Today let’s talk about an age-old investing dilemma faced by all investors whether seasoned or beginner, in buying a house vs stocks market, where to invest?

Talk about it at a party or any gathering, the casual discussion on it can eventually heat up and include politics, technology, governments, the economy, and whatnot.

True, these all are factors to be considered while foraying into any investments, but comparing investing in real estate vs investing in the stock market is like comparing apples to oranges.

None of them is bad, but both offer different benefits.

Difference between Buying a House and Investing in Real Estate

Also, buying a house is different from investing in real estate for obvious reasons. The house you buy for you to live in is not going to generate any income.

Also, even if its value appreciates manyfold, you are less likely to sell it and move to a low-cost house.

Let’s See What Alex Does

Let’s talk about Alex, a young professional with some extra cash to put to work. He’s got a stable job, a decent chunk of savings, and the ambition to build some long-term wealth.

Like every beginner, he’s also a bit unsure of where to start. Should he head into the dynamic world of stock markets, or get into something more tangible and conservative, real estate?

After speaking with financial advisors and, a few of his fellow investor friends and by conducting his research, he decided to venture into both. Here are his findings

Investing in Stocks:

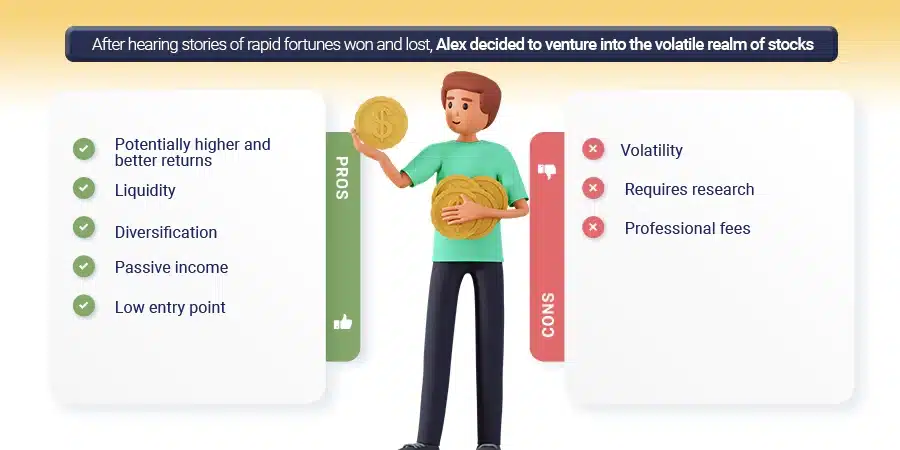

Hearing tales of fortunes made and lost in the blink of an eye, Alex decided to dip his toes into the dynamic world of stocks.

He opened a brokerage account and explored the vast world of stocks, bonds, and funds.

The stock market offered a different kind of excitement – the thrill of buying stocks and selling, the allure of potentially high returns, and the flexibility to adjust their investment strategy in real-time.

Over time he found out the benefits and some shortcomings of this investment.

Pros

- Potentially higher and better returns: Historically, across the globe, stocks have outperformed real estate in terms of average annual returns. Think of companies like Amazon or Apple, where early investors saw their money multiply exponentially.

- Liquidity: Need your money back in a hurry? One of the standout features of stock market investments is he got flattered by his liquidity.

Unlike real estate, stocks can be bought or sold almost instantaneously, providing flexibility for investors to react to market conditions.

Stocks can be bought and sold quickly, unlike real estate which can take months to unload. Also, stocks can be sold in chunks, partially.

This may not be an option with most of the real estate holdings.

- Diversification: With a wide array of companies and sectors to choose from, you can spread your risk and tailor your portfolio to your specific goals.

Additionally, stocks offer a broader range of popular investment options, allowing for easy diversification across industries, sectors, and geographic regions

There are small to large-cap companies of all sizes belonging to all sectors. This provides for not keeping all eggs in one basket, even within stock investment.

- Passive income: Dividend-paying stocks can provide a steady stream of income, even while you sleep.

Also, for those seeking a hands-off approach, index funds and exchange-traded funds (ETFs) offer a passive investment strategy in the stock market.

These funds track market indices, providing diversification and reducing the risk associated with individual stock picking.

Passive investing, he found, can be an attractive option for investors who prefer a set-it-and-forget-it approach.

- Low entry point: Investing in stocks can be as low as a few dollars. To test the waters, one need not part way with a big pie of the savings.

Cons

- Volatility: The stock market is a rollercoaster, with prices fluctuating constantly. He learned that investors have to be prepared to take the fluctuations and be patient in the journey.

- Requires research: Understanding different companies and market trends takes time and effort.

Also conducting own research and getting the right guidance is of paramount importance.

He had already heard many stories of foraying into penny stocks just to see investments wiping off. - Professional fees: If you go the managed route, you’ll be paying fees to financial advisors.

However, paying the right financial advisor and getting the right guidance can put you much higher in the world of investing

Investing in Real Estate:

Alex quickly learned that real estate investment was more than just picking paint colors. Being a landlord meant dealing with leaky pipes, midnight repair calls, and the occasional challenging tenant. There were also documentation and legalities to abide by. The nature of real estate investment demands both time and effort. There are multiple benefits that real estate investment also offers.

Pros

- Tangible asset: One of the appeals of real estate investment he found lies in the tangible nature of the asset.

You can see, touch, and even live in your real estate investment.

Investors can physically inspect and maintain their properties, providing a sense of control not found in stocks.

Additionally, real estate allows for direct management and decision-making, offering hands-on involvement in the investment It’s a more concrete way to build wealth.

- Rental income: Renting out your property can provide a steady stream of passive income, potentially covering your monthly mortgage and generating additional profit.

Physical Real estate often provides a consistent income stream through rental payments.

This dual income stream can be a significant advantage for those seeking financial stability.

- Potential for appreciation: Over time, the value of the property could increase, especially in desirable locations.

By acquiring properties in high-demand areas, investors can benefit from passive income while simultaneously enjoying potential appreciation in investment property value over time.

- Tax benefits: Also Alex found that real estate investors can enjoy certain tax deductions and depreciation benefits.

Cons

- High upfront costs: Buying property requires a significant down payment, closing costs, and ongoing maintenance expenses.

- Illiquidity: Selling real estate can take time and effort, unlike the quick trades of the stock market.

- Management responsibilities: Being a landlord comes with challenges, from finding tenants to dealing with repairs.

- Vulnerable to market downturns: Just like the stock market, real estate can experience slumps, impacting property values and rental income.

Consider REIT (Real Estate Invest Trusts)

However, Alex soon found a smart way to start investing in Real Estate which is as flexible as the stock market

What is REIT?

Well, unlike buying a physical property, Real Estate Investment Trusts (REITs) allow individuals to invest in real estate assets without directly owning and managing the properties themselves.

REITs pool funds from multiple investors to invest in a diversified portfolio of income-generating properties such as commercial buildings, residential complexes, hotels, and shopping centers.

Benefits of REIT Investment

- Masterful Management and Expertise: Ever dreamed of having a real estate dream team handling all the nitty-gritty details?

That dream becomes a reality with Real Estate Investment Trusts (REITs).

These squads of seasoned professionals not only snag prime properties but also ace the game in management, leasing, and maintenance.

Say goodbye to administrative headaches and hello to the enhanced potential return on investment!

- Cash Flow Bliss and Dividend Delight: Picture this – a steady stream of income flowing in like clockwork. That’s the magic when you invest in REITs.

The commercial properties they own kick off rental income that translates into consistent dividends.

And here’s the kicker – these dividends often outshine the rate of return from your run-of-the-mill fixed-income investments.

- Riding the Capital Appreciation Wave: Hold onto your hats because REITs don’t just stop at steady income.

As the value of their commercial properties appreciates over time, the share prices of these investment powerhouses can skyrocket.

That’s right – potential capital gains waiting to spice up your better investment journey.

- Dazzling Diversification: Ever heard the saying “Don’t put all your eggs in one basket”?

Well, with REITs, you’re practically spreading those eggs across a dazzling array of commercial properties.

Different sectors, diverse geographic locations – you name it. This level of diversification isn’t just a fancy term; it’s your shield against the unpredictable.

No more losing sleep over one property’s performance – your investment is in a league of its own.

- Liquid Gold: Imagine having the flexibility to jump into or out of an investment with the ease of a magician pulling a rabbit out of a hat.

Well, that’s the kind of magic REITs bring to the table. Unlike the hassle of physically owning property, REIT shares are the epitome of liquidity.

Buy or sell on stock exchanges at your leisure – because, in the world of REITs, flexibility is the name of the game.

So, what should Alex do? Or what should you as an investor consider?

Well, ultimately, the decision depends on the individual’s circumstances, risk tolerance, and investment goals. Here are some questions that, if answered in the right spirit, can help you decide better

- How much money can I afford to invest?

- What are my immediate, short, and long-term expenses?

- How comfortable am I with risk and market volatility?

- What is my investment timeframe? (Short-term vs. long-term)

- Do I have the time and energy to manage a real estate property?

- What are my overall financial goals? (Retirement, passive income, etc.)

Parting Thoughts

Remember, there’s no one-size-fits-all answer.

Some investors might thrive in the fast-paced world of stocks, while others prefer the stability and tangible benefits of real estate.

The key is to do your research, understand your risk tolerance, and choose the investment path that aligns best with your goals.

And hey, who says you have to choose just one? A balanced portfolio often includes a mix of stocks, real estate, and other asset classes.

This helps spread risk and potentially smooth out the bumps along the investment road.