Are you worried about the future of Social Security and not sure how to plan your retirement without it? It’s a valid concern, given projections suggest that the Social Security program may run out of funds within the next decade.

This article is here to guide you through viable strategies for retiring comfortably, sans Social Security. Ready to secure your golden years? Let’s dive in!

Key takeaways

● You may not get Social Security if you lack credits, plan to retire in certain countries, or have certain jobs.

● To retire without Social Security, work longer, or save more in 401(k) and other plans. Save money outside of retirement too.

● More income can also come from hobbies turned into cash during retirement.

● Pension and health insurance are important when planning for a future without social security.

Situations Where Social Security May Not Be an Option

Social Security may not be an option for workers who lack enough credits. If you’re planning to retire in certain foreign countries, your Social Security benefits might be restricted too.

Some government and railroad employees also face unique regulations that can limit their access to these federal benefits.

Workers with insufficient Social Security credits

Some people don’t have enough social security credits. To get these credits, you need to work and pay into the system. The number of credits you need changes with your retirement age. If you are young and become unable to work, you may qualify for social security benefits with fewer credits.

Older workers usually need at least 40 credits – that’s about 10 years of work – to get retirement benefits from Social Security.

Individuals retiring in certain foreign countries

If you want to retire in a foreign land, you face an extra hurdle. Living outside the U.S. can make getting social security hard. Many retirees dream about warm beaches and cheap living costs in certain countries like Mexico or Thailand.

But they may find that their plan does not work out as they thought.

The U.S. has deals with some nations called ‘totalization agreements’. These allow workers to get social security retirement benefits even if they are not in the U.S. Yet some countries don’t have this deal with the U.S.

Retiring there might mean no social security money for you. So, before making plans to retire abroad, check if your choice country is on this list. Be sure it won’t bring problems for your retirement contributions from Social Security taxes.

Certain government and railroad employees

Some workers do not pay into Social Security. They often work in roles such as government or railroad jobs. These jobs have different retirement plans. For example, they may get a pension or use defined contribution plans like 403(b) or 457(b).

Plans like these let workers set aside money for their future. This money is not taxed until they take it out at retirement. Some of these jobs also match what the worker puts in up to a point.

So if you work in these kinds of jobs, you can plan for your future even without Social Security.

Strategies for Retiring Without Social Security

To retire without Social Security, consider extending your working years or increasing 401(k) contributions. Explore saving outside of retirement plans and fortifying your emergency fund to meet unexpected expenses.

Use creative ways to generate income, such as monetizing hobbies during retirement, for additional financial support. These strategies can help achieve a comfortable retirement even in the absence of social security benefits.

Working longer

Working longer is one plan for retiring without Social Security. By staying in the job, you can keep adding to your retirement savings. More work years also mean more money saved and invested.

This way, you have more time to grow your personal savings too. So, don’t rush to retire if you are healthy and like what you do!

Increasing 401(k) contributions

Put more money into your 401(k) plan. This can be a good way to save for when you retire. The more you put in, the bigger your savings will grow over time. You may have less cash each payday, but it helps build your retirement account.

You could also try getting extra from your boss’s 401(k) match program. Some bosses will add money to what you save. If yours does this, make sure to give enough to get all that free money! It is like a raise that is saved for later.

It helps you retire comfortably without needing social security as much.

Saving outside retirement plans

Saving money outside of retirement plans is smart. It can happen in a regular bank account or through buying stocks. When you start early, it gets easier. Last year, a family with an older person at the head spent about $52,141.

So, if you save little by little every month soon after starting work, you can get close to having $1 million when you stop working.

Boosting the emergency fund

Putting more money in your emergency fund is a smart move. This fund helps you pay for things you don’t expect, like car fixes or medical bills. It can also help you when you retire.

When the stock market drops, pull money from your emergency fund instead of your retirement account. This gives the stock market time to go back up again before you need to take out more cash.

Try putting a part of each paycheck into this fund until it has enough to cover six months of costs.

Earning extra income

Saving money is not the only way to get ready for retirement. Making more money can help too. People can earn extra income in many ways. One common way is by turning hobbies into cash.

If you love doing something, why not make money out of it? Like craft making, baking, or gardening are all good examples. Selling your crafts or baked goods at a local market could bring in some extra cash.

You could also do part-time jobs that fit around your life schedule.

Turning hobbies into income during retirement

You can make money from your hobbies in retirement. Your love for painting, baking, or gardening could bring extra cash. Sell paintings at an art show. Bake and sell cookies or pies at a local market.

Grow vegetables in your garden and sell them too! Your garage band might play gigs for pay. This helps you stay happy because you do things you like to do. You are also making money which is good for peace of mind during retirement times.

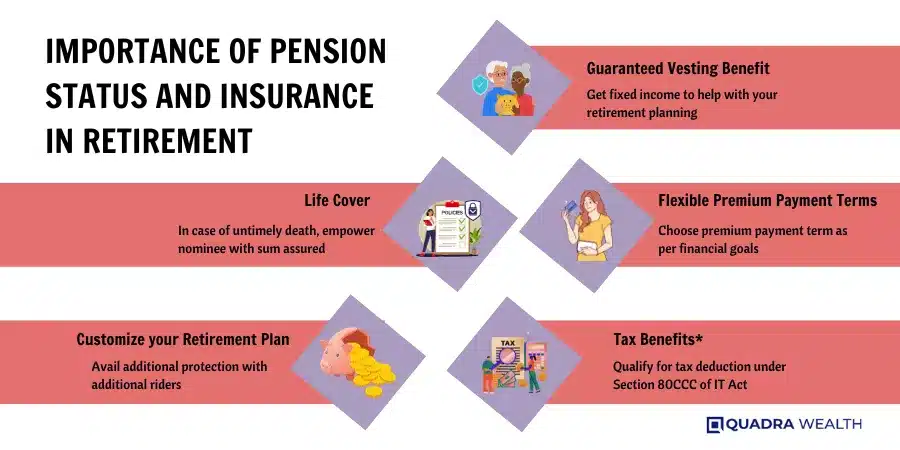

Importance of Pension Status and Insurance in Retirement

Pension plans give extra money in your full retirement age. You get this money after you stop working. Many jobs offer these plans. They take a little bit of your pay each time and put it in the plan for later.

Insurance like health care is also key when you retire. As we get older, we may need more doctor visits or medicines. Having good insurance can help cover these costs without dipping into savings too much.

Conclusion

Planning to retire without social security is a smart move. It allows you to enjoy your golden years with ease. You can work longer or save more each month to prepare for it. Take control of your future today!

FAQs

It means planning for retirement costs using other methods, like investing in stocks or making monthly contributions to a 401(k) or IRA, instead of relying on the federal government’s social security program.

You can use investment returns from stock recommendations and portfolio advice given by sources like The Motley Fool and NerdWallet. You could also use an online broker or robo-advisor to help with your investments.

It helps to educate yourself about index funds, IRA definitions, investing in stocks, and the benefit of after-tax dollars in Roth IRAs or Roth options within 403(b) plans and 457(b) plans. Using these strategies will aid in wealth building for your retirement.

Yes! Teachers often have access to state-run pension plans through the National Association of State Retirement Administrators (NASRA). They may also contribute to a traditional IRA or a Roth IRA as well as employer-matching contributions programs.

The latest Trustees Report suggests that scheduled benefit cuts could happen around the year 2035 due to long-life expectancy rates increasing nationally while monthly benefit amount remains stable which might allow less than promised per personal case scenario.

Yes! Consider shifting substantial earnings towards other types of investment returns such as those offered by Index Funds; this would make up part of your larger picture regarding your strategy for life post-retirement.