This question often arises among Muslim investors seeking to align their financial decisions with Islamic principles.

Our discussion today will delve into the nuances of this topic, offering insights into how Islamic finances guides asset management.

We’ll explore the key principles that shape investment strategies within the bounds of Islam, including interest prohibition and its implications.

You’ll learn about Shariah-compliant financial products like index funds and mutual funds offered by Islamic banks and how they can be used in constructing portfolios that resonate with a Muslim investor’s belief system.

Beyond just investments, we also examine ethical guidelines under Islamic asset management, such as avoiding unethical investments and dealing with job roles with conflicting religious tenets.

Does asset management haram when viewed through these lenses? Stay tuned to find out more.

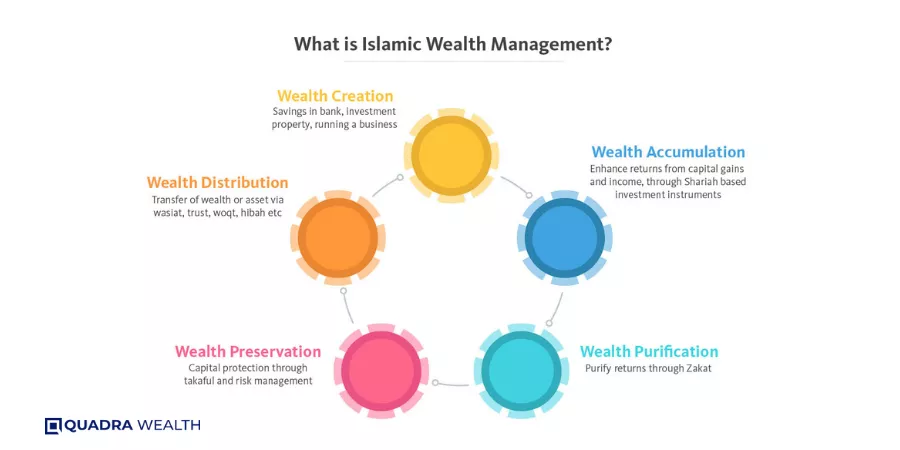

Understanding Islamic Wealth Management

Is wealth management haram? The realm of Islamic finances is guided by unique principles and prohibitions that aim to ensure equitable distribution of wealth.

This system, deeply rooted in religious beliefs, presents an alternative approach to conventional financial products offered by investment banks.

Principles Guiding Islamic Asset Management

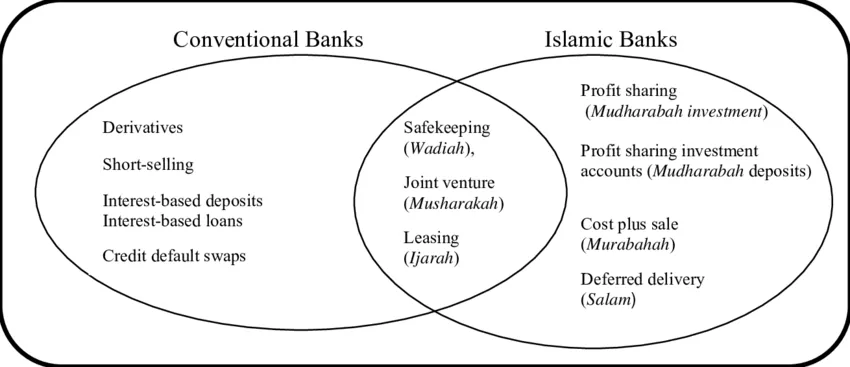

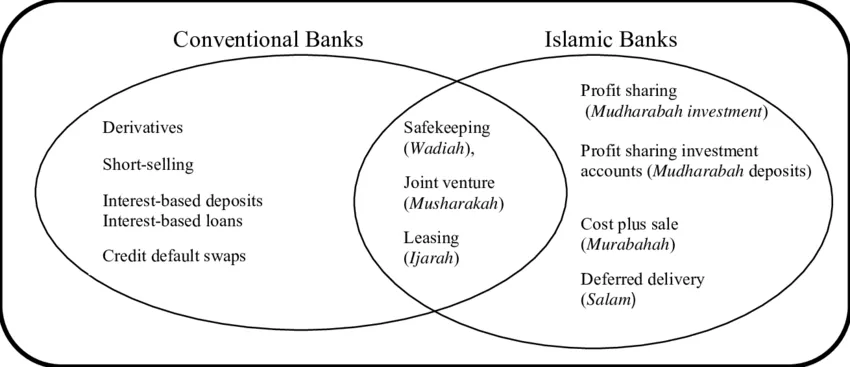

In contrast with the traditional banking sector and systems, the Islamic bank operates under strict guidelines derived from Sharia law.

These rules prohibit certain activities such as usury (charging interest), gambling, and investing in businesses involved in unethical or harmful industries like alcohol production or pork processing.

The goal is not just about making profits but also ensuring these profits are earned ethically and distributed fairly among all stakeholders.

How Interest Prohibition Affects Investment Strategies

- Compliance with Shariah

- Ethical investments

- Long-term perspective

- Risk-sharing and fairness

- Limited investment options

- Higher due diligence

- Subjectivity and interpretation

- Potentially lower liquidity

A key difference between Islamic finances and its conventional counterpart lies in the treatment of interest or ‘riba’. In Islam, charging or paying interest-based loans is considered exploitative and thus prohibited.

However, this does not mean Muslim investors cannot participate in lucrative ventures such as mutual funds provided by an investment bank.

Rather than earning money through fixed returns on investments (interest), Islamic financial institutions generate profit through trade-based activities where risk and reward are shared among the parties involved.

For instance, instead of lending money at a predetermined rate of return, an Islamic bank might buy goods for a customer who then repays over time at a markup – essentially achieving similar results without involving any form of riba.

This principle extends to other forms of investments too; for example, equity financing where the accredited investor become part owners sharing both risk and rewards rather than creditors expecting fixed returns regardless of the outcome of the business venture they invested in, thereby aligning their interests more closely with those of the entrepreneurs themselves resulting in a fairer economic system overall benefiting society at large.

- Promotion of equity-based investments

- Focus on real economic activities

- Reduced risk of financial crises

- Limited access to conventional financial instruments

- Increased complexity and cost

- Potential Impact on economic growth

Investment Banks and Islamic Finance

Investment banks have recognized the potential of Islamic finances and have started offering Sharia-compliant financial products. Investment banks have developed Sharia-compliant financial products to meet the needs of Muslim investors who wish to invest in accordance with their faith.

By offering these products, investment banks can tap into a growing market and provide a valuable service to their clients.

Islamic Banks and Mutual Funds

The Islamic bank also offers mutual funds that comply with Sharia law.

These funds invest in companies that meet certain ethical standards and avoid those involved in activities prohibited by Islam.

By investing in these funds, Muslim investors can earn returns while ensuring their investments are in line with their religious beliefs.

Conclusion

Islamic finance presents a unique approach to asset management that is guided by religious principles and aims to ensure equitable distribution of wealth.

By avoiding interest-based transactions and investing in ethical companies, Muslim investors can earn returns while staying true to their beliefs.

Investment and Islamic banking institutions are collaborating to provide financial services tailored to the expanding market of Islamic finances.

Key takeaways

Islamic asset management follows strict guidelines derived from Sharia law, which prohibits usury and investing in unethical industries. Instead of making money through fixed returns on investments, Islamic financial institutions generate profit through trade-based activities where risk and reward are shared among the parties involved. Investment banks have recognized the potential of this market and offer Sharia-compliant products to meet the unique needs of Muslim investors who want to invest in a way that aligns with their religious beliefs.

Investment Strategies within the Bounds of Islam

As a Muslim investor, you may have difficulty finding investment options that adhere to your religious convictions; however, there are many strategies available for investing in accordance with Shariah law such as utilizing Shariah-compliant index funds.

But fear not, there are plenty of strategies available for investing in accordance with Shariah law.

Utilizing Shariah-compliant index funds

Islamic index funds are a great solution for Muslim investors.

These funds track groups of stocks that comply with Islamic principles, meaning they don’t include companies involved in haram businesses like alcohol or gambling.

Popular examples include the Dow Jones Islamic Market Index and the S&P 500 Shariah Index.

- Diversification

- Lower costs

- Simplicity

- Transparency

- Limited customization

- Performance limitations

- Potential tracking error

- Reliance on index composition

Constructing halal portfolios

Another effective strategy is to construct your portfolio around halal assets, such as real estate, stocks, gold and silver commodities, and Sukuks.

Sukuks are a type of bond that generates profit from tangible assets or business ventures, rather than interest payments which are forbidden under Islamic law.

- Sukuks: Unlike traditional bonds, Sukuks represent ownership in a tangible asset or business venture and generate profit from these enterprises instead.

- Mutual Funds: Halal mutual funds also exist where asset managers ensure all included securities comply fully with Sharia laws.

To ensure compliance, many Muslim investors seek guidance from financial advisors knowledgeable about both finance and Islamic law.

Key takeaways

Maximize your investments while staying true to Islamic principles. Explore Shariah-compliant index funds and halal portfolios with the help of knowledgeable financial advisors.

- Alignment with Islamic principles

- Ethical investments

- Potential for long-term stability

- Tailored investment options

- Limited investment options

- Potentially higher costs

- Complex screening criteria

- Performance variations

Ethical Guidelines and Social Responsibilities Under Islamic Asset Management

Islamic wealth management is more than just making profits.

It’s a holistic approach that emphasizes ethical investments, social responsibilities, and compliance with Sharia law.

This unique approach to asset management ensures that Muslims can participate in the global financial markets without compromising their religious beliefs.

Avoidance of Unethical Investments

In line with Islamic finance principles, certain types of investments are considered haram (forbidden).

Dealing with financial instruments such as subprime mortgage bonds are unethical and their consequences were seen in the financial crisis.

These include companies involved in activities such as alcohol production, pork-related products, gambling, or any form of interest-based transactions like credit default swaps.

As an investor seeking to adhere strictly to these guidelines set by the Islamic bank, it becomes crucial to understand which financial products fall within the acceptable range.

For instance, mutual funds that invest in businesses adhering strictly to Sharia laws are preferred over those investing in non-compliant sectors.

Similarly, investment banks offering structured notes based on halal assets become more attractive to Muslim investors.

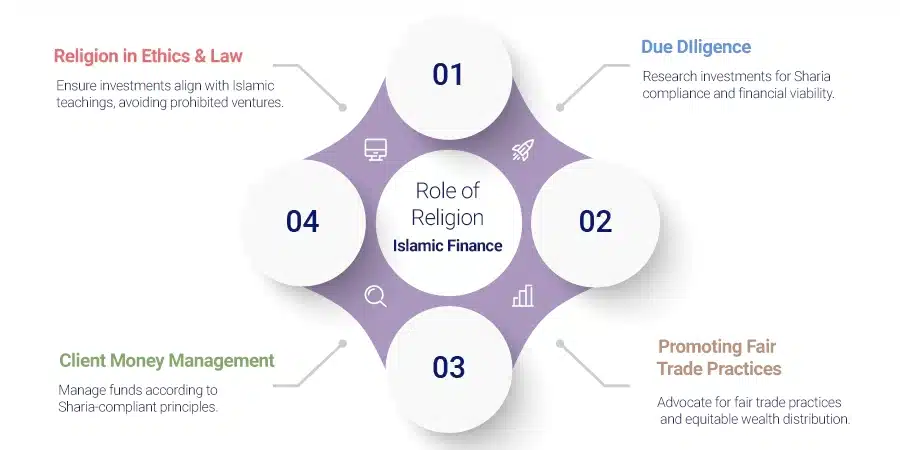

Job Roles Conflicting With Religious Tenets

The job roles within Islamic financial institutions also need careful consideration when it comes down to ethical compliance under Islam.

For example, a portfolio manager at an investment bank must ensure all his decisions align with the teachings of Islam.

He cannot knowingly invest clients’ money into prohibited ventures regardless of potential returns.

This adherence extends beyond individual actions too – entire organizations operating under this system have a responsibility towards promoting fair trade practices and ensuring equitable distribution among stakeholders.

The emphasis here isn’t solely on profitability but rather on achieving a balance between material gains and spiritual fulfillment.

The job roles within Islamic financial institutions also need careful consideration when it comes down to ethical compliance under Islam.

For example, a portfolio manager at an investment bank must ensure all his decisions align with the teachings of Islam. He cannot knowingly invest clients’ money into prohibited ventures regardless of potential returns.

This adherence extends beyond individual actions too – entire organizations operating under this system have a responsibility towards promoting fair trade practices and ensuring equitable distribution among stakeholders.

The emphasis here isn’t solely on profitability but rather on achieving a balance between material gains and spiritual fulfillment.

Socially Responsible Investing (SRI)

- Mutual Funds: Mutual funds following SRI principles avoid stocks from companies engaged in unethical or harmful activities according to Islamic Law.

- Islamic Banks: These institutions offer various services including savings accounts and loans without charging interest – thus conforming fully with Sharia rules.

- Hedge Funds: Although rare due to their speculative nature, some hedge funds do comply by investing only in halal securities, thereby providing an alternative option for high-risk tolerant investors looking to diversify their portfolios.

Mutual Funds: Mutual funds following SRI principles avoid stocks from companies engaged in unethical or harmful activities according to Islamic Law.

Islamic Banks: These institutions offer various services including savings accounts and loans without charging interest – thus conforming fully with Sharia rules.

Hedge Funds: Although rare due to their speculative nature, some hedge funds do comply by investing only in halal securities, thereby providing an alternative option for high-risk tolerant investors looking to diversify their portfolios.

Key takeaways

Islamic wealth management is a holistic approach that emphasizes ethical investments, social responsibilities, and compliance with Sharia law. Investors seeking to adhere strictly to these guidelines must understand which financial products fall within the acceptable range. Organizations operating under this system have a responsibility towards promoting fair trade practices and ensuring equitable distribution among stakeholders while achieving a balance between material gains and spiritual fulfillment through socially responsible investing (SRI).

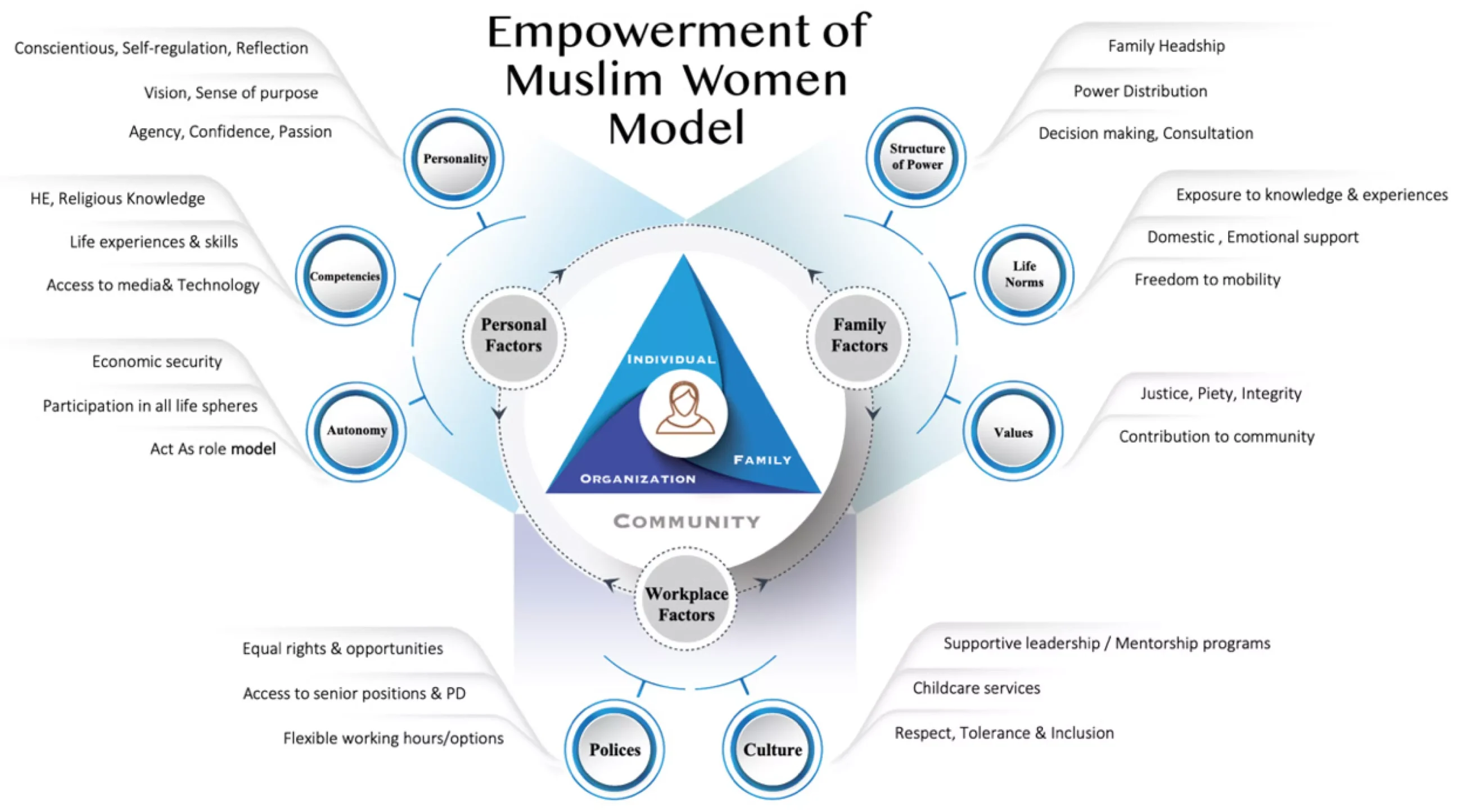

Gender Equality Perspective in Conventional and Islamic Wealth Management

The Quranic view on gender equality is one of parity, as declared by God in the holy book. It clearly states that men and women are equal in the eyes of God.

This principle has led to significant improvements concerning contract enterprise earning accumulation among women.

Improvements in Contract Enterprise Earning Accumulation Among Women

In many Muslim-majority countries like Malaysia, this belief is being translated into action by empowering more and more women to take control of their financial futures.

Women are now actively participating in wealth management activities, which were traditionally dominated by men.

They are entering into contract enterprises, accumulating wealth independently while adhering strictly to Sharia law.

This shift not only promotes economic growth but also encourages gender equality within the community.

It challenges traditional norms about who should manage family finances and paves the way for a more equitable distribution of resources.

Challenges Faced by Malaysian Women

However, despite these positive strides towards inclusivity and empowerment, there still exist certain challenges that need addressing, particularly for Malaysian women balancing family-work obligations.

- Societal Pressure: Many societies place undue pressure on women to prioritize familial responsibilities over professional ones, which can hinder their financial independence journey.

- Lack of Financial Literacy: Due to years of exclusion from financial discussions at home or work, some women may lack the necessary knowledge needed for effective wealth management.

- Gaps in Legal Frameworks: Some laws might not fully support or protect female investors, leading them vulnerable to exploitation.

- To overcome these hurdles, it’s crucial that we promote financial literacy amongst all individuals, regardless of gender status, ensuring they have access to the right tools and investment advice to navigate the complex world of investment banking confidently and effectively while staying true to religious beliefs and principles laid down by Islam, such as the prohibition of interest and ethical investments.

Key takeaways

The article discusses the gender equality perspective in conventional and Islamic wealth management, highlighting how women are now actively participating in contract enterprises to accumulate wealth independently while adhering strictly to Sharia law. However, there still exist certain challenges that need addressing, particularly for Malaysian women balancing family-work obligations such as societal pressure, lack of financial literacy, and gaps in legal frameworks. It's crucial that we promote financial literacy amongst all individuals ensuring they have access to the right tools and investment advice to navigate the complex world of investment banking confidently and effectively while staying true to religious beliefs and principles laid down by Islam.

Government Support Programs for Women's Financial Stability

Women face unique challenges in achieving financial stability, but several government support programs are designed to promote economic empowerment among women.

The i-SURI Scheme: Empowering Malaysian Women

Malaysia’s “housewife welfare aid” program, the i-SURI scheme, helps women balance family and work obligations.

It allows housewives to contribute to their retirement savings under their husband’s Employees Provident Fund (EPF) accounts, with the government matching contributions up to a certain limit annually.

The scheme also provides assistance for religious pilgrimages to Mecca, promoting both spiritual and monetary well-being among citizens.

By recognizing unpaid domestic work as valuable labor deserving compensation, the i-SURI scheme empowers women and promotes gender equality.

It encourages women to participate in wealth management activities, breaking down cultural barriers and promoting economic independence.

Benefits of Government Support Programs for Women

- Economic Security: Direct benefits like matched contributions towards retirement savings help secure long-term economic safety for women who may otherwise rely solely on familial support systems.

- Social Empowerment: Such schemes validate the importance of household chores often performed by housewives without any monetary compensation.

- Cultural Acknowledgement: Providing assistance for religious pilgrimages highlights how such programs respect individual beliefs while promoting overall prosperity.

Governmental interventions like the i-SURI scheme are instrumental in promoting gender equality and breaking down barriers preventing women from actively participating in wealth management activities while staying true to their religious tenets.

Key takeaways

Empowerment starts with recognition. Government support programs like Malaysia's i-SURI scheme promote economic security and gender equality for women.

Quality Discrepancy Between Conventional Versus Sharia-Compliant Asset Services

The financial world is vast and diverse, offering a plethora of services to cater to the varying needs of its clientele.

However, when it comes to Islamic finance and wealth management, there’s an apparent gap in service quality between conventional asset services and those that are Sharia-compliant.

This discrepancy often leads to less satisfactory outcomes for clients who adhere strictly to their religious beliefs.

Impact of Service Quality on Client Preference

One primary reason behind this disparity is the early reliance on Modern Portfolio Theory (MPT) by many Islamic financial institutions.

While MPT has been instrumental in shaping investment strategies worldwide, its application within the realm of Islamic finance can sometimes be challenging due to the strict adherence required towards ethical investing principles as prescribed by Sharia law.

This situation creates a unique conundrum for Muslim investors – how do they balance their desire for robust returns with their need for investments that align with their faith?

The answer lies in bridging this service quality gap through innovative solutions tailored specifically towards these unique requirements.

In recent years, several initiatives have aimed at improving the service quality offered by Sharia-compliant asset services.

These include enhancing transparency levels regarding investment processes and outcomes; providing detailed information about potential risks associated with different types of investments; ensuring compliance with all relevant regulations both domestically and internationally; among others.

Islamic banks, insurance companies (Takaful), pension funds, mutual funds, hedge funds, and other financial institutions, etc., have started adopting such measures aiming at increasing customer satisfaction while staying true to fundamental principles governing Islamic finance.

By doing so, they hope not only to retain existing customers but also to attract new ones looking forward to better-quality offerings aligned closely with personal values and beliefs.

- Enhanced client satisfaction

- Trust and confidence

- Competitive advantage

- Long-term relationships

- Increased costs

- Subjectivity and perception

- Difficulty in measuring and quantifying

- Limited resources and capacity

Bridging the Gap

While there still exists a noticeable difference in terms of service quality between conventional versus Sharia-compliant asset services today, efforts are being made to bridge this gap.

This promises a future where every investor, regardless of religion or belief system, will be able to access high-quality financial products that meet specific needs and aspirations effectively and efficiently without compromising core values and ethics guiding life choices and decisions.

Key takeaways

The article discusses the quality discrepancy between conventional and Sharia-compliant asset services in wealth management for expatriates and residents in the Middle East. The reliance on Modern Portfolio Theory (MPT) can be challenging due to the strict adherence required towards ethical investing principles as prescribed by Sharia law, creating a unique conundrum for Muslim investors. However, initiatives have aimed at improving service quality offered by Sharia-compliant asset services through transparency levels regarding investment processes and outcomes, providing detailed information about potential risks associated with different types of investments, and ensuring compliance with all relevant regulations both domestically and internationally among others.

Promoting Financial Literacy For Effective Navigation

Financial acumen is an indispensable capability that all should have, particularly when managing assets.

It becomes even more essential when dealing with Islamic finance and Sharia-compliant investments.

The world of finance can be complex and daunting for many individuals; however, by promoting financial literacy through free advice, we aim to simplify this process.

At Quadra Wealth, we believe in empowering our clients with knowledge about various investment tools available within the Islamic financial sphere.

This includes understanding how hedge funds are structured per Sharia-compliant contracts and how they can contribute towards consistent growth in their investment portfolio management.

The Importance Of Free Advice By Banking Institutions

Institutions play a crucial role in fostering an environment conducive to learning about finances.

They have access to vast resources and expertise that can greatly benefit individuals seeking guidance on managing their wealth effectively.

- Educational Seminars: Many institutions offer seminars where experts discuss different aspects of investing, including risk assessment, diversification strategies, market trends, and more. These are invaluable for both novice investors as well as seasoned ones looking to refine their skills further.

- Dedicated Advisory Services: Some banks provide dedicated advisory services where customers can seek personalized advice tailored according to their specific needs and circumstances. These advisors guide clients in making informed decisions aligned with their financial goals while ensuring compliance with Islamic principles.

- User-friendly Online Resources: With digitalization becoming increasingly prevalent in today’s age, banking institutions also provide a plethora of user-friendly online resources like blogs, articles, e-books, interactive calculators, and more. This provides individuals the ability to learn in a comfortable and familiar environment while avoiding information overload.

This initiative not only helps enhance individuals’ understanding but also builds trust between them and the institution providing these services – creating a win-win situation for all parties involved.

We firmly believe that by taking advantage of such initiatives offered by banking institutions, along with utilizing platforms like Quadra Wealth’s expert advisory service, you’ll be able to navigate your way confidently and effectively through the world of Islamic asset management, achieving the desired level of financial independence sooner than you think possible.

Remember, the journey of a thousand miles begins with a single step, so why wait? Start yours today.

- Accessibility for all clients

- Trust and loyalty

- Financial education

- Reputation and brand image

- Potential conflicts of interest

- Sustainability and cost implications

- Limited expertise and scope

- Potential information overload

Key takeaways

The article promotes financial literacy and the importance of free advice from banking institutions for effective wealth management in Islamic finance. Quadra Wealth's asset managers empower clients with knowledge about Sharia-compliant investment management, including the hedge fund, to achieve consistent growth in their investment portfolio. Educational seminars, dedicated advisory services, and user-friendly online resources are valuable tools offered by banks to enhance individuals' understanding of finances and build trust between them and the institution providing these services.

Conclusion

Islamic asset management follows principles that prohibit interest and prioritize ethical and social responsibilities, including gender equality.

Government support programs for women’s financial stability and promoting financial literacy are crucial for the effective navigation of conventional versus Sharia-compliant asset services.

By utilizing index funds under Shariah law and constructing portfolios aligning with Muslim investors’ beliefs, it is possible to invest within the bounds of Islam while still achieving financial goals.

FAQs in Relation to Asset Management haram

Islamic wealth management, also known as Islamic asset management, follows Sharia law principles such as avoiding interest (Riba) and unethical investments.

Yes, as long as it adheres to Sharia-compliant investment principles.

Yes, as long as they comply with Islamic ethical guidelines.

Mutual funds can be halal if they are structured according to Sharia laws. (source)

Avoid discussing religious beliefs outside of the context of Islamic finance, controversial topics such as politics, race, and religion, and personal opinions or anecdotes. Stick to facts and established knowledge within the field.