Are you bogged down with multiple debts and seeking a streamlined solution? Debt consolidation might be your salvation. This financial strategy involves merging all your debts into one manageable loan, often with lower interest rates or monthly payments.

Stick around to discover how debt consolidation can help simplify your finances and potentially save you money over the long haul!

This article provides a step-by-step guide on starting your SIP investment journey, from understanding these plans to actually setting one up. Let’s dive into this guide and unfold what it means to invest smartly!

Key takeaways

● Debt consolidation means putting all your debts into one loan. This can make it easier to keep track of payments.

● There are many types of debt consolidation loans such as personal loans, credit card debt, home equity loans, and student loans.

● While useful, debt consolidation loans may involve fees or higher interest rates over time. Make sure the benefits outweigh these costs before choosing this option.

● To get approved for a consolidating debt loan, you need a good credit score and history. Having a stable income also helps.

● Before applying for a new loan, check your credit score and gather all needed paperwork like pay stubs and bank statements.

Understanding Debt Consolidation

consolidating debt is a method to help manage and pay off debt. You take out one large loan to pay off all smaller loans or debts. It’s like putting all your debts in one basket.

It can make things easier for you. Instead of making many payments each month, you just make one payment. Many times, this new loan has a lower interest rate than the ones before it.

That means you could save money over time.

But be careful! Debt consolidation could lead to paying more if the repayment term is longer than before. Also, it may impact your credit score in different ways.

The Process of Debt Consolidation

Debt consolidation takes some steps to complete. First, you need to add up all your debts. This includes credit cards and loans. Next, look into ways you can consolidate your debt. You might get a personal loan or home equity loan. Then, apply for a new loan or credit card. If approved, use the new funds to pay off your old debts. At this point, you only have one debt to focus on paying off. That’s it! That is how debt consolidation works.

Types of Debt Consolidation Loans

Explore various options for consolidating debt, including personal loans, credit cards, home equity loans, and student loans. Unveil the potential and intricacies of each type to make an informed decision.

Stay tuned for a comprehensive guide on these diverse debt consolidation tools.

Personal Loans

Personal loans are great for debt consolidation. They take your high-interest debts and gather them into one payment with a lower interest rate. This can save you money on charges over time.

You can get these loans from banks or credit unions, but they are unsecured loans. This means the bank cannot take away your stuff if you do not pay the loan back. It’s good to have this in mind as personal loans play a crucial role in managing financial issues.

Credit Cards

You can use credit cards to bring together all debts. Some credit cards offer a 0% APR for some time. This makes it easier to pay off debt. They don’t charge interest during this time.

Yet, getting approval for these cards depends on your income and credit score. Using them too much may hurt your credit score a little bit. But, they can help you save money if used right.

Home Equity Loans

You can use home equity loans to group all your debt in one place. This is for people who own a house and have built up equity. Equity is the part of the house you truly own, not the bank.

A big plus here is that these loans can bring lower interest rates or monthly payments. How? They are tied to an asset, your home. So they are called secured loans. But be careful! If you don’t pay back this loan, you could lose your house!

Student Loans

You can use student loans in a debt consolidation loan. This lets you put many student loans into one loan. The federal government offers this choice for people who have these loans.

Paying on time is very important when your student loans are in a debt consolidation loan. If you miss payments, it will hurt your credit report for seven years. But if all goes well and you pay all the money back, this good news stays on your credit report for ten years! So with careful choices and steady work, merging student loans in a debt consolidation loan can help manage your financial situation.

Benefits of Debt Consolidation

Debt consolidation offers a streamlined approach to paying off multiple debts, potentially at a lower interest rate, but there are risks such as added costs and the potential for higher interest rates over time.

Streamlined Finances

Debt consolidation makes money matters simpler. You can use it to put all your loan payments into one single payment. It’s like having one big pool for all your debt. This way, you won’t need to worry about many due dates or different amounts.

All of your loans get paid at the same time each month with just one payment! Debt consolidation helps clear confusion and keeps finances neat. It’s a good tool to help manage debt in a smart way and avoid missing any payments.

Expedited Payoff

Debt consolidation can speed up debt payoff. You pay less interest and more of the main sum each month. This helps you clear your debts faster. Getting out of debt quickly is good for your credit score too.

Less time in debt means less risk to lenders, so they may offer better rates in the future. Debt consolidation makes it easy to keep moving forward toward a life free from loans and financial stress.

Potential for Lower Interest Rate

A big perk of debt consolidation is that you can get a lower interest rate. This can save money over time. If you have high-interest credit card debt, you could put it all together in a new loan.

The new loan would have much less interest.

Such as, if the bank gives personal loans at low rates, this would help. You could also use a balance-transfer credit card with 0% APR for a while. Both methods will cut down on what you owe in interest payments.

Risk of Added Costs

Debt consolidation sometimes comes with extra charges. These could be in the form of origination fees or annual fees. You may also have to pay closing costs if you use a home equity loan for debt consolidation.

If you get a balance transfer credit card, watch out for balance transfer fees. Always ask about all costs before signing up for a new loan or credit card to make sure it is worth it.

Risk of Higher Interest Rates Over Time

Debt consolidation can be a tool for better money management. But, it may lead to higher interest rates over time. This happens when the term of your new loan is longer than the loans you had before.

Even if your monthly payments are less, you might end up paying more in total interest in the long run. It is important to look at this risk when thinking about debt consolidation.

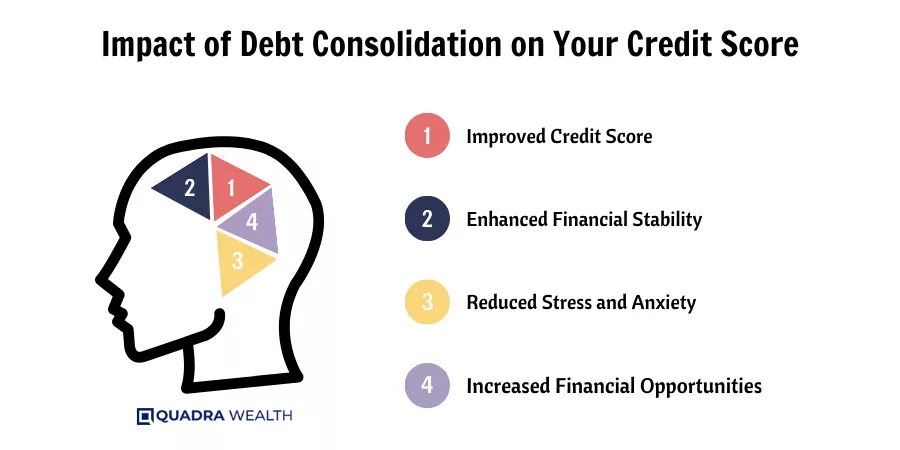

Impact of Debt Consolidation on Your Credit Score

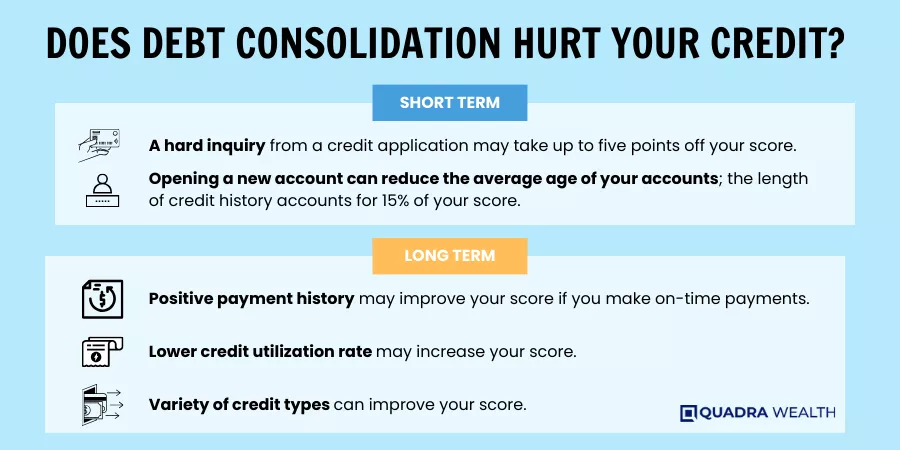

Debt consolidation has a big effect on your credit score. It can cause a small drop in your score at first. This is due to the hard credit check that happens during the loan process.

Not all hope is lost, though! Making payments on time will help your credit score over time. But be careful with missed payments as these can hurt your score for up to seven years! In fact, paying off loans well could even boost your score for up to 10 years.

However, if you keep building up debt after consolidating, it could harm your credit more than it helps. To get the full benefits from consolidation and keep a good credit rating, make sure you qualify for lower interest rates before starting this process.

How to Qualify for Debt Consolidation

To qualify for debt consolidation, follow these steps:

- Check your credit score: This shows how good you are with money.

- Fix any wrong facts on your report: Make sure all facts about you are right.

- Know how much money you make: You need to show that you earn enough.

- Know what you owe: Write down all the money you have to pay back.

- Make a list of your assets and debts: This will be used to see if you can pay back the loan.

- Have a stable job or other income source: It proves that you can repay the loan.

- Have a good credit history: You need to show that you’re good at paying back loans on time.

When is Debt Consolidation a Good Idea?

Debt consolidation is a smart move if you have many high-interest loans. This idea works best when you can find a new loan with better payoff terms. For example, if your new loan has lower interest rates, it means more money stays in your pocket.

Consolidation shines when it simplifies the debt payment process too. Instead of keeping track of many due dates and payments, there’s just one to focus on each month. It puts less stress on you and makes managing money easier.

But use caution! Make sure that the fees for the consolidation loan don’t eat up the benefits.

What to Do Before Consolidating Debt

Getting ready to combine your debts into one loan requires a few steps. Here’s what you need to do:

- First, check your credit report and score. Good or excellent credit often leads to lower rates.

- Next, take a look at all your current loans. Include credit cards, auto loans, and student loans.

- Write down the total amount owed for each debt. Also, note the interest rate and payoff terms.

- Think about what kind of loan you want for debt consolidation. Do you want a secured loan like a home equity loan? Or maybe an unsecured personal loan?

- Take a close look at your monthly costs and income too. This can help shape how much you can afford to pay each month.

- Finally, speak with creditors or a debt consolidation company if needed.

How to Apply for a Debt Consolidation Loan

Applying for a debt consolidation loan needs care. Follow these steps:

- First, you need to look at your credit score. It can affect your chance to get a loan.

- Next, get all the papers you will need for the loan. This includes pay stubs and bank statements.

- Then, find out how much you owe on other loans.

- Look at different loans and find the one with the best rate.

- Fill out a form to ask for the loan.

- If they say yes, you will get money from them to pay off your old loans.

What you want to know more about debt consolidation

In this section, we’ll answer common questions about debt consolidation, including how it affects your credit score and when it might not be the best option for your financial situation.

Does debt consolidation hurt your credit?

Debt consolidation can touch your credit score a bit. It may drop when you first get a new loan because of the hard credit check. But don’t worry too much! If you pay on time, it could go up again in some months.

Paying off high-interest loans also helps boost your credit score over time. A key point is to keep paying the new loan on time every month! So yes, debt consolidation might cause small ups and downs in your credit score at first but it’s not always bad news.

When is debt consolidation not a good idea?

Debt consolidation may not be the best move in some cases. For those with a small amount of debt, it might not make sense. If you can pay off your bills within a year or less, this step is not needed.

Also, people who have trouble paying their monthly debts should avoid this option as well. A low credit score can lead to higher rates on a new loan or credit card too. This means you could end up paying more than before.

Plus, stretching out repayments over time also adds to total interest costs. So sometimes, it’s better to explore other options instead of going for debt consolidation.

Is it hard to get approved for debt consolidation?

Getting approved for debt consolidation is not too hard if you have a good job and strong credit. Lenders want to see that you earn enough money to pay the loan back. They also check your credit history.

This shows how well you have paid past loans. If it’s good, they feel sure you will pay them too. But there could be a small drop in your credit score at first because of the check they run on your credit report.

Conclusion

Debt consolidation is a tool to handle money better. It can turn lots of debts into one, making it easier to pay them off. But it’s key to choose the right kind of loan and keep up good money habits after that.

So, debt consolidation is not perfect but it can be helpful if used wisely.

FAQs

Debt consolidation means getting a single loan to pay off your existing loans. This can make your payments and due dates easier to manage.

First, you apply for a loan that can cover all of your current debts. Once approved, the loan funds are used to pay off your old debts one by one.

Yes, if you have bad or fair credit it might be hard for you to get the lowest rates on new loans but options like installment loans for bad credit exist too.

You may need W-2s, tax returns, or other proof of income during your application process.

A financial advisor or counseling service can help guide these decisions based on factors like your spending habits and how much debt you owe.

Sure! A Debt Consolidation Calculator allows users to compare different scenarios including parameters such as different interest rates and varying payment terms.

Why You Need a Personal Financial Manager?

Personal finance management (PFM) is not confined to budgeting and investment any longer. There are

Nearing Retirement Advice for a Secure Future

Nearing retirement advice? A plan for retirement is essential to enjoy a happy healthy life

What is Debt Ceiling? A Complete Guide for Beginners

What is Debt Ceiling? Debt Ceiling, also known as the debt limit, is the highest

Is It Possible to Have No Debt?

Debt is often considered the norm in the corporate world, but the debt free companies