Should I talk to a Financial Advisor When Buying a House? Or thinking of splurging on a vacation condo by the lake? Other ways, thinking of downsizing or building an extension to your existing house?

Given the huge sum of money, all these endeavours require and the fact that the decisions involving them are almost irreversible, the stakes are high, and it is advisable to run your ideas through a few bunch of people.

Beyond obvious emotions a home buying involves, we must remember it’s the real estate we are talking about! Real estate is an investment and often to own one, it requires digging into our savings of the last few years and also pledging our future earnings as the loan instalments we will be paying for a few years.

Wondering whether the money spent on Advisors are wasted or not?

Are financial advisors a go-to for your home purchase?

Questions to ask a financial advisor can vary depending on your goal to purchase a certain property but the financial advice will always get you the best home’s value.

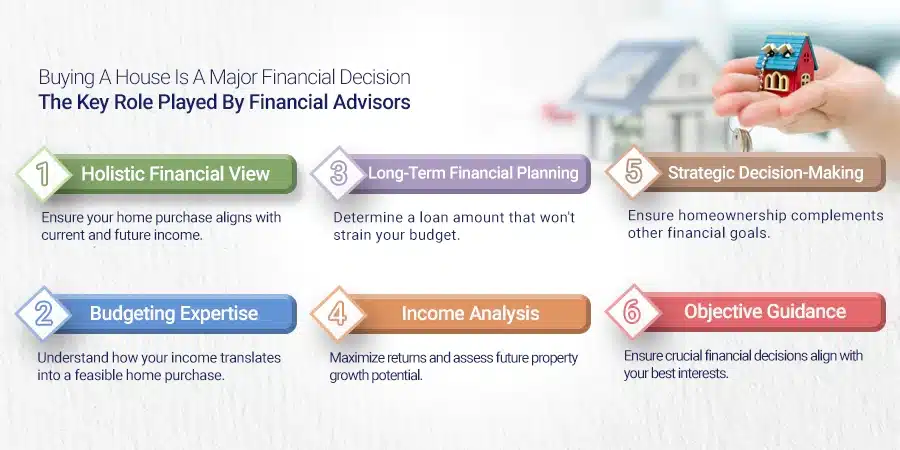

Given the nature of complexity, and impact a house buying decision carries, consulting a financial advisor before buying a house is always recommended. Here’s why,

Big financial decision

Buying a house is usually the biggest financial decision in anyone’s life. A financial advisor can provide a holistic view of your finances and ensure this purchase aligns with your current and future income.

They can analyse your income, debts, and savings to determine a comfortable loan amount that won’t strain your budget. They’ll look beyond just what you qualify for and focus on what’s truly affordable.

They can also give you a fair picture of your financial future to accommodate all your financial goals. Financial advisors help you factor in other goals like retirement savings and future expenses, ensuring homeownership doesn’t adversely impact other aspirations.

The advisor will help work with a financial idea to purchase a home and answer your right questions which allows you to understand your gross income.

The Advisor before buying a home will prepare a set of questions so that you can save in homebuying and help you make one of the biggest returns and determine how much your property can grow in the future.

Real Estate agents will aim to sell the property which gets them good profits but the financial advisor will help and want to make sure that important financial decisions are taken for your new home so that you do not need to save everything you earn.

Understanding mortgage and hidden costs

There’s more to buying a house than the humongous purchase price. An advisor can help you understand ongoing costs like property taxes, homeowner’s insurance, and maintenance needs.

They can advise on the optimal down payment amount considering factors like interest rates and investment returns. Another crucial component – the loan, advisors guide you through different mortgage options like fixed vs.

adjustable rates, helping you choose the loan that best suits your financial situation. They may also help you arrive at your down payment amount, which they foresee won’t jeopardise you.

While there may be a cost associated with financial advisors, their guidance can save you money in the long run by preventing costly mistakes and ensuring a sound financial decision for your home purchase.

Also Read: 6 Signs It’s Time to Hire a Financial Advisor for Your Personal Finances

Knowing when to hire a financial advisor? Should I talk to a Financial Advisor When Buying a House?

Decisions on real estate are of a varied nature, like buying a house, renovating one, downsizing or upsizing, renting existing property or even splurging on that farmhouse.

Since all these decisions involve huge amounts of money, insurance, taxation and other legalities bundled along, it is always advisable to consult qualified financial advisors. Let’s look at various occasions when it would be strategic to hire a financial expert.

1. Before the house purchase

A financial advisor’s role is to take a holistic view of your finances, not just leverage your past investments. They will safeguard your children’s education fund, emergency fund or retirement fund irrespective of the situation.

Financial advisors will work for you to find the right solution or plan out so that you can afford your dream home without trading off your financial basics.

Ready for a bespoke financial planning conversation? Schedule your personalized investment advisory meeting today

2. Upgrading your home

Upgrading your home is not just a one-time thing. With an upgraded home comes all those expenses of increased maintenance costs, higher taxes and insurance.

So a financial advisor can truly guide you on whether you can afford to upgrade your house, both during the purchase and even afterwards.

3. Downsizing your property

When eventually for reasons like, children moving out of the house, you may feel that a bigger house is not required. You may want to sell and encash the existing home and relocate to a smaller one.

Another option is renting a part of it which is unused/you don’t feel the need for a bigger house.

4. When splurging on that ‘vacay’ home

Dreaming of buying a condo in a hill resort or a shack by the lake, your financial planner will help you buy your vacation home. It can be tricky to secure a mortgage for such purchases.

Also, he can assess if you can afford this buy. And in case you seal the purchase, your advisor will find the smartest way to liquidate assets to allow you to buy your dream vacation home.

5. When buying a property for renting

Buying a rental property is a great investment as it will give you an additional steady income stream. Also, with time there is price appreciation to the property. Financial professionals will guide you in the process of preparing a suitable budget and assessing taxes and maintenance costs.

They’ll be able to determine the actual return on investment your property will fetch and if you’ll be able to cover the mortgage repayments, costs and taxes.

Also Read: Discover why financial planning is important for everyone.

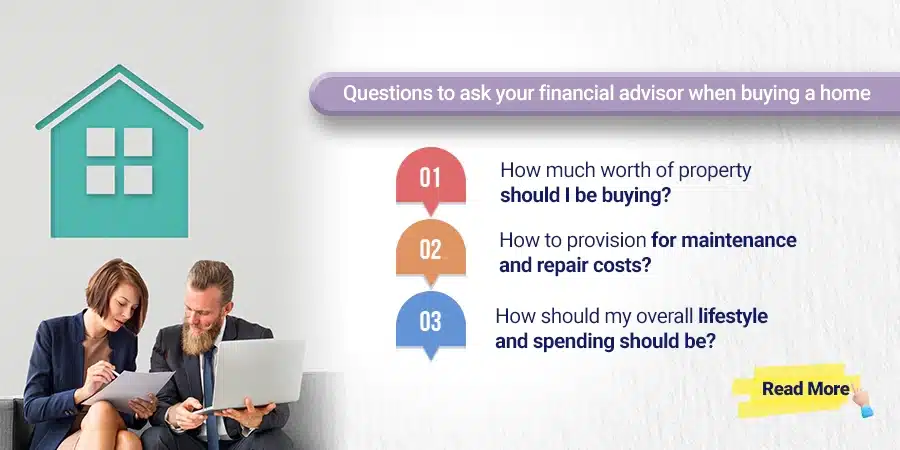

Questions to ask your financial advisor when buying a home

Let’s look at some of the relevant questions you’ll want to ask financial professionals when buying a home.

1. How much worth of property should I be buying?

Arriving at your affordability is the first step in the home-buying process. Together, you’ll calculate how much house you can afford by assessing various parameters like household income, existing monthly debts and your amount of savings for the down payment.

2. How to provision for maintenance and repair costs?

Your financial advisor will be able to look at your finances and ensure you always have that emergency fund secured. As a homeowner, you’ll need to be prepared for maintenance and repair costs that can arise at any time.

3. How should my overall lifestyle and spending should be?

An upgraded lifestyle and a bigger house can call for many unexpected expenses. A financial expert will lend an impartial opinion when it comes to your spending decisions and working out how much loan you can afford. A financial advisor is qualified to take into account your current lifestyle, spending habits and your financial goals.

Parting Thoughts

A financial advisor can be a valuable asset, Even if you’re on a budget, They’re not just about investing – they’re also up-to-date on tax credits and can help you save money on major financial transactions. Their unbiased guidance can take the stress out of these milestones, especially if you’re unfamiliar with the process.

Find an advisor, ask the right questions. work with a financial advisor as the financial advisor can help save your time and money and get much home you can afford. Home is an important idea of large purchases that can go wrong.

Ready for a bespoke financial planning conversation? Schedule your personalized investment advisory meeting today.