Today, let us address a not-so-cheery but inevitable topic, what happens to your pension when you die?

Yes, the meticulous planning, consistently parking funds in your retirement account even if that at times calls for living below the means.

The hard work and dedication towards building a retirement fund, do pay off. Your golden years are secured. But what happens when you are gone?

How is your retirement account treated and how can the funds go to the intended beneficiaries? A darker scenario, you die before retirement?

So what happens to all the money parked in retirement kitties? Let’s explore all the possibilities for your retirement accounts to get a sense of security.

Beneficiary Reigns Supreme

First off, let’s talk about those beneficiary designations. You know, those forms you fill out when you open a retirement account and promptly forget about?

Well, they’re important. If you’ve named beneficiaries for your retirement accounts—like your spouse, kids, or even your favorite charity—those folks are in line to inherit your retirement stash when you’re gone.

It’s like a gift from beyond the grave, except hopefully, you’ve already given them plenty of love in life!

Spouse As A Beneficiary To Retirement Accounts

Now, if you’ve got a spouse, they might have a bit of a leg up in the inheritance tax game.

In many cases, they can simply step into your retirement shoes and carry on with the funds as if they were their own.

It’s like a joint bank account but with way bigger numbers. But if your beneficiaries aren’t your spouse, well, things can get a bit more complicated.

Child(ren) As The Beneficiary To Retirement Accounts

Let’s say you’ve named your kids as beneficiaries. Well, first off, congrats on being a thoughtful parent! But now, your offspring are faced with some choices.

They could take the money as a lump sum and go on a spending spree (hopefully, a responsible one).

Or they could opt for regular distributions over time, kind of like an allowance from beyond the grave. It’s all up to them.

Also Read: Best Retirement Planning Books

Oh! No Beneficiary Scenario

But hold on, what if you didn’t bother naming any beneficiaries?

Oops. Well, in that case, your retirement savings might end up in a bit of limbo.

They’ll likely get tangled up in the probate process, which is a fancy way of saying they’ll be divvied up according to your will or state laws.

Not exactly ideal if you had specific plans for where you wanted that money to go.

Tax implications on retirement funds

Oh, and let’s not forget about taxes. Uncle Sam always wants his cut, even after you’ve kicked the bucket.

Depending on your retirement account type and who’s inheriting it, there could be some tax implications to consider.

Spouses usually get a bit of a tax break, while non-spouse beneficiaries might have to cough up some cash to the IRS.

Factors Affecting The Fate Of Your Retirement Funds

How funds are inherited from retirement accounts depends on several factors, including:

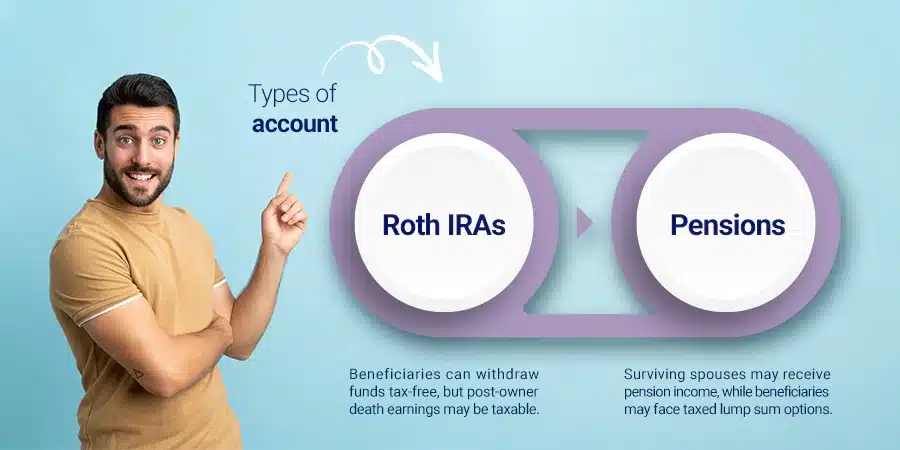

Type of account:

Traditional IRAs and 401(k)s: Generally, non-spouse beneficiaries must withdraw the entire balance within 10 years (exceptions apply for certain categories like minors, disabled individuals, or those within 10 years of age of the deceased).

Spouses have more options, including keeping the account as an inherited IRA or rolling it into their own.

Roth IRAs:

Beneficiaries can typically withdraw funds tax-free, but any earnings accrued since the original owner’s death may be taxable.

Pensions:

Often, surviving spouses receive a portion of the pension as income. Some plans offer a lump sum option to beneficiaries, but it might be taxed.

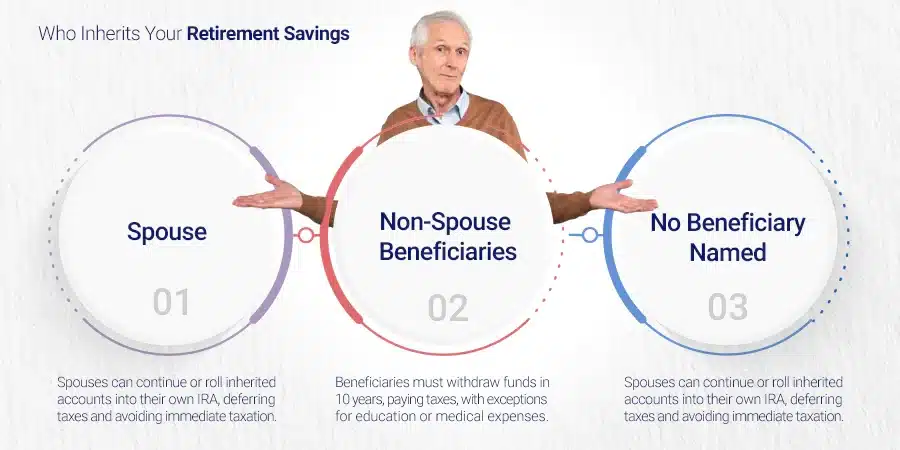

Who Inherits The Funds:

Spouse:

Spouses generally have more flexibility, like continuing the inherited account or rolling it into their own IRA. This allows for tax-deferred growth and potentially avoids immediate taxation.

Non-spouse beneficiaries:

These beneficiaries usually have to withdraw the funds within 10 years and pay income taxes on the distributions. Exceptions exist for qualified distributions, such as those used for education or medical expenses.

No beneficiary named:

The funds become part of the deceased’s estate and are distributed according to their will or state laws.

Other factors affecting retirement funds inheritance.

- The age of the account owner at death: If the owner reached their required beginning date (RBD) for taking withdrawals before death, different rules apply compared to if they hadn’t.

- The specific terms of the retirement plan: Some plans may have unique rules or restrictions on inheritances.

A Few Important Considerations For Retirement Accounts

Updating Beneficiaries:

Life changes such as marriage, divorce, birth, or death in the family may necessitate updating your beneficiary designations. Update beneficiaries immediately when required.

Educating Yourself:

Continuously educate yourself about retirement planning, investment strategies, and changes in financial regulations that may impact your retirement accounts. Knowledge empowers you to make informed decisions adapt your retirement strategy and tweak the necessary factors as and when required

Seeking Professional Guidance:

Multiple factors are involved that decide the fate of your retirement funds. If you are not equipped enough, consider consulting with a financial advisor or retirement planning specialist for personalized guidance and advice.

Parting Thoughts

Planning for the inevitable isn’t morbid, it’s responsible. By understanding how your retirement savings will be handled after your passing, you can ensure your loved ones are secure and your legacy lives on.

Take the time to review your beneficiary designations, update them as needed (especially after major life events), and consider chatting with a financial advisor or estate planning expert to make sure your wishes are crystal clear.