Navigating the world of financial investments can be daunting, especially with a plethora of options to choose from. One such option is structured notes – unique debt securities whose returns are based on the performance of various underlying assets or benchmarks.

This article unravels this often misunderstood investment tool, and elaborates on its different types and how they work, their benefits, and associated risks.

Let’s jump into the fascinating world of structured notes!

Key takeaways

●Structured notes are a kind of investment. Banks make them to match your money needs.

●There are many types of structured notes like Principal Protected Notes, Yield Enhancement Notes, and Market-Linked GICs.

●These notes give more cash than regular deposits. But they have risks too. They can be hard to understand and sell in the market.

●You need to think about assets, returns, costs, and risks before investing in a structured notes.

Understanding Structured Notes

Structured notes are a kind of investment. Banks create them to help keep your money safe. They have been used for a long time by big-time investors with lots of money and banks. Now, everyone can use structured notes allowed through their financial advisor.

There are four main parts to structured notes which make them work. These parts include when the note ends (maturity), what it is linked to (underlying asset), keeping your investment safe (protection), and how much you could earn (return/payoff).

Based on these, there are different types of structured notes such as principal protected notes, reverse convertible notes, enhanced participation or leveraged notes, and structured notes are hybrid that people can pick from based on what they want.

Unlike structured deposits, structured notes can offer no principal guarantees (unless a third party guarantees the payout of principal investment in the event the structured note issuer defaults).

Because there is a wide variety of structured notes in the market, there is no simple description of how they work.

But they typically involve options: the structured note issuer either buys or sells an option on the reference asset or security, and the investor gives the issuer the right to put securities on or call securities from him/her.

Types of Structured Notes

This section delves into various common types of structured notes, including Principal Protected Notes that safeguard the initial investment, Yield Enhancement Notes that offer higher potential returns, Market-Linked GICs tied to market performance of a structured note, Buffered Return Enhanced Notes for cushioning downside risk, and Dual Directional Notes that pay off based on multiple market scenarios.

Each type comes with a unique set of features tailored towards specific investor needs in terms of the note risk tolerance and return expectations.

Principal Protected Notes

Principal Protected Notes (PPNs) are a type of structured note. They show care for your cash. This means, even if things go wrong in the market, you get back what you put in.

Many times, these notes link to assets like stocks or goods we use every day. The term for PPNs can be short or long – six months to twenty years! These notes offer different covers against money loss.

So they can fit with many plans and whatever is happening in the market right now. The neat thing about PPNs? You can make them work for your needs!

Yield Enhancement Notes

Yield Enhancement Notes offer more cash to investors receives. The extra cash comes in the form of coupon payments. This type of note can also be based on many types of assets, like stocks or bonds.

It is made to fit what an investor needs and how much investment risk they can handle.

Market-Linked GICs

Market-linked GICs are a type of structured notes. They tie to the worth of an asset. With these GICs, you can pick what fits your money needs best. For example, there are income notes and growth notes.

These let you earn money over time or quickly grow your funds. The fixed term for Market-Linked GICs can be as short as 6 months or as long as 20 years.

But it’s not all good news; how much you make depends on how well the tied asset does in its market! To know more about this, look at the structured Product Highlights Sheet and Prospectus before investing.

Buffered Return Enhanced Notes

Buffered Return Enhanced Notes are a type of structured notes. They help to keep your money safe when the market goes down. Level of downside protection. You can pick what you want from these types of notes.

You can choose how long you want them for, what asset class they tie to, and how much safety or payoff you want. The length of time can be as short as 6 months or as long as 20 years! There are two ways they give protection: hard and soft.

Hard protection acts like a wall against loss while soft provides a buffer against falls in prices.

Dual Directional Notes

Dual Directional Notes are a type of structured note. You can make money from these notes when the price of the thing you invested in goes up or down.

So, they let you win either way! These notes also keep your original money safe while giving you a chance to make more.

You can change Dual Directional Notes to fit what you want and how the market is doing. They can give set returns or be based on how well the thing you invested in does.

The lifetime of these notes, what they invest in, how much safety they have, and their return or payoff structure can all differ.

How Structured Notes Work?

Structured notes are a type of investment product banks offer. They have a certain way they work:

- A bank makes the note and sells it to investors.

- The note has two main parts: a bond and pathways to more gains.

- The bond part helps keep some of your money safe.

- The other part links your money to something in the market, like stocks or bonds.

- If that thing does well, you make more money.

- Four things shape how a structured note works: how long it lasts, what it’s linked to, how safe it is, and what you can earn from it.

- It’s not all good though, there might be risks like losing money if the markets go down.

Benefits of Structured Notes

Structured notes offer potential for higher returns, customizable investment options, and often principal protection, notes providing excellent opportunities to refine your portfolio. Discover more about the benefits by delving further into our blog.

Potential for Higher Returns

Structured notes can earn more than regular deposits. This is because they are tied to the results of certain assets or benchmarks. If these do well, the return on a structured note might go up too.

But watch out – high returns often mean high risks! So, be sure you know what you’re getting into before choosing this kind of structured investment.

Customization

You can shape structured notes to fit your goals. They match all kinds of investment aims. Income notes, growth notes, absolute notes, and digital notes are just some types you can pick from.

Tailoring for market changes is part of this too. For example, if the structured note market falls or rises a lot, your note suits that shift.

This way you always have control over your assets. Structured notes let you make choices that feel right for you.

Principal Protection

Structured notes often have full Principal Protection. This means you get back the money you put in. But, it will only happen when the note is held until the end date. It keeps your money safe from loss in a bad market.

But, if the market does well, you could make more money! The hard and soft protections are there to guard against losses. On one hand, hard protection guards all of your funds at maturity date while soft protection offers a limit up to which losses can be borne by investors may without causing them any harm.

Risks Associated with Structured Notes

When investing in structured notes, one should be aware of various associated risks such as market risk due to volatility, risks of structured notes complexity arising from intricate payoff structures, and potential issues with liquidity and call provisions that could impact investment returns.

Market Risk

Market risk is a big worry with structured notes. It comes from changes in the market. This can mess up how much money you get back.

If your structured note is linked to stocks or bonds, and they do badly, you might lose money.

Your returns depend on how those assets perform. For instance, if your note is tied to the price of gold and gold prices drop, so will your return rate.

So it’s a must to keep an eye on what your note links to and watch out for any swings in that market!

Complexity

Structured notes can be hard to grasp. They are complex because they rely on many factors.

Different types of these notes use various assets or marks. This makes them diverse and tough to understand.

Calculating the returns from structured notes is also tricky. It depends a lot on how well the asset does over time. The risk tied to who issues the note and what asset it is based on adds another layer of complexity.

Also, other facts make things even more confusing! The date when the note matures or comes due affects its complexity too. And if there’s an option for early cash-out, this brings in yet another level of difficulty.

Liquidity and Call Provisions

Liquidity shows how fast you can sell structured notes in the secondary market. It tells you if it is easy to buy or sell them. Call provisions let the person who issues the note take back, or “call,” the note before its end date.

Both these things are risks when deciding to invest in structured notes. They should not be ignored by any investor.

Structured Notes vs. Structured Deposit

Understanding the difference between structured notes and structured deposits is a stepping stone in making an informed investment decision.

Structured Notes | Structured Deposits | |

Definition | Structured notes are financial instruments that are built by investment banks. They come with a return that is based on the performance of underlying assets or benchmarks. | Structured deposits are a types of product offered by banks. They provide potential returns based on the performance of underlying assets and have a fixed term. |

Risk | Structured notes carry a higher level of risk. This is because they are not covered by any deposit insurance and the return is not guaranteed. | Structured deposits are less risky as they are covered by deposit insurance schemes in most countries. Notes can provide a guaranteed return regardless of the performance of the underlying asset. |

Accessibility | Structured notes were traditionally available to institutional investors and the ultra-wealthy, but now are accessible to most investors through financial advisors. | Structured deposits are more widely accessible and can be purchased by retail investors. |

Popularity | In Europe and Asia, structured notes are considered retail investments. However, many U.S. investors are unfamiliar with structured notes. | Structured deposits are relatively well-known and widely available in the U.S., Europe, and Asia. |

Investors should evaluate their risk tolerance, and investment objectives, and understand the underlying assets before investing in either structured notes or structured deposits.

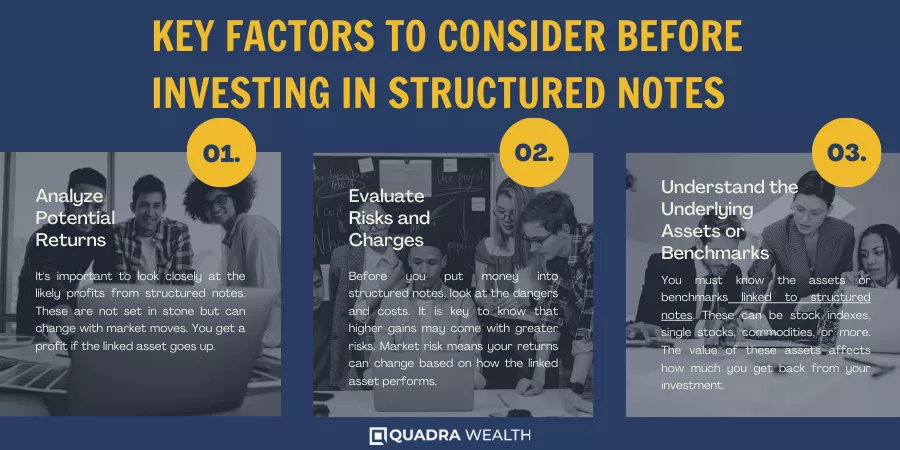

Key Factors to Consider Before Investing in Structured Notes

Before delving into structured notes, understand the value of the underlying assets or benchmarks, scrutinize potential returns, and evaluate risks and costs associated with them. Remember, your financial decisions must align well with investment objectives.

Dive deeper to gain comprehensive knowledge about structured notes by reading further!

Understand the Underlying Assets or Benchmarks

You must know the assets or benchmarks linked to structured notes. These can be stock indexes, single stocks, commodities, or more. The value of these assets affects how much you get back from your investment.

Let’s look at some examples. A note may stick to an equity index like the S&P 500. If it performs well, your return rises too. In contrast, a commodity-linked note goes up and down with gold prices for instance.

Think about what asset is in the mix before you invest money in structured notes.

Analyze Potential Returns

It’s important to look closely at the likely profits from structured notes. These are not set in stone but can change with market moves. You get a profit if the linked asset goes up.

But, you won’t lose money if it drops below a certain level. Each note comes with details on its possible return or payoff method. This tells you how much money you may make based on what happens in the market.

There is lots of choice too, so pick one that fits well with your needs and your sense of risk.

Evaluate Risks and Charges

Before you put money into structured notes, look at the dangers and costs. It is key to know that higher gains may come with greater risks. Market risk means your returns can change based on how the linked asset performs.

Charges are often taken out from your returns by the note issuer or seller. These charges pay for selling, setting up, and managing the note. So before investing in structured notes, check all fees applied by the issuer and figure out their effect on your potential return.

FAQs

Many structured notes are financial products that private banks use for targeted investment strategies. They link the bond market and derivative component of structured note outcomes to an underlying asset price, like equity indexes or foreign currencies.

A Principal Protected Note or PPN is a main type of structured note often linked with debt assets such as treasury bonds. It has a fixed interest rate to protect your first money from loss, but the final return also links to other things like stock market action. Although there is no downside risk to the investor, there is still a credit risk to the issuing bank.

Yes! You can get gains even when markets fall by investing in bearish market investments known as put options. But be careful of high risk because you could lose if the result doesn’t go as planned.

No! Investing always carries some risks, including credit risk default which means not getting all your money back due to the issuer not paying its debts on time, and call risk where the note might stop paying before it should due to the Issuer’s callable clause.

There are many types including Equity-linked structured note, Commodity-linked structured note, Currency-linked structured note, Interest rate-linked and Credit-linked structure notes each focusing on different aspects like commodities markets, equity security prices interest rates etc. For example, In Equity-Linked these returns would depend upon a single equity security or pool of them. In Commodity-Linked these tie up the commodity future costs etc.

Financial Institutions include the U.S. Securities and Exchange Commission. Broker-dealers give out most of them while others create platforms such as Halo for this work. The Offices Of Investor Education And Advocacy provide helpful guides too!