As They Say, There’s Always a First Time Investor

So, the investment bug has caught you and you’re ready to dip your toes into the exciting world of stocks, bonds, and all things finance.

As the wiser say, earning money is not enough, right investing makes it come full circle.

So Congratulations, you have embarked on the journey to earn even when you are not actively earning that pie.

You may be currently holding onto surplus funds and are looking for avenues to park them, you have the gift monies sitting idle, or you want to chip off from your regular salary and start disciplined savings.

But the question remains: how much should a first-time investor throw into the ring? Let’s tackle this like we’re having a casual coffee chat

Finding the Sweet Spot: Balancing Ambition and Prudence

How much should you invest as a first-timer? The answer lies in balancing between ambition and prudence.

Here are a few strategies that financial experts have reiterated and they help you strike that balance.

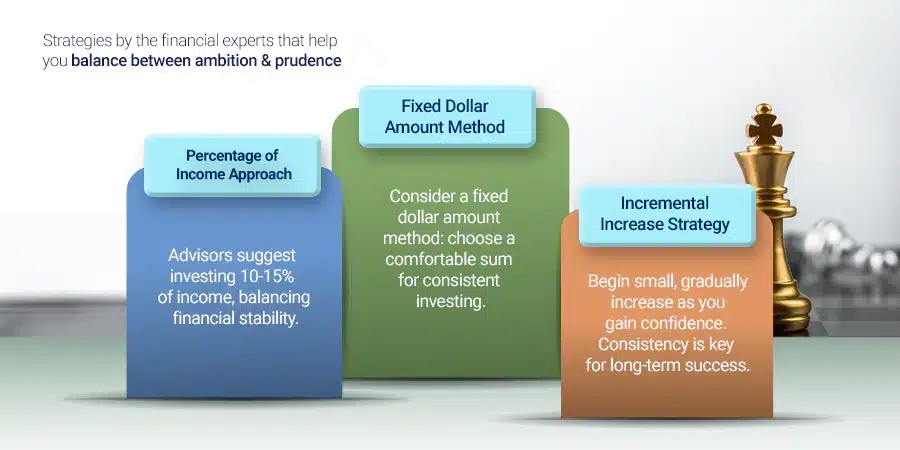

- Percentage of Income Approach – Some financial advisors recommend investing a percentage of your income, typically between 10% to 15%.

This approach considers your investment amount by analyzing financial capacity, ensuring you’re not compromising your basic needs or emergency fund. - Fixed Dollar Amount Method – Alternatively, you can opt for a fixed dollar amount method.

You intuitively know a sum you can be part of after meeting your expenses. Set a specific sum you’re comfortable amount to investing regularly, regardless of income fluctuations.

This method provides consistency and discipline in your investment strategy. - Incremental Increase Strategy – Start small, and as you become more familiar with financial markets and get comfortable with the investment journey, consider small chunk increases.

Being consistent is the key so increase only with the amount you can follow later on.

This gradual approach allows you to adapt to market dynamics without making impulsive decisions based on short-term fluctuations

Although, there’s no one-size-fits-all answer to the question of how much a first-time investor should invest, let’s dissect the two scenarios here,

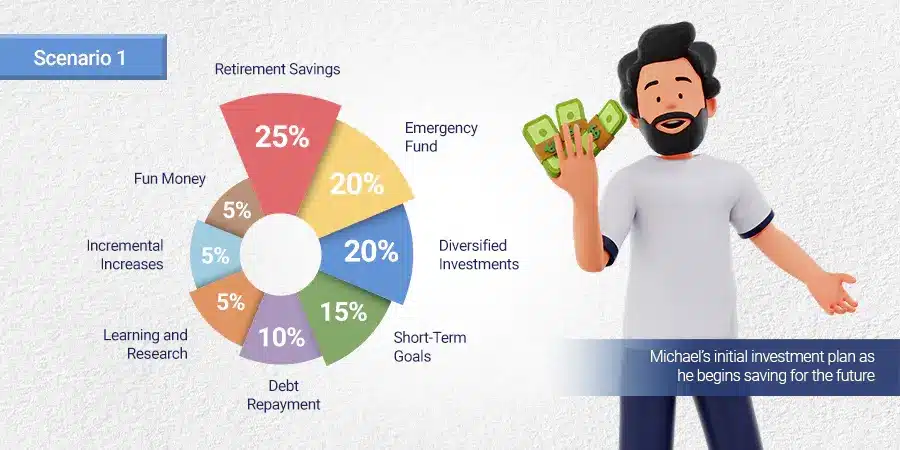

Scenario 1 - Being Salaried

Michael earns a fixed monthly salary of $6,000 monthly salary. He wants to start investing as early as his part in savings, let us understand how he arrives at that pie size.

Emergency Fund (20%):

He allocates 20% of his initial investment towards building an emergency fund.

This portion serves as a cushion for financial uncertainties, and unexpected expenses, ensuring he has a safety net in place.

Debt Repayment (10%):

Michael evaluates any outstanding debts and allocates 10% of his initial investment towards reducing the high-interest debts.

After all, no point in paying interest higher than your investment can return.

Reducing debt certainly improves overall financial health and investors can invest with a relaxed mind det.

Short-Term Goals (15%):

For his short-term investing goals, such as a vacation or purchasing a new gadget, Michael sets aside 15% of his initial investment.

This portion balances his life’s pleasures and financial goals.

Retirement Savings (25%):

Michael allocates 25% of his initial investment towards his retirement. This may include contributing to a workplace 401(k) or an Individual Retirement Account (IRA).

This portion ensures that irrespective of market fluctuations, his post-work life is secured.

Diversified Investments (20%):

Michael recognizes the importance of diversification in his investments. He does know the adage of not putting all eggs in one basket.

He allocates 20% of his initial investment to a mix of investments like low-cost index funds, individual stocks, and possibly real estate.

This diversified approach helps spread risk and improves overall stability.

Learning and Research (5%):

Before making investment decisions, he allocates 5% of his initial investment to educational resources.

This may include attending skill-enhancing workshops, subscribing to newsletters, or purchasing books on investment strategies.

Investing in knowledge ensures his continuous learning and that he grows professionally. Well after all that’s what going to enable him to add more to his investments!

Incremental Increases (5%):

Michael adopts an incremental approach to investing. He starts with a modest sum, allocating 5% of his initial investment, and plans to gradually increase his investment contributions with each paycheque.

This gradual way allows him to adapt to market dynamics over time.

Fun Money (5%):

To maintain a healthy work-life balance, Michael allocates 5% of his initial investment to a “fun money” category.

This portion allows him to splurge on occasional treats or entertainment, ensuring that investing doesn’t have to make him stop from experiencing life’s pleasures.

Scenario 2 - You Gotta Business, So How do you Start Investing?

Meet Sarah, a successful businesswoman who runs a chain of restaurants.

She is 33 years old, and to date, she has been investing all her surplus the apple of her eye, the pride and joy, of her business and its expansion.

Now, on scaling certain heights in her venture, she has a surplus of $100,000.

Although every business owner is prone to think that no investment can grow as fast as he/she can grow through own business they are right in their might.

But this time she decides to invest outside the realms of her business. After years of culinary success, Sarah ventures into investments for the first time.

Evaluating her business’s financial health, Sarah seeks advice from financial consultants to diversify her portfolio.

She chooses a balanced approach and allocates funds to low-risk mutual funds and blue-chip stocks, as she is testing the waters for the first time.

Cautiously starting with $100,000 as seed capital, Sarah takes the incremental increase strategy and gradually gains confidence in the market.

Recognizing the importance of diversification, she spreads investments across sectors.

Sarah’s journey is a perfect example of business acumen applied to financial management, showing how successful entrepreneurs can achieve financial success beyond their primary business.

Key Considerations Before You Set the Sail

The Financial Check-Up

Imagine you start on a road trip without checking if your car has enough gas or if the tires are properly inflated.

Investing without a financial check-up is just similar to this adventure. Before deciding on the magic number to invest in, evaluate your current financial state thoroughly.

Know Your Numbers: Income and Expenses

Start by understanding your monthly income and expenses, the inflows, and outflows.

Creating a budget might seem like a tedious task, but the outcome is all worth it. Budgeting is the foundation of any sound financial plan.

Debts, Debts, Debts

Are you still juggling credit card bills, student loans, or any other debts? While the investment journey might seem tempting, with debts at hand it may not be just so fruitful.

Just imagine this scenario: you are paying a higher interest on your debt than your investments will earn. Got the catch?

Hence it’s essential to address outstanding debts first. Also being debt-free relaxes your mind and can help you make better investment decisions.

Emergency Fund: Your Financial Safety Net

Have you ever considered your emergency fund? Do you have one? Well, its significance is undeniable.

This fund is a financial safety net, cushioning you from unexpected expenses like medical bills car repairs, or unexpected travels.

It is often recommended to have three to six months’ worth of living expenses saved up. Consider building your emergency fund before making substantial investments.

The "Can I Afford to Lose It?" Rule

Now that you have a clear picture of your finances, here’s the golden rule of investing for beginners: only invest what you can afford to lose.

Picture your investment as a high-stakes poker game – if losing the chips on the table still allows you to live a life you are already living, you’re probably in the safe zone.

Start Small, Learn Big

So when you plan to buy a new shampoo, do you grab the large package of it? No, you first look out for a small serving, a small bottle, or even a trial sachet.

Think of your first investment as a learning experience, a test run. Starting small allows you to grasp the dynamics of the market and makes you gain confidence.

You can judge the suitability and then take the plunge

The Psychology of Investing: Risk Tolerance

How much risk can you tolerate? We all have an answer to it. It probably perennially runs in our subconscious.

Also, few of us love taking risks, and few of us are the reverse of it. But rather than mindset, arrive at realistic risk tolerance levels by careful financial planning.

Your comfort level with risk plays a dominant role in determining how much to you need to invest.

Investing Shouldn't Be Stressful

Investing should not be your ticket to anxiety land. If you find yourself losing sleep over market fluctuations, then it’s a sign you might have invested more than you’re comfortable with.

The idea is to enjoy the process, learn from it, and gradually increase your investment as your confidence grows.

Diversification: Don't Put All Your Eggs in One Basket

This old-age adage in the realms of investment still holds the banner of being the wisest. Spread your investments across different assets to mitigate risk.

Diversification is your financial insurance policy. Imagine a scenario where you have multiple streams of income.

If one dries up, the others can still provide a steady flow. So always always and always diversify!

Staying in the Game: The Power of Compounding

Investing is a long-term phenomenon. The magic of compounding works best over time. By reinvesting your earnings, your money generates more money.

Patience is key, and staying in the game during market fluctuations can only lead you to glorious results.

It is here that a sound advisor can soothe your nerves and let you continue the game.

Parting Thoughts

Investing is not a sprint; it’s a marathon. Start with what you can afford to lose, diversify your investments, and let the power of compounding work its magic over time. Don’t let market volatility deter you – view it as part of the adventure.

So, put on your investor hat, grab your long-term financial compass, and embark on this exciting journey with confidence. Happy investing!