What rate of return should i use for retirement planning. Retirement planning can be a confusing process, especially when it comes to deciding what rate of return should be used. Did you know that the ‘4% rule’ is commonly used as a baseline for retirement spending? This article aims to break down the complexities of determining a realistic rate of return for your retirement plan.

Continue reading to streamline your journey toward financial security in your golden years!

Key takeaways

●The rate of return is an essential factor in retirement planning and can significantly impact your accumulated wealth and lifestyle during retirement.

●Determining a realistic rate of return requires considering factors such as time horizon, investment portfolio, confidence in your financial plan, and adjustments based on changing conditions.

●It's important to assess your investment portfolio, regularly review and adjust your retirement plan, consider average rates of return for past performance and future growth projections, and calculate the total rate of return on your investments.

What Rate of Return Should I Use for Retirement Planning

The rate of return is a key factor in growing your retirement portfolio. It’s essentially the gain or loss made on an investment relative to the amount invested.

Typically expressed as a percentage, it gives you an idea of what you’re earning back from your investments.

It’s crucial to differentiate between nominal and real rates of return. The nominal rate doesn’t account for inflation; therefore, it might present a rosy picture of your returns.

The Real Rate of Return considers inflation and provides a more realistic outlook on what you’re actually gaining from your investments after accounting for changes in purchasing power due to rising prices over time.

The Importance of Rate of Return in Retirement Planning

Your asset allocation choices – stocks or bonds or cash – will also dictate variations in your portfolio’s ending balance and initial withdrawal rate.

The rate of return plays a vital role in the success of your retirement planning. It can significantly impact how much you accumulate over time and, ultimately, your lifestyle during retirement.

A rate that exceeds inflation and costs puts you on track for substantial growth. The 4% rule is one way to map this out; it’s a common guideline suggesting a 4% withdrawal rate in the first year of retirement.

Balancing this with historical market returns can contribute to sustainable spending patterns throughout your golden years.

Higher rates may allow more aggressive withdrawals, but unpredictable markets require careful management to avoid the early depletion of assets.

However, bear in mind that every individual might see different results based on their circumstances—life expectancy and access to other resources are just two factors that could affect personal expenditure rates.

Essentially, ensuring an optimal return rate is integral as it provides financial stability while factoring uncertainties such as lifespan, market fluctuations, and unexpected expenses—all crucial considerations within any solid retirement income strategy.

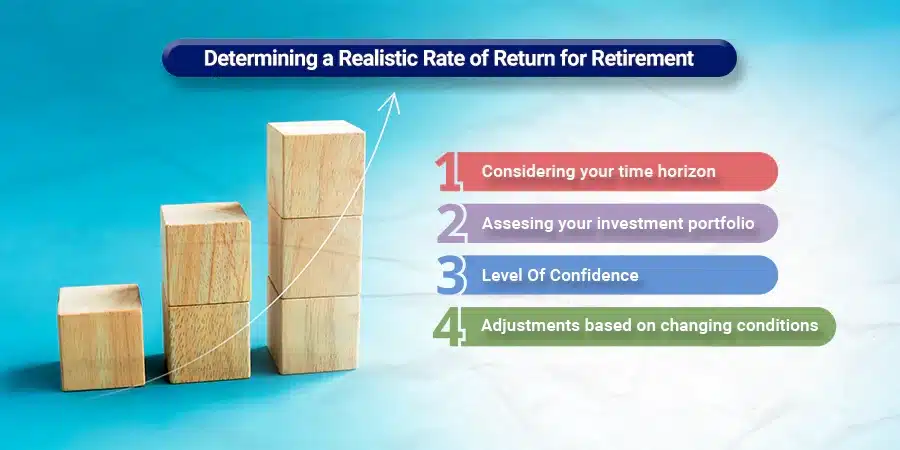

How to Determine a Realistic Rate of Return for Retirement

To determine a realistic rate of return for retirement, you need to consider factors like your time horizon, investment portfolio, confidence in your financial plan, and adjustments based on changing conditions.

Considering your time horizon

Your time horizon plays a crucial role in determining an appropriate rate of return for retirement planning.

This refers to the length of time your investments have to grow before you’ll need to start making withdrawals.

A longer time horizon generally allows for more aggressive investing, as there’s additional time to recover from potential short-term losses.

Conversely, if your retirement is only a few years away, safer investment options may be prudent because immediate returns become significantly more important than long-term growth.

Tailoring your investment strategy and asset allocation based on this timeline helps optimize the chances of reaching desired financial goals upon retirement.

It’s also vital to regularly evaluate and adjust this plan as you approach closer to your retirement date or experience changes in life expectancy due to health conditions.

Assessing your investment portfolio

Assessing your investment portfolio is a crucial step in retirement planning. It allows you to evaluate the performance and composition of your investments to ensure they align with your long-term goals.

By assessing your portfolio, you can determine if any adjustments need to be made based on factors such as tolerance of risks, time horizon, and changing market conditions.

This process helps you make informed decisions about which assets to hold and when to rebalance your portfolio for optimal growth and stability in preparation for retirement.

Properly assessing your investment portfolio sets the foundation for a solid retirement plan that can help you achieve your financial goals.

Level of confidence in your financial plan

The level of confidence in your financial plan is influenced by various factors, including your individual circumstances and resources.

Your health, life expectancy, and access to other assets can impact the level of confidence you have in your plan.

It’s important to consider taxes and investment fees separately from the 4% rule when determining a personalized spending rate.

Additionally, asset allocation plays a crucial role in the ending balance of your portfolio and the initial withdrawal rate, which ultimately affects your level of confidence in your financial plan.

Regularly updating and adjusting personalized spending rates based on individual circumstances and investment performance contributes to a higher level of confidence in your plan.

Adjustments based on changing conditions

Adjustments to your retirement plan may be necessary to account for changing conditions. Keep these factors in mind:

- Market volatility: Stay informed about market trends and adjust your investment strategy accordingly.

- Inflation: Consider the impact of inflation on the purchasing power of your retirement income and adjust your spending plan as needed.

- Life changes: Major life events such as marriage, divorce, or a change in health can affect your financial situation. Review your plan and make adjustments if necessary.

- Tax laws: Stay up-to-date with changes in tax laws that could impact your retirement savings and adjust your plan accordingly.

- Economic factors: Changes in interest rates, GDP growth, and other economic indicators can influence investment returns. Stay informed and adjust your plan as needed.

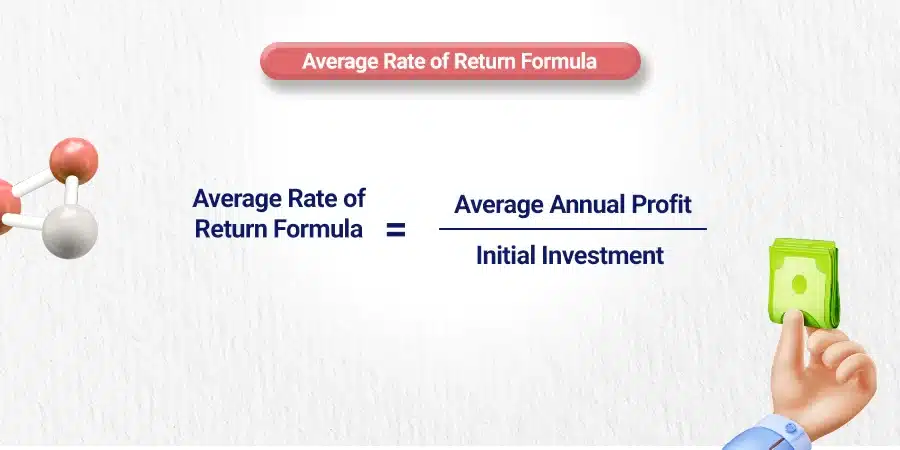

Understanding Average Rate of Return

The average rate of return can be used as an indicator of past success and as a tool to predict future growth in retirement planning.

Average rate as an indicator of past success

The average returns serve as an indicator of past success in investments. It provides a way to assess how well an investment has performed over a specific period of time.

By calculating the average rate, investors can get an idea of the historical performance of their portfolio and use that information to make informed decisions about their future investment strategies.

However, it’s important to remember that the average rate is just one piece of the puzzle when it comes to retirement planning.

Other factors such as inflation, market returns, and individual circumstances also need to be considered for a comprehensive financial plan.

Using average rate to predict future growth

The average rate of return is a useful tool for projecting future growth in retirement planning. By looking at historical averages, you can get an idea of how your investments may perform over time.

Keep in mind that longer time frames provide more reliable averages, so consider using rates from several decades rather than just a few years.

The asset class also has varying average rates of return, with the stock market generally offering higher returns compared to bonds.

By understanding and analyzing these average rates, you can make more informed decisions about your investment strategy for the future.

Key Factors to Consider When Projecting Retirement Plan

Consider the right time frame, evaluate past performance and future results, use long-term average rates for long-term investments, calculate fluctuations for short-term investments, and determine the total rate of return on a retirement account or individual position.

Right time frame

Determining the right time frame is crucial when projecting your retirement plan. It’s important to consider how long you have until retirement and how many years of income you will need in retirement.

The commonly used 4% rule assumes a 30-year time horizon for retirement, but individual circumstances may vary.

Factors such as health, life expectancy, and access to other resources should be taken into retirement account for personalized planning.

By understanding your specific time frame, you can better determine the appropriate investment strategy and withdrawal rate that align with your goals and needs in retirement.

Past performance and future results

Historical performance can provide insight into how an investment has performed in the past, but it does not guarantee future results.

It’s important to remember that market conditions are constantly changing, and what worked well in the past may not necessarily continue to do so in the future.

While analyzing past performance can be helpful, it should not be solely relied upon when making investment decisions for your retirement plan.

Instead, consider a combination of factors such as your time horizon, risk tolerance, and current market conditions to make informed decisions about your portfolio’s future potential.

The long-term average rate for long-term investments

Long-term investments require careful consideration of the long-term average rate of return. This rate is an indicator of past success and can be used to predict future growth.

When projecting retirement plans, it’s important to take into account this average rate for long-term investments as it provides insight into the potential performance and overall growth of a portfolio over an extended period.

By understanding and factoring in this average rate, individuals can make more informed decisions about their investment strategies and ensure they are on track to meet their retirement goals.

Evaluating fluctuations for short-term investments

Short-term investments can be subject to significant fluctuations in value, making it crucial for investors to carefully evaluate these changes.

By monitoring and assessing the volatility of short-term investments, individuals can make informed decisions about their portfolios.

It is important to consider factors such as market trends, economic indicators, and financial news when evaluating fluctuations.

This enables investors to manage risks effectively and potentially capitalize on opportunities that arise from market movements.

By staying vigilant and informed, investors can navigate the ups and downs of short-term investments more confidently.

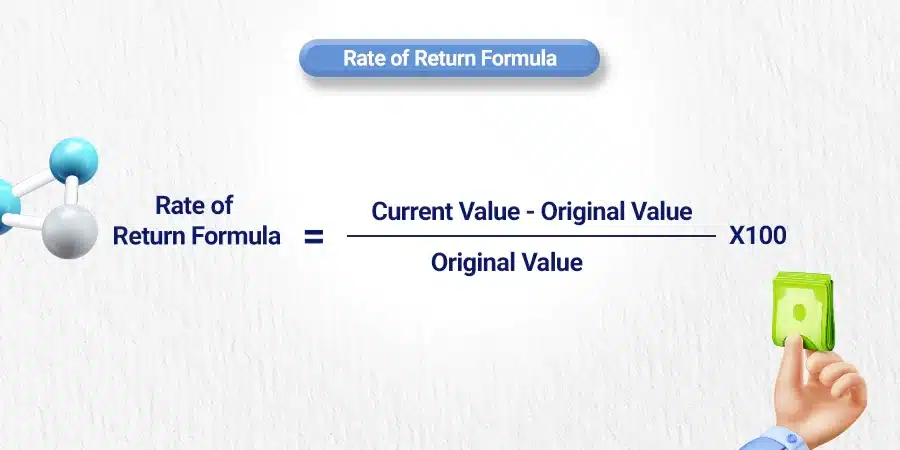

Calculating the total rate of return on an account or individual position

To determine the total rate of return on an account or individual position, you need to consider both the capital gains and losses over a specific period of time.

Start by subtracting your initial investment from the current value of the account or position.

Then, divide that difference by the initial investment amount. Multiply this figure by 100 to express it as a percentage.

This calculation allows you to see how well your investment has performed, taking into account any income earned and capital appreciation or depreciation.

By calculating the total rate of return, you can assess whether your investments are meeting your financial goals and make informed decisions for future investments.

Understanding Returns by Asset Class

The S&P 500 has a long-term average rate of return, and different asset classes have varied historic returns over the past 20 years.

The long-term average rate of return for the S&P 500

The S&P 500 is a widely recognized index that represents the performance of 500 large companies listed on stock exchanges in the United States.

Over the long term, it has shown strong historical returns.

While past performance is not indicative of future results, analyzing the average rate of return for the S&P 500 can help investors understand its potential for long-term growth.

This information can be valuable when projecting retirement plans and determining an appropriate rate of return to consider for long-term investments in your portfolio.

Historic returns for different portfolios

In retirement planning, it is crucial to understand historic returns on different portfolios, as this data can guide us in setting realistic expectations for potential future returns.

Portfolio Type | Historic Returns |

100% Stocks | 7-10% |

60% Stocks/40% Bonds | 6-9% |

50% Stocks/50% Bonds | 5-8% |

40% Stocks/60% Bonds | 4-7% |

100% Bonds | 3-6% |

As a guideline, the 4% rule is often used in retirement planning. This rule assumes a portfolio composition of 50% stocks and 50% bonds and takes into account inflation. The 4% rule suggests a high probability of not outliving one’s money during a 30-year retirement.

However, individual circumstances such as health, life expectancy, and access to other resources should be considered in retirement planning.

The asset allocation, including a mutual fund, stocks, bonds, and cash, can impact the portfolio’s ending balance and initial withdrawal rate.

It’s also critical to update and adjust personalized spending rates regularly for retirement planning. Historical market returns are used to calculate a sustainable withdrawal rate, which should be regularly reviewed and adjusted as necessary.

Understanding historic returns for different portfolios can help in maximizing your real rate of return for retirement.

Sometimes historic rates of return are reported as a compound annual growth rate (CAGR).

20-year averages by some asset classes

The 20-year averages by different asset classes can yield differing results which are important to consider when planning for retirement. Here’s a snapshot of the estimated returns for some common classes:

Asset Class | 20 Year Average Annual Return |

Stocks | 7% |

Bonds | 5% |

Cash and Cash Equivalents | 3% |

Treasury Inflation-Protected Securities (TIPS) | 3.5% |

These averages are not fixed and vary based on numerous factors, including market performance, inflation, and global economic conditions.

Thus, it’s crucial for investors to stay updated, understand their investment options and make informed decisions.

Utilizing tools like a stock simulator can be a good way to practice and understand how different asset classes perform over time.

Furthermore, gaining education about portfolio management and various asset class can be beneficial.

This will help in striving for the highest possible rate of return for each specific asset class to maximize your retirement savings. Always remember past performance is not indicative of future results; however, they can serve as a guide in planning.

The Impact of Inflation on Rate of Return

Inflation can significantly affect your rate of return, reducing the purchasing power of your retirement savings over time.

Discover how to adjust your portfolio for inflation and maximize your real rate of return for a secure retirement.

Read more to understand the impact of inflation on your investments.

Determining your personal inflation rate

To determine your personal inflation rate, consider the following factors:

- Compare prices over time: Monitor the prices of goods and services that you frequently purchase. Look for trends or increases in price to get an idea of the inflation rate for those specific items.

- Track your expenses: Keep a record of how much you spend on various categories such as housing, groceries, transportation, and healthcare. This will help you understand where your money is going and how it may be affected by inflation.

- Research national inflation rates: Stay informed about the national inflation rate published by official sources such as the Bureau of Labor Statistics. While this may not reflect your personal experience exactly, it can give you a general idea of what is happening in the economy.

- Adjust for regional differences: Inflation rates can vary by region or city due to factors like supply and demand dynamics and local economic conditions. If you live in an area with higher costs of living, you may need to account for these differences when calculating your personal inflation rate.

- Consider lifestyle changes: Changes in your lifestyle or spending habits can impact your personal inflation rate. For example, if you start buying more expensive brands or upgrade to a bigger house, your personal inflation rate may be higher than average.

How inflation affects different asset classes

Inflation can have a varied impact on different asset classes, influencing their overall returns and value over time.

Asset Class | Impact of Inflation |

Stocks | Stocks tend to beat inflation over the long term as businesses can generally raise stock prices to compensate for increased costs. However, high inflation can be detrimental to growth stocks as it might hinder overall economic growth. Dividend stocks can suffer when inflation is rising since the value of the dividends might not keep pace with the rate of inflation. |

Bonds | Investors may demand higher yields to compensate for expected inflation, resulting in falling bond prices. However, Treasury Inflation-Protected Securities (TIPS) are designed to increase in value as the Consumer Price Index (CPI) increases, offering some level of protection against inflation. |

Cash and Cash Equivalents | Inflation erodes the purchasing power of cash over time, making it a less attractive asset during periods of high inflation. However, if interest rates rise in response to inflation, the yield on cash and equivalents like money market funds could increase. |

Adjusting Your Portfolio for Inflation

Adjusting your portfolio for inflation is a crucial step in ensuring that your retirement savings continue to grow and provide sufficient income.

Inflation erodes the purchasing power of your money over time, so it’s important to make adjustments to combat its effects.

One way to do this is by investing in assets that historically perform well during inflationary periods, such as real estate or commodities like gold.

Additionally, you can consider increasing your asset allocation to stocks, which have historically outperformed other asset classes over the long term.

By regularly reviewing and adjusting your portfolio for inflation adjusted return, you can help protect the value of your investments and maintain a steady stream of fixed-income securities throughout retirement.

Maximizing Your Real Rate of Return for Retirement

Maximizing Your Real Rate of Return for Retirement

To maximize your real rate of return for retirement, consider investing in a mix of stocks, bonds, and cash equivalents based on your risk tolerance and investment goals.

Stocks

Stocks are an important component of any investment portfolio. They offer the potential for high returns over the long term but also come with a higher level of risk compared to other assets like bonds or cash equivalents.

When investing in stocks, it’s crucial to consider your risk tolerance and time horizon. By diversifying your stock holdings across different sectors and companies, you can help mitigate some of this risk.

It’s also important to regularly assess and adjust your stock investments based on changing market conditions to ensure that they align with your investment goals and objectives.

Bonds

Bonds are an important component of retirement planning. They offer a more conservative investment option compared to stocks, providing stability to your portfolio. The 4% rule, a commonly used strategy in retirement planning, assumes a 50% asset allocation to bonds.

However, it’s important to consider the impact of taxes and investment fees associated with bond investments when determining your overall rate of return.

Historical market returns are used as a basis for calculating sustainable withdrawal rates, which include returns from bond investments.

Keep in mind that future returns on bonds may be lower than long-term averages, potentially affecting your retirement plan over time.

When considering bonds in your portfolio, it’s crucial to assess their performance and adjust accordingly based on your individual financial goals and tolerance of risks.

Savings in Cash and Cash Equivalents

Savings in cash and cash equivalents play a crucial role in retirement planning. Cash reserves provide a safety net for unexpected expenses and serve as a source of liquidity during the market downturn.

By maintaining an adequate amount of cash, retirees can avoid selling investments at unfavorable times and preserve their portfolio’s long-term growth potential.

Additionally, having readily available funds allows retirees to meet short-term financial goals without relying solely on investment returns.

It is important to strike the right balance between cash reserves and long-term investments to maximize the real rate of return and ensure financial security throughout retirement.

Conclusion

In conclusion, determining the rate of return for retirement planning is a crucial factor in ensuring a secure financial future.

It is important to consider factors such as time horizon, balanced portfolio composition, and confidence level in your financial plan.

By understanding average rates of return, adjusting for inflation, and maximizing your real rate of return through strategic investment choices, you can better prepare yourself for a comfortable retirement.

Working with a certified financial planner can also provide valuable guidance and expertise in navigating the complexities of retirement planning.

FAQs

When determining the rate of return for retirement planning, it is important to consider your age, tolerance of risks, investment portfolio, and financial goals. These factors will help you determine an appropriate rate of return that aligns with your individual circumstances.

To estimate a reasonable rate of return for your retirement investments, you can look at historical market returns and consult with a certified financial planner. It is important to note that past performance does not guarantee future results, but analyzing historical data can provide insights into potential returns.

A realistic rate of return for retirement planning varies depending on individual circumstances and market conditions. Generally, the financial advisor suggests aiming for an average annualized return between 5% and 8% over the long term. However, it is crucial to adjust your expectations based on factors like inflation and economic trends.

The choice between using a conservative or aggressive rate of return depends on your tolerance of risk and time horizon until retirement. If you have several years until retirement and are comfortable with higher levels of risk, an aggressive approach may be suitable. However, if you prefer more stability and preservation of capital, a conservative approach may be more appropriate.