can help you select suitable assets, weigh them correctly, and monitor your portfolio for optimal performance.

Some Examples Of Minimum Variance Portfolios

Minimum variance means stable, and stability parameters can vary across individuals. Let us see a few sample minimum variance portfolios based on your risk appetite.

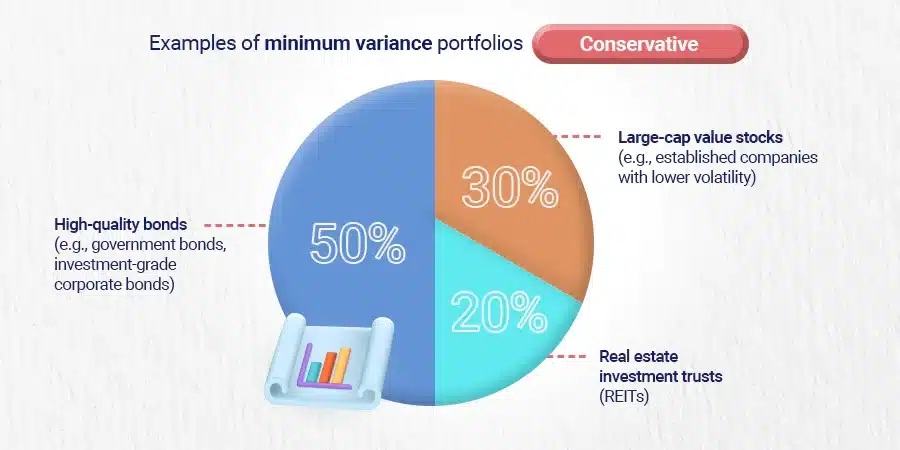

Conservative:

50% High-quality bonds (e.g., government bonds, investment-grade corporate bonds)

30% Large-cap value stocks (e.g., established companies with lower volatility)

20% Real estate investment trusts (REITs)

This portfolio prioritizes stability with a focus on low-risk assets like bonds and defensive stocks. REITs offer some potential for growth while providing income diversification.

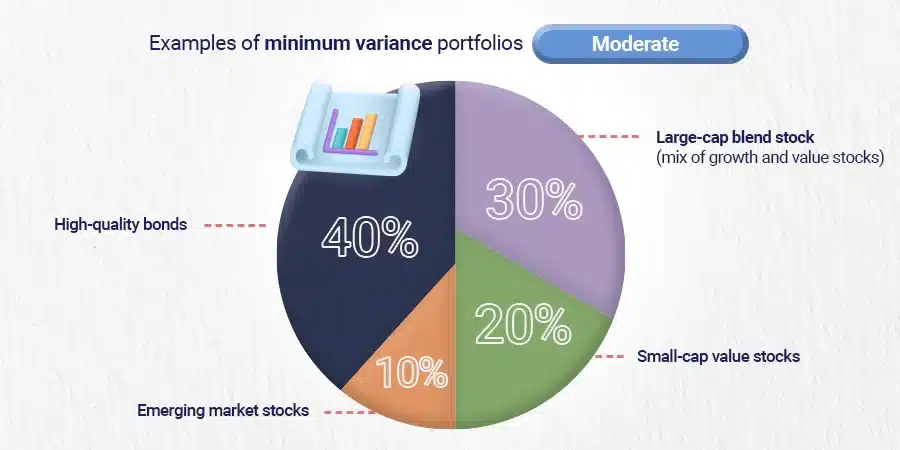

Moderate:

40% High-quality bonds

30% Large-cap blend stocks (mix of growth and value stocks)

20% Small-cap value stocks

10% Emerging market stocks

This portfolio adds some risk with small-cap and emerging market stocks while maintaining a significant allocation to bonds and defensive assets.

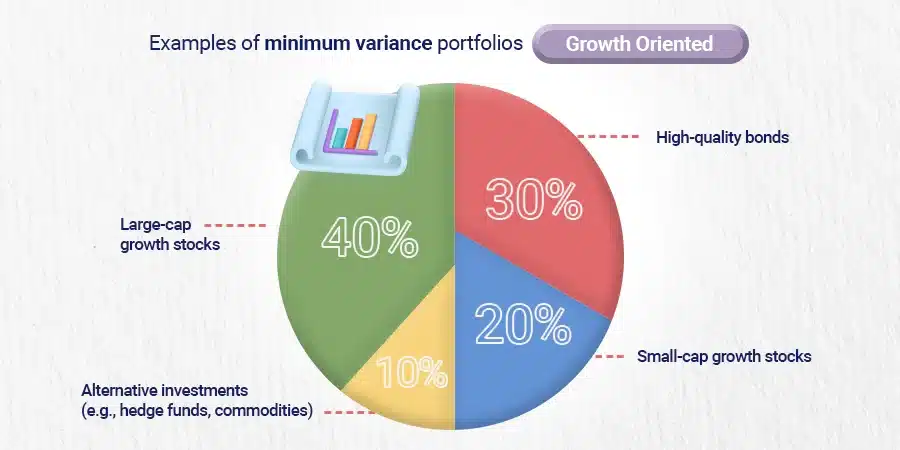

Growth-Oriented:

30% High-quality bonds

40% Large-cap growth stocks

20% Small-cap growth stocks

10% Alternative investments (e.g., hedge funds, commodities)

This portfolio prioritizes the potential for higher returns with a larger allocation to growth stocks and alternative investments.

However, it also comes with higher volatility.

Remember, these are hypothetical examples and not recommendations. You should only build a portfolio with an understanding of your risk tolerance and goals.

Parting Thoughts

So before you embark on the journey to build a minimum variance just patiently gulp these aspects.

It’s not a magic Bullet: There’s no guaranteed smooth sailing, and past performance isn’t a promise of future results.

It takes some work: You’ve got to do your research and choose the right assets for your risk tolerance and goals.

Talk to a pro: This stuff can get complex, so consider consulting a financial advisor for personalized guidance.

So, is a minimum variance portfolio right for you? Only you can answer that. But if you’re looking for a calmer ride on the investment rollercoaster, it’s worth exploring!