The Capital-protected structured product is a type of investment that offers a combination of protection of the principal amount and the potential for returns.

These products provide investors with a certain level of security by guaranteeing the return of their initial investment, while also offering the opportunity to earn additional income through market-based investments.

By investing in capital-protected structured products, individuals can mitigate the risk associated with traditional investment vehicles while still participating in the potential upside of the market.

These products appeal to risk-averse investors who seek a balance between capital preservation and growth.

The capital-protected structured product is designed to provide investors with a level of certainty in an uncertain market.

These products typically consist of a combination of fixed-income securities and derivative instruments, which are carefully structured to minimize the risk of loss.

The principal amount invested is protected by various mechanisms, such as a guarantee from a financial institution or the use of options contracts.

In addition to the principal protection, these products also offer the potential for additional return of capital through participation in the performance of an underlying asset, such as a stock market index or a basket of stocks.

One unique feature of capital-protected products is that they allow investors to participate in the potential upside of the market while limiting their downside risk.

This is achieved through the use of derivative instruments, which provide exposure to the performance of the underlying assets without requiring the investor to directly own these assets.

By structuring the product in this way, investors can benefit from positive market movements without assuming the full risk associated with owning stocks or other assets.

This feature makes capital-protected structured products a suitable option for conservative investors who want to protect their capital while still having the potential for gains.

According to the article titled “What You Need to Know About Capital Protected Structured Products,” these investment vehicles provide a unique combination of principal protection and higher returns.

This source highlights the importance of understanding the structure and risks associated with capital-protected structured products before investing.

Summary:

- Capital-protected structured product offers investors a way to potentially earn returns while protecting their capital investment. These products combine elements of traditional investments and derivatives to provide a level of capital guarantee.

- Understanding the mechanics of structured products is essential for investors. Structured products are typically composed of a bond or note and a derivative component, such as an option. The performance of the product is linked to an underlying asset or underlying index.

- Structured products offer various features, including different levels of capital protection, participation rates, and maturity dates. It is important for investors to carefully evaluate these features to determine the best fit for their investment goals and risk tolerance.

Understanding the Mechanics of Structured Products

Understanding the intricacies of Structured Products

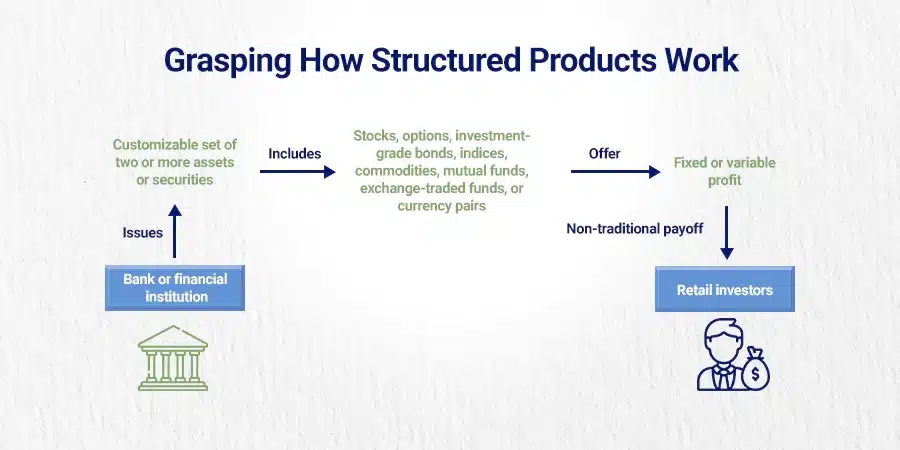

A structured product is a complex financial instrument that requires a deep understanding of its mechanics in order to fully grasp its potential benefits and risks.

These products offer a unique combination of features and are designed to cater to different investor preferences and goals.

To gain a better understanding of the mechanics of structured products, let us take a closer look at the following table:

Table: Understanding the Mechanics of Structured Products

Feature | Description |

Capital Protection | Structured products provide a level of principal protection, ensuring that a portion of the original investment is safeguarded even in times of market volatility. |

Participation | Investors can benefit from the potential upside of underlying assets, such as stocks or indices while having downside risk limited through structured product features |

Customization | Structured products can be tailored to meet individual investor needs, offering choices regarding the underlying assets, maturity dates, and payout profiles |

Diversification | By incorporating a mix of different assets within a single product, structured products offer a way to achieve diversification and potentially reduce risk. |

Risk-Return Profile | Understanding the risk-return profile of structured products is crucial. These instruments can offer different levels of potential returns, but these gains come with varying degrees of risk, which need to be carefully evaluated by investors. |

The table above provides a comprehensive overview of the key features and characteristics of structured investment products. It highlights the importance of capital protection, participation in potential market gains, customization options, diversification benefits, and the need to carefully assess the risk-return profile.

In addition to the information presented in the table, it is worth noting that structured products have gained popularity among investors seeking to balance risk and reward. However, it is crucial to thoroughly understand these products and their underlying mechanics before making any investment decisions.

One real-life example of the importance of understanding the mechanics of structured products involves a retail investor who was attracted by the potential high returns promised by a structured product linked to a volatile commodity.

Unfortunately, the investor was not fully aware of the downside risk products associated with such products and experienced significant losses when the commodity price dropped sharply.

This cautionary tale emphasizes the need for investors to educate themselves about the mechanics and potential risks of structured products before investing their hard-earned money.

To navigate the world of structured products successfully, it is essential to acquire a solid understanding of their mechanics, carefully assess the risk-return profile, and seek professional advice when needed.

By doing so, investors can make informed decisions that align with their financial goals and risk tolerance.

Exploring Different Features of Structured Products

Structured products offer a range of unique features that investors can explore. These features provide various benefits and protection mechanisms to investors. Let’s analyze some of these features in detail in the table below:

| Feature | Description |

| Capital Protection | Structured products provide protection for the invested capital, minimizing risk. |

| Return Enhancement | Certain structured products offer the potential for increased returns. |

| Customization | Investors can tailor structured products to meet their specific investment goals. |

| Diversification | Structured products allow for diversifying investment portfolios effectively. |

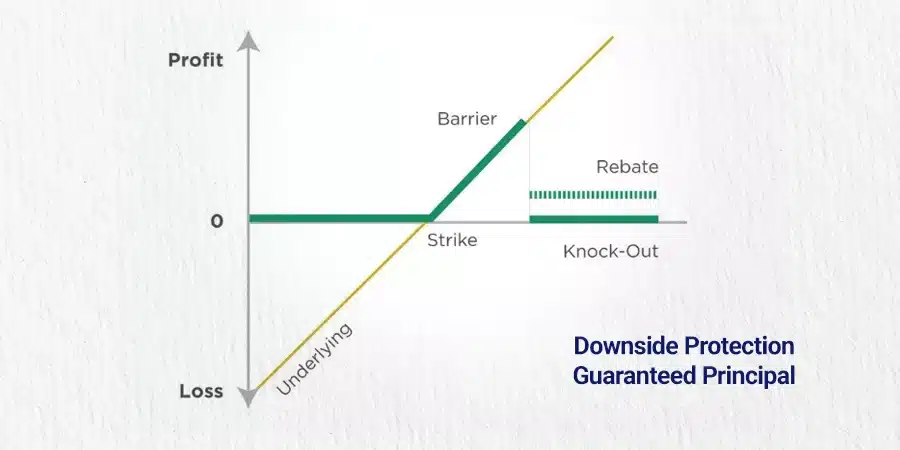

| Barrier Monitoring | Some products have barriers that trigger specific events, such as a knock-in or out. |

| Downside Risk Control | Structured products can limit the potential downside risk in volatile markets. |

Additionally, it’s important to note that structured products offer other unique details that haven’t been mentioned yet. These details may include features like principal at risk, participation rates, and liquidity options.

Each of these details provides investors with different opportunities and considerations to explore when investing in structured products.

To fully leverage the benefits of structured products, consider the following suggestions. First, thoroughly analyze the risk-reward profile of each product to ensure it aligns with your investment objectives.

Second, diversify your portfolio by investing in a mix of structured products with varying features. This strategy lowers the overall risk exposure while maintaining potential upside.

Lastly, regularly monitor the performance of your structured products and adjust your investment strategy accordingly.

By understanding and utilizing the different features of structured products, investors can enhance their investment portfolios and tailor their investments to meet their unique goals and risk tolerance.

Evaluating the Benefits and Risks of Capital-Protected Structured Products

Evaluating the Benefits and Risks of Capital-Protected Structured Products is a critical step in making informed investment decisions.

These specialized financial instruments offer a unique combination of downside protection and potential returns, making them attractive to risk-averse investors seeking to preserve capital while participating in market opportunities.

On one hand, capital-protected structured products provide a level of security by guaranteeing the return on the initial investment, thus appealing to those prioritizing capital preservation.

Additionally, they offer the potential for additional income through market-based investments, adding a layer of growth potential to the portfolio.

However, it’s essential to carefully consider the associated risks. While these products mitigate downside risk, they also come with limitations such as capped returns and exposure to counterparty credit risks.

Understanding these risks is crucial for investors to align their expectations and risk tolerance with the potential outcomes of the investment.

Furthermore, evaluating factors like diversification, maturity dates, and the reliability of the counterparty enhances the decision-making process.

Thorough research and consultation with financial advisors play a pivotal role in assessing the suitability of capital-protected structured products for individual investment goals.

In conclusion, a balanced evaluation of both benefits and risks empowers investors to make sound investment choices, ensuring that capital-protected structured products align with their financial objectives and risk appetite.

Here are the benefits and risks associated with Capital-Protected Structured Products:

Benefits:

- Downside Protection: Capital-Protected Structured Products offer investors a level of downside protection by guaranteeing the return on the initial investment. This feature is particularly appealing to risk-averse investors seeking to preserve their capital.

- Principal Guarantee: These products typically provide investors with a guarantee on the principal amount invested, ensuring that they will receive at least the initial investment amount at maturity, regardless of market conditions.

- Potential for Returns: Despite providing downside protection, Capital-Protected Structured Products also offer the potential for returns. Investors can still participate in market gains through underlying assets or indexes, providing an opportunity for additional income.

- Diversification: Investing in Capital-Protected Structured Products allows investors to diversify their portfolios by gaining exposure to various underlying assets or indexes within a single investment vehicle.

- Tailored Investment Options: Capital-Protected Structured Products can be structured to meet specific investor needs, offering choices regarding underlying assets, maturity dates, and payout profiles.

Benefits:

- Limited Returns: While offering downside protection, Capital-Protected Structured Products often come with capped returns. Investors may not fully benefit from favorable market movements beyond a certain threshold.

- Counterparty Risk: There’s a risk that the financial institution issuing the structured product may default on its obligations, leading to potential losses for investors. It’s essential to assess the creditworthiness and reliability of the counterparty.

- Complexity: Capital-Protected Structured Products can be complex financial instruments with intricate features and terms. Understanding the terms and conditions, including any associated fees and penalties, is crucial for investors.

- Market Risk: Despite providing downside protection, investors are still exposed to market risks associated with the performance of underlying assets or indexes. Fluctuations in market conditions can impact the overall value of the investment.

- Liquidity Risk: Some Capital-Protected Structured Products may lack liquidity, making it difficult for investors to sell their investments before maturity. Limited liquidity can result in challenges in accessing funds when needed.

Understanding both the benefits and risks associated with Capital-Protected Structured Products is essential for investors to make informed investment decisions aligned with their financial goals and risk tolerance levels.

Pro Tip: Prioritize thorough research and consultation with financial advisors when evaluating the suitability of capital-protected structured products for your investment goals.

Five Facts About Capital-Protected Structured Products:

- ✅ Structured products are pre-packaged investments that include assets linked to interest and derivatives. (Source: Team Research)

- ✅ These products often replace the payment features of traditional securities with non-traditional payoffs. (Source: Team Research)

- ✅ Structured products can offer principal guarantees and provide returns on the maturity dates. (Source: Team Research)

- ✅ The risks associated with structured products can be complex, as they may not be insured by the FDIC and lack liquidity. (Source: Team Research)

- ✅ Structured products can be a useful addition to diversified portfolios, providing exposure to hard-to-reach asset classes and subclasses. (Source: Team Research)

Conclusion

Capital-protected structured products present a compelling investment opportunity for risk-averse individuals.

These products offer a balance between capital preservation and potential returns by combining fixed-income securities and derivatives.

Investors benefit from principal protection and the opportunity to participate in market gains without assuming full asset ownership.

To make informed decisions, understanding the mechanics and risk profiles of structured products is essential.

Evaluating features like capital protection, participation rates, and diversification benefits allows investors to align their investments with their goals and risk tolerance.

Although structured products offer advantages, they also carry risks such as limited returns, lack of liquidity, and counterparty credit risk.

To minimize potential pitfalls, thorough research, professional advice, and a clear grasp of product terms are crucial.

By harnessing the benefits and managing risks, investors can use capital-protected structured products as valuable tools to diversify their portfolios and work towards long-term financial success.

FAQs about What You Need To Know About Capital Protected Structured Products

The retail investment world refers to the realm of investments that are made by individual retail investors, as opposed to institutional investors. It includes individuals who invest in various financial instruments such as a bond, stocks, mutual funds, and structured notes.

Trustees and asset managers are professionals who oversee and manage investment portfolios on behalf of their clients. Trustees are responsible for ensuring that investments are managed in accordance with the best interests of the beneficiaries, while asset managers make investment decisions and manage the day-to-day operations of the portfolio.

Debt instruments are financial assets that represent a loan made by an investor to a borrower. Examples include a bond and promissory notes. Equity instruments, on the other hand, represent ownership in a company and include stocks and shares.

Structured notes are pre-packaged investments that include derivatives linked to assets. They provide retail investors with a simplified way to gain exposure to derivatives, which is a financial instrument whose value is derived from an underlying asset or underlying index. This allows investors to take advantage of the performance of the underlying asset without directly owning it.

Structured products can be fairly complex and may lack liquidity, meaning they may be difficult to buy or sell. Additionally, they may not be insured by the FDIC, unlike traditional bank deposits. Investors should carefully consider the risks associated with structured notes and ensure they understand the terms and conditions before investing.

Structured products can offer capital protection by including a principal guarantee. This means that the plan matures early and the investor will receive their capital investment before the maturity dates, regardless of the performance of the underlying assets. However, it’s important to note that capital protection may come at the expense of potential returns, and investors should weigh the trade-off between protection and performance potential.