Introduction

A decade back it was either taking a traditional route of going in for bonds or fixed-income investment options. Or, it was trading equity at a stock broking office.

There were barely any kind of diversified investing options other than the above two. Whereas, today, investors are almost spoilt for their choices. You have so many financial products and investment-grade schemes that are being introduced to the world of investments and finances.

Do you have any clue as to how this kind of paradigm shift took place within a relatively shorter span of time? Guessing it to be technology or the internet? No, it isn’t.

Shall I say to you all what it is? It is the introduction of a new type of investment option that is named structured notes. These are hybrid notes that comprise an optimum allocation of debt and equity.

Let us first understand what these notes are and then discuss the Risks vs Benefits of Structured Notes. Helping you get started:

What are Structured Notes- Meaning and Conceptualization Explained

Structured Notes are hybrid notes that comprise debt as well as equity. While the debt component protects investor’s capital to a greater extent, the potential returns of the notes are predominantly determined by assets that underlie within the structure of the notes.

Here, the asset allocation can comprise of stocks, equities, high-paying shares or securities, bonds, mortgages, credit-notes, market linked indexes, futures, commodities and currencies to name a few.

Therefore, the investor can choose financial notes using innumerable number of permutations or combinations by including each asset class under the notes.

The product designing firm embeds financial instruments by discussing the customized financial solutions every independent investor would have. This way, the firm appoints experienced wealth managing exponents or financial planners decide the kind of assets that would fit into the investor’s budget and timeline.

Therefore, every investor gets customized financial solutions that align with the financial objectives each investor has. This kind of a customer-centric approach or tailor-made investment approach is exclusive for structured notes and not available for other types of investment options like stocks, bonds or mutual funds.

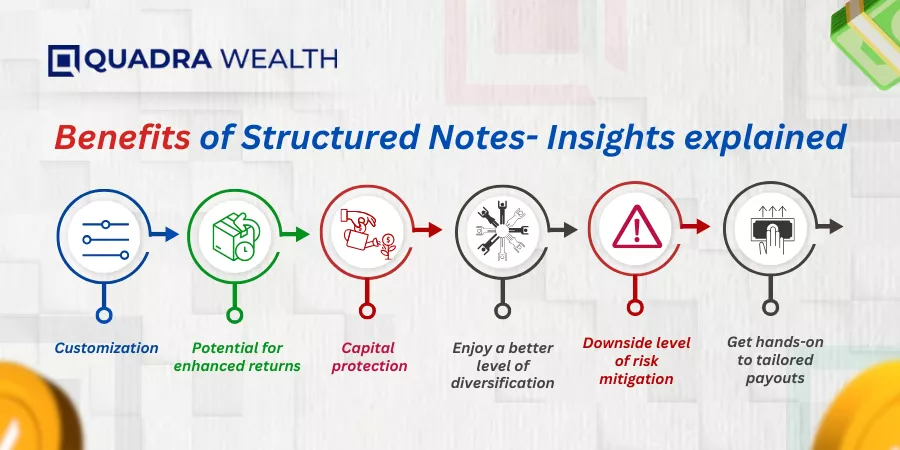

Benefits of Structured Notes- Insights explained

These are the primary benefits that are associated with structured notes as such. Let us have a run-down into the same:

Customization

Structured notes can be customized or tailor-made to meet the specific financial objectives of investors. This is done by choosing currencies, commodities, equities or fixed-income securities like bonds or corporate mortgages.

Every investor must choose assets that align with specific investment objectives like capital preservation, estate planning or income-generation on the whole.

Potential for enhanced returns

With structured notes, you have a potential for enhanced returns. This is because investors are eligible to receive interest earnings, coupons, dividends and other capital-intensive emoluments depending on the assets the notes are linked with. You may not have such a wide range of payouts with fixed-income securities or regular bonds. By incorporating ‘call’/ ‘put’ or multiple hedging options on derivatives, you can leverage turbo boost returns on your notes as compared to equities or traditional bonds.

Capital protection

There are structured notes like Principal Protected notes or PPNs. These notes provide a guarantee of capital return to investors even if the embedded linked-in assets of PPNs perform badly inside the market. In other words, you can expect complete principal protection with PPNs.

You can also tailor notes with hard-core or soft protection nets so that you do not allow adverse market scenarios erode your entire capital wallet.

Enjoy a better level of diversification

The notes also enjoy diversification unline other investment options like stand alone bonds or equities. You can embed a wide variety of linked-in assets inside each of your notes. Here, you choose between credit notes, market index assets, stocks, high-paying securities, a basket of high-paying stocks, commodities, futures, currencies and other derivatives. You can curate innumerable patterns with assets thereby giving you a wider diversification of building robust income cum wealth generating financial portfolios as such.

Downside level of risk mitigation

Even if investors do not choose 100 percent capital protected notes, they can curate notes in such a way that their downside risks are mitigated by a greater or considerable extent indeed.

Say for instance, you purchase an ELN that offers a downside protection of 15%. This means, 15 percent of your capital wallet stay protected even if underlying assets perform poorly in the market. This is at the onset of maturity of these notes.

On the contrary, if you make direct investments in shares or equities and the economy faces severe slumps like global recession or other unprecedented downfalls, you might lose your entire capital wallet.

Therefore, structured notes mitigate risks by a greater extent indeed.

Get hands-on to tailored payouts

You can choose what type of payouts you want to earn on notes and this can be done at the inception stage itself. You can tell your product issuer that you would love to receive coupons or regular interest earnings typical to bonds or fixed income securities and you can design your payouts this way.

Investors can prefer to get capital emoluments like dividend earnings or equity shares if underlying assets fare well across stock exchanges or other secondary markets. You can choose to receive dividends or equity shares over your capital investment.

Therefore, you have the flexibility to use notes as income notes or as growth notes. This kind of a leverage is not available to investors in other investment options such as bonds, equities or through mutual fund houses.

What are the risks of Structured notes?

These are the primary risk factors that are associated with structured notes. Let us have a run-down into the same:

Complexity

As structured notes comprise a mix of debt and equity, this is a type of investment option that can slightly be difficult for an ameteur investor or a newbie to learn or understand. The structured notes also comprise other market complexities an investor might not be aware of.

Lack of liquidity

The notes are highly customized keeping every individual investor in mind. Therefore, these notes are not so easily tradeable in secondary markets for equities or bonds. However, the investors may hand over the notes to the prdodcut issuing firms. The guarantee of receiving capital and returns cannot be exactly determined here. There are some investors who sell their notes in secondary markets at affordable pricing margins.

In a crux, the structured notes may not be that easy to sell in case of an emergency situation that unfolds for the investor.

Credit risk

There is a possibility of the creditworthiness of the product issuing firm going for a toss.

Take the instance of Lehmann Brother or Merily Lynch that were investment biggies who signed up for their insolvenc when a global recession was announced by the US in 2008. Most of the structured notes rendered by these two firms were made penniless for investors who lost their entire capital wallet in one single go.

In a crux, if the product issuers sign up insolvency or sign a petition for bankruptcy, the investor’s capital stands to suffer huge losses.

Not able to enjoy complete upside participation for equity assets

The investors cannot enjoy complete upside participation for equity assets that underlie the notes. This is because these notes are pre-designed with cap limits or ceiling limits on how much returns the notes should earn throughout the tenor of the same.

Therefore, even if the equity-based linked in assets perform exceedingly well in the market, the investors of the notes can only encash capped returns with respect to the same. They cannot enjoy the entire upside participation of equity as with direct investment holders.

Involving market risks

Like any other form of investment, structured notes are also subject to a fleet of market risks the investors must be wary about. Changes in interest rates, volatilty of the market and under performance of underlying assets of the notes can have a sizeable impact on the returns the notes would garner for investors as such.

Complex payoff structures

There are notes that have preset terms or conditions with respect to specified barrier levels that are required to be met on the same. If these conditions are not met, then investors may not get expected rates of return on the capital investment. In a worst case scenario, they may receive nothing.

Fees and costs that are involved

The customization and inclusion of high-end derivatives might turn expensive for structure note investors of the primary market. The product issuing firms levy design fees, admin fees, early redemption fees or transaction fees leading to erosion of potential returns on the longer run. The fee slabs therefore must be discussed in advance before you want to invest in notes.

Intervention of regulatory authorities

Regulatory authorities keep issuing fresh norms for notes. The private authority firms might be taken over by govt agencies or third party financial conglomerates. The intervention of regularoy authorities might cause quite a stir for investors of structured products.

Tax treatments

You might never know if the returns the notes garner as treated as regular income or as capital gains. If the tax is charged as in regular income, the coupons or payouts from notes might not add to much of a thing. And for capital gains, lower tax slabs are implied. The notes are therefore subject to changing tax norms. As an investor of notes, you can verify tax norms or implications with product issuers of notes at the inception stages itself.

Potential loss of cap investment

If the notes do not offer complete cap protection and the underlying assets too perform poorly in the market, then investors might lose a significant portion of their capital wallet or in a worse-case scenario lose the whole of it.

The Bottom Line

Investors must read through the terms and conditions of offer cum policy documents to analyze the risks vs donwsides of structured notes before investing.

What are your thoughts on this? Do mention it in the comments below!

Frequently Asked questions or FAQs

What is your understanding of market volatility?

Answer: Most of the assets of structured notes are equity-based assets. The notes may underlie stocks, basket of shares or equity-based derivatives. Therefore, the bullish or bearish trends in the equity market might impact the prices of linked-in assets of notes as well.

Changing interest rates and influx of unprecedented economic slump like announcement of a global recession or lack of credit obligation by product issuing firms add to the market volatility that can impact the principal investment wallet and returns of structured notes.

How do you calculate the maturity date for structured notes?

The notes are pre designed by the product issuer keeping the financial obligations of investors in mind. Therefore, the terms of the note including the tenor of the notes are determined at the inception stages of these notes.

The fluctuation of prices of linked-in assets alter the potential returns the notes may garner for investors during the time of maturity of the notes.