Being a smart investor, you already have made SIP a part of your investment portfolio. And why not?

SIP is a smart and proven way to invest in the stock market without worrying about timing the market. With SIP, your value of investments gets compounded, your dollar cost gets averaged, you inculcate disciplined savings and your money is in the hands of experts who know how to invest it wisely.

It’s a win-win situation! But what if your financial priorities change or you face unexpected expenses? You may want to stop your SIP to hold onto your money.

Alternatively, if you come across other investment opportunities or your strategy changes, you may want to rethink your existing SIP.

While there are no losses in stopping your SIP, you may miss out on the benefits of accumulating units over time. Let’s explore what happens when you stop your SIP.

What Does Stopping SIP Actually Mean?

Well, stopping a SIP simply means discontinuing the regular, periodic investments that you were making into a mutual fund through the SIP. In other words, you’ll no longer be contributing a fixed amount at predefined intervals (monthly, quarterly, etc.) to accumulate units of a mutual fund.

So, if you’re thinking about stopping your SIP, keep in mind that you’ll be taking a break from your investment journey.

Don’t Fret Over SIPs Invested or Cancellation Charges

The invested amount doesn’t disappear or get forfeited! Also, there are no penalties for stopping an SIP. But It can disrupt the rhythm of cost averaging.

The money invested in the SIP has already been used to purchase mutual fund units. These units remain in your bank account even if you stop making further contributions. The value of your existing units will continue to fluctuate based on the performance of the underlying securities in the mutual fund.

If the market goes up, the value of your funds units increases, and vice versa. The performance of your overall portfolio will be influenced by the existing units.

The returns will depend on how well the mutual fund SIP performs in the market. You have the choice to either redeem (sell) the existing units if you need the funds or continue holding them for potential future growth.

Remember that stopped or missed SIP installment doesn’t impact the units already purchased; it simply means you’re not adding more units through regular contributions.

Also Read: 10 Best Options for Risk-Free Returns

To Stop or to Pause, that is the Question

So, if you’re thinking about stopping your Systematic Investment Plan (SIP), it basically means you’re putting a halt to your regular contributions to the investment plan. This could be a permanent decision, which would require you to either redeem your existing units or just hold onto them without adding any more.

But if you’re looking to take a break from contributing for a little while, then pausing your SIP is the way to go.

This means you can take a temporary break from contributing, but your existing units will still be there when you’re ready to jump back in and restart contributing again.

Re-Think – Is it Necessary to Stop Ongoing SIPs?

SIPs – they’re a great way to build your wealth over time and reach your long-term financial goals. Plus, if you’re a high-net-worth individual, SIPs are a convenient way to diversify your investments and spread out your risk.

But here’s the thing – if you stop your SIPs, you could miss out on some serious opportunities. The financial markets are always changing, and by not investing regularly, you might miss out on chances to capitalize on market fluctuations.

By sticking with your SIPs, you can benefit from both market highs and lows and smooth out the impact of volatility. Plus, SIPs help you avoid or cancel market timing errors that could hurt your overall returns.

So, if you’re a mature investor who values financial discipline, SIPs might be just what you need to preserve and grow your wealth consistently.

How’s it Affecting Your Goal Planning

Stopping an SIP might have implications for the achievement of your financial goals if they were aligned with the SIP. It’s advisable to reassess your goals and the value of the investment strategy periodically.

The decision to stop the SIP should be made based on a careful consideration of your personal finance objectives, market conditions, and any changes in your personal circumstances.

If uncertain, seeking advice from a financial advisor is recommended.

Not Fully Aware of How SIP Works? Here’s an Example

Let’s say, an investor named Alex starts a monthly SIP of $100 in a mutual fund scheme. In the first month, the NAV (Net Asset Value) of the fund is $20, allowing Alex to purchase 5 units of the mutual fund ($100 / $20 = 5 units).

Now, in the second month, due to market fluctuations, the NAV decreases to $10. With the same $100 investment, Alex can now buy 10 units of the mutual fund ($100 / $10 = 10 units).

In the third month, the NAV rises to $15. Now, with the same $100, Alex can buy approximately 6.67 units of the mutual fund ($100 / $15 = 6.67 units).

If we calculate the average cost per unit over these three months, it would be: Average Cost = Total Investment / Total Units.

1. For the first month: $100 / 5 units = $20 per unit

2. For the second month: $100 / 10 units = $10 per unit

3. For the third month: $100 / 6.67 units ≈ $15 per unit

The average cost per unit over these months is approximately $15.83. Despite market fluctuations, Alex’s SIP allows them to buy more units when prices are lower and fewer units when prices are higher, leading to a lower average cost per unit over a period of time.

This is the essence of Dollar-Cost Averaging, helping many investors navigate market volatility and potentially benefit from lower average costs.

Want to know about Systematic Investment Plans (SIPs) returns?

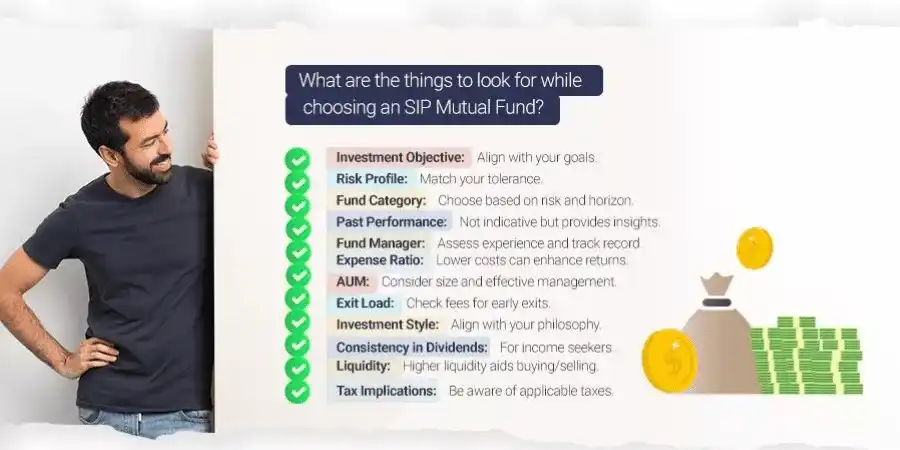

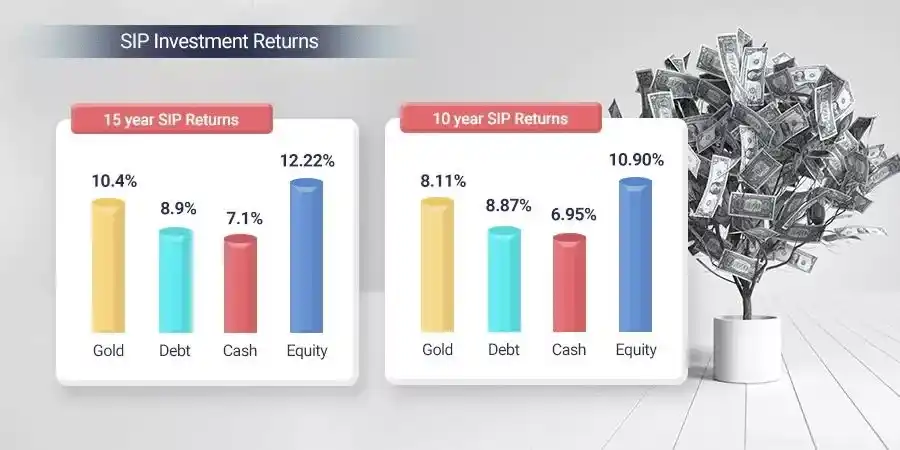

The chosen mutual fund, market conditions, and investment horizon determine returns.

Equity SIPs offer higher returns over the long term with an average annual return of 12% to 15%. Debt SIPs are more conservative and offer lower returns ranging from 6% to 9%. Keep in mind that SIPs are created for long-term wealth creation, so market dynamics may cause fluctuations in the short term.

Past performance is not a guarantee of future results, so aligning your SIP investments with your financial goals and risk tolerance is crucial for a well-rounded and informed investment strategy.

Parting Thoughts

Stopping your SIP is a decision that requires careful consideration. Before hitting the brakes, carefully assess your financial goals, market dynamics, and potential repercussions.

Remember, the key to sustained financial growth often lies in the commitment to a systematic and disciplined investment approach. Due to insufficient funds, life events, or changing priorities may necessitate a temporary break, understanding the potential long-term impacts may require you to rethink your decision.

Keep in mind the power of compounding and the disciplined approach SIPs offer for sustained wealth creation. Whether it’s a brief pause or stop investing in mutual funds SIPs, align your investment decisions with your broader financial goals for a prosperous and secure financial future.