Introduction

Getting yourself updated with different types of investment products is just one side of the coin. While the other side of the coin is knowing how every investment platform works.

A lot of online firms and offline merchants may bombard you with promising returns and throw fancy jargon terms which may turn misleading for you at the end.

Therefore, getting yourself acquainted with how different investment portfolios work vis-a-vis the returns they provide must be thoroughly researched by you as such.

Above all, different investing platforms provide different set of rules, regulations, norms, fee structures, and transactional overlays concerning investment products and as an investor, you may have to probe into each consideration to exactly determine if an investment option is suitable for you or not.

In this parlance, let us discuss how principal protected notes regulations work:

What Are Principal Protected Notes- Meaning And Conceptualization Explained

Principal-protected notes work typically like fixed-income securities. Although the notes are linked to underlying assets, the promissory bond of these notes states that atleast the principal amount or the capital investment gets returned to investors at the end of the term.

The return of capital or return of initial investment is the most distinguishing feature you have with respect to principal-protected notes or PPNs. These are structured securities that have different names or conventions given to them as such.

In the US, PPNs are called structured securities or structured products. These are also non-conventional investment options as to how the US market perceives PPNs as.

In Canada, PPNs are also known as market-linked notes or equity-linked notes with the stature of a Guarantee Investment Certification or GIC.

In a nutshell, PPNs offer capital investment as the minimum and the most basic consideration for investors. At the same time, these notes can also offer attractive returns on investment if the market conditions perform favorably.

Principal Protected Notes Regulations and Disclosure- Explained

As PPNs are structured products, investors must understand that the notes combine debt with equity. Therefore, these are complex financial instruments to deal with as a newbie investor.

Therefore, it is important that investors evaluate the regulations, risk factors, fees, and other complex norms these notes come to you with. As an investor, you must go through its disclosure document thoroughly.

Notes have a mix of debt and derivative components and therefore, they do not work in the same way as regular stocks, bonds or mutual funds do. As with other forms of structured notes, PPNs also come to you with embedded options.

In other words, a bond or a promissory note of the PPN promises capital investment at the end of the term. However, as the notes are linked to derivative components or assets like stocks, options, or commodities, the upside potential of the notes depends on the performance of the underlying assets these notes are linked.

Therefore, the returns on investment for PPNs also depend on the performance of linked investments the notes carry. Therefore, regulators like the National Association of Securities Dealers (NASD) and Canadian Securities Administrators primarily involve themselves in framing regulations and norms pertaining to how the notes must be bought and sold. This way, the interests of the buyers and sellers of PPNs stand protected.

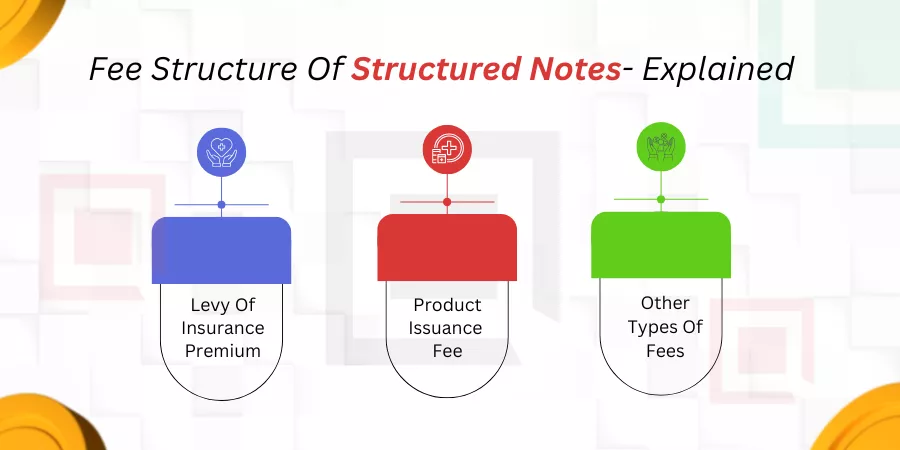

Fee Structure Of Structured Notes- Explained

There would be more elements that defined the fee structure with respect to PPNs. And as such, notes have expensive fee structures as compared to your regular investing options like stocks, bonds, or even mutual funds.

Let us have a look into different types of fees structured notes like PPNs may be involved with:

Levy Of Insurance Premium

As PPNs guarantee principal protection, the product issuer levies insurance premium as the major contingent fee that the notes carry. The notes are insured to provide capital investment to the notes regardless of how the assets perform in the market. And the insurance premium money would be levied by the seller to the buyer. This is in the name of product premium fees.

Product Issuance Fee

The seller or the product issuing firms levy the cost of printing a customized note in the name of the buyer or the investor with pre-designed or customized terms and conditions. The transactional fee or the product issuance fee is levied to the member in this case.

Other Types Of Fees

As such, the structured notes are hard to manage and maintain because of their operational fluctuations. Therefore, varied other fees get levied to the buyer of these notes.

The other fees include selling-commission fees, management fees, performance fees, operating fees, and early redemption fees to name a few. Early redemption refers to disposing of the notes before the maturity date.

However, the fee structure for one type of structured product may differ from the other type. You may have to get in touch with your legal or financial advisor to decide or determine how the fee structure works to PPNs.

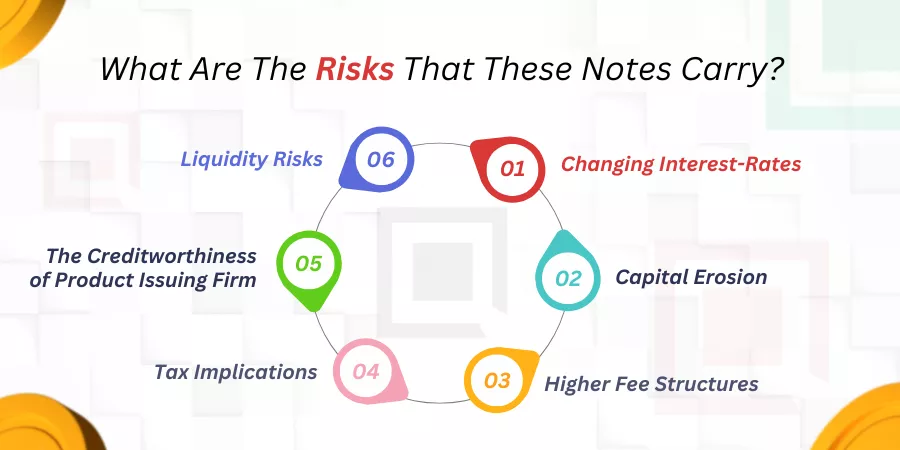

What Are The Risks That These Notes Carry?

Numerous risks structured notes carry within their whim. Helping you get a run-down into the same:

Changing Interest-Rates

The interest rates may change rapidly on account of the volatility of market conditions. For instance, the underlying stocks may hike or plummet in bearish scenarios. Or, there can be stocks with embedded options that may perform superseding well in bullish scenarios.

Inflation of assets also has a bearing on the overall valuation of the portfolio.

Auto-callable notes may also carry different interest rates at the start or end of the term. Therefore, changing interest rates pose a significant risk for investors of structured products.

Capital Erosion

As structured notes are linked to underlying assets like stocks, commodities or other derivative options, the upside gains or the income-earning potential of these notes are directly proportional to the performance of the underlying assets the notes are linked to.

If the linked-in assets do well in the market, investors receive their principal amount and enhanced returns the assets have earned through the term of the portfolio. You receive dividends or coupon payouts over and above getting hands-on to your initial capital or face value of the investment amount.

On the other hand, if structured notes have assets that fair poorly or do not perform all that great in the market, the investors lose partial or complete value of the investment amount.

Higher Fee Structures

Structured notes, owing to their complex operational structures carry a higher amount of fees as compared to what regular stocks, bonds, or mutual funds carry.

The higher fee structures have a direct bearing on the returns the investor earns on the term of the asset.

You may need to have a word with product issuing firms, wealth managers, and experienced professionals as to how the fee structures may vary between products.

Tax Implications

Investors may never know if the income the note earns will be treated as a regular source of income and be taxed accordingly. Or, would the investment returns be charged under lower slabs if the income received is taxed as capital gains.

You should get guidance from a tax advisor as to how tax implications work on different investment products especially connected with structured notes.

The Creditworthiness of Product Issuing Firm

One must carefully evaluate the credit rating of product issuing firms before venturing into structured notes. The creditworthiness of the firm issuing the notes can have a direct bearing on whether the investor will get back his principal investment or not.

Sometimes if the credit rating of the firm slips badly or performs adversely, the investors may lose a significant portion or even all of their capital amount.

In other words, if the issuing firm goes bankrupt, investors may face a sharp decline in their investment portfolio as to receiving the amount invested by them as such.

Take the case of Lehman Brothers. During the year 2008, this investing firm in the US signed up for its insolvency and liquidated. At that point in time, all the structured notes that were issued in the name of Lehman Brothers were rendered valueless.

Therefore, the creditworthiness of the product issuing firm is a major risk consideration an investor must know beforehand with respect to structured products or notes.

Liquidity Risks

Structured notes cannot be disposed of that easily in secondary markets owing to their complex structures. Therefore, investors may have thinner chances of disposing of them over a reasonable profit margin. Therefore, the notes may have to be held to maturity in order to redeem the same.

As the underlying assets are observed using matrix or average guessing methods as adopted by product issuers of these notes, the potential gains these notes earn would also be known to the investor only upon maturity of these notes.

For Whom Are Structured Products Suitable?

Structured products are suitable for investors who are a little more experienced in the field of investing. As these are notes that comprise debt and equity, it may be a little harder for a newbie investor to learn or grasp the nuances of the trade.

The notes were only suitable for high-end retail and institutional investors two decades back. And, the notes were made or issued in the primary marketplaces, on the whole.

But of late, middle-class retail investors have also started procuring structured notes from secondary markets comprising investment-grade banks, stock-holding firms, and other financial conglomerates.

The notes have bonds linked to derivatives or assets. Therefore, the investment portfolio suits investors who are capable of handling risk tolerance or a better degree of risk appetite under their belt.

This is mainly because the downside protection these notes provide is linked to the upside potential of underlying assets the notes are linked to. Speculative gains or capital erosion are the main risk factors these notes can throw if the market conditions are adverse.

The Bottom Line

With the changing landscapes of the financial market, investors can find a variety of investment products on their desks. However, it is important that the investors learn the various risk factors that are associated with the buying of structured products and owning them as investment portfolios.

Tax implications, risk factors, regulatory compliance procedures, and the nature of structured products are the main factors to consider before you want to invest in this market or not.

What are your thoughts on this? Do let us know in the comments!!