Introduction

There is a general perception that wealth management principles are usually followed by high-net individuals or that this is a domain that could only be afforded by the ultra rich. However, this is a perception that need not be true all the time.

This is mainly because there are optimized set of wealth management strategies that middle-income groups or lower strata of the society could also follow and benefit from the same.

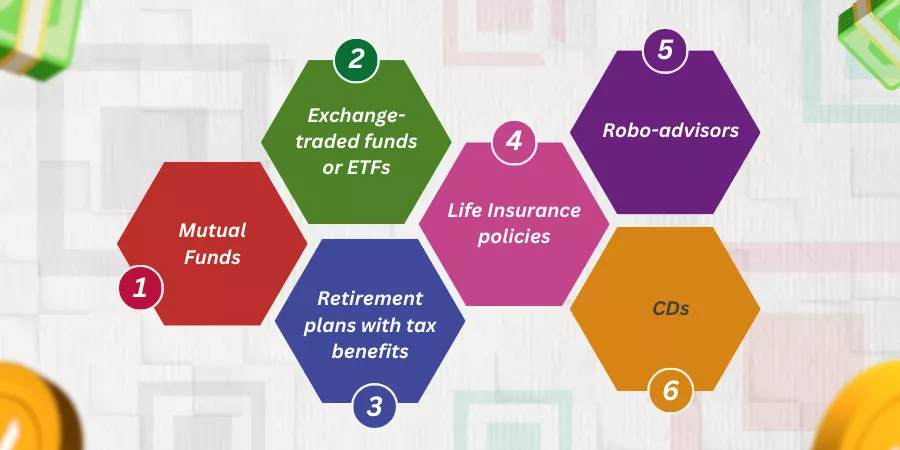

On this parlance, let us discover 10 Products Of Wealth Management for Middle Class and lower-income groups of society. Helping you get started here:

Mutual Funds

Mutual funds collect investment amounts from different investors and the pooled corpus money gets invested in high-paying stocks, shares, or securities. This is a wealth management or investment product that can be afforded by income-earning groups or middle-income-earning groups of the society.

Investing via mutual funds also helps you earn interim passive amounts in the form of interest earnings, dividend disbursements, and other capital-based emoluments. And, then the principal amount is reimbursed at the end of the tenure period.

Therefore, this is a product that is highly appealing to risk-averse or capital-protective investors too. You can approach a financial planner to get your investments panned out systematically.

Exchange-traded funds or ETFs

Exchange Traded Funds or ETFs are another wealth management product that can be afforded by middle-class or lower-income groups of society as such. Stocks, bonds, and internationally acclaimed investment products are consolidated as diversified portfolios and you call the product Exchange-Traded Funds or ETFs.

The portfolios are usually issued to retail and middle-income investors by mutual fund houses or investment banking firms. There is usually a processing fee that is collected from you and the performance tracker of index funds under ETFs is monitored using passive investment strategies.

You can avail of regular sources of payouts such as interest payments or capital disbursement amounts paid out to you every annum. And, you can get your capital sum once you decide to sell these ETFs in the market at a premium. A certified financial planner would help you manage your investment options such as ETFs wisely.

Retirement plans with tax benefits

Middle-income groups or lower-income groups of society can choose affordable retirement plans that also provide you with lucrative tax-saving benefits.

This is a perfect middle-class wealth management product as you compulsorily save a dispensable portion of your income towards your retirement. This is because you build a sustainable corpus from the start of your career until the period of your retirement.

You can also save money through tax benefits that get re-credited by banks and serve as lucrative cash-back offers for your investment portfolio. And, this is the money that stays in your kitty for a lifetime of unforeseen expenses like hospitalization, funding education for your grown-up daughters or sons or enjoying financial freedom during your retirement phase when you would no longer be employed by service organizations.

Life Insurance policies

Life insurance companies invest in capital-protected stocks, shares, and bonds wherein the sum assured is paid to your nominee or nearest kith and kin post your demise. You can also avail medical policies or health coverage policies to avail cashless hospitalization and to avail a host of health care benefits for your family members.

This is an ideal wealth management product that suits middle-class family units mainly because you can choose a short-term life insurance policy or a long-term one.

And these life policies can be great adding protective layers to your life.

For instance, a life insurance policy assures you and your family members against your life. Health insurance provides you with cashless hospitalization and helps you sail through medical emergencies with ease.

A fire and accident policy covers damages for loss of property at factory outlets due to a sudden outbreak of fire. Likewise, you have different insurance policies that care of different types of unforeseen circumstances you might face in life. Therefore this is a wealth management product that is most suitable for middle-income or even lower-earning groups of the society.

Robo-advisors

Hiring robo-advisors is an optimal style of wealth management program that is meant for collegiate or freshers who have just passed out of college. These are young professionals who are tech-savvy and might not have a huge investment base to hang on to. As the online software embeds robo advisors, you get the recommendations or strategic advice at one-tenth the price you may levy with an actual wealth management firm or hire human advisors to do the job for you.

You get a robo advisor with the online platform once you sign up with an investment service provider. The installation and setup can be done from your end once you follow the step-by-step instructions that the welcome email comprises.

Here, your only investment is with respect to the purchase of the automated software and your minimum investment deposit money. And, you get started after all. Therefore, this is a cost-effective option for young investors who are foraying into investments, finances, or wealth management prodigies as such.

CDs

CDs refer to Certificates of Deposits. These are fixed deposit accounts wherein you would earn higher yields in the form of coupons, interest earnings, and investment-aided dividends to name a few.

Here, you deposit a sum of money into your fixed deposit accounts. And, you earn interest amounts quarterly, half-yearly, or annually. And, you have a fixed tenure of 10 to 15 years.

You can get the principal amount once the tenure is taken for closure. And, you earn interest payouts from time to time. This is an ideal product for middle-income earning groups of people because the investment product is highly liquid and is capital protected as you get the principal money at the end of the tenure period.

Retirees, pensioners, and risk-averse investors prefer investing their funds in bonds or CDs.

Govt or Corporate Bonds

Govt or Corporate Bonds comprise fixed-income securities that aim to repay the investor’s principal amount at the end of the tenure period. This is a kind of investment product that is highly appealing to risk-averse investors as you get periodic income in the form of interest payments or coupon earnings. Plus, you get your principal money back at the end of your tenure.

The Govt bonds are highly liquid, capital protected, and offer a range of tax waiver benefits as well. Therefore, Govt or Corporate bonds are preferred investment options amongst the middle-income and lower groups of the earning society.

Corporate or Real estate bonds can also be chosen over your regular variant of bonds for more lucrative interest-earning options and investors find bond investments safer as compared to investing with equities that are highly volatile in nature.

Real Estate Investments- a way to higher appreciation

You can choose to buy real estate shares or bonds from financial companies or investment trust firms that typically issue investment portfolios or include products that belong to real estate alone.

These investment options can be short-term or medium-term investments that garner higher rates of return as the property values or firms appreciate exponentially. Plus, you get higher interest payouts or dividend reimbursements from time to time.

Potential investors who want to foray into something different and challenging as compared to regularly traded stocks or bonds prefer real estate investment options. This is a wealth management product that suits middle-class families in a picture-perfect manner indeed.

Health benefits affiliated Savings Account

There are investment firms that collaborate with health and wellness service providers to lend investment options with loads of health benefits added to the investments after all. This is an option more prevalent in advanced economies of the world that comprise a huge population of the elderly and senior citizens.

Via health-affiliated savings accounts, members get their medical expenses covered while these investments offer you tax waiver options too. Apparently, you get your principal money back or you can levy medical or healthcare benefits in lieu of the same.

This is an investment option that suits middle-income groups who cannot afford expensive hospitalization in case of medical emergencies. These investment houses receive their grants or funding from governments or local bodies too.

Annuities

Investing through annuities is a great wealth-managing option indeed. Here, you can either deposit a lump sum or make periodic payments from time to time.

The money sourced from investment houses that issue annuities gets reinvested into stocks, bonds, or high-paying securities. Therefore, the annuities pay regular and guaranteed sources of passive income via interest earnings or dividend payouts or coupons.

Plus, you can have these annuities released after specific lock-in periods. The lump sum money you receive from annuities can be utilized for education, performing your son’s or daughter’s wedding, or for expenses that are done on a grander extravaganza.

What are the investment considerations middle-class earners look for while dealing with investments- Insights explained

These are the prime considerations and prerequisites middle-class investors look for while they deal with investments or wealth management options. Helping you through with a run-down on pointers connected with the same:

Risk tolerance

You mostly have 9-5 jobs or income earners that fall under the middle-class segment of society. They are not very poor nor do they have excessive income flow like that of businessmen or entrepreneurs. That is why are they primarily called ‘middle-class citizens’ of any given society.

Therefore, the risk tolerance of these average income earners is comparatively lesser as they have bills to pay and families to run. Thus, they prefer their investment options through safer and more reliable investment options as compared to high returns-high risk investment options.

Time Horizon

Middle-income groups choose time horizon investment options that reflect how meticulously they can plan their finances over a long-term tenure. Retirement planning, mutual funds, and estate planning prove good choices for time horizon-based investment options.

Customized or tailormade financial solutions

Middle-class income earners look for customized or tailor-made financial solutions that align with the financial objectives they have in mind. The saving amount can substantiate retirement planning, funding of education, or other long-term financial objectives seamlessly.

Questions you can ask your investment advisor or financial planner with respect to investment options

a. Can you disclose the privacy policy documents that are up for disclosure?

b. Are investment portfolios comprising debt or credit and what are your budget constraints to start off?

c. What investment products offer long-term financial stability?

d. Do you have an app to choose assets and investments?

e. Do you spend on decision making advisories or select investment options that include guidance?

f. Can you look for the concept of cash backs or gain hands-on to click based investment options?

g. When is your office outlet closed for a weekly holiday?

The Bottom Line

Wealth management products for middle-class income groups must be chosen after considering factors like time horizons and market risks.

You must also look into the affordability of middle-income groups before you zero in on investment plans for them.

What are your thoughts on this? Do let us know in the comments below!