Navigating the world of economics can often feel like trying to decode a foreign language. Two terms in this field that might seem puzzling are recession and stagflation.

This article will serve as your translator, clarifying the difference between these two economic states, their impacts, and historical examples for better understanding.

Ready for an enlightening journey into macroeconomics? Let’s dive in!

Key takeaways

●A recession is a period when the economy slows for at least six months. People spend less and many lose jobs. Rising unemployment rates and falling profits are signs of a recession.

●Stagflation is a tough time for the economy with high jobless numbers, and fast-rising prices but slow economic growth in making goods and services. It can lead to a loss in the value of people's money and can last a long time.

●Both stagflation and recession impact interest rates and investments differently. In stagflation, higher inflation may push banks to raise interest rates while low growth might lower them.

●Unlike recessions, stagflation has not been common, with one major instance occurring in 1970s America due to oil price shocks. This led to cost increases while economic growth was minimal or stagnant.

Understanding Recession

A recession is a significant decline in economic activity, marked by falling GDP, declining profits, and layoffs.

This downturn in the economy impacts businesses negatively, resulting in lower demand for goods and services. Other indicators of a recession include high unemployment rates and reduced personal income.

When recessions occur, they can be triggered by various factors such as financial bubble bursting, catastrophic events, or even shifts in government monetary policies.

These periods can have long-lasting effects on the economy including negative GDP growth and an overall economic slowdown.

What is a Recession?

A recession happens when the economy shrinks. It is a time when people spend less money, and businesses make less profit.

This slow time lasts for at least six months or more. During a recession, many people lose their jobs.

The USA has seen 12 recessions since 1945. These tough times do not last long but they come again and again in every economy.

Impact of a Recession

A recession can hurt people and businesses a lot. Jobs become hard to find. Many people may lose their jobs. Businesses make less money and some even close down. People spend less as they worry about their money.

This makes the economy slow down even more. It can also make it harder for the government to pay for things like schools and roads because they get less tax money.

Understanding Stagflation

In this section, we delve into defining stagflation, discussing its causes, and highlighting the impacts it has on an economy.

We explore how high inflation pairs with stagnant economic growth to create this unique economic state. Stagflation is a period of stagnant economic growth combined with high inflation and high unemployment rates.

Furthermore, we touch on the integral role of monetary policies in either abating or exacerbating stagflation conditions and underscore how these profoundly affect interest rates, investments, and overall business impacts.

The discussion extends to highlight key factors such as supply shocks and fiscal policies that may trigger stagnation coupled with high inflation. In essence, our understanding of stagflation is critical in establishing its difference from a recession.

What is Stagflation?

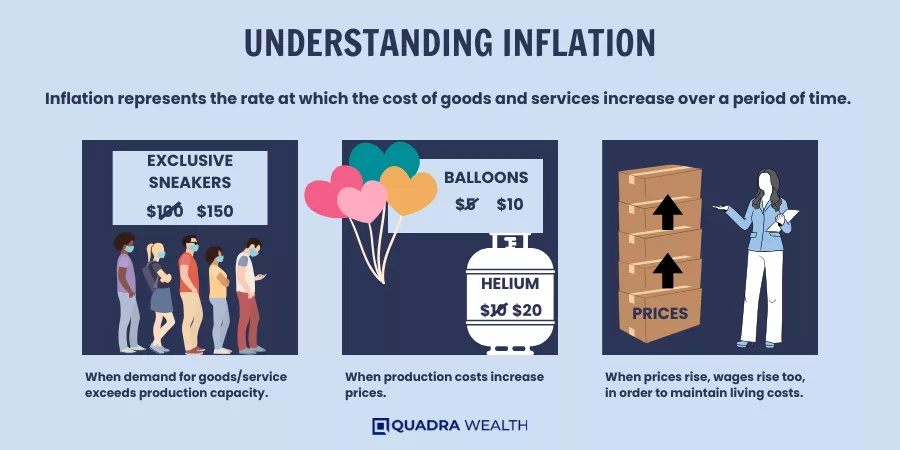

Stagflation is a hard time for an economy. It happens when prices of things rise fast, but the rate at which goods and services are being made does not grow.

At the same time, more people do not have jobs. It happened in the US from the 1970s to early 1980s. the U.S. and some other advanced economies experienced a perpetual cycle of spiraling prices and wages.

Things were costly as inflation rose from about 1% in the mid-1960s to over 14% in 1980. while economic output sagged and unemployment soared. Inflation climbed from about 1% in the mid-1960s to more than 14% in 1980.

Causes of Stagflation

Though Stagflation happens when a country’s stagnant growth slows down or stops. At the same time, costs and prices go up. Here are some things that can cause stagflation:

- Supply shocks: Big changes like oil price shocks can trigger stagflation. In the 1970s, rising oil prices four times! This sudden change made everything more costly.

- Too much money: When governments make too much money available, it can lead to stagflation. The extra cash can make prices rise faster than usual.

- Bad policies: Wrong moves by leaders can also cause stagflation. For example, if they try to control trade too much, it might hurt growth and increase costs.

- High costs for labor: If workers ask for too much pay, it might be hard for firms to grow. They might have to raise their prices instead.

- Extra debt: If people borrow too much money and cannot pay it back, it may spark stagflation.

- Global events: Big world events like wars or diseases may also lead to stagflation.

- Energy prices: A sudden jump in energy prices could stall the economy and push up inflation.

- Changes in supply chains: Problems with getting goods from where they are made to where they are sold can slow growth and raise costs.

Impact of Stagflation

Stagflation hurts a country’s economy in many ways. It slows down the growth of businesses and leads to job losses. High inflation eats away people’s money value, making things costly to buy.

This makes it tough for families to manage their daily needs like food and rent. Stagflation is hard to fix quickly and can last a long time, causing much pain for people in the process.

It happened once in the U.S., from the 1970s until the early 1980s when oil prices went up four times their rate.

Stagflation vs Recession: what's the Difference?

This section will delve into the distinctive variances between recession and stagflation, examining critical aspects such as economic indicators, and impacts on interest rates and investments.

It’s important to note that while both conditions can adversely affect an economy, they’re triggered by different circumstances and have unique repercussions.

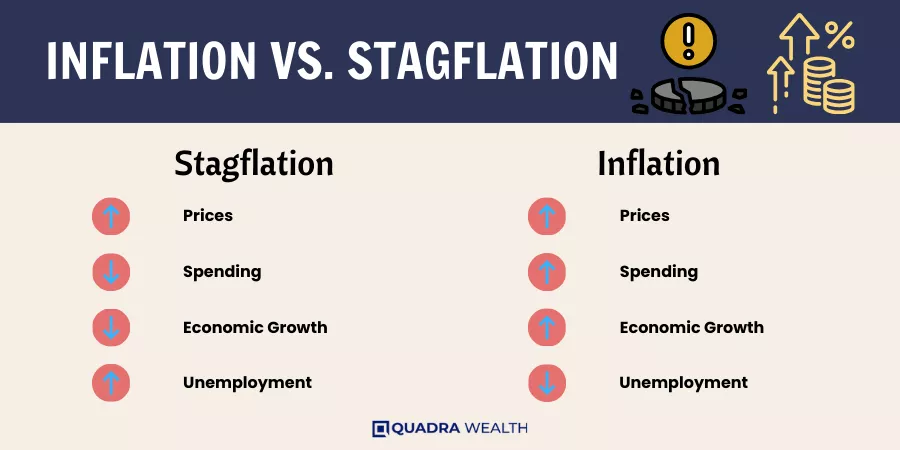

Recession is typically characterized by a general slowdown in economic activity over months or years; whereas stagflation presents a tricky scenario where inflation rises even amid stagnant economic growth – a tough challenge for policymakers.

Recognizing these differences can help you understand how each might impact your personal finances and investment decisions.

Economic Indicators

Economic indicators show how well a country’s economy is doing. High unemployment and low gross domestic product (GDP) are signs of a recession. During stagflation, prices go up even though economic growth is not strong.

Key performance indicators (KPIs) can track these changes in an economy.

Effects on Interest Rates

A recession can change interest rates. Banks often lower these rates in a downturn. This helps to boost borrowing and spending. It encourages businesses and people to invest money.

But, stagflation makes it hard for banks to decide on rates. High inflation may push banks to up the rates, while low growth may lead them to drop the rates.

Both recession and stagflation can shift interest rates, but not in the same way.

Impact on Investments

Stagflation affects investments in several ways. High inflation during stagflation lowers the value of money. This impacts your investments as they are worth less than before.

Stagflation also leads to high interest rates that can cut into investment returns. Unsteady monetary or poor economic policies make investing hard too. Also, when unemployment is high for a long time, people spend less money.

This hurts businesses and might lower the value of your investments because profits can drop.

Historical Cases of Recession and Stagflation

We’ll delve into specific historical instances of recession and stagflation, illuminating the causes, consequences, and overall economic implications.

We analyze two prominent periods: the 2007-2009 Great Recession may triggered by a worldwide financial crisis and the inflation-ridden stagnation of the 1970s.

Dive in to understand these phenomena better!

The Great Recession

The Great Recession started in 2007 and lasted till 2009. It was a time when money was tight for many people. Jobs were hard to find.

Many lost their homes because they couldn’t pay the mortgage. This triggered a recession not just in the US but the whole world. It was a tough time for everyone involved and recovery took several years.

Stagflation of the 1970s

In the 1970s, America faced a tough time. It was stagflation. Prices went up fast from 1% to over 14%! One big reason was oil prices. They became four times higher! This hurt growth a lot.

Even after many years, the country’s growth stayed low.

Here's an extra bonus

Is stagflation worse than a recession?

Yes, some people think stagflation is worse than a recession. A recession means less money and no jobs. But stagflation has that too, plus high costs for stuff people buy. In the 1970s, this happened in the United States.

Incomes didn’t rise much, but prices did. That was bad for people on fixed incomes or with low pay. High unemployment and inflation rates made it hard to find work as well! So stagflation can hit harder than a regular recession.

Can stagflation lead to a recession?

Yes, stagflation can lead to a recession. This can happen when costs keep going up while no one is buying things. Jobs may be hard to find and pay could drop too.

A time in history when this happened was the 1970s in the U.S. Then, oil prices shot up which made everything cost more money.

At the same time, people were not spending money so businesses lost money, and jobs were lost also.

What investments perform best during stagflation?

Gold and real estate often do well during stagflation. Gold keeps its value even if money loses its worth.

Real estate can also rise in price when there is high inflation. People also make money from rent on property they own.

Bonds are not a good idea, because their value drops as inflation goes up.

Conclusion

In conclusion, understanding the distinction between recession and stagflation is paramount for individuals, policymakers, and investors navigating the complex realm of economics.

While both economic states carry adverse consequences, they stem from different circumstances and exhibit unique repercussions.

Recession represents a broad slowdown in economic activity, typically associated with falling GDP, declining profits, and job losses. Its causes are diverse, ranging from financial crises to shifts in government policies, and its impact is often felt in prolonged periods of economic hardship.

On the other hand, stagflation presents a challenging scenario where inflation rises alongside stagnant economic growth and persistently high unemployment.

The causes can include supply shocks, monetary policies, labor costs, debt, global events, and energy price fluctuations.

Stagflation’s adverse effects encompass reduced business growth, job losses, and eroding purchasing power.

Recognizing these differences is crucial for decision-makers, as it can inform effective responses to each economic state, whether in terms of personal finances or policy measures.

Historical examples, such as the Great Recession and the stagflation of the 1970s, serve as valuable lessons in comprehending the real-world implications of these economic conditions.

So, we see that stagflation and recession are not the same. They hurt our money in different ways.

Stagflation hits when prices go up a lot, but jobs and growth do not. A recession hits when the economy goes down for at least six months.

FAQs

You must know the difference between stagflation and recession to steer investments away from low-yield storms. While stagflation and recession describe declining economic conditions that negatively impact business profits and personal wealth, they’re not interchangeable. The most common definition of a recession is two consecutive quarters of declining gross domestic product (GDP), while Stagflation is a mix of inflationary pressures and economic stagnation.

Financial data and analysis tools offer real-time access for business leaders. These tools help make forecasts, create what-if scenarios, and plan for different economic conditions like recessions or stagflations.

Yes! Real estate investments like multifamily properties often stay steady when other values fall. Therefore, they are considered safe harbors even in uncertain times.

Government stimulus measures can help to fix imbalances caused by factors such as overheating the economy or falling profits that lead to recessions or stagflations.

Inflation-proof investments help keep your money’s purchasing power even when prices rise due to increasing costs of raw materials and labor market inefficiencies.

Global pandemics, natural disasters, and trade wars all can tip economies into contraction leading potentially toward recession or even causing price increases creating conditions for potential stagflation.