Are you grappling with the complexities of financial derivatives and how they can factor into your investing strategy?

The reality is, that these instruments are more than just obscure financial jargon – they’re contracts that hinge on an underlying asset like a stock or commodity.

This blog post will break down the types of derivatives, their pros and cons, as well as essential considerations to bear in mind before diving in.

Ready for a crash course on smart investing with financial derivatives? Let’s dive right in!

Key takeaways

●A financial derivative is a financial instrument based on an asset's price change. They include futures, forwards, swaps, and options.

●Derivatives help control risk, allow more access to assets, and boost potential gains.

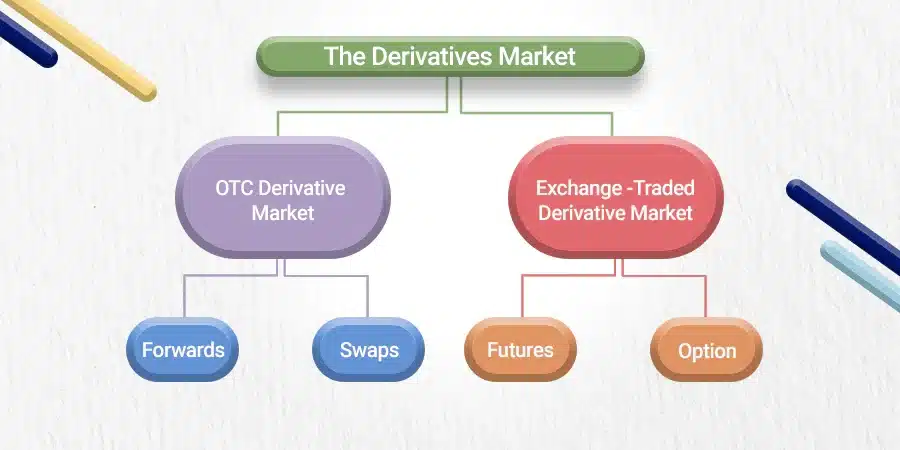

●Trading of derivatives happens in two places: exchanges or over-the-counter (OTC).

●But there are risks with derivatives like wrong value guess, quick market changes or other party not doing their job.

What Are Financial Derivatives

Financial derivatives are like deals or trades. They get their value from something else called an underlying asset. This asset can be a stock, bond, currency, or even a market index.

People use these contracts to make bets on how the price of the underlying asset will move.

There are two places where people trade financial derivatives. One is on an exchange and the other is over-the-counter (OTC).

When traded on an exchange, everything about the contract is fixed except for its price

.

In OTC trades, two parties set up their own terms for buying and selling.

Types of Financial Derivatives

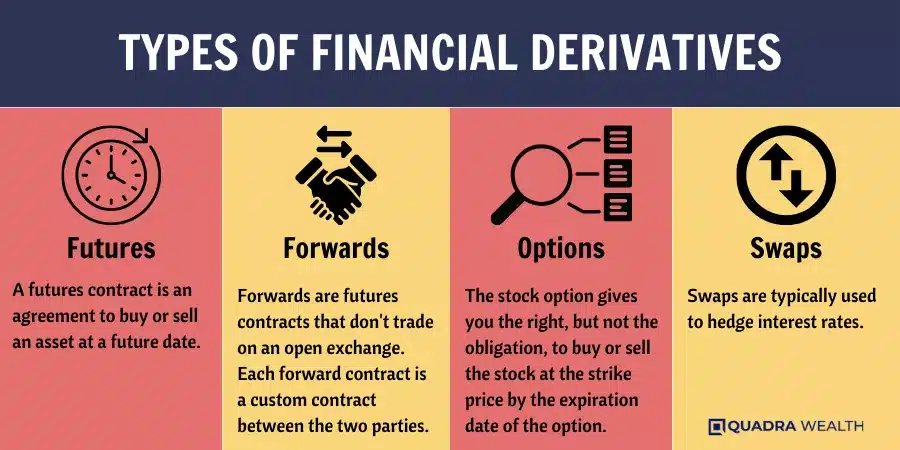

Financial derivatives come in various forms such as futures, forwards, swaps, and options. Futures are contracts to buy or sell an asset at a predetermined price on a specific future date.

Forwards offer the obligation to buy or sell an asset at set terms but with flexibility in execution timing. Swaps allow parties to exchange sequences of cash flows for different investment types.

Lastly, options grant buyers the right – not the obligation – to transact an underlying asset while sellers take on the duty should option owners exercise their rights.

Futures

Futures are like a bet on prices. People use them to guess if the cost of goods will go up or down. These guesses are written as contracts. In these contracts, people agree to buy or sell things at a set price in the future.

Traders deal in futures on an exchange market. This is a place where buyers and sellers meet to do business. Futures can be about many types of assets, not just money.

They could also involve items like oil, wheat, or even gold! Over time this allows traders to control risk and possibly make more profit.

Forwards

Forwards are deals you make today for later. They commit you to buy or sell an item at a set price in the future. People use them to guard against big price changes.

This is called hedging. For example, an airline might use forwards to lock in fuel prices and avoid surprises.

But unlike futures, they’re not standard and don’t trade on exchanges like stocks do. Instead, they trade over-the-counter (OTC).

This means they’re less liquid and harder to value than futures.

Swaps

Swaps are a kind of financial deal. They let people switch cash flows. This is often linked to things like money values, goods, or credit risks.

You can trade swaps in two ways: over the counter (directly between two parties) or on exchanges (where many people buy and sell).

People use swaps to manage changes in interest rates or money value. But some also use them to try and make money from these changes. Swaps may be simple or hard depending on what they involve.

Options

Options are a kind of financial derivative. They are contracts that give the buyer the right to buy or sell an asset at a fixed price in the future, but they don’t have to do it. There are two types of options: American and European.

American options let you use your contract any time before it ends. But with European ones, you can only use your contract on its end date.

You can also gain from selling these contracts or protect yourself against loss by buying them. The value of these contracts can shift based on how much money the base asset is worth and what’s going on in the market.

Each contract has an expiration date too, which means they don’t last forever!

How Financial Derivatives Work

Financial derivatives function as a contract between two or more parties based on the future price movements of an underlying asset, enabling investors to hedge risks, leverage their investments, gain access to various assets without owning them directly, customize contracts to suit specific investment strategies and earn income through speculation and arbitrage.

Hedging

Hedging is a tool used in financial derivatives. It helps protect against risk. For example, you have an item that might drop in price.

To keep its value, you would use a futures contract. This locks the price at a set rate for some time to come. Say there’s fear that loan interest rates will go up.

You can switch from having a loan with changing rates to one with stable rates using swaps. This way, hedging guards your money during times of change or doubt.

Leverage

Leverage in financial derivatives lets you use less money for more gain. Look at it as a tool to boost your buying power. Instead of putting down the full price, you borrow funds from brokers or investors.

This is called buying on margin. Leverage also brings bigger risk and reward scenarios with it. The goal here is to earn high profits by paying little money upfront.

But, if market conditions take a bad turn, losses can pile up fast too!

Access to assets

Derivatives let you reach assets that are tough to get. These financial contracts form a link to the asset’s price, not the asset itself.

So, they can open doors to assets in far places or big markets where buying directly is tricky or costly.

Look at a stock option as an example here. It lets you control a lot of shares with a small amount of money upfront. Derivatives offer this access without needing the full cost of the asset up front from you!

Customizability

Customizability sets financial derivatives apart. This feature allows buyers and sellers to shape the terms of their deal. They can add new parts or change the ones there.

Maybe they want to limit certain risks of derivatives or aim for gains in some markets. This way, they make a contract that matches their plans.

Making custom derivates is not hard either. Parties involved can tweak different features of this contract with ease. It turns into a tool that suits all their needs best!

Income

You can make money with derivatives. They let you guess how the price of an asset will change. This can lead to more income.

If you buy an option contract, you have the right to buy or sell later at a set cost. If your guess is right, this might give you more money too.

Many kinds of products in the market help build income based on what you want and how much risk you can take. Derivatives also help lock prices so that changes in rates don’t hurt your earnings.

Sometimes, people buy them on margin, which means they borrow money to invest more and potentially earn bigger profits.

Pros and Cons of Financial Derivatives

This section will delve into the advantages and disadvantages of financial derivatives, exploring aspects such as risk management, cost-effectiveness, increased leverage, and potential for significant returns while carefully considering drawbacks like complexity, potential for substantial losses due to leverage and exposure to systemic risks.

- Derivatives offer many upsides. They can be used to handle risk or bet on the price change of a key asset. With derivatives, traders can set firm prices and protect against unfavorable rate shifts.

- They open up access to many more assets without heavy costs because they are often bought with borrowed money, known as margin trading. This makes them less costly but also increases risk and reward potential at the same time.

- The range of derivative products continues to grow, offering choices for different needs and levels of risk tolerance from investors around the globe.

- Derivatives can be risky. One big risk is called "counterparty default". This happens when the other party in the deal does not do what they said they would. For example, the other party might fail to pay money they owe.

- This is hard to predict and value.

- Another problem with derivatives is that they are hard to understand. The price of a derivative changes as per another asset's price, which also keeps changing. Even if you know about markets, it's tough to get correct values for derivatives.

- Market risks affect derivatives quite a lot as well. Sometimes market moods change fast without any warning; these quick swings can impact your investment in a bad way.

Special Considerations in Financial Derivatives

This section will delve into specific factors to bear in mind while dealing with financial derivatives, including effective risk management practices and strategic investment actions for maximizing potential gains.

Risk Management

To manage risk in financial derivatives, you need a good plan. This plan helps to control the possible loss that can happen.

It includes steps like checking how much money is at risk and making sure it’s not too much. The aim of this plan is to prevent big losses from taking place.

This type of management also deals with controlling other risks, such as changes in the market or issues between two parties who’ve agreed on a trade deal.

Investment Strategies

Investment strategies use derivatives to manage risk. They let you bet on price moves without owning assets. Some people use them to protect against loss, others for making more money.

You can lock in a future price with futures and forwards. Options give the choice but not the duty to buy or sell at a set cost. Swaps exchange one cash flow type for another kind.

The strategy depends on what you hope will happen and how much risk you want to take on.

The Derivatives Market

In the derivative market, a wide range of participants such as professional traders, financial institutions and individual investors trade contracts to manage risk or speculate on changing conditions.

These trades can occur in two main platforms – exchange-traded derivatives markets and over-the-counter (OTC), which is essentially a broker-dealer network.

Exchange-traded derivatives are standardized contracts traded on an organized futures exchange like Chicago Mercantile Exchange (CME), while OTC derivatives are customized contracts that trade informally amongst financial firms and commercial enterprises.

Participants in the derivatives market

There are many players in the derivatives market. Each one plays a key role.

- Big financial firms: They make trades to manage risk, guess on future prices or seek to profit from price changes.

- Individual investors: They use derivatives to hedge or offset possible losses in their investment accounts.

- Market makers and traders: They keep the market moving smoothly by buying and selling.

- Financial centers around the world: They host exchanges and trading platforms for these complex financial contracts.

- Groups that watch over the market: These include regulatory bodies like the Securities and Exchange Commission (SEC) in the United States.

Exchange-Traded Derivatives

Exchange-traded derivatives are contracts bought and sold on public markets. This type of trading happens through a clearinghouse. That means both parties tell the exchange what they’re doing.

This lessens the chance that one party won’t hold up their end of the deal, called counterparty risk. The clearinghouse also steps in to take on financial risks from its clients, which cuts down more counterparty credit risk for transacting parties.

Plus, there are lots of rules around this kind of trading which makes it safer than other types.

Conclusion

Financial Derivatives are crucial tools in finance. They help manage risk and allow for more investment openings. This makes them great fit for diverse needs and risk levels.

Yet, they can be risky if not used with care.

FAQs

Derivatives are powerful financial contracts whose value is linked to the value or performance of an underlying asset or instrument and take the form of simple and more complicated versions of options, futures, forwards, and swaps.

With a derivative contract, you hedge against risk in the markets, such as exchange rates or interest rate swaps. They let you lock products at fixed values for set time periods to protect against price changes.

Yes! Derivatives can use various assets including market indexes, commodities like West Texas Intermediate (WTI) oil futures contracts or even cryptocurrencies like Bitcoin (BTC) and Ether (ETH).

No! While many trades on spot markets where asset delivery is immediate, others like bond options and currency swaps have forward delivery at a future date.

Yes! Trading derivatives carries investment risk due to margin calls or sudden price decline in the underlying security caused by factors such as supply-demand changes or macroeconomic issues.

Absolutely! Options include put options which allow selling an asset at Strike Price before expiry and call options allowing buying of an asset. Option type depends on whether it’s Stock Option, Bond Option or Commodity option etc.