Introduction

Well, what is your understanding on what a Credit-Linked Note or a CLN is all about? Credit Linked notes or CLNs are structured notes that combine debt instruments with credit linked derivatives.

The asset allocation or underliers comprise a credit risk of one entity or the credit indexes of multiple entities. Or, you can underlie a basket of credit-linked derivatives to the notes. The notes then are deemed as CLNs or Credit Linked notes.

The CLNs are primarily issued by financial conglomerates that specialize in issuance and direct monitoring of credit products. Through the issuance of CLNS, the financial entities manage:

- the credit performance of a single reference entity

- a portfolio of entities and

- A specific index comprising of mixed credit instruments

Now, let us move on to Find Features, Benefits And Risks For CLNs.

Helping you get started further:

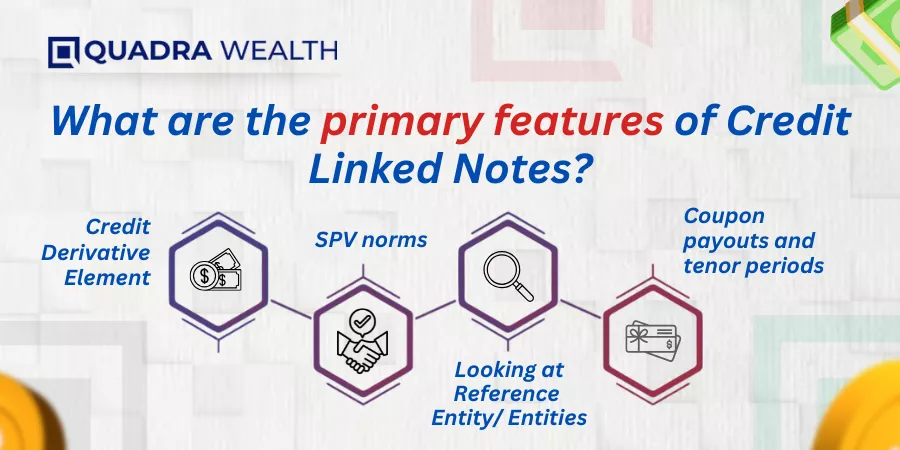

What are the primary features of Credit Linked Notes?

These are the primary features that are associated with the usage of CLNs for credit investors.

Let us have you covered through with a run-down of pointers that are associated with the same:

Credit Derivative Element

CLNs operate quite differently as these notes do not underlie bonds or regularly traded equity indexes. These notes underlie credit derivatives that investors must be aware of.

These CLNs are linked to the credit risks of specific types of borrowers. Like say government entities, corporate entities or a portfolio of entities that lie under a specific credit index.

The issuer of these notes allows the investors to assume the credit risks of these entities in exchange for a wholesome premium.

Curation of Special Purpose Vehicle or SPV norms

For the curation of a CLN, the product issuance firm has to embed a Special Purpose Vehicle or an SPV norm to independent notes.

By doing so, the notes can be infused with a series of credit instruments onto each one of them.

For instance, the note can be linked with a corporate bond, a specific credit index or to a basket of credit instruments from different types of entities.

Looking at Reference Entity/ Entities

The CLNs can be linked to a single entity or a group of entities. Here, the credit performance of one entity is matched with the credit performances of several entities.

Investors would receive payouts if the referenced entities fare well in the market. If the credit rating of the referenced entity/ entities go down due to insolvency or capital restructuring, then the investor might lose a major portion of his capital wallet.

Coupon payouts and tenor periods

The CLNs provide fixed as well as floater coupons based on the initial terms and conditions that underlie these notes as such.

With respect to the tenor periods, the CLNs come to you with the specific maturity dates as specified on your offering or contractual documents. The investors receive their principal and interest earnings as long as the credit performance of the referenced entity or entities do not pose a potential risk to insolvency or bankruptcy issues.

In case the entity or referenced entities sign up for bankruptcy or if the liquidation issues of the firm pose severe threats, then the investors might lose the entire portion of their capital wallet and the designated interest earnings on the portfolio.

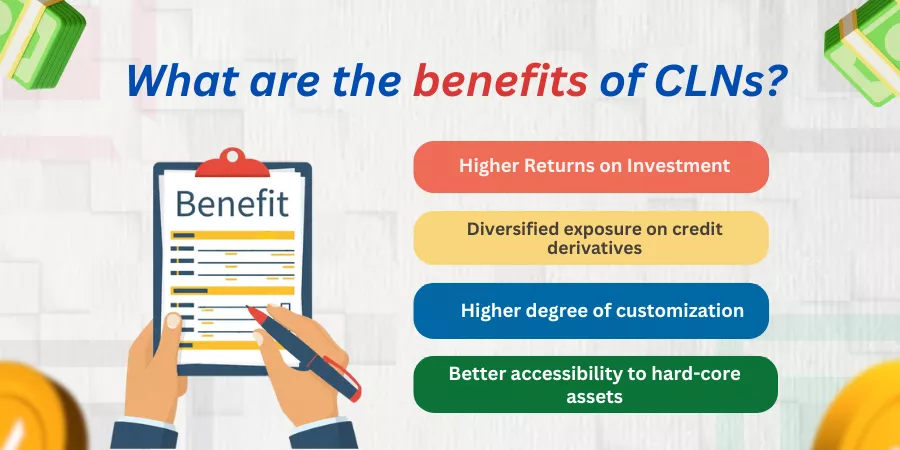

What are the benefits of CLNs?

These are the benefits of CLNs. Here is a rundown of pointers that are associated with the same:

Higher Returns on Investment

CLNs usually offer lucrative payouts in the form of fixed and floating coupons for investors. This is because they assume the credit risk of a particular entity or a group of referenced entities as curated to you via SPV norms. Therefore, CLNs offer attractive income payouts as compared to what you receive via traditional bonds or fixed-income securities.

Diversified exposure on credit derivatives

As compared to fluctuating prices of equities, the credit performances of referenaced entities remains stable as long as the markets do not suffer global recession or more severe economic downturns.

The investors, therefore, are more likely to receive their capital wallet and interest earnings back with CLNs. Plus, as an investor, you get a diversified exposure to the credit risks of a particular sector of entities belonging to domestic as well as international markets. This exposure helps you gain a better exposure to the credit markets of your investment portfolios.

Higher degree of customization

You can customize your CLNs to get a more tailored approach to your game of investing. Here, you can choose your credit entities, rate of interest and maturity or tenor periods with the product issuer.

Better accessibility to hard-core assets

With CLNs, you can achieve better and seamless accessibility to hardcore assets that you may have never imagined while you stick to traditional bonds or equities.

Here, you get exposure to private wealth management firms and witness amalgamations or product mergers as you witness the credit ratings of referenced entities.

You can scale up your expertise as a financial advisor to build a lucrative career potential for yourself, or you can leverage your expertise to an exemplary level while dealing with private firms, emerging market debts, and high-yield bonds.

What are the risk factors of CLNs?

Here are the risk factors that are primarily associated with CLNs. Helping you through with a rundown into the same:

Credit Risk

In a CLN, there is a pertinent risk of the credit entity or referenced group of entities signing up for their insolvency or liquidation.

If a credit event occurs, then the investor might lose a major portion of his capital wallet and not receive interest earnings too.

Market Risks

The investment value of CLNs may fall due to the following changes in market scenarios. These include:

- interest-rate fluctuations

- market based downturns like say an impending recession the economy is clouded with

- and, broader economic sentiments

The overall value of your CLN portfolio falls even if the economy faces a broader fleet of market risks on the whole.

Liquidity risk

For CLNs, you may not be able to liquidate these debt instruments in case you have impending financial emergencies like a sudden hospitalization or the death of a loved one inside the family. Investors may have to wait until maturity periods to get hold of their capital wallet plus interest earnings.

Occurrence of a credit event before the onset of maturity

If a credit entity or the referenced entities announce amalgamations, liquidation mergers or face insolvency issues just before the onset of tenor periods of CLNs, then we call it the occurrence of a credit event. In these scenarios, the investors may lose a significant portion of their capital wallet and not get hold of their interest earnings too.

The Bottom Line

As an investor, you must understand that CLNs do have the potential to provide higher yields on investment portfolios as you assume credit risks of one entity or a basket of entities.

At the same time, you must also understand the complexity and varied risk factors these CLNs can expose investors to.

What are your thoughts on this? Do mention it in the comments below!

Frequently Asked Questions or FAQs

What is your understanding of a Credit Default Swap or a CDS?

Answer: A Credit Default Swap or a CDS is a financial instrument that allows an investor to hedge their credit risk from one entity to another in exchange for a financial obligation like interest premiums or so. The CLNs can be linked to the performance of credit default swaps or other credit-linked indexes.

Does CLNs provide fixed or floating coupons?

Answer: CLNs provide fixed as well as floating coupons based on the financial institution that curated or collateralized them. In case of a credit event, the reference entity signs up for insolvency, and the repayment of investor’s capital and interest is based on recovery rates the firm’s litigation unit comes up with. The firm repays the principal component on a lower scale as compared to the initial level of principal investment.