High-Yield Bonds for Retirement

Susan stared at the investment brochure, the words “high-yield bonds” right there, before her eyes.

The promise of higher returns for her retirement was tempting, but not all seemed very convincing. She had always been a cautious investor, sticking to safer options.

High-yield bonds, with their risk of default and volatility, felt like venturing into unconvincing.

Yet, the thought of her retirement corpus slowly growing in a low-interest-rate environment seemed to be losing out on potential.

Susan sighed, realizing the decision wouldn’t be easy, and she knew she needed to do more research before taking the plunge.

What Are High-Yield Bonds?

High-yield bonds, also known as junk bonds, are a type of fixed income security issued by companies with a higher risk of default compared to investment-grade bonds.

These bonds are issued by companies with lower credit ratings, typically below BBB- by Standard & Poor’s and Fitch Ratings, or Baa3 by Moody’s Investors Service.

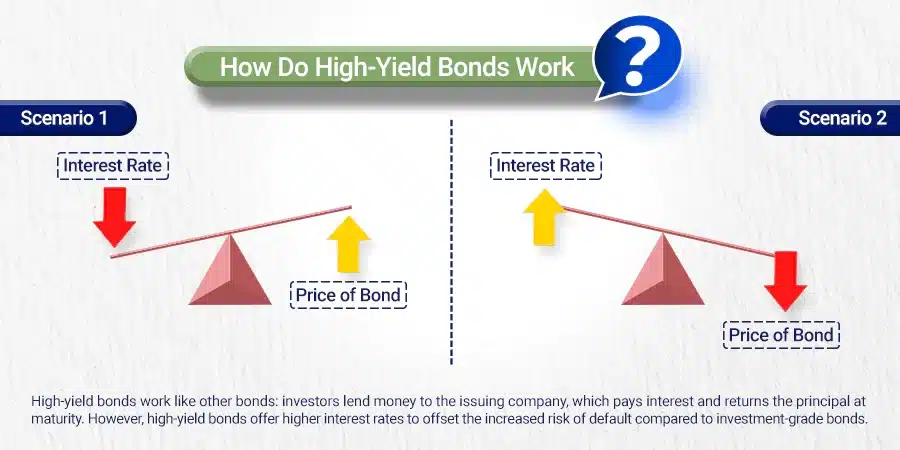

How Do High-Yield Bonds Work?

High-yield bonds, like any bond, are essentially loans you make to a company.

In exchange for your money, the company promises to pay you back a set amount (the principal) at a specific date (maturity) and make regular interest payments (coupons) throughout the loan term.

However, unlike safer bonds with investment-grade ratings, high-yield bonds are issued by companies categorized as riskier by credit rating agencies.

This higher risk translates to a higher interest rate for you, the investor, as compensation for the increased chance the company might default and not repay you.

You potentially earn more, but you also take on a greater chance of losing your investment.

How to Invest in High-Yield Bonds

You can invest in high-yield bonds in multiple ways:

- You can buy high-yield corporate bonds directly from broker-dealers.

- You can buy into a mutual fund or ETF that holds high-yield bonds.

With the latter, you buy shares of a fund that is managed by a fund manager who chooses which bonds to include.

When researching your choices in high-yield bonds, you can read primary documents like the bond’s prospectus, which provides information about the financial health of the company issuing the bond.

It also includes the company’s plans for using the proceeds of the bond, along with the bond terms and risks involved.

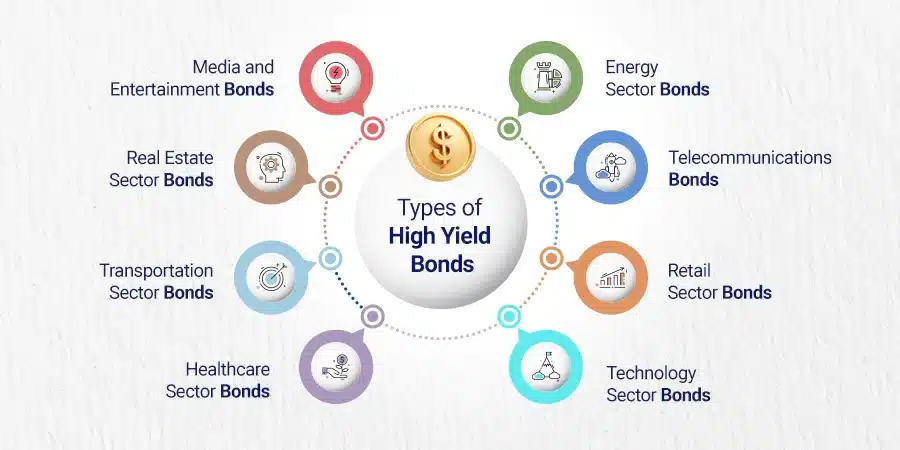

Types for high yield bonds

- Companies across all sectors, when faced with industry-specific challenges, look forward to raising capital through these bonds. Let’s explore which are those and why

- Energy Sector Bonds: Bonds issued by companies in the energy sector, such as oil and gas exploration and production companies, often fall into the high yield category due to the cyclical nature of the industry and its susceptibility to commodity price fluctuations.

- Telecommunications Bonds: Companies in the telecommunications sector, particularly those with high debt levels or facing intense competition, may issue high-yield bonds. These bonds could be issued by companies providing services like cable, wireless, or satellite communications.

- Retail Sector Bonds: Retail companies facing financial challenges, such as declining sales or heavy debt burdens, may issue high-yield bonds. These could include bonds from department stores, specialty retailers, or apparel companies.

- Technology Sector Bonds: While many technology companies issue investment-grade bonds, some smaller or struggling firms in the sector may issue high-yield bonds due to their riskier financial profiles. These could include bonds from software companies, hardware manufacturers, or semiconductor producers.

- Healthcare Sector Bonds: Bonds issued by healthcare companies, particularly those in pharmaceuticals or biotechnology, may fall into the high-yield category if the companies have high debt levels, face regulatory challenges, or have uncertain revenue streams due to the nature of their research and development.

- Transportation Sector Bonds: Airlines, shipping companies, and other transportation firms may issue high-yield bonds, especially during periods of economic downturn or when facing industry-specific challenges such as rising fuel costs or regulatory pressures.

- Real Estate Sector Bonds: Bonds issued by real estate investment trusts (REITs) or real estate development companies may be classified as high yield if the underlying properties face occupancy challenges, rental rate pressures, or other operational difficulties.

- Media and Entertainment Bonds: Companies in the media and entertainment industry, including broadcasting, publishing, and entertainment production, may issue high-yield bonds due to changes in consumer behavior, technological disruptions, or shifts in advertising spending.

These examples illustrate the diverse range of industries and companies that may issue high-yield bonds, each with its own unique risk factors and investment considerations.

Investors in high-yield bonds typically seek to balance the higher yield potential with the increased risk of default compared to investment-grade bonds.

The Returns Of High-Yield Bonds

As of recent years, the yield on high-yield bonds has often been in the range of 4% to 10%, but it can sometimes be higher or lower depending on bond market conditions and the credit quality of the issuer.

During periods of economic uncertainty or market stress, the yield on high-yield bonds may increase as investors demand higher compensation for the increased risk.

High-yield bonds can be a double-edged sword for retirement portfolios.

While they offer the allure of higher potential returns to combat low-interest-rate environments, their suitability for retirement hinges on individual circumstances.

Are High-Yield Bonds Suitable Pick For Retirement Portfolios?

For risk-averse investors nearing retirement, the increased risk of default and volatility associated with high-yield bonds might be too much to take.

These fluctuations could significantly impact their guarded retirement corpus and may jeopardize their financial security in their golden years.

However, for investors with a longer time horizon and a higher risk tolerance, a small allocation of high-yield bonds within a diversified portfolio could be a strategic option.

This strategy aims to potentially boost long-term returns without putting the entire retirement at risk.

Parting Thoughts

The allure of high-yield bonds cannot be missed in this low-interest rate environment. All said and done, these bonds if at become a part of your retirement portfolio, shouldn’t occupy a larger share. Though these are bonds, they are risky ones. Invest only with the amount you are okay with letting go of. Consult a financial advisor before venturing here. There are good chances that an advisor will help you pick the best amongst the risks.

Why You Need a Personal Financial Manager?

Personal finance management (PFM) is not confined to budgeting and investment any longer. There are

Nearing Retirement Advice for a Secure Future

Nearing retirement advice? A plan for retirement is essential to enjoy a happy healthy life

What is Debt Ceiling? A Complete Guide for Beginners

What is Debt Ceiling? Debt Ceiling, also known as the debt limit, is the highest

Is It Possible to Have No Debt?

Debt is often considered the norm in the corporate world, but the debt free companies