Introduction

Wealth Management belonged to ultra-posh and rich investors two decades back. But in the present generation, we are plagued with an ever-increasing rate of inflation. Therefore, following precise wealth management techniques seems to be the need of the hour for middle-class retail investors who do 9-5 jobs too.

The lower strata of society also seem enthusiastic about investing in low-risk investment options as they do not want to put their funds over idle deposition into bank accounts. This is because they have higher aspirations to grow their children while also providing their families with a better standard of living.

On this parlance, let us discover the overall Know-How on Wealth Management For Individual Investors. Helping you get started here:

Wealth Management- Meaning and Conceptualization Explained

Wealth Management refers to a detailed set of principles and methodologies that aim at wealth generation or capital preservation for those investors who look for streamlined solutions that align with their financial needs.

Here, a financial manager, investment banker or a wealth advisor talks to an investor-client on a one-on-one basis or using a Face to Face interview to discuss how the client maanges to build his/her investment portfolio and what is the capital the investor has to dispose with. The risk tolerance ratios are then configured and then the assets are distributed in the form of customized wealth or investment baskets.

Wealth baskets comprise of diversified investments like bonds, high-paying securities, structured notes, credit bills, currencies and exchange-trade-funds or ETFs to name a few.

The wealth manager further assesses the portfolios and rebalances the not-so good financial instruments with one that are performing well. This way, the investment portfolios are maintained intact and retrieve a steady rate of growth for investors even during adverse market conditions.

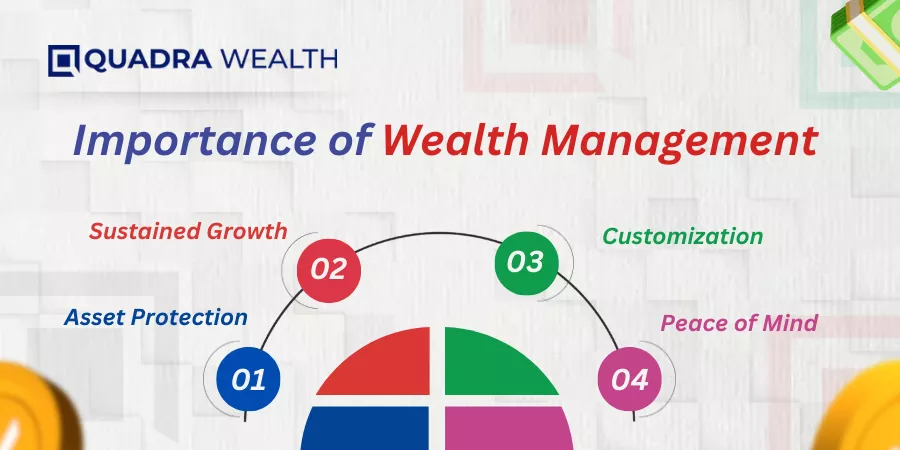

Importance of Wealth Management

Unexpected life events, unexpected market movements, and rising costs can adversely impact our financial security. Hence, wealth management is more important than ever before. The reasons are discussed below:

Asset Protection

Wealth management ensures the protection of wealth due to unforeseen events like sudden emergence of a hospitalization or what is known as a medical emergency, a sudden damage to property premises on account of an earth quake and other circumstances you may have never contemplated upon.

Sustained Growth

Individuals can grow their wealth over time by strategically making investment decisions ensuring that their financial objectives are met. This ensures long-term and consistent growth of income for decades to come.

Customization

Wealth management strategies can be customized depending on the client’s financial conditions and investment objectives. These personalized strategies help individuals make investments that can give maximum returns.

For instance, a customized and a well-planned investment strategy helps you align your financial objectives as short-term, medium term or long-term. A short-term goal can be to buy your car and a long-term objective can be to source a funding for your kid’s college education in an University abroad.

Peace of Mind

Effective wealth management works as an armor against all the odds that life can throw towards an individual. Here, we aim at building customized investment strategies that can align with the nature of financial objectives you have in life. This way, you safeguard yourself from unfore

Generally, wealth management strategies are offered by financial advisors or wealth managers as they are experts in creating customized strategies that meet clients’ needs. However, individuals can also create and implement strategies to manage their investment portfolio and grow their wealth. Let’s discuss the core components of wealth management.

Core Components of Wealth Management Services

Investment Management

Investment management involves managing various investments like stocks, bonds, real estate, mutual funds, and so on while considering factors such as risk tolerance, investment objectives, investment approach, time horizon, and preferred industries for investment. It includes important aspects like:

Asset Allocation

This includes dividing investment into different asset classes. Asset allocation can also mean portfolio management. You are managing your portfolio based on your preference and various other factors.

Diversification and Rebalancing

It means diversifying your portfolio by investing in different asset classes as this will help in reducing the risks involved due to market volatility.

Rebalancing refers to selling the assets that are not no longer performing well in the market over replacing them with asset or investment options that are really doing well in the market.

Retirement Planning

One of the most powerful wealth management strategies is retirement planning indeed. Here, you must optimize your earnings in such a way that you dispense a portion of your income towards your retirement plan. When you aim for retirement planning, you can save enough that covers for your hospitalization and medical expenses at a time when you retire and can no longer work.

Tax Planning

Effective tax strategies can significantly maximize the returns of an individual. The main aim is to minimize the tax liabilities. An individual can use strategies such as tax-loss harvesting, investing in tax-advantaged accounts, and estate tax minimization. These are some of the best strategies to minimize the tax liabilities and maximize the returns.

Estate Planning

This step ensures that the wealth of an individual is distributed according to his wish and with minimum tax liabilities. Strategies such as creating a will, hiring power of attorneys, and investing in life insurance must be followed to ensure a dispute-free wealth transfer.

Succession Planning

It is essential to identify the right leader to replace your leadership in exigencies like sudden death, disability of current leader, or plan of early retirement. Once you identify the right candidate to replace you as a leader, you need to start his training, complete legal formalities, and make him independent to make decisions that are in profit of the business and family.

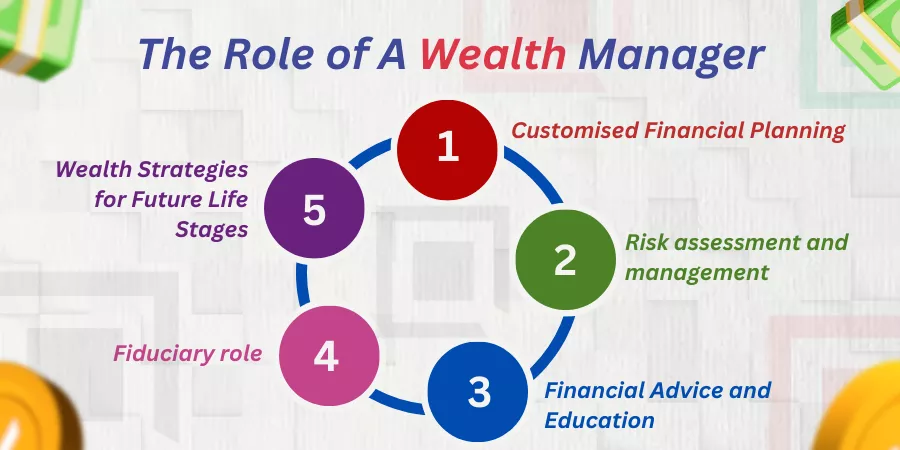

The Role of A Wealth Manager

Wealth management is a comprehensive approach that includes financial planning that is beyond investing. It include analyzing the risk tolerance profiles of independent investors and configuring investment portfolios that can be handled by clients or investors in a chartered manner indeed.

A competent wealth manager uses his experience and intellect to guide newbie or amauteur investors in a step by step manner. You would need a hand-holding support to choose your investment portfolios wisely and this is where you require the services of an investment banker, a financial advisor or an experienced wealth manager who can help you sail through the complexities that are involved in the world of finance or investments.

Let us find out different types of services a wealth manager does for investors, clients and other financial stakeholders through a run-down of pointers that pertain to the same:

Customized Financial Planning

Wealth managers or wealth advisors provide personalized financial plans as per the financial situation and financial objective of an individual. These people are financial experts who understand an individual’s current and future financial status and guide them accordingly.

Risk assessment and management

You need the guidance of a competent wealth manager who assesses the risk factors that are involved with different financial products that are available to you as such. And then, a wealth manager further moves on to assess your risk ratio. This is also known as a risk tolerance ratio. Your investment portfolio is then devised and is managed from time to time.

Financial Advice and Education

Wealth managers typically provide financial advice and also give you the required education related to market volatility. They will also create financial strategies that align with your overall financial goals and objectives. This way, you get customized solutions to tackle your financial obligations on a hassle-free note indeed.

Fiduciary role

A wealth manager must be a fiduciary which means that the designated individual acts in the best interests of investors and provide the rightful advise to investors and does not work to fulfill personal or vested interests of the self.

Wealth Strategies for Future Life Stages

Wealth strategies are designed to take care of investor’s financial needs in a phased out manner. The investors have short-term, medium term and long term goals or objectives that are well-seggregated by experienced wealth managers. Investment strategies and portfolios are designed accordingly.

How much does a Wealth Manager charge?

These are the types of fee structures that are charged by a wealth manager as such. Let us have a run-down into the same:

Asset Under Management (AUM)

In this structure, a wealth manager charges a percentage of the value of the asset they are managing. The range is between 0.5% to 2% annually. Here, the high-net-worth affluent equity net worth is determined as such.

Flat Fee Slabbing Method

Under a flat-fee slabbing method, wealth managers usually charge a flat fee or a fixed fees that must be paid out by investors on a one-time scale before they undertake your financial portfolios as such.

For instance, when you own equity assets ranging 1 million USD, apart from your taxable or fixed income persay, you can get a flat slab fee and receive specialized investment advice just to protect your equity assets alone.

Hourly Fee

Wealth managers charge on an hourly basis for individuals who are looking for guidance on specific financial services rather than comprehensive wealth management. You can also look for experienced advisors that belong to a private wealth management firm indeed.

The Bottom Line

Wealth Management strategies that the ultra-posh rich and institutional investors were using two decades back is now available for middle-class retail investors and other investors who belong to the lower strate of the earning societies too.

You can look for Investment Houses or Mutual Fund Companies that provide investment options on a more affordable platter. However, investment options are always subject to market risks. One must therefore read the offer documents carefully before investing.

What are your thoughts on this? Do let us know in the comments below!