How to invest in s&p 500 from UAE. Learning how to invest in the S&P 500 from the UAE can be a rewarding journey, offering significant opportunities for wealth creation.

As an investor based in the UAE, it is imperative to become familiar with available investment options and methods of engaging in this process.

This article will provide a comprehensive overview of investing in the New York Stock Exchange, including platforms such as Baraka and eToro that are available to UAE residents, low-risk index funds, robo advisors’ advantages over traditional banks, and diversifying risks with bonds and international indices alongside S&P 500.

It will guide you through various platforms such as Baraka and eToro that facilitate seamless investments for UAE residents.

We’ll delve into low-risk index funds, explore robo advisors’ advantages over traditional banks, and discuss diversifying risks with bonds and international indices alongside the S&P 500.

By understanding these elements of investing, you’re setting yourself up for a successful investment journey in the S&P 500 from UAE.

How To Invest In S&P 500 From UAE

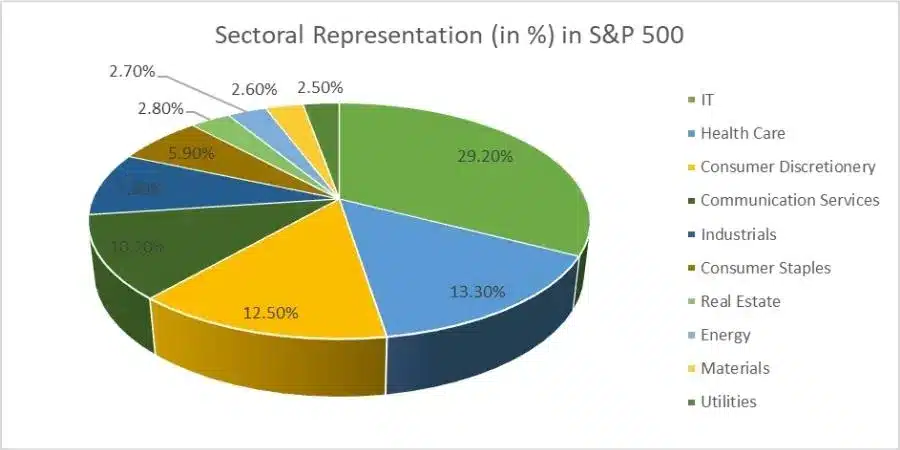

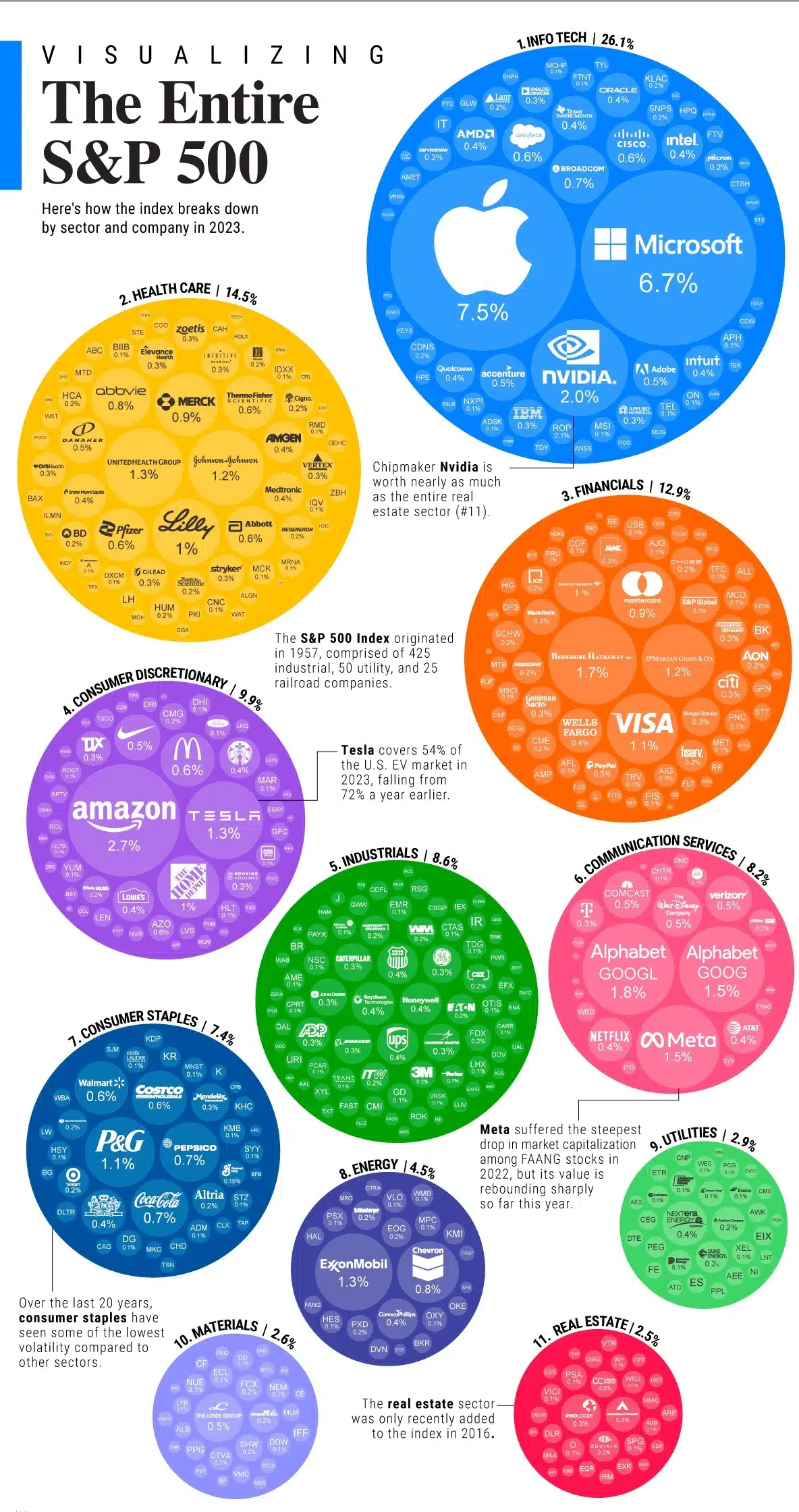

Investing in the US stock market is a great way for UAE residents to start their investment journey. The Dubai financial market offers a plethora of investment options, including mutual funds, index funds, and exchange-traded funds (ETFs).

When it comes to investing in the S&P 500 from the UAE, it will be costly and inefficient for individual investors to attempt to invest in each of these 500 companies separately.

However, Exchange-Traded Funds (ETFs) offer a practical solution by providing a single investment vehicle representing the entire index’s performance. By investing in S&P 500 ETFs, Emiratis and UAE residents can effectively participate in the potential growth of the index and enjoy the benefits of diversification.

Start Investing with the Right Platform

To invest in the US stock market, you need to locate a suitable investment platform or brokerage account that offers access to major exchanges such as the NYSE and provides tools for DIY investing, including robo advisors and financial advisors.

These platforms offer tools for DIY investing, such as robo advisors and financial advisors, who guide your investments based on your risk appetite and goals.

These platforms provide access to stock exchanges, including the NYSE, across the world. With these platforms, you can buy individual stocks or invest in popular index funds like the S&P 500, which represents a significant portion of global assets.

- Access to options

- User-friendly interface

- Convenience

- Cost-effective

- inadequate options

- Difficulty tracking

- Higher costs

- Lack of Convenience

Diversify Your Portfolio with Bond Funds

While equity investments offer a high return, they also come with high risks. To reduce risk and diversify your portfolio, bond funds are an ideal choice to balance out the volatility of equity investments.

These funds offer a steady return and help balance your overall portfolio, even if you lose money on certain trades due to unpredictable factors affecting stock prices worldwide.

When comes to investing in US stocks, you can capitalize on the potential of long-term asset creation while minimizing transaction costs. So, start investing today and take advantage of the opportunities offered by the market.

- Risk diversification

- Regular income

- Professional management

- Accessibility

- Missed diversification

- Limited income options

- Lack of management

- High entry barriers

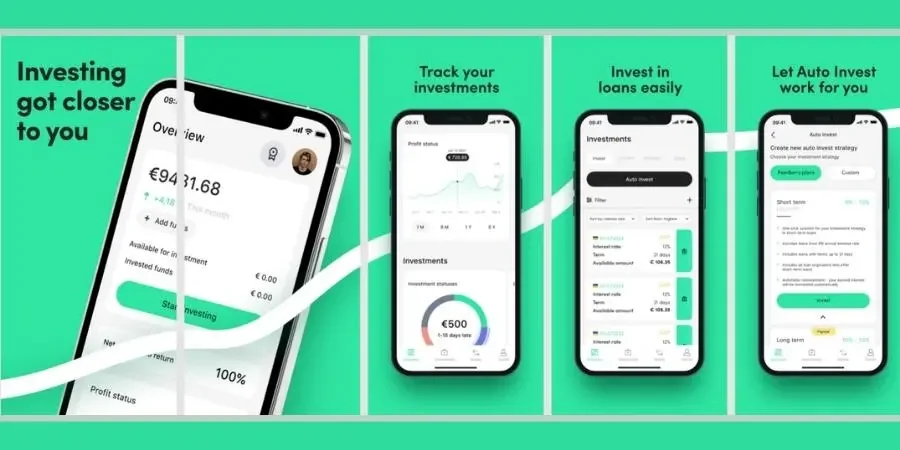

Investing in the S&P 500 with Baraka

Looking to invest in the S&P 500 from Aby Dhabi? Baraka is an excellent choice. With no minimum investment requirements, this self-directed investment tool offers access to over 6,000 US-listed securities.

What is Baraka?

Baraka is a user-friendly platform that empowers investors by providing comprehensive market data and insights. Even beginners can navigate through various investment options available on the US stock market.

Baraka also offers educational content to help investors understand complex financial concepts and make informed decisions about their investments. They provide articles, videos, and podcasts covering everything from basic investing principles to advanced trading strategies.

Automatic Investments with Baraka

Baraka’s unique feature is automatic investments in stocks and ETFs based on your preference. You can set up recurring deposits into your account at intervals that suit you – daily, weekly, or monthly – which are then automatically invested according to your pre-set preferences.

This feature saves time and encourages disciplined investing as it eliminates the need for constant monitoring of market movements. Recurring deposits can be a great way to gradually accumulate assets without significantly affecting your regular finances.

Investing in the S&P 500 has never been easier with Baraka. Try it out today.

- Simplified investing process

- Regular investment discipline

- Potential for dollar-cost averaging

- Access to professional guidance

- Minimal control over investment decisions

- Potential for higher fees

- Dependency on the performance of the chosen investment strategy

- Lack of customization options

Exploring the eToro Trading Platform

If you’re tired of the same old index funds and want to spice up your investment portfolio, eToro is the platform for you. This multi-asset platform lets you trade in everything from stocks to cryptocurrency assets to CFDs.

Contracts for Difference (CFDs) are derivative financial instruments that allow traders to speculate on the price movements of an underlying asset without actually owning the asset itself.

Multi-asset Trading Made Easy

eToro offers an impressive range of tradable assets. Whether you’re into tech giants like Apple and Amazon, want to invest in cryptocurrencies like Bitcoin and Ethereum, or feel like speculating on the price movements of commodities via Contracts for Difference (CFD), eToro has got you covered.

The platform’s interface is designed to be straightforward, allowing even those new to trading to explore and make decisions with ease.

Portfolio Management Made Simple

What sets eToro apart from other platforms is its innovative social trading feature known as CopyTrading. With this service, you can copy the trades made by successful investors automatically.

This not only simplifies investing but also helps novice traders learn from experienced ones. In addition to CopyTrading, eToro provides access to professionally managed portfolios called CopyPortfolios that bundle together various investments under one chosen market strategy.

These portfolios are designed with different risk levels and investment goals in mind, catering to diverse investor profiles.

Overall, eToro’s robust features cater well to achieving your financial objectives, whether you’re a seasoned trader seeking diversity or a beginner needing guidance.

So why not give it a try?

Wealthface - Online Trading Made Easy

Living in the UAE and want to do trading in the US stock market? Look no further than Wealthface. This platform makes opening a brokerage account a breeze, perfect for both newbies and seasoned investors.

US Brokerage Accounts via Wealthface

Wealthface’s user-friendly tool makes stock trading easy, and with no minimum account requirement, it’s accessible to everyone.

Plus, they take security seriously, so you can rest assured your investments are safe.

Security Measures Taken by Wealthface

Wealthface employs stringent safety protocols to protect investor data from potential threats or breaches. They also offer educational resources on investing strategies and retirement plans, making them a comprehensive financial partner.

Diversifying your portfolio can be daunting, especially when venturing into international markets like the S&P 500 index funds. But with Wealthface’s professional guidance and user-friendly interface, it’s less intimidating.

Wondering how to start investing? Check out these Investopedia articles on investment strategies and retirement planning.

Index Funds - Lower Risk Exposure Investments

If you’re an investor in the UAE looking for a stable and efficient investment option, index funds might be your best bet. These investments are popular due to their tax efficiency and lower risk exposure.

Benefits of Investing in Index Funds

- Tax Efficiency: Index funds generate fewer taxable events than actively traded stocks.

- Risk Management: By mirroring market performances, index funds spread out potential risks across a broad range of companies or sectors.

- Cost-Effective: Index funds usually have lower expense ratios than managed mutual funds because they don’t require active management.

Note that returns aren’t guaranteed, but these benefits make index funds attractive for investors.

Finding Suitable Brokers or Financial Advisors

To invest in index funds from the UAE, you’ll need access through brokers or financial advisors who offer these services. Some reputable platforms include eToro, Wealthface, and Sarwa.

All three provide access to a wide variety of global markets, including US stock exchanges where most S&P 500 Index ETFs are listed. Remember to do thorough research before choosing your broker as fees can vary significantly between different providers.

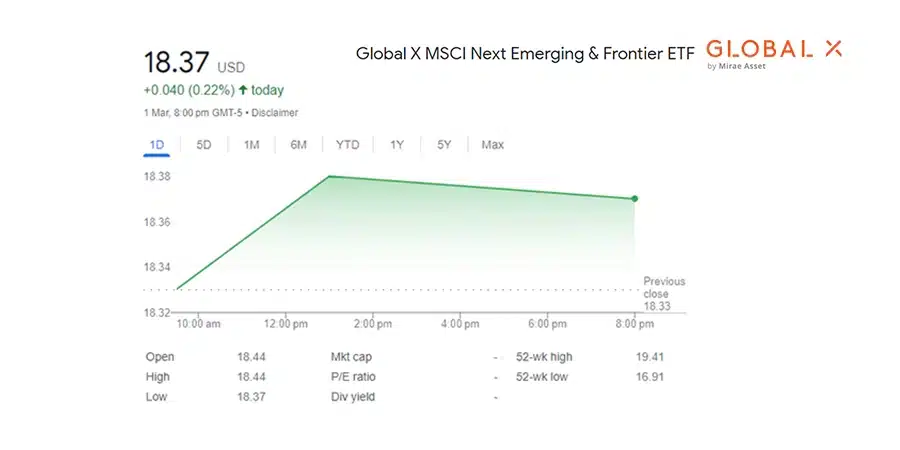

Global X MSCI Next Emerging & Frontier ETF

If you’re on the hunt for an investment opportunity that offers exposure to high-growth emerging markets, look no further than the Global X MSCI Next Emerging & Frontier ETF.

These ETFs provide an opportunity to diversify your portfolio with exposure to rapidly developing economies, potentially leading to attractive returns.

Investing in High-Growth Emerging Markets

The Global X MSCI Next Emerging & Frontier ETF focuses on countries with promising economic prospects that are not yet classified as developed markets. These include nations like Vietnam, Bangladesh, Nigeria, and others.

By investing in these emerging markets, you stand a chance to benefit from their rapid growth and development. This approach can be particularly beneficial for UAE residents who want to expand their investment horizons beyond local or regional markets.

Investing in emergent markets can be risky, but diversifying across various regions and industries may reduce this risk. What sets this ETF apart from mutual funds is its lower fee structure, making it an attractive option for cost-conscious investors.

Unlike mutual funds that charge management fees based on a percentage of assets under management (AUM), ETFs typically have fixed operating expenses regardless of AUM size, making them cheaper over time, especially when considering compounding effects.

- Higher return potential

- Benefits of Diversification

- Access to emerging industries

- Favorable demographics

- Higher risk/volatility

- Lack of transparency

- Currency risk

- Liquidity concerns

Why Choose Global X MSCI Next Emerging & Frontier ETF?

Aside from its lower fee structure, the Global X MSCI Next Emerging & Frontier ETF offers exposure to some of the world’s fastest-growing economies.

This ETF is designed to track the performance of companies in emerging and frontier markets, giving you a chance to invest in high-growth potential areas.

For those seeking to diversify their portfolio and benefit from the potential of higher return, investing in emerging markets may be a wise decision.

Despite the potential rewards, it is essential to evaluate the associated risks before making an investment in emerging markets.

By investing in the Global X MSCI Next Emerging & Frontier ETF, you can gain exposure to these markets while reducing your overall risk level.

So, if you’re looking for a low-cost alternative that provides access to high-growth emerging markets, consider investing in the Global X MSCI Next Emerging & Frontier ETF today.

Key takeaways

The Global X MSCI Next Emerging & Frontier ETF is a low-cost investment opportunity that offers exposure to high-growth emerging markets, focusing on countries with promising economic prospects. Investing in these markets can be beneficial for UAE residents who want to diversify their portfolio beyond local or regional markets and potentially reap substantial returns while mitigating risk through diversification.

Sarwa's Low-Cost ETF Portfolios

Investing in the stock market can be scary, but Sarwa makes it easy and affordable with its low-cost Exchange Traded Fund (ETF) portfolios.

Sarwa tailors their portfolios to your risk tolerance and investment goals, so you can invest with confidence.

Diversified Portfolios for Every Investor

Sarwa’s approach involves creating a globally diversified portfolio of low-cost index funds that are automatically rebalanced over time. They use Modern Portfolio Theory (MPT) to optimize asset allocation based on your specific needs and risk profile.

Their platform offers three main types of portfolios: conservative, balanced, and growth-oriented. The conservative portfolio has more bonds than stocks; the balanced one has equal amounts of both; while the growth-oriented portfolio leans towards stocks in the UAE.

By diversifying your investments across different asset classes such as equities, fixed-income securities, or commodities, you can reduce your overall risk level associated with investing in a single security type.

Plus, Sarwa offers tax-loss harvesting services to help you minimize your taxable income and maximize your returns. If you’re a new investor looking to make smart decisions about where to put your money, consider Sarwa’s professional financial advisory service.

Their user-friendly interface and expert advice from seasoned professionals with extensive experience dealing with global markets, including the S&P500 Index, make it a great place to start.

Directly Investing Into S&P 500 Index Fund

If you’re an expatriate or resident in the UAE and planning to invest directly in the S&P 500 index funds, it’s important to understand that this investment option comprises prices tracking 500 of the largest American stocks.

Investing directly into the S&P 500 index funds can be a great way to gain exposure to some of America’s most successful companies.

Direct Investment Process into S&P500

To begin, you’ll need a brokerage account to acquire these investments as either ETFs or mutual funds. Several platforms are available for this purpose, such as eToro, Baraka, and Wealthface.

These platforms provide access to US-listed securities, including the S&P 500 index funds.

- eToro: Offers multi-asset trading, including stocks, crypto assets, and the CFD, along with portfolio management services like copy trading.

- Baraka: A self-directed investment tool offering automatic investments based on user preference with no minimum investment requirements.

- Wealthface: A UAE-based online platform facilitating trade into the US stock market through opening a brokerage account while providing tools for stock trading alongside top-notch security measures plus education and retirement plans without any account minimum requirement.

- Exposure to a diverse range of leading US companies

- Potential for long-term growth

- Transparent and widely recognized index

- Lower fees compared to actively managed funds

- Concentrated exposure to US equities

- Susceptible to market volatility

- Lack of active management and adjustment to market conditions

- Minimal diversification beyond the S&P 500 index

Prior to investing directly in the S&P 500, consulting with a respective financial advisor is highly recommended. They will guide you according to your risk tolerance level and help ensure that your portfolio remains balanced over time.

Remember, investing involves risks, so sure you do thorough research before making any decisions.

Robo Advisors vs Traditional Banks

Investing in the S&P 500 from UAE has never been easier. While traditional banks have been a common choice for the lot, robo-advisors are gaining traction due to their cost-effectiveness and ease of use.

Advantages of Robo Advisors over Traditional Banks

- Easy Access: Robo advisors provide an online platform that is accessible anytime, anywhere. This allows UAE investors to manage their portfolios at their convenience.

- Affordability: Unlike traditional banks which may charge high money for financial advice and portfolio management services, robo-advisors typically offer these services at much lower costs.

- Sophisticated Algorithms: Robo advisors utilize advanced algorithms and artificial intelligence to optimize investment strategies based on individual investors’ risk tolerance and financial goals.

The introduction of robo-advisors has made investing much more attainable than before. They allow you to invest directly into the S&P 500 index funds without needing a large amount of capital or extensive knowledge about the stock market.

Additionally, they also offer automatic rebalancing features ensuring your investments stay aligned with your chosen best investment strategy even during volatile market conditions.

If you’re considering using a robo advisor for your investment needs, some popular options include Wealthfront, Betterment, and SoFi Invest.

Each offers different features tailored towards specific investor needs so make sure you do thorough research before choosing one that suits your requirements best.

In conclusion, robo advisors are a cost-effective and convenient way to invest in the S&P 500 from the UAE. Robo advisors provide a cost-effective and accessible option for investing in the S&P 500 from UAE, due to their cutting-edge algorithms and user-friendly interfaces.

Diversifying Risks Through Bonds And International Indices Alongside S&P 500

Investing in the S&P 500 from the UAE is great, but don’t put all your eggs in one basket. Diversification is key, according to finance expert Stefan Grasic.

Bond Indices: A Steady Income Stream

Don’t forget to incorporate bond indices into your investment strategy. The Bloomberg Barclays US Aggregate Bond Index offers broad exposure to safer, U.S.

The Bloomberg Barclays US Aggregate Bond Index provides access to a variety of safe, USD-denominated investment-grade bonds.

International Indices: Spreading Out Potential Risks

International ETF indexes like MSCI World or FTSE All-World are also essential for risk diversification. They give you access to companies based outside of the United States, spreading out potential risks across different economies and sectors.

A balanced mix of these assets alongside investing directly in the S&P 500 can create a well-diversified portfolio that spreads risk while providing opportunities for growth.

This approach aligns with Quadra Wealth’s mission – helping expatriates and residents become financially independent by offering consistent growth through structured notes.

Investing has never been more accessible thanks to modern technology advancements. So why wait? Start building your diversified portfolio today.

Conclusion

As a UAE resident or CXO expat, diversify your portfolio and gain exposure to US markets by investing in the S&P 500 through mediator platforms like Baraka and eToro, or online trading with Wealthface and Sarwa’s low-cost ETF portfolios.

Investing in the S&P 500 allows Emiratis and UAE resident investors to gain exposure to the US market and potentially benefit from its long-term growth.

Consider directly investing in S&P 500 index funds or exploring emerging markets with Global X MSCI Next Emerging & Frontier ETF, while diversifying risks through bonds and international indices alongside S&P500.

Follow these guidelines to make informed investment decisions that align with your financial goals and check out credible sources like Forbes and Investopedia for more information.

Frequently Asked Questions

Investing in the S&P 500 from the UAE is easy with online trading platforms like eToro, Baraka, and WealthFace.

- Use these platforms to purchase ETFs that track the index.

- Residents of UAE can also invest in US stocks through online brokerages like eToro and WealthFace.

- To invest in Vanguard’s S&P 500 ETF (VOO) from UAE, use international brokerage accounts offered by companies like eToro.

- Investors from anywhere in the world can put their money into an ETF that tracks the performance of the S&P 500 index.

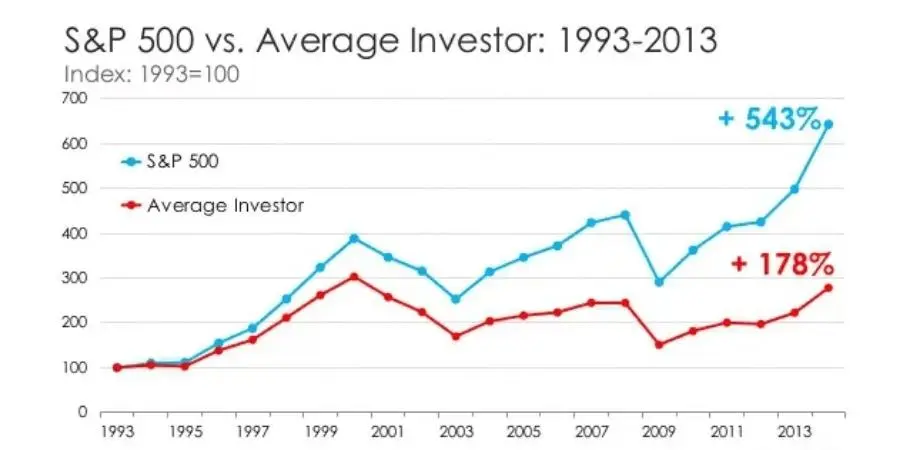

Remember to avoid discussing illegal activities, high-risk investment strategies, or making guarantees about future market performance.