Do you ever find the topic of retirement planning overwhelming or far off?

If so, you’re not alone – but studies show that starting a plan to retirement early can lead to a significantly larger nest egg.

This blog post aims to share helpful financial strategies and tips on how anyone – even those just out of college – can begin saving now for a secure future.

Ready to kick-start your journey towards financial security in your golden years? Keep reading!

Key takeaways

●Start saving early for a big retirement fund. Small amounts grow over time due to compound interest.

●Young people can make risky choices with their money. More time means more chances to get a lot of money back.

●Quitting work sooner may be possible if you start late in life. Early saving allows for early retirement!

●Job benefits like a 401(k) plan boosts your savings power. Take the most from jobs that match your investment.

●People worry about Social Security in the future. But even so, it's still an important part of planning for retirement-age funds.

Why Start Retirement Planning Early?

Starting planning early gives you the privilege of long-term compound growth, allowing your savings to escalate over time.

The benefit is most potent when younger, with fewer financial responsibilities such as mortgages or children’s education expenses.

Also, it significantly reduces the amount you need to save later in life.

You can max out your contributions to tax-advantaged IRAs (Individual Retirement Accounts), helping lower your taxable income now and possibly providing tax-free withdrawals at retirement if chosen wisely, like a Roth Individual Retirement Account instead of a traditional one.

Benefits of Long-term Compound Growth

Your money can grow fast if you start early. This is due to compound growth. It means that even a small amount of money saved, like $100 each month, grows over time.

For example, if you start saving at age 22, you could have around $380,000 by the time you retire. Having a reliable source of retirement income is also important when preparing for a comfortable retirement.

So don’t wait; start your retirement savings today!

Fewer Financial Responsibilities

You have less to pay for in your early years. This is the time when you do not have big bills. You may need to pay back student loans, but there are no kid’s fees or home loans yet.

Small changes can help save money too. Let’s say you stop a movie service that you don’t use much or lower your phone data plan. These small steps help put extra cash into your retirement fund.

Starting early means good news! You don’t need to set aside big amounts of money later on in life for planning, which means fewer financial responsibilities as you grow older and more focus on building a financially secure future now using strategies like compound growth, diversifying stocks, and contributing to a tax-advantaged account.

Lower Savings Requirements in Later Life

Saving early for retirement means you can put away less money. It is like a slow and steady race to build your retirement fund. Every dollar saved now will grow over time due to compound growth.

For example, saving $100 every month from age 22 could give you about $380,000 by the time you retire.

But if you wait until 42 years old, it would take almost five times that amount each month to save up the same total!

So, an early start helps lower how much Gen Z has to save later in life expectancy on the rise.

Instead of trying to catch up on savings down the line, they can focus more on financial goals like housing costs or maybe even an early retirement plan.

Maxing Out Tax-advantaged IRAs

Many Gen Z people can fill up their tax-advantaged Individual Retirement Accounts (IRAs). You don’t have to save a lot later in life when you do this. Your money grows more as time passes.

It’s just like planting a tree today and eating its fruit many years from now. Putting away $100 every month at age 22 may make you $380,000 richer by the time you retire!

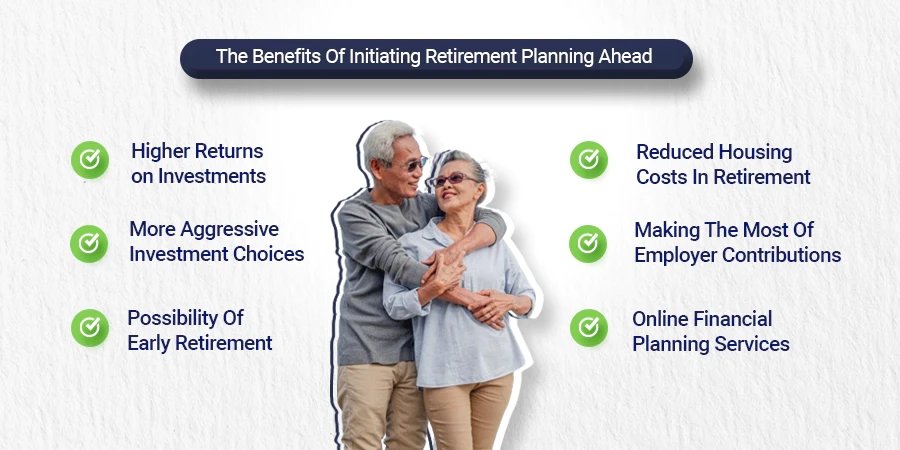

Advantages of Early Retirement Planning

Kickstarting your planning early can yield higher investment returns, and allow for aggressive investments while providing the possibility of an early retirement.

Lower housing costs in retirement savings and greater retirement benefits from employer contributions are additional perks to starting ahead.

When it comes to retirement planning, individuals must assess their current financial standing, establish clear retirement goals, and develop a comprehensive savings and investment strategy to ensure a comfortable and secure retirement.

Discover more advantages of initiating your plan now.

Higher Returns on Investments

You can get more cash from your money by starting to save early. This is called higher returns on investments. You have time, so you can put money in places that give a lot of money back, like stocks.

Even if the value goes down for some time, there’s plenty of time for it to go up again before you need the money for retirement.

More years spent investing means more chances to grow your wealth. Late to start thinking at 22 years old with $100 each month and an average yearly gain of 7%, you could have about $380,000 when you retire!

Contrarily, waiting until 42 would make achieving this amount much harder–requiring nearly five times as much saved monthly.

So it pays off big-time to start saving for retirement.

It Is Never Too Early To Start Planning For Retirement

You can choose risky investments when you’re young. Risky stocks offer the chance for more money. This higher income is good for your retirement plan.

Getting an early start allows for time to bounce back if there are losses in the market.

Choosing these riskier options leads to bigger savings once it’s time to retire.

Possibility of Early Retirement

Earlier you start can lead to quitting work sooner. Plans for your retirement, starting at a young age, it’s never too early.

You will have more than enough in your retirement fund. This means more time for travel or hobbies.

Even if you run out of money, small changes help free extra cash for the future.

Reduced Housing Costs in Retirement

Planning early for retirement can cut down housing costs later. Gen Z is in luck! They have more years to save, which takes care of housing expenses when old. Small changes now make a big difference then.

Just cutting back on phone data or skipping that extra cup of coffee can free cash. This cash goes into the retirement fund and grows over time due to compound interest. This secures a house without stress in full retirement age.

Late to start planning today to enjoy lower housing costs in your golden retirement years.

Making the Most of Employer Contributions

Your job can help grow your retirement fund. Some jobs offer a 401(k) plan. When you put money into this plan, your boss may add more money too! This is called an employer contribution.

You should always max out these contributions.

Try to put in just as much cash as your company will match. It’s like free money! Employer contributions can make a big boost in your monthly retirement savings. Your future self will be glad you took advantage of these extras from the start of your career.

Understanding the Uncertainty of Social Security

Social Security benefits may not be as secure for young people. Some worry that not enough money will be left when they retire. Still, Social Security is a vital part of most retirement plans.

It helps many cope with the cost of living in the golden years.

Fewer and fewer people work for each person getting Social Security now though. This can hurt the fun amount later on if it keeps going this way. People your age might get only 75% of what older ones do today by 2035.

Understanding these facts early helps plan better for future needs and wants. Social Security benefits may not be as secure for young people.

Some worry that not enough money will be left when they retire. Still, Social Security is a vital part of most retirement plans.

It helps many cope with the cost of living in the golden years.

Fewer and fewer people work for each person getting Social Security now though. This can hurt the fun amount later on if it keeps going this way. People your age might get only 75% of what older ones do today by 2035.

Understanding these facts early helps plan better for future needs and wants.

Conclusion

In conclusion, the path to a financially secure retirement begins with early planning and strategic choices.

Embracing the power of compound growth, minimizing financial responsibilities in youth, and capitalizing on tax-advantaged accounts can pave the way for a comfortable retirement.

Never too late to start investing early as possible, individuals can enjoy higher investment returns, explore more aggressive investment options, and even consider the possibility of early retirement.

Moreover, early planning can reduce future housing costs and maximize the benefits of employer contributions.

While the future of Social Security may be uncertain, understanding its role in retirement planning remains crucial.

Ultimately, the key is to commence this journey today, ensuring a brighter, worry-free future.

FAQs

Generation Z can start planning their long-term retirement plans early. After graduation, they may get an entry-level job and begin by making small monthly contributions towards social security benefits, 401(k), IRA, or high-yield savings account.

An investment advisor suggests using the extra cash from a salary raise to boost your retirement savings plan, diversify stocks in your investment portfolio, or pay off student loan payments quickly.

Yes! Digital budgeting tools like mobile apps are very useful. They give spending alerts and balance notifications to young professionals helping them manage their earned income effectively.

Traditional IRA works on deductible contributions made from your earned income up to certain limits based on age and tax filing status, offering tax-deferred growth.

Having a certified Financial Planner or a financial advisor guide us through complex financial decisions providing insights about expense management, asset classes allocation strategies depending upon risk tolerance level, etc., which assist in building a healthy nest egg for a desired retired lifestyle sustainably!

When considering the role of a financial experts, it’s important to recognize the multifaceted ways in which financial planner can help you reach individuals achieve their financial goals. Investing for retirement is a crucial financial planning strategy that enables individuals to secure a comfortable and stress-free post-employment life.

Retirement contributions are vital savings that individuals make to secure their financial future post-employment. It’s never too late Employer-sponsored retirement plans are a vital component of many employees’ long-term financial security.

You could investing for retirement wisely under the guidance of fiduciary financial advisors considering long-term care insurance premiums and contribution into diversified stocks increasing your rate of returns on investments and further strengthening overall financial future stability.