Introduction

Are you a newbie in your journey of investing? Then you must choose a wise investment plan that takes care of your short-term, medium-term, and long-term goals in an efficient manner.

You can choose between traditional bonds or fixed-income securities if you are a risk-averse investor.

There is a newly introduced hybrid variety of investments namely structured notes or products that combine debt with equity.

While the debt component protects investors’ capital, the notes garner additional returns from linked assets like currencies, equities, or a basket of shares to name a few.

On this note, let us unveil the key differences covering structured notes vs mutual funds.

Structured notes Vs. Mutual Funds

Let us unveil key differences covering structured notes vs mutual funds:

Understanding The Basics

Structured notes are dual component notes that combine equity with traditional debts like bonds or mortgages. The notes are popularly known as hybrid notes as they combine debt funds with asset allocation.

On the other hand, mutual funds relate to pooled funds of investors that are utilized by money managers to purchase stocks, bonds, and other high-paying investments.

The mutual funds cover wider segments of retail investing demographics as compared to high-end structured notes that only high-net-worth retail or institutional investors can afford to purchase.

Issuance

Structured notes are mainly issued by investment-grade banks and large financial corporations while you have dedicated mutual fund companies that purchase bonds, investments, and high-paying securities to issue them to investors.

Yield And Payment Flows

Structured notes have debt instruments like traditional bonds or mortgages that are primarily linked to underlying assets like equity, commodities, and currencies. The payouts or returns from structured products can therefore be linked to the performance of the assets that the notes are linked to. Therefore, the returns or payouts cannot be fixed or determined in nature.

For mutual funds, investment holders get periodic interest payments from bonds or fixed-income securities. The payments can be monthly or quarterly. Therefore, the returns or payoffs in the case of mutual funds are fixed and stable.

Risk Factors

Structured notes come to you with a variety of risks like market risks, credit risks, and liquidity risks to name a few. If the underlying value of the assets is properly managed by efficient portfolios, the investors can avail wider opportunities for income diversification. Therefore, the investors must understand the various risks the structured notes are associated with.

In the case of mutual funds, the funds are owned by companies or proprietary agencies that have a high credit standing. Therefore, the risk of default amongst investors is on the lower edge indeed. However, mutual funds are also subject to market risks. Therefore, one must read the offer documents carefully before investing.

Period Of Maturity

Structured notes do not have a fixed period of maturity. The notes have underlying assets like securities or other forms of derivatives. The maturity period ranges from a couple of months or even a few years. Say, for instance, autocallable notes have auto-call dates that allow notes to mature as and when the triggers are initiated.

For mutual funds comprising bonds and securities, you have fixed maturity periods ranging from 3 years, 5 years, 10 years, and 20 years. Mutual funds also offer periodic payments from time to time and therefore the income yields investors get from mutual funds are periodic and consistent.

Liquidity

Structured notes are calibrated using the investor’s level of customization. Therefore, it is highly improbable that you find suitable buyers for similar notes. In a nutshell, it can fairly be concluded that structured notes are not liquid and the investor may have to home them until they mature.

However, as mutual funds deal with direct investments of shares, securities, and bonds, the mutual funds can easily be traded in the secondary market.

Therefore, mutual funds share a better liquidity level than structured notes.

Transparency

Structured notes are complex financial instruments that combine a mix of debt and equity. The rate of returns for notes is also not fixed or pre-determined. Therefore, structured notes are complicated to learn or understand if you are an investor who has just started foraying into the world of investing.

On the contrary, mutual funds involve the buying and selling of bonds and shares. Therefore, the terms and conditions of the trade are simple for even a layman to understand how things work.

In a way, mutual funds work the same way as equity. You can take your funds like interest earnings once the mutual fund scheme that you may have signed up for matures.

Capital Protection

For structured notes, investors are not guaranteed full-time capital protection. This is because the notes have underlying assets that are subject to a whole basket of market and credit risks.

Even principal-protected notes may only offer the investor a buffer spread beyond which one must take into capital erosion. A full capital payment is possible only when the underlying assets perform exceedingly well in preset conditions.

While for mutual funds, most of the investors receive their capital money with interest earnings as the fund schemes mature.

Therefore, it is to be concluded that mutual funds offer a better degree of capital protection than structured notes.

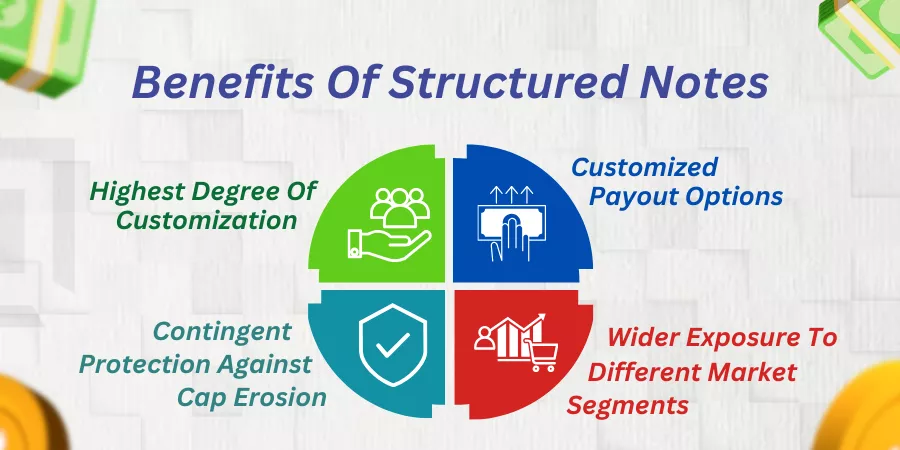

Benefits Of Structured Notes

These are the benefits you have concerning structured notes. Helping you get a run-down into the same:

Highest Degree Of Customization

Structured notes combine debt with equity. Therefore, you get the highest degree of customization in getting the notes curated. You can choose the underlying assets you want to link with the notes.

You choose between high-paying stocks, a basket of securities, or high-paying currencies to name a few. As an investor, you can also choose the tenor of the asset. Therefore, these are investment products that can be tailor-made to suit investor’s independent preferences or financial requirements.

Customized Payout Options

With structured notes, you can also choose payouts according to your immediate financial needs or dire requirements you have on hand. You can choose growth notes if you want to improve the overall financial curve of your investment-based wealth basket. In this case, you must choose stocks or ELNs with lucrative derivatives underlying the notes.

For fixed-income coupons, you can opt for regular bonds or fixed-income securities underlying your notes. Similarly, for traditional investors who risk trading against their capital investments, going with principal-protected notes or PPNs is what you must be going in for.

Therefore, structured notes provide investors with customized income generation opportunities as compared to the limited payout options you find in bonds or fixed-income securities.

Contingent Protection Against Cap Erosion

Although structured products combine debt with equity or derivative components, investors get coverage against capital losses or capital erosion due to posh or embedded options that are added at the time the notes are designed for investors.

With options like buffers or cap limits embedded in notes, investors get protection against their principal money to some extent as compared to losses the portfolios would otherwise make with direct investments in blue chip companies.

With options like ‘call’ or ‘put’., hedging, buffers, and barrier limits as set on notes, investors can mitigate losses even in adverse market conditions. This means you get a kind of contingent protection despite the volatility in market conditions.

Wider Exposure To Different Market Segments

As compared to bonds or fixed-income securities, investors of structured notes get a wider exposure to retail and institutional marketplaces on the whole.

The notes combine debt with equity. While the fixed component protects investor’s capital to a certain extent, the upside potential for the notes to garner higher yields depends on the performance of underlying assets the notes are linked to. So, in a way, investors get exposure to the equity markets too.

In a nutshell, investors of structured notes get optimal exposure to primary, secondary, and tertiary marketplaces on the whole.

What Are The Risks Associated With Structured Notes?

Let us get detailed insights into the risk factors that are typically associated with structured notes. Helping you get a run-down into the same:

Market Risks

Although structured notes protect risks they are not entirely risk-free either. When the market slumps, the performance of underlying assets of notes suffers too. This way, investors might lose a portion of or even their entire share of capital investment. Equity index and interest rate fluctuations can also cause assets to rise or plummet.

Credit Risks

Credit risk refers to the default risk of the product issuing company. This risk is applicable when the product issuing firm signs up for bankruptcy or gets busted. This way, investors may not get their capital returns or payouts from structured notes.

Take the example of Lehman Brothers. While the investment banker in the US signed up for bankruptcy in the year 2008, their structured notes were rendered valueless.

Liquidity Risks

Structured notes may not be as liquid as in the case of intra-day shares that are bought and sold the very same day at the stock exchanges. The notes come to you with a tenor period ranging from 6 months to 10 years or even more.

Therefore, for investors to get redemption of their cap money and payouts, the notes must be held until their maturity.

The exception to this rule is in the case of autocallable notes. In the case of an autocallable note, the performance of underlying assets is gauged by the product issuing company during said periods namely observation dates.

If the pre-set terms of the notes get fulfilled, the notes are auto-called. The notes then stand redeemed as and when the autocalls are successfully registered. It means the investors get the capital investment amount and the coupon payments as accruing on the notes. And, the event happens before the maturity dates of these notes.

If the autocalls fail, then the assets are monitored for the next observation date as determined by the product issuing firm.

And, RCNs are Reverse Convertible Notes wherein investors get underlying shares in lieu of their capital investment. This happens if the market conditions show volatility and the performance of the underlying assets of these notes does not match the expected levels. Therefore, investors are paid out in cash if assets do well and they are given shares if the underlying performance of assets does not happen as anticipated.

Who Issues Structured Notes?

Structured notes are usually issued by large-scale investment-grade banks and independent wealth managers who curate these notes for retail and institutional investors.

You may also have capital-intensive financial issuers like JP Morgan, Goldman Sachs, or Citi Group who issue these notes for corporate and retail investors. However, thanks to technological advancements and financial innovation, this landscape has been changing lately.

Nowadays more and more middle-class retail investors are also foraying into buying and selling different types of structured notes. With a high degree of income customization and portfolio designing, the notes are highly in demand amongst the latest-gen investors whose purchasing power is good to go with respect to purchase of these notes.

Notes can be availed at nominal prices from secondary markets or stock-holding corporations too for an affordable wallet range.

What Is The Minimum Investment For Structured Notes?

The minimum investment tab for a structured note stands at 1 million US dollars while the upper caps cannot be determined for investors as such. This is a heavy-priced product if you have primary markets curating the notes for you from scratch.

In case you purchase these notes from secondary marketplaces like stock exchanges or other stock-holding corporations, these notes can be available in denominations of $1000 or so per note. However, the pricing differs across financial products.

If you want structured components like tenor, strike prices, or customized income-earning options, going in for brand new structured notes as given to you from a primary marketplace can be the best decision for investors who want to take their wealth management skills to the next level.

Therefore, it is not quite surprising that the structured notes are hitting a trillion-dollar mark. You can have your underlying assets comprising of currencies, a basket of securities, or independent stocks linked to structured notes and therefore unveil a better pattern of developing sophisticated and diversified investment portfolios that stand chosen.

While every investment product has its risks and benefits, structured notes also have their share of risks and benefits. So, it is always better you seek the services of an independent financial advisor or a well-experienced wealth manager to see where you stand with respect to investing in these posh and sophisticated investment products.

What Are The Tax Implications While You Try Investing In Structured Notes?

Tax implications depend on how the income you earn from investments is treated by tax authorities and other havens. The income you earn from coupons may sometimes be charged as regular income.

While lower tax slabs imply incomes that fall under ‘capital gains’. The tax implications here vary significantly as in the case of regular treasury bonds or ETF options for investors.

While structured notes have divided connotations with respect to their tax implications, you should take guidance from a tax advisor to help you understand tax implications on notes.

The Bottom Line

While structured notes are known for the dynamic exposure the investors are provided with, mutual funds favor investors who belong to the traditional school of thought.

Every investment plan has its pros and cons. You must evaluate the terms of the offer documents carefully before you sign on the dotted lines. You can also appoint a wealth manager or a relationship manager to help you through proper guidelines before you sign in for an investment plan.