Navigating the world of investment can be tricky, especially when you’re venturing into lesser-known territories like structured notes. Popular among sophisticated investors, structured notes blend bonds and derivatives to offer market exposure with a certain level of protection against losses.

If you’ve ever wondered where to purchase these unique fixed-income securities, look no further than this guide. Prepare to embark on your journey toward diversification and potential high yields!

Key takeaways

● Structured notes combine bonds and other assets. The payout you get can change based on how these assets perform.

● You can buy structured notes from big banks, online broker platforms like Ameriprise Financial and Fidelity, or investment pools like Yieldstreet.

● Caps in the fine print set a limit to your returns. There might also be barriers that could reduce your earnings.

● Structured notes come with risks like hard-to-sell issues or high fees. Always check all details before you buy.

Understanding Structured Notes

Dive into the world of structured notes, exploring their definition and working operations, along with a detailed examination of pros and cons. Discover how these unique investment vehicles combine bonds and derivatives to offer potential market-beating returns while providing downside protection

Definition and Working of Structured Notes

Structured notes are a type of investment. They mix bonds and other assets like stocks, currencies or commodities. Unlike regular bonds, structured notes don’t give fixed interest rates.

The return you get depends on how well the mixed assets perform.

You can make money in two ways with structured notes: income payments and changes in value. Issuers of the note decide how often they will pay out income to investors – this could be quarterly or at another set time.

Some might offer returns plus principal at the end when it’s time for payment while others prefer making airtime-based payments for an income stream.

As long as the asset linked to your note does well in its market, you will earn more money—the better it performs, the more cash you get! But if luck is not on your side and that asset falls in price? Don’t worry, that’s where “protection” comes to play! This built-in feature helps guard against losses from bad asset performance, but remember protection level varies – some offer full coverage while others provide just a part.

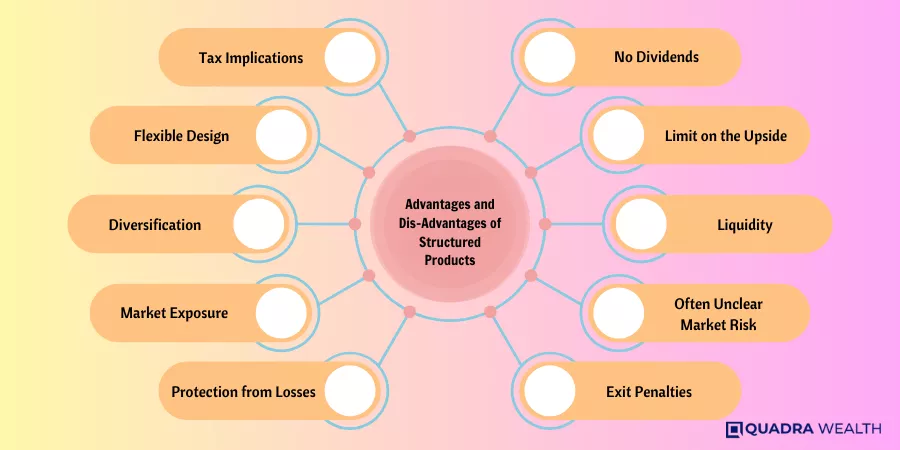

Advantages of Structured Notes

Investing in structured notes has clear advantages. Let’s talk about them.

- Protection from Losses: Structured notes help keep your money safe. They offer protection if the asset linked to them falls in value.

- Payouts: Structured notes can give you money in different ways. Some may pay out returns and the main sum at the end of the term. Others make ongoing income payments every three months.

- Diversification: These unique notes allow for more spread-out investments because they are tied to stocks, bonds, commodities, and currencies.

- Market Exposure: You get a chance to tap into markets you usually couldn’t through these investment tools.

- Potential High Returns: Depending on how well the base assets perform, you can get decent gains from structured notes with lower risk levels compared to just owning stocks or other assets directly.

- Flexible Design: The design of a structured note can be tailor-made to fit within one’s specific investment objectives and risk profile.

- Tax Implications: The way taxes work on your structured note gains can vary based on their design. Some gains may be taxed as simple income whereas others could be seen as capital gains.

- They Enable Complex Investment Strategies: You could potentially design the same investment portfolio that offers the same result as a structured note, using a combination of options, stocks, bonds, and other investment positions.

However, with one purchase you get the result from a structured note versus building all this on your own, which takes considerable time and investment expertise.

Disadvantages of Structured Notes

Structured notes can seem like a good choice but there are some downsides to keep in mind.

- First, structured notes often lack liquidity. These are hard to sell after they have hit the market.

- Second, their prices may not be right. A matrix approach is usually used to work out the price.

- Next, credit risk can be a big issue. The bank that gave out the note might fail and not meet its duties.

- Also, you may get less than face value for your note if it gets bought back by the issuer before maturity.

- Another issue is tax. Even before the note fully matures, you might have to pay federal taxes.

- Finally, these notes can come with high costs. The common fee hidden in a structure note can be as high as 2.9%.

How to Invest in Structured Notes

Start by selecting a financial advisor or an online broker platform like Fidelity or Ameriprise Financial. Next, identify the structured notes you wish to invest in and proceed with the buying process.

The selling of structured notes usually takes place in secondary markets. Understand that payouts from Structured Notes are subject to tax treatments; they can be classified as capital gains or ordinary income depending on how long you hold onto your investment.

Being aware of these factors will allow a seamless investment experience with structured notes

Buying and Selling Process

Getting structured notes is not hard. Here are the steps involved in buying and selling these notes:

- Choose a good dealer. You can go for big banks like Goldman Sachs, JP Morgan, and many more.

- Get ready with your money. In most places, the lowest amount you need is $250,000.

- Talk to your bank or online broker platform such as Ameriprise Financial or Fidelity to start buying the notes.

- Wait for a while after buying them. Usually, you need to keep them until they reach maturity.

- Selling the notes before they mature can be hard because they cannot be easily converted into cash.

Payouts and Tax Implications

You make money from structured notes in different ways. It can be a set amount or tied to an asset’s value. Yet, how you earn decides your taxes. If your pay is like regular income, it will face high tax rates.

But if it counts as capital gains, the tax rate may be less. Selling these notes before the end means big fees and no easy return on what you spent.

Deciding If Structured Notes Are Right for You

Analyzing the credit risks and liquidity concerns, as well as understanding potential high fees and missed payments structured notes, are crucial steps to determine if structured notes are a suitable addition to your investment portfolio

Analyzing Credit Risks and Liquidity Concerns

We often look at credit risks and liquidity issues when we invest in structured notes. Here are some key points to note:

- Credit risk is always there. There is the risk that the bank that gave you the note may not pay you back.

- The health of the market affects your investment. If the market drops, your structured note’s worth may also go down.

- Selling before time can be hard. As written in our facts section, getting rid of your notes early is tough because they are illiquid.

- It’s also tough getting a fair price for them before time is up.

- Read about the creditworthiness of the banks handing out these notes, to avoid bad risks.

Understanding Potential High Fees and Missed Payments

It is important to know about possible high fees and missed payments before you invest in structured notes. Here are some things to be aware of:

- High Fees: Some structured notes have high fees. These can cut into your investment returns, making them less than what you expected.

- Credit Risks: The money you get back depends on the credit of the firm that sold the note. If they have problems, it might affect your payout.

- Missed Payments: If the underlying asset classes do not do well, the issuer may not make a payment.

- Complex Pricing: It may be hard to understand how much you will get back from structured notes because their pricing is challenging to understand.

Where to Buy Structured Note

You can buy structured notes through various avenues including financial advisory firms like Ameriprise Financial or Fidelity. Additionally, online alternative investment platforms such as Yieldstreet offer convenient access to this type of investment.

Always do thorough research and consult with a trusted advisor before making a purchase decision.

Financial Advisory Firms

You can buy structured notes at financial advisory firms. These are places where experts help you with money choices. Big banks like Goldman Sachs, Morgan Stanley, JP Morgan, Bank of America and Citi sell these notes too.

You will need to speak with an advisor that works there first. This person can tell you about the options for different notes they have to offer. Meeting with an expert helps make sure you pick a note that matches your needs best.

Online Investment Platforms

You can buy structured notes from online broker platforms. Names that come to mind are Ameriprise Financial and Fidelity. They let you invest in these notes easily. But, there is another cool place too! It’s called Yieldstreet.

In this spot, people pool their money to buy structured notes. This helps if you don’t have big bucks but still want to give it a shot at investing in them. The best part about Yieldstreet? They only partner with high-grade banks when picking structured notes to sell.

Importance of Reading the Fine Print

Before investing in structured notes, it’s crucial to read and understand all the details within the fine print. This includes information on potential caps and barriers, which can impact your investment returns.

Understand any stipulations around principal protection and familiarize yourself with terms like conditional or contingent protections. In addition, identify any embedded derivative component that could affect payout structures or tax treatments.

Finally, evaluate the call risk associated with structured notes as they can be called prior to the maturity date by the issuer under specific circumstances explained in the offering memorandum or prospectus.

Always remember: understanding every detail is essential for informed decision-making in investments.

Understanding Caps

Caps are a part of structured notes. They set the top amount you can get back from your note. For example, if you buy a note linked to stocks and they do great, the cap stops how high your gain can go.

It’s important to know about caps when buying these notes. Caps may stop you from getting all the growth from your investment. If there is a larger rise in what you linked the note to beyond its cap level, you will not benefit past this point.

Identifying Barriers

Barriers can pop up in the fine print of structured notes. These may lead to less money for you at times. Some barriers could mean limits on your gains from the note. Or they might put a cap on what you earn even if stocks do very well.

It’s key that barriers are looked at before buying any type of structured note.

Conclusion

Structured notes are not hard to buy. You can use online brokers like Ameriprise Financial and Fidelity. Investment platforms like Yieldstreet also let you put money in structured notes.

Major banks give out these too! So, there are many places for you to buy structured notes from.

FAQs

Structured notes are a type of investment where you can tie your money to underlying assets like the S&P 500 or other reference assets. They blend debt investments and call options.

You might get structured notes from financial institutions, alternative investment platforms, and corporate borrowers. A provider like Synapse Brokerage LLC offers such services.

Yes! Types include income-structured notes that come with coupon payments, others offer full or partial principal protection; some may even be Principal Protected Notes (PPNs). The details are usually in the investment prospectus.

Like all investments, structured notes do have risks -including interest rate risks and risks to your full initial investment value-.Yet they offer a downside protection barrier so not all your principal balance is at risk.

It varies depending on rules set by financial institutions but many mutual funds, exchange-traded funds, or multi-asset class funds allow this kind of long-term commitment within IRAs.

Investment strategies with Structured Notes diverge from traditional securities, diversifying portfolios It could help shape overall risk/return profiles and permit exposure to new market trends. Thus it’s commonly included as part of diversified portfolios including tech portfolios or consumer portfolios.

Should I talk to a Financial Advisor When Buying a House?

In This Article Should I talk to a Financial Advisor When Buying a House? Or

Master Robert Kiyosaki 10 Keys to Financial Freedom

In This Article Robert Kiyosaki 10 keys to financial freedom Have you ever felt the

Can SIPs Make You Rich? Mutual Fund SIP Grow Your Wealth

In This Article Can SIP make you rich? Systematic Investment Plans can help in wealth

Exclusive Investments of Elon Musk: Disruption, Vision, and Risk

In This Article A visionary entrepreneur who has been a consistent disruptor in the way