If you’re considering dipping your toe into the world of alternative investments, there’s a lot to learn. These assets, from commercial property and private equity to cryptocurrencies and collectibles, offer an exciting variety beyond traditional stocks and bonds.

This blog is here to guide you through the process, of unpacking these complex investing options into easily digestible pieces. Prepared for your financial journey? Let’s dive in!

Key takeaways

● Alternative investments are things like art, real estate, and cryptocurrency. They can help spread risk in your money plan.

● You need to give personal details and some cash to start investing on a platform. Each one asks for different amounts of money.

● ETFs let you buy alternative assets with less cash than buying full shares. Some types follow the prices of gold or oil, others take care of risks for you.

● Alternative assets can bring more profits but also higher losses than stocks or bonds. So, think about your goals and how soon you will need your money before picking these kinds of investments.

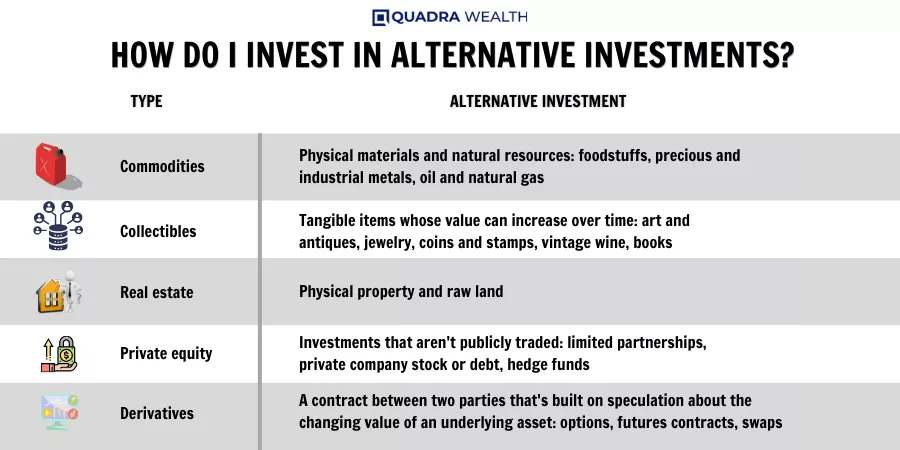

Understanding Alternative Investments

Alternative investments are not like stocks and bonds. They come in many forms. Some of these include real estate, wine, gold and silver, cryptocurrency, hedge funds, private or distressed debt, private equity or venture capital, hedge funds, managed futures, art and antiques, and derivatives contracts. Many alternative investments have high minimum investments and fee structures, especially when compared to mutual funds and exchange-traded funds (ETFs). These investments also have less opportunity to publish verifiable performance data and advertise to potential retail investors. Although alternative assets may have high initial minimums and upfront investment fees, transaction costs are typically lower than those of conventional assets due to lower levels of turnover.

These options started to get popular after the financial crisis in 2008.

They can behave differently than traditional long-only investments like stocks and bonds. That means when stock prices go down, alternative investments may not follow suit – they move in their own way. This is because they do not have a positive correlation with regular stocks and bonds.

So if you put some into your investment mix it can help spread out risk.

Comparison: Alternative Investments vs Stocks

Alternative investments and stocks offer a wide range of benefits and risks to investors. Here’s a quick comparison of the two:

| Alternative Investments | Stocks |

Liquidity | Alternative investments usually have lower liquidity. This may make it harder to sell your investments quickly. | Stocks offer high liquidity. You can easily buy or sell shares anytime the market is open. |

Fees | These investments can come with higher fees. Private equity and hedge funds, for example, typically have high management and performance fees. | Stocks generally have lower fees. This is especially true if you’re investing through low-cost index funds or ETFs. |

Minimum Investment | Alternative investing platforms have different minimum investment requirements, which can be high in some cases. | Many brokerage accounts allow you to buy stocks with no minimum investment. |

Correlation | Alternative investments offer a negative correlation to traditional stocks and bonds, providing a way to diversify your investment portfolio. | Investing in stocks is correlated with the overall health of the economy. Stocks tend to rise when the economy is doing well. |

In summary, while alternative investments can offer diversification and potentially high returns, they come with risks like lower liquidity and high fees. On the other hand, stocks offer easy access, liquidity, and lower fees, but are more directly tied to the economy’s performance.

How to Purchase Alternative Investments

Buying alternative investments is a straightforward process. Here are the steps:

- Start by choosing what type of alternative investment you want. This could be art, private real estate, or something else.

- Find a platform that lets you buy your chosen investment. Crowdstreet and Fundrise are good for real estate. For art buying, try Masterworks.

- Open an account with your chosen platform. You will need to give some personal details.

- Decide how much money you want to put into your new investment.

- Use your funds to buy the investment on the platform.

What You Need to Open an Alternative Investment Account

To open an alternative investment account, you’ll need to provide personal information such as your government-issued ID and banking info, and meet the platform’s minimum deposit requirements.

Personal Information Requirements

To start with alternative investments, you need to give some personal data. The details needed may vary but often include:

- Your full name.

- Your home address.

- Your birth date.

- Your Social Security number.

- An ID proof like a driver’s license or passport.

- Proof of your address like a bank note or power bill.

- How much money do you make every year?

- Details on your net worth, that is the total of what you own minus what you owe.

Minimum Deposits

You need some money to start investing in alternative assets. The bonds and cash you need may be small or large. Different platforms ask for different amounts from $10 and upward. Some might want thousands of dollars at the start.

But, all will say how much they want before you open an account with them. This is known as a minimum deposit. It’s smart to know what this amount is on any platform you think about using for your investments.

Best Platforms for Alternative Investments

Here are some top spots for buying alternative investments:

- Fundraiser: This platform lets you invest in real estate.

- Yieldstreet: Here you can put money into different asset types like art, real estate, and shipping vessels.

- Crowdstreet: Another site for real estate investing but only accredited investors can use it.

- Masterworks: The place to go for investing in fine art.

- iTrustCapital: This is the spot for dealing in cryptocurrency for your retirement account.

Gaining Exposure to Alternative Investments Through ETFs

ETFs are useful in the world of alternative investments. You can buy them from regular investment brokers or investing apps. They grant access to different types of alternative investments.

Many investors choose ETFs for their ease and simplicity. This is because you do not need a lot of money to start buying them. Also, they offer cash flow and price stability just like owning full shares.

One type of ETF is a commodity investment one that follows gold, silver, oil prices, etc. There are also managed ETF types that take care of things like risk balance or merger plans for you.

Pros and Cons of Alternative Investments

Alternative investments offer unique benefits and drawbacks that investors should consider before deciding to include them in a diversified portfolio. Understanding these pros and cons can help in making informed investment decisions.

- Alternative investments can offer lower correlations with stocks and bonds, which can help diversify a portfolio and minimize volatility.

- They provide the possibility of higher returns, potentially outperforming traditional investment types in certain market conditions.

- More accessibility to smaller investors is now possible through crowdfunding platforms, funds, and managed ETFs.

- Certain alternative investments, such as private equity and private debt, can be exclusively for accredited investors, providing access to opportunities typically reserved for institutional investors.

- Alternative investments can come with higher risks compared to traditional investments, with the potential for significant losses.

- Some alternative investments are not regulated by the Securities and Exchange Commission (SEC), which can limit investor protections.

- Alternative investments can have long lock-up periods, meaning the investment could be illiquid for several years.

- Investors may face potentially excessive fees, particularly with hedge funds and private equity funds, which could erode returns.

Considerations When Investing in Alternative Assets

Before diving into alternative investments, you must consider key factors such as your financial objectives, liquidity needs, and time horizon to ensure that the chosen investment aligns with your overall financial strategy.

Objectives

Alternative assets have clear goals. They can help make more money and lower bumps in the market. Real estate can keep income safe during times when costs go up. Also, hedge funds and real stuff like gold or art can bring different types of returns to a portfolio.

It means they don’t all move in the same way at the same time. Private credit and private equity investments offer chances for higher returns too. But these come with more risks than stocks and bonds.

Liquidity

Liquidity means how easy it is to buy or sell a financial asset. Stocks are more liquid assets than alternative assets. You can sell stocks fast and get your money. But, many alternative investments are not like that.

They lock your money for a long time before you can take it out. This is called the ‘lock-up period’. It’s important to think about liquidity before putting money in different asset classes.

Time Horizon

Your time frame matters a lot in alternative investing. Longer plans work best for these types of tangible assets. Different investments need different lengths of time to grow. Some might take months, others may take years.

A long-term outlook can help your money grow more. It also lowers the risk that comes with short-term market changes. You should think about how soon you will need the private funds before deciding where to invest it.

Diversifying Your Portfolio with Alternative Investments

Adding different types of investments to your list can help spread risk. This is called diversification. You reduce the chance of losing a lot if one type goes down in value. Alternative investments can give your portfolio this balance.

Right now, most people only have stocks and bonds in their portfolios. But you do not want all your eggs in one basket! Adding things like art or private equity can give you more safety.

Also, these kinds of investments don’t follow the stock market’s ups and downs as much.

Another good reason to add alternatives is for higher returns than traditional ones offer over time. For instance, cryptocurrency has grown fast recently! So think about your money goals when picking what to invest in next.

Types of Alternative Investments

Dive into the diverse world of alternative investments, exploring a spectrum from private equity and private debt to commercial property and cryptocurrency; each offering unique investment angles.

Keep reading as we delve deeper into these various types and how they can potentially enhance your portfolio’s performance.

Private equity

Private equity means you invest in companies that do not trade stocks on the public market. Big firms get money from investors to buy a large part of these kinds of companies. They aim to boost the value of their private companies over time.

Then they sell it for profit. These investments often earn more than stocks or bonds, but there’s a catch: your money is locked up for a long time and can’t be pulled out quickly.

Private debt

Private debt is a type of alternative investment. It means giving money to private firms or people who need it. This cash can be for many things like helping small businesses or paying for real estate.

Private debt can bring in big returns and also make your investments diverse. However, these investments are usually not easy to sell quickly and take a lot of time compared to usual fixed-income investments such as bonds.

Commercial property

Commercial property is a form of alternative investment. It does not move just like stocks and bonds. This can give more wins to the investor. Little cash buyers can buy commercial property too.

They can use crowdfunding sites, funds, or managed ETFs for this task. To do that, they start an account on an app or a stand-alone firm. Commercial property also adds more variety to an investor’s list of different kinds of asset classes.

These may include art items, hedge funds, and private equity among others.

Cryptocurrency

Cryptocurrency is a type of alternative investment. This includes popular ones like Bitcoin and Ethereum. It’s different from stocks because they may change prices fast, cost varied fees, and you can put in as much money as you want.

Due to crowdfunding platforms, funds, and managed ETFs, even small investors can now get into this field. But be careful! It often takes special skills to find cryptocurrencies that will hold or grow their worth over time.

How to Find Alternative Investment Opportunities

It can be tricky to find alternative investment opportunities. Here are some ways to do it:

- Look up crowdfunding platforms: These sites offer a variety of unique investments. They gather money from many people to fund a project or venture.

- Use peer-to-peer lending: This is online lending without a bank. You lend your money to others and they pay you back with interest.

- Find reliable brokers: Brokers who know about alternative private markets can help you find good deals.

- Join investment clubs: These are groups that pool their money to make big investments.

- Consider Real Estate Investment Trusts (REITs): REITs allow investing in real estate without having to buy property.

- Try managed ETFs and Commodity ETFs: These funds give exposure to different asset allocation types like gold, silver, or oil.

- Look at Masterworks or Yieldstreet sites: These websites offer chances to invest in art and private debt.

- Use Fundrise and Crowdstreet for real estate options: These platforms let you invest in property developments

- Think about cryptocurrency with iTrustCapital: Cryptocurrency is a new type of digital investment

- Explore secondary markets for pre-IPO shares: This allows buying shares of companies before they go public

- Check out hedge funds: Although risky, these funds aim for high returns

- Research Private Equity Firms: Such firms buy and improve companies for profit

Understanding Risk in Alternative Investments

Alternative investments can be risky. These risks come from many places. You might not know a lot about the private investment. The value may change quickly in ways you did not expect. Some alternatives, like art or wine, might get damaged or lost.

Also, alternative investments don’t have as many rules as regular stocks and bonds. This means there are fewer safety nets if things go wrong. It’s hard to pull your money out fast because these assets often lack liquidity.

Plus, fees can be high which eats into your returns.

There is also something called the lock-up period for alternatives like private equity or hedge funds where you cannot sell for a set amount of time.

Know that risk is part of investing but good planning and understanding of what you’re investing in – makes managing those risks easier.

How Alternative Investments Can Benefit Investors

Alternative investments can be good for your money. They offer a chance to earn more than with stocks or bonds. Because they don’t follow the same path as these usual options, they offer a shield when markets go bad.

This means you could still make money even if stock market prices fall.

Investing in alternative assets tends to bring better returns too. Assets like gold, silver, art, and real estate often grow more over time than stocks or bonds. Plus, fewer people invest in these which gives you an edge! So not only do alternative investments protect your money but they also have big earning potential.

Conclusion

Putting money in different types of assets is a smart move. You can buy real estate, art, gold, or even Bitcoin! This way you protect your money and make more out of it. Always remember to be careful and learn as much as you can before buying anything new.

FAQs

Alternative investments are a type of investment strategy away from traditional assets like quoted equities. They can include private and distressed debt, merger arbitrage, fixed-income bonds, and even bitcoin strategy.

You first need to open an Alternative Investing Account or Investment Brokerage Account. Then you can pick your investment choices and get investment advice based on risk tolerance and return potential explained by your financial advisor.

Yes, like all financial markets, there is always some level of risk involved in alternative investments too! To lessen the chances for losses, a careful risk assessment should be done before making investment decisions in these alternative asset classes.

While no forms of private investments – offers guaranteed rewards; many investors find that using a diverse mix of strategies including commodity-indexed trust and market-neutral ETFs helps boost their investment performance and balance risks.

The impact on your tax reporting will depend on the nature of your investments but investing through certain types of qualified accounts might provide some tax benefits.

Sure! Besides portfolio diversification and potentially higher investment returns; they could offer access to less liquid alternatives of the market providing unique opportunities for capital appreciation.

Some investors seek out alternative investments because they have a low correlation with the stock and bond markets, meaning that they maintain their values in a market downturn. Also, hard financial assets such as gold, oil, and real property are effective hedges against inflation. For these reasons, many large institutions such as pension funds and family offices seek to diversify some of their holdings in alternative investment vehicles.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way