In This Article

Financial Planner: Your Key To Wealth Management In UAE

In This Article

Engaging a financial planner is an essential step towards securing your financial future. With their expertise, they can guide you through the complexities of investment strategies, insurance coverage, cash flow assessment and budget analysis.

The role of personality in shaping our financial decisions cannot be underestimated. A comprehensive financial plan tailored to your unique traits can instill confidence and peace of mind about your monetary affairs.

Furthermore, considerations such as family education policies and strategic retirement planning form integral parts of any robust financial blueprint. As we delve deeper into these areas later on in this post, you will gain insights into how a competent financial planner could assist in achieving these objectives.

We’ll also explore the realm of estate planning – a key component that ensures your wealth continues to serve its purpose even after you’re gone. The impact personal aspirations have on estate planning will be discussed further down the line.

In today’s technologically advanced world, online platforms combining human expertise with technology are becoming increasingly popular for wealth management services. We’ll examine when it might be beneficial to consider fee-only CFPs for managing your assets effectively.

The Importance of a Comprehensive Financial Plan

Creating a financial plan can help you construct the life of your dreams and gain greater control over your finances. It provides a roadmap to achieving personal finance stability, improving saving and budgeting habits, and creating clear pathways towards individual goals. According to CNBC, 65% of individuals with comprehensive financial plans feel financially stable.

Understanding the role of personality in financial planning

Your personality traits can significantly influence your approach to managing finances. For instance, risk-takers might be more inclined towards aggressive investment strategies while conservative personalities may prefer safer options like bonds or fixed deposits. Recognizing these tendencies can help tailor a plan that aligns with your comfort level and long-term objectives.

How comprehensive financial planning leads to increased confidence

Comprehensive financial planning takes into account all aspects of your economic situation – from daily expenses to retirement savings – providing an overarching view of where you stand financially at any given moment. This clarity often translates into increased confidence in making informed decisions regarding investments, expenditure management, and future goal setting.

In essence, having a thorough understanding of one’s current position enables better anticipation for future needs or changes in circumstances (like job loss or market downturn). This proactive stance helps maintain stability even during turbulent times by ensuring adequate resources are available when needed most.

Components of True Financial Planning

A truly holistic approach considers someone’s entire economic situation before making recommendations regarding specific elements like investment planning, cash flow assessment, tax strategy development among others. The aim is not merely reviewing investment holdings or providing insurance analysis but offering tailored advice based on detailed evaluation including income sources, current liabilities, future aspirations, etc. This method ensures each aspect contributes positively to overall wealth growth rather than being an isolated component within a larger framework.

Key takeaways

The importance of a comprehensive financial plan in achieving personal finance stability and creating clear pathways towards individual goals by taking into account all aspects of one's economic situation, including personality traits that influence investment strategies, leading to increased confidence in making informed decisions regarding investments, expenditure management, and future goal setting. A true holistic approach considers someone's entire economic situation before making recommendations based on detailed evaluation to ensure each aspect contributes positively to overall wealth growth.

Components of True Financial Planning

Financial planning is a comprehensive process that goes beyond simply reviewing your investment holdings or providing insurance analysis. It’s about taking a holistic approach to your financial life, considering every aspect of your economic situation before making recommendations on specific elements like investment planning, cash flow assessment, and tax strategy development.

Investment Planning as part of a broader framework

The cornerstone of any robust financial plan is an effective investment strategy. Investment planning involves assessing risk tolerance, setting appropriate asset allocation targets, selecting suitable investments such as mutual funds or structured notes, and monitoring the portfolio for ongoing adjustments. Diversification and long-term growth prospects should be carefully considered in order to achieve a successful investment strategy.

- Diversification

- Goal alignment

- Risk management

- Holistic approach

- Lack of coordination

- Lack of goal focus

- Limited risk management

Evaluating Insurance Coverage within Your Financial Plan

In addition to investments, another critical component in true financial planning is evaluating insurance coverage. Whether it’s life insurance to protect loved ones from unexpected loss or health insurance to cover medical expenses, insurance plays a crucial role in safeguarding one’s financial future. A thorough review can help ensure you have adequate protection without overpaying for unnecessary coverage.

- Risk mitigation

- Peace of mind

- Financial stability

- Inadequate protection

- Financial vulnerability

- Lack of risk management

Cash Flow Assessment and Budget Analysis

A detailed understanding of where money comes from (income) and where it goes (expenses) forms the basis for sound budgeting practices, a vital element in achieving financial goals. This step involves analyzing spending habits, identifying potential savings opportunities, and creating realistic budgets that align with personal objectives while maintaining lifestyle preferences.

In essence, true financial planning isn’t just about focusing on individual aspects. It requires viewing all components together through the lens of overall objectives. From managing debt effectively to maximizing retirement contributions, all these factors interplay significantly when charting out plans for securing one’s financial future.

This broad-based perspective helps identify gaps or overlaps between different areas, which might otherwise go unnoticed if considered individually. It’s always better to seek professional help for estate planning and other financial matters to ensure a secure financial future.

Key takeaways

True financial planning involves taking a holistic approach to one's economic situation, including investment planning, insurance coverage evaluation, cash flow assessment and budget analysis. It requires viewing all components together through the lens of overall objectives and seeking professional help for estate planning and other financial matters to ensure a secure financial future.

Education and Retirement in Your Financial Life

Financial planning isn’t just about money; it’s also about the life you want to lead. Two critical aspects of this journey are education and retirement, which require strategic thinking and careful planning.

Creating an Effective Family Education Policy

A Family Education Policy isn’t merely setting aside funds into savings accounts—it involves a deliberate design aimed at meeting specific educational goals for your family members. This policy might include saving for children’s college tuition or investing in lifelong learning opportunities for adults.

- Determine the goal: Define what success looks like—Is it sending your kids to a private university? Or perhaps ensuring they graduate debt-free from any institution?

- Create a timeline: How many years until you need the money? The more time available, the greater opportunity to venture into riskier investments.

- Select investment vehicles: Consider tax-efficient options such as 529 plans or Coverdell ESAs that offer potential growth over time.

An effective Family Education Policy takes these factors into account, creating a roadmap toward achieving your family’s educational aspirations without compromising other financial objectives.

- Provides clear guidelines

- Consistency

- enables proactive planning for education-related expenses, such as tuition fees, books, and extracurricular activities.

- Long-term success

- Lack of direction

- Missed opportunities

- Financial burden

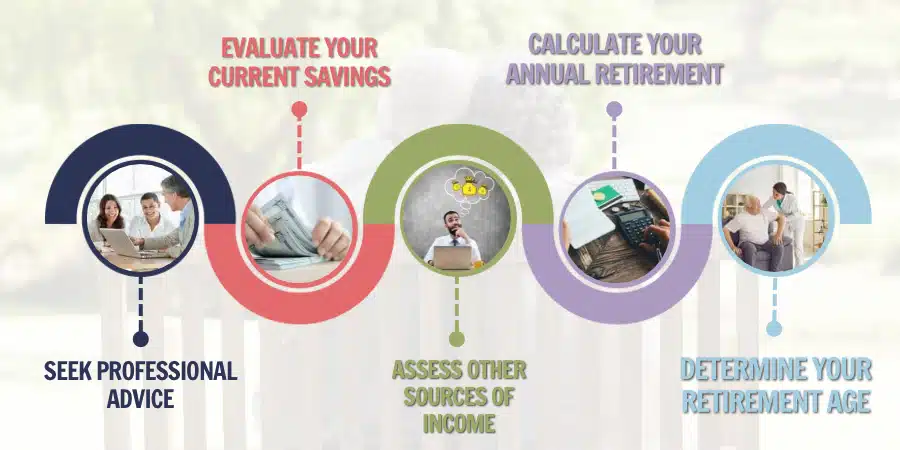

Achieving Independence through Strategic Retirement Planning

The concept of retirement has evolved significantly over recent decades. Today, it’s less about stopping work entirely and more about finding something enjoyable that provides income indefinitely while effectively attaining independence and allocating resources for enjoyment today, mid-term, and future.

- Lifestyle Goals: Identify how much annual income will be needed based on desired lifestyle during retirement – travel plans, hobbies etc. Retirement Income Planning Guide

- Savings & Investments: Analyze current savings rate along with expected return on investments (ROI) to determine if adjustments are necessary. How To Save For Retirement – U.S News & World Report Money

- Risk Management: Evaluate insurance needs including health care costs during retirement. Managing The Costs Of Your Retirement Health Care Needs – Kiplinger

In essence, effective wealth management entails having control over one’s finances regardless of external circumstances. This way, you’re able to maintain the desired lifestyle now and in the future without worrying about economic downturns or unforeseen expenses. For those seeking financial stability and security, enlisting the help of experienced professionals to navigate through the intricate process is a must.

Key takeaways

Financial planning is not just about money, it's also about the life you want to lead. Two important aspects of this journey are education and retirement, which require strategic thinking and careful planning. Creating an effective Family Education Policy involves setting specific educational goals for your family members by defining what success looks like, creating a timeline, and selecting investment vehicles that offer potential growth over time. Achieving independence through strategic Retirement Planning requires identifying how much annual income will be needed based on desired lifestyle during retirement, analyzing current savings rate along with expected ROI to determine if adjustments are necessary, and evaluating insurance needs including health care costs during retirement. Effective wealth management entails having control over one's finances regardless of external circumstances so whether you're an expatriate or resident in the Middle East who wants to achieve financial stability and security enlist the services of experienced professionals to guide you through the complexities of the process.

Estate Planning - Leaving Behind a Legacy

As our time on this earth comes to a close, we all have hopes and fears about the legacy that will remain after us. These emotions can significantly impact how we approach estate planning. Creating a lasting legacy is not just about accumulating wealth; it’s also about aligning your financial decisions with your values and priorities.

The Impact of Personal Aspirations on Estate Planning

Your personal aspirations play a crucial role in shaping your estate plan. For instance, if you’re passionate about philanthropy, you might consider setting up a charitable trust. Including a scholarship fund in your estate planning could be an option if you have educational goals for future generations.

Similarly, if preserving family harmony is one of your top priorities, careful thought should go into the distribution of assets among heirs to avoid potential conflicts. Understanding these aspects allows you to craft a “financial life” as defined by the Certified Financial Planner Board.

A comprehensive estate plan goes beyond drafting a will or setting up trusts. It encompasses various elements like tax planning strategies that ensure maximum benefits are passed onto beneficiaries while minimizing tax liabilities.

What Estate Planning Involves

In essence, estate planning involves:

- Taking inventory: This includes all tangible and intangible assets such as properties, cash savings, bonds, equities, and intellectual property rights, etc.

- Determining goals: What do you want accomplished after death? Decide if you wish to provide for your family, sustain a lifestyle, or support a charity with the assets left behind.

- Making legal arrangements: This involves creating necessary documents like Wills, Living Trusts, Durable Power of Attorney, Health Care Directives, etc., to ensure your wishes are carried out efficiently and effectively.

- Tax optimization: This aims at reducing overall inheritance taxes payable upon death through effective structuring of asset ownership and use of exemptions and allowances available under the law.

If this seems overwhelming or complex, it’s understandable. That’s where professional help comes in. A certified financial planner, like those at Quadra Wealth, can guide you through the process, ensuring each aspect is thoroughly considered and aligned with your unique needs and desires.

They specialize in helping individuals and families create holistic plans that encompass every facet of their economic lives, including investment management, tax strategy development, cash flow assessment, retirement planning, and estate planning. They offer an objective perspective to navigate complexities successfully and achieve the stability and security of a desired legacy intact.

Key takeaways

Estate planning is not just about accumulating wealth, but also aligning financial decisions with values and priorities. Personal aspirations play a crucial role in shaping an estate plan, such as setting up charitable trusts or educational funds for future generations. A comprehensive estate plan involves taking inventory of assets, determining goals after death, making legal arrangements like wills and trusts, and optimizing taxes through effective structuring of asset ownership with the help of certified financial planners.

Accessing Professional Help for Wealth Management

When it comes to managing your wealth, seeking professional help can make all the difference. Luckily, there are several options available to individuals looking for assistance. From robo-advisors to hybrid online platforms, each offers unique benefits tailored to different financial situations.

Understanding Robo-Advisors and Their Role in Portfolio Services

For those seeking a convenient and straightforward approach to managing their investments, robo-advisors may be an ideal choice. These digital platforms use algorithms based on modern portfolio theory to optimize your investment strategy according to your risk tolerance and financial goals. Plus, they offer robust investment management services at minimal fees. It’s a win-win.

The Benefits of Hybrid Online Platforms Combining Human Expertise and Technology

For those who want the best of both worlds, hybrid online platforms that blend human expertise with technological prowess are the way to go. These platforms offer personalized advice from certified professionals alongside algorithm-driven recommendations. With just a few clicks, you can connect with planners who understand your specific needs and aspirations. Plus, the professionals on these platforms often come with years of experience and relevant certifications.

- Ease of Access: Get personalized guidance from experienced advisors with just a few clicks.

- Credibility: The professionals on these platforms often come with years of experience and relevant certifications.

- Diversity: Choose from experts specializing in various areas such as retirement planning, tax strategies, estate planning, and more.

When to Consider a Fee-Only CFP for Wealth Management

In more complex scenarios where multiple aspects like inheritance issues or business succession plans come into play, it might be wise to consider enlisting a fee-only Certified Financial Planner (CFP). These professionals take the time to understand your complete economic situation before crafting a customized plan that ensures every aspect is addressed adequately. Plus, they’re bound by fiduciary duty, meaning they’re legally obligated to act in your best interest. This level of service may require a higher upfront cost but could prove invaluable in the long run when navigating the intricate financial landscape.

Key takeaways

Professional help is essential for managing wealth, and there are several options available. Robo-advisors use algorithms to optimize investment strategies according to risk tolerance and financial goals while hybrid online platforms offer personalized advice from certified professionals alongside algorithm-driven recommendations. In more complex scenarios, a fee-only Certified Financial Planner (CFP) may be necessary as they take the time to understand complete economic situations before crafting customized plans that ensure every aspect is addressed adequately.

The Role of Planners in Successfully Navigating Financial Complexities

Financial planning can be a complex process, especially for expats at the CXO level residing in the UAE. Managing investments and ensuring financial stability require an objective perspective that only experienced professionals can provide. This is where meeting with a planner comes into play.

The Value of Objective Perspective in Managing Investments

A financial planner serves as an advisor who offers guidance beyond just managing your investments. They help you navigate through changes in your financial landscape by providing unbiased advice based on their expertise and understanding of market trends.

An objective perspective from these professionals becomes invaluable when dealing with significant life events such as changing jobs, buying a home, or planning for retirement. These situations often involve major decisions that could significantly impact one’s financial future.

In addition to offering strategic advice during these pivotal moments, planners also assist in keeping track of various investment opportunities available within the Middle East region. Their comprehensive knowledge about different asset classes helps them design diversified portfolios tailored to meet individual client needs while minimizing risk exposure.

The Benefits of Working with a Financial Planner

- Objective Analysis: Financial planners conduct thorough analysis using sophisticated tools to evaluate each investment opportunity objectively without any personal bias influencing their recommendations.

- Risk Management: They understand the importance of balancing risk and reward effectively – aiming not just for high returns but also preserving capital by mitigating potential losses.

- Tailored Strategies: Each investor has unique goals, risk tolerance levels, and time horizons which are taken into account while formulating personalized strategies.

This objectivity extends beyond merely selecting suitable investment options; it includes regular portfolio reviews ensuring alignment with evolving objectives over time – whether they relate to wealth accumulation or preservation post-retirement phase. Moreover, they ensure clients stay informed about the latest developments affecting their finances so proactive steps can be taken if required.

Hence, residents in the UAE, particularly those holding senior executive positions like CXOs, can greatly benefit from enlisting services offered by professional advisors who guide them towards achieving desired outcomes amidst complexities inherent within the realm of finance, thereby securing peace of mind along the way. So why wait? Start your journey towards successful navigation through the intricate world of finance today.

Key takeaways

Financial planning can be complex, especially for expats at the CXO level residing in the UAE. A financial planner serves as an advisor who offers guidance beyond just managing investments and provides unbiased advice based on their expertise and understanding of market trends to navigate through changes in your financial landscape. The benefits of working with a financial planner include objective analysis, risk management, tailored strategies that take into account unique goals, risk tolerance levels, and time horizons while formulating personalized strategies.

FAQs in Relation to Financial Planner

A financial planner assesses your finances, identifies goals, and creates a plan to achieve them.

The 7 key components of financial planning are cash flow management, investment planning, retirement planning, risk management & insurance, tax planning, estate planning, and goal setting.

The 4 types of financial planners are Certified Financial Planners (CFP), Chartered Financial Analysts (CFA), Personal Financial Specialists (PFS), and Registered Investment Advisors (RIA).

Yes, financial planners can provide significant assistance in achieving long-term monetary objectives.

Hiring a financial planner can help you make informed decisions, avoid costly mistakes, and achieve your financial goals faster.

Look for a financial planner with experience, credentials, and a fiduciary duty to act in your best interest.

The cost of a financial planner varies depending on the services provided, but expect to pay between $1,000 to $3,000 for a comprehensive financial plan.

You can find a reputable financial planner through referrals from friends and family, professional organizations like the National Association of Personal Financial Advisors (NAPFA), or online directories like the XY Planning Network.

Conclusion

A financial planner can help you create a comprehensive plan that includes investment planning, insurance coverage evaluation, cash flow assessment, and budget analysis, all while providing valuable objective perspective in managing investments and navigating complexities successfully.

Considering accessing professional help for wealth management? Understand the role of robo-advisors and online platforms combining human expertise and technology, and consider fee-only CFPs for wealth management to gain increased confidence in your financial future.

Why You Need a Personal Financial Manager?

Personal finance management (PFM) is not confined to budgeting and investment any longer. There are

Nearing Retirement Advice for a Secure Future

Nearing retirement advice? A plan for retirement is essential to enjoy a happy healthy life

What is Debt Ceiling? A Complete Guide for Beginners

What is Debt Ceiling? Debt Ceiling, also known as the debt limit, is the highest

Is It Possible to Have No Debt?

Debt is often considered the norm in the corporate world, but the debt free companies