Are you wondering how to diversify your investment portfolio? Did you know that knock-out options are a unique financial instrument that can limit potential losses, yet also cap profits? In this article, we’ll walk you through the complex world of knock-out options in structured investments.

Get ready to understand their mechanism, benefits, and role within structured notes!

Key takeaways

● Knock-out options are deals linked to prices. They start and end based on these price levels.

● There are two main kinds of knock-out options: down-and-out, and up-and-out.

● Structured notes have parts like bonds mixed with other things that cause changes, such as underlying stock or indexes.

● Pros of knock-out options include lower initial cost and safety during tough times in the market. Cons include limits on profits and a higher chance for big losses.

Understanding Knock-Out Options

In this section, we delve into the complexities of knock-out options, examining their basic definition and how they work in real-time financial scenarios to provide investors with unique investing opportunities.

Definition of a Knock-Out Option

A knock-out option is a kind of deal. This deal stops if a price reaches a certain point. These points can be high or low in relation to what something costs now. The person who buys this deal cannot get more than a fixed amount of profit.

Such deals cost less money compared to similar ones without any stop points.

Working Mechanism of Knock-Out Options

Knock-Out Options work in a unique way. The seller sets the price of an asset. This is called the strike price. If the cost of the asset goes too high or too low, the option stops working.

It becomes worthless. So, these options are like fences. They put a limit on how much buyers have to pay if costs change a lot. Buyers like Knock-Out Options because they don’t cost as much money at first as other types of options with no limits do.

Types of Knock-Out Options

In the realm of financial instruments, there are two primary types of knock-out options: down-and-out and up-and-out. The down-and-out option becomes useless when the underlying asset price falls below a set barrier level, while an up-and-out option expires worthless if the asset’s value moves above a certain threshold.

These options provide varied approaches to managing potential risk and capitalizing on market volatility in structured investments.

Down-and-Out Option

A down-and-out option is a type of knock-out option. It gets wiped out if the price of what it’s tied to dips below a set point. The hold ends at this knock – out level, so there is no value left in the option.

This kind can cost less than the ones without this limit. Even though one can’t lose more than what was paid for it, big gains are also ruled out with this sort of setup.

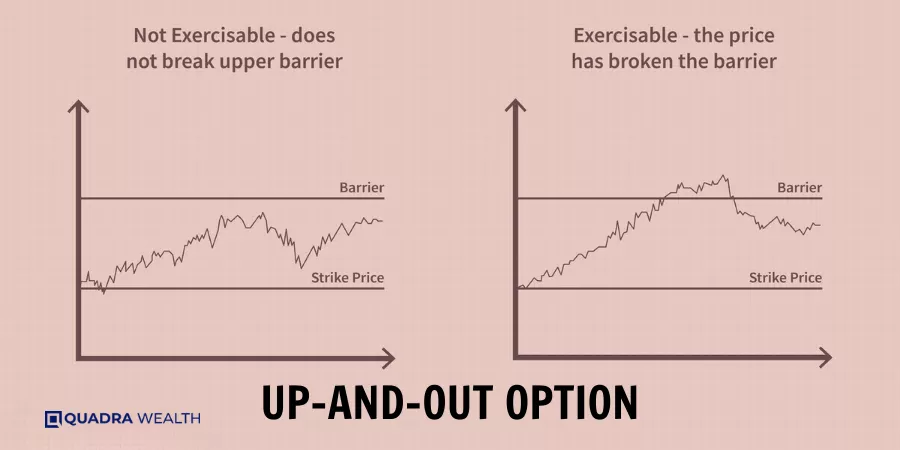

Up-and-Out Option

An Up-and-Out Option is part of Knock-Out Options in structured investments. This type happens when the price of the asset we are watching goes above a set level. Then, the investor loses all their money put into this option.

The knock-out barrier for an Up-and-Out Option sits higher than the current price of that asset which makes it more likely to be triggered. However, if the price stays below this high bar then investors can earn more return on their investment.

Despite its risks, an Up-and-Out Option also protects investors from losing everything unless that high price is met by the asset.

Advantages and Disadvantages of Knock-Out Options

Knock-out options come with unique benefits and risks that investors must carefully weigh before engaging in this type of investment.

Advantages of Knock-Out Options:

- Lower Premiums: Investors can purchase knock-out options for a smaller premium compared to an equivalent regular option, making them a cost-effective investment strategy.

- Capital Protection: These options provide a level of capital protection in unfavorable market conditions.

- Potential Returns: In the event of a breach of the knock-out barrier, investors receive at least some return on investment.

- Over-proportional Gains: Certain types of knock-out options, such as mini futures, can result in overproportional gains in favorable market conditions.

Disadvantages of Knock-Out Options:

- Limited Profits: Knock-out options limit potential profits for the buyer as they cease to exist once the price of the underlying security reaches a predetermined level.

- Primarily Institutional: They are predominantly used in commodity and currency markets by large institutions, making them less accessible to individual investors.

- Overproportional Losses: Despite the potential for overproportional gains, knock-out options can also cause overproportional losses in unfavorable market conditions.

- Capital Risk: Like other structured investments, knock-out options carry the risk of total capital loss.

An Overview of Structured Notes

Structured notes are complex, customizable investment products that couple a bond with a derivative. They’re designed on the basis relevantly to an underlying asset such as commodities, currencies, or equity indices.

These notes offer the potential for greater returns linked to market performance but also incorporate risk in case of negative market situations. Unlike structured deposits, which offer full capital protection, structured notes carry default risks connected with the issuer’s creditworthiness giving a chance for losses if bankruptcy happens.

There are different types of structured notes including principle-protected and non-principle-protected ones tailored for both conservative and aggressive investors respectively. For offering combinations of diverse feature sets like caps on returns or particular kinds of payouts due to specific conditions it became popular among various investors worldwide.

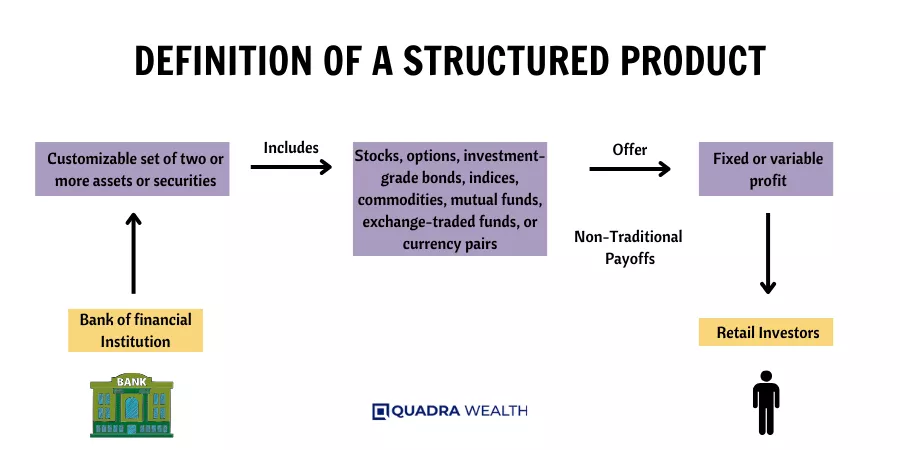

Definition of a Structured Product

A structured product is an investment built from many kinds of financial instruments. These may be stocks, bonds, or other assets. The aim is to provide investors with a way to tap into complex strategies or asset classes in one package.

Structured products often have a set end date and give fixed returns based on how the different parts perform. They can be crafted to match the exact goals and risk comfort levels of each investor.

Financial firms often create these products. They can be bought or sold either on exchanges or over-the-counter (OTC) markets.

Difference between Structured Notes and Structured Deposit

A structured note and a structured deposit are not the same. Your money is safe if you put it in a structured deposit. You get all your money back from the bank when it’s time unless something bad happens to the bank.

However, a structured note can make more money for you or lose more too. They tie how much money you will get to other things like stocks or bonds.

Types of Structured Notes

There are many kinds of structured notes. Each one links to a different kind of asset. Here is a list:

- Equity-linked notes: These are linked to things like shares, groups of shares, and stock market lists.

- Interest rate-linked notes: These connect to rates that change. An example is the Singapore Interbank Offered Rate.

- Credit-linked notes: These tie in with credit events or risks linked to certain entities and the worth of backing assets.

- Currency-linked notes: These relate to pairs of money types such as USD/Euro.

- Commodity-linked notes: These link up with groups of items linked to raw goods or lists connected with raw goods.

Returns from Structured Notes

You get money back from structured notes in a few ways. One is the interest earned over time. Another way you make money is if the price of what you bought goes up. This change in market value can happen on things like stocks and bonds that are part of your note.

However, getting cash back isn’t always sure. Risk plays a big part in how much money structured notes bring back to investors. In volatile markets, values can dip below what was paid for them or reach far higher than expected.

Outcomes lean toward drastic losses or gains when trading leveraged products such as mini-futures and knock-out warrants without a stop-loss limit set.

The Role of Knock-Out Options in Structured Investments

In structured investments, knock-out options play a critical role by adding leverage and enhancing possible returns while also limiting risk due to their built-in ‘knock-out’ feature; moreover, they allow investors to strategically gain exposure or hedge against volatile markets with knockout warrants.

Knock-Out Warrants

Knock-out warrants are part of structured investments. They can give investors a chance to earn money. This happens when the price of something like a stock price goes up past a set level.

But if the price falls down below a certain mark, these warrants “knock out”. That might save an investor from losing too much money. To get more returns, financial experts often use Knock-Out Warrants in their plans for investing.

Leverage

Leverage is a big part of knock-out options in structured notes. It multiplies the money you put into your investments. If a note has high leverage, it means small changes in the market can lead to big wins or losses for an investor.

This makes them risky but also full of chances for profit.

Care must be taken when using leverage in investing decisions, as it involves bigger risks. Such risk comes from the fact that if markets don’t move in the expected way, investors might lose more than what they invested originally.

Not everyone should use flashy investment tools like this; only those who are okay with taking on more danger.

Understanding the Risks and Benefits

This section offers an in-depth exploration of both the pros and cons associated with investing in knock-out options, detailing how potential investors can evaluate if such investments align with their investment strategy and risk tolerance.

Pros and Cons of Investing in Knock-Out Options

Investing in Knock-Out options comes with its own set of pros and cons, which can significantly vary depending on the investor’s risk tolerance, investment objectives, and market understanding. Here is an overview of some of the main advantages and disadvantages:

- Knock-out options can be purchased for a smaller premium than an equivalent option without a knock-out stipulation, making them a cost-effective investment approach.

- They provide a way for large institutions to hedge their bets in commodity and currency markets.

- There is the potential for high returns, especially in volatile market conditions.

- These options have a built-in mechanism to expire worthless if a specified price level in the underlying asset is reached, posing a risk of potential loss.

- Knock-out options limit the profit potential for the option buyer, as they expire if the underlying asset's price exceeds or falls below a specified price.

- They are considered exotic options and may be traded in the over-the-counter (OTC) market, which can be less liquid and more complex to navigate.

In conclusion, while Knock-Out options can offer appealing returns and cost benefits, they also come with a degree of risk and complexity that investors need to fully understand before investing.

Assessing Suitability for Individual Investors

Knock-out options may not always work for single investors. Big firms often use these options, not regular people. These options can curtail how much money an investor makes. Buying such options costs less than buying similar ones without a knock-out rule.

Before choosing this type of investment, one must be sure if it fits their plan and risk appetite

Conclusion

Knock-out options can be strong tools in investments. They protect against large price swings and manage risks better. Yet, these options also limit how much money you can make. So, understanding them well is very important before using them for investing money.

FAQs

A knock-out option in structured investments is a type of exotic option used for risk management strategies. It’s an option that stops working when the underlying asset passes a certain level named the ‘knock-out’.

The up-and-out option becomes useless if the price of the underlying asset goes above the strike price. In case of down-and-out, if it falls below the set rate, it also turns worthless.

No! Knock out-options are found across various financial markets like commodity and currency markets along with over-the-counter (OTC) markets as well.

Yes! These kinds of barrier options such as Knock-outs act as hedging tools to secure against volatile markets through well-planned premium payments.

Any player in financial institutions involved like derivatives traders who understand risks tied to such areas or people seeking financial planning advice can invest using various product types including mini-futures, constant leverage certificates, etc.

Knock-outs hold inherent risks as this market proves both complex and known for its volatile nature which can lead to unexpected results from their operations.